Insights and Observations

Economic, Public Policy, and Fed Developments

- While we were never convinced, the FOMC meeting at the end of July led to market speculation of a coming Fed “pivot” to a more accommodative policy. Markets flirted with the idea for much of August as well until Powell put to bed the idea of a “dovish Fed pivot” in his Jackson Hole testimony. “The historical record cautions strongly against prematurely loosening policy,” Powell noted, and “Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance.”

- While the stock market seemed a little blindsided, the bond market appeared to have priced in no change fairly well. There was little impact to Bloomberg’s WIRP futures-derived Fed Fund rate expectations, although with several Fed speakers publicly stating they expect Fed Funds to exceed 4%, the implied 3.9% March 2023 Fed Fund rates may have room to rise by about another half hike.

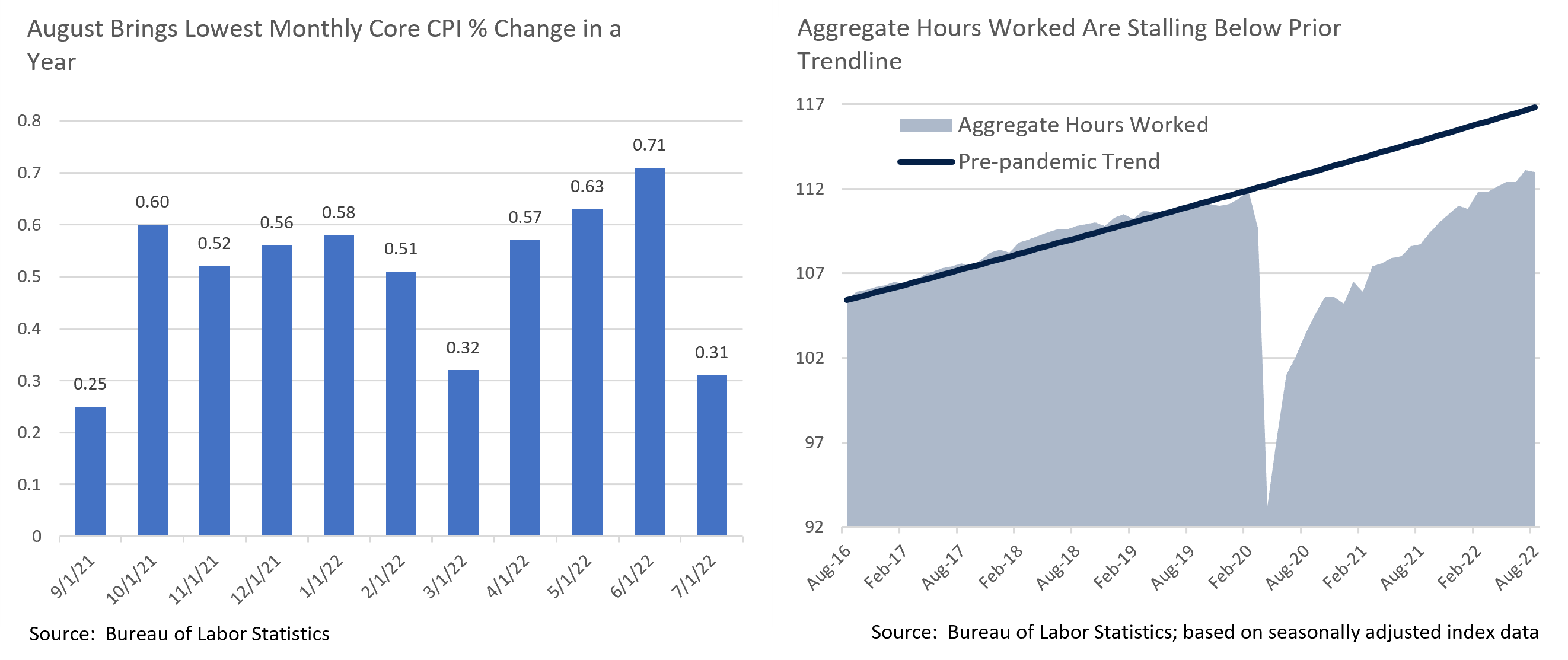

- There was plenty of good news in the July inflation report – falling oil prices helped pull the headline down to flat vs. +0.2%, and core to +0.3% vs. +0.5%, although the report brought less evidence of food price softening than we had hoped. This is the smallest monthly core CPI increase in a year. The PCE inflation report released near the end of the month was even better, falling -0.1% vs. flat expectations, and core only rose 0.1%, half the expected increase. Notably, the declines were broad based, with slowing inflation in all categories other than food and housing.

- Oil prices should pull headline August inflation down again upon the September 13th release, and while poor harvest data might offset this a little, food prices have been in steady decline for some time now. We expect the Fed to remain focused on core, not headline inflation (where the food and energy impacts will be clearest) but declines in these two categories would be a welcome relief. At the margin, it would increase the likelihood of a soft landing.

- While inflation is clearly slowing, the employment picture remains complex. The August jobs report was closely in line with expectations (growth moderating to 315k vs. expectations for 300k), although it did bring with it 110k of prior downward revisions. One notable surprise was a large increase in workforce participation that pulled the unemployment rate up 0.2% to +3.7%. Also, while it garnered less attention, a decline in the average workweek nudged aggregate hours worked down 0.1% despite workforce growth and may have explained a slight reduction in average hourly wage growth.

- This begs the question, with most economic indicators pointing to recession, of how we could be in one with solid job growth? Two things are worth keeping in mind. First, labor is often a lagging indicator, and especially after a sustained period of labor shortages employers may be reluctant to reduce headcount. Second, while the unemployment rate has hit pre-pandemic lows, aggregate hours worked have only just reached pre-pandemic levels, and remain well below prior trendline. Since the labor supply was previously too small to support aggregate demand (leading to inflation), aggregate demand could fall quite a bit before the labor supply would need to be reduced, and employment may continue to look healthy even in an economic contraction. This may be the outcome the Fed is counting on.

Equity News and Notes

A Look at the Markets

- Stocks were whipsawed in August as the S&P 500 gained +4.3% over the first 2 weeks before surrendering those gains and more, closing with a -4.1% loss and a YTD negative return of -16.1%. Nasdaq fared worse, down -4.6% in August, a loss that increased its YTD decline to -24.1%, with Technology posting a -6.3% monthly loss. Leadership remained defensive with outperformance from Utilities and Consumer Staples, although Energy led despite falling crude oil prices.

- The S&P 500 had previously rallied by over 17% from mid-June through mid-August, in part on data suggesting that inflationary pressures might have peaked, along with hopes that the Fed would slow monetary policy tightening in the face of a slowing economy. Coming out of the July FOMC meeting, market expectations for only a 50bps rate hike at the September meeting followed by the possibility of cuts in 2023 had grown. However, a chorus of Fed leadership pushed back on the notion of a more dovish stance, capped off by Powell’s much anticipated Jackson Hole speech on August 26th. The Chairman made it clear that restrictive policy would be necessary for some time to regain price stability, and as a result, “pain” would likely be felt by households and businesses. Markets responded by pushing short-term rates higher (2Yr UST to its highest level since 2007) and risk assets sharply lower.

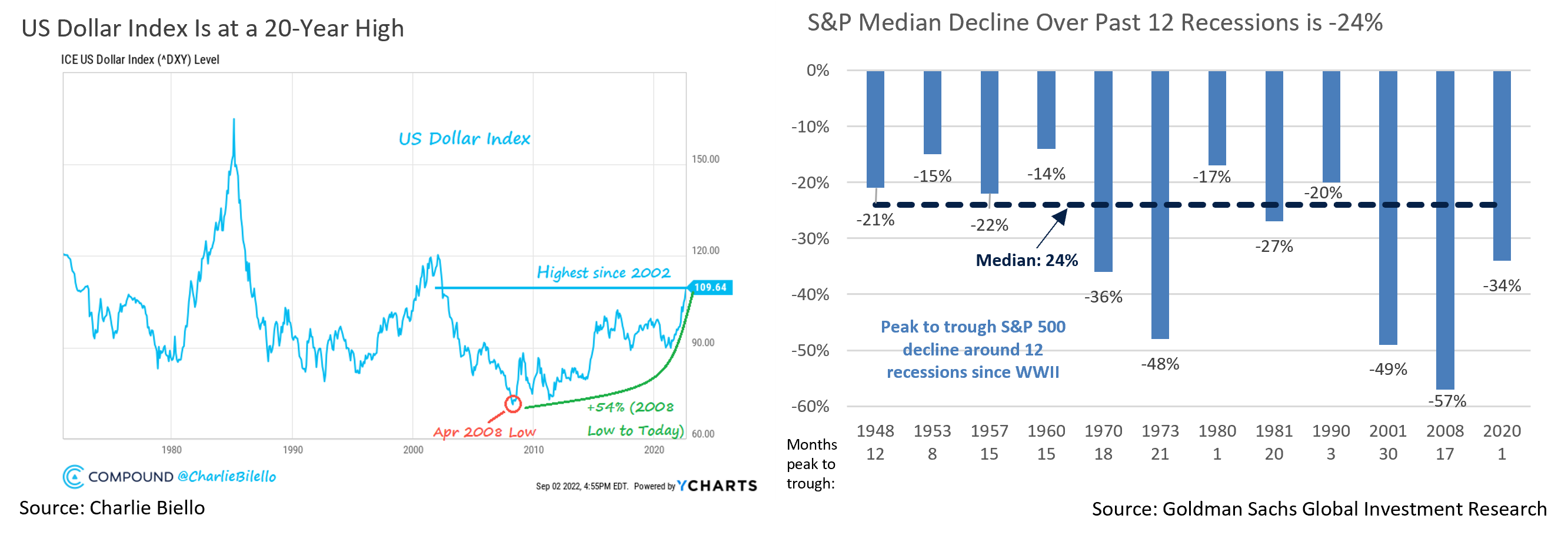

- A potential risk that bears watching lies in the strength of the US dollar. The DXY index, which measures the US dollar against a basket of foreign currencies, recently hit a 20-year high. Contributing factors include higher domestic interest rates, global economic growth concerns, and a flight to safety. The Euro, which makes up more than half of the DXY, has been particularly weak given the continent’s surging inflation rate and still relatively low interest rate policy. A strong dollar can hinder US multinational earnings as it reduces the value of foreign sales.

- With the Fed willing to tighten monetary policy to tame inflation, the odds of a recession have been on the rise, making it instructive to look at stock performance during past recessions. Across 12 recessions since WWII, the S&P 500 has pulled back by a median of -24% from peak to trough with an average closer to -30%. The index typically peaks about 7 months prior to the start of a recession. The market low of the current bear market was 3,666 on June 16th which represented a contraction of -23.6% from the January 3rd all-time high. Much of the pain may already be priced in, particularly if a Fed induced recession turns out to be relatively mild. The path of corporate earnings is critical, and estimates have been cut but not yet dramatically.

- The Fed’s balance sheet is yet another issue worthy of attention. After peaking close to $9 trillion earlier this year, the balance sheet has been slowly shrinking although it is still up $69 billion YTD. The pace of reduction is set to ramp up with up to $95 billion of monthly roll-off anticipated as maturities are no longer reinvested. This is a form of monetary tightening as the Fed reduces its demand influence on the front-end of the UST curve.

- Many uncertainties linger as we near the fourth quarter of a turbulent year and volatility is likely to remain elevated. Seasonality is not currently favorable for bullish investors given that September has historically been one of the market’s weaker months. Over the past 70 years, the S&P 500 has increased in value only 44% of the time in September with an average loss of -0.60%. When down YTD through July and August (12 occurrences), the index has increased only 17% of the time in September (-3.3% average monthly loss).

- At Jackson Hole, Powell said the Fed will be watching the “totality of the data” and will adjust policy on that basis. Investors are likely to remain in a “wait and see” mode as we await more evidence relative to the fight against inflation and the associated economic fallout. As always, timing the market is problematic, and as the picture plays out, we are continuing to look for quality companies offering growth at a reasonable price.

From the Trading Desk

Municipal Markets

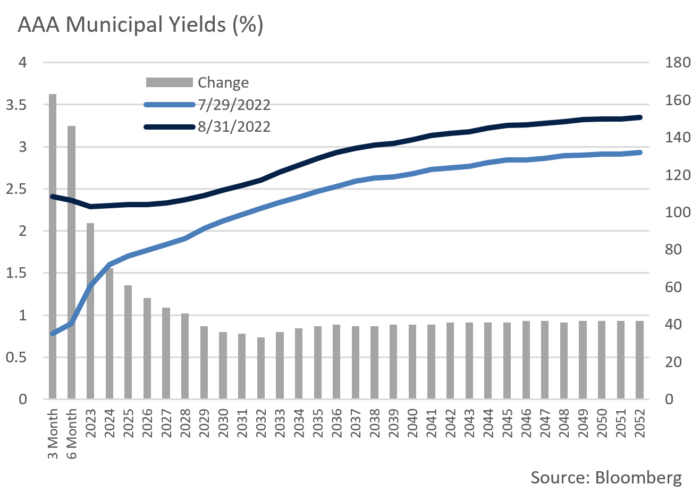

- August brought a steep sell-off in the front end of the AAA municipal curve given a rapid acceleration of monetary policy tightening. Over the course of the month, 3-month yields rose by 163bps, 6 months by 146bps, 1-year bonds by 94bps, and 2-years by 70bps.

- The slope of the tax-exempt curve flattened as short yields rose causing a decline in the spread between 2 and 10-year yields to 29bps by the end of August. As a point of reference, during the last period of significant municipal market strain in 2020, the slope flattened to just 11bps. Further flattening could occur with most market participants fully expecting a Fed Funds rate hike of as much as 75bps after the September meeting.

- Curve flattening will inevitably lead to valuation challenges. A key driver of repricing lies in an ability to pick up what were longer maturity yields at a shorter position on the curve. This leads many to a front-end bias that allows investors to reduce duration risk.

- AAA muni/UST ratios across various maturities all now rest above their five-year averages, suggesting there is value in tax-exempt issues. Within the tax-exempt curve, the ratio of 2Yr yields to 30Yr yields has increased dramatically over the past year given the spike in short rates off extremely low levels. August’s month end ratio of 69% compares to only 4.7% one year earlier. Perhaps more notably, today’s 2 to 30-year AAA municipal ratio of 69% lies well above the 5-year average of 58.1%.

- With the curve being relatively flat, we are seeking value in pockets of intermediate steepness and selectively with credit spreads. In a reversal from last month, long duration and lower credit went from performance contributors to laggards.

- We caution that the front end of the municipal curve may remain quite volatile due to summer technical factors compressing ratios. As discussed, limited supply on top of the seasonal cash roll added to a positive tone for municipals. With the Fed expected to hike rates again, the front end could experience some volatility.

- The September new issue calendar is likely to be modestly lower relative to recent historical averages. The month began on a holiday shortened week and issuers have tended to stay on the sidelines during the week of FOMC meetings, the next due to take place at the end of September. Limited new issue supply will likely bolster near term market pricing dynamics.

Corporate Bond Markets

- The Investment Grade credit market incurred more than its share of volatility during August. Remnants of July’s credit rally lingered and by mid-month the Bloomberg Barclays US Corporate Index touched an OAS of 131, 29bps off the YTD high 160 set in early July. Despite that spread volatility, August ended just 3bps tighter than where we began the month. In general, liquidity strains have been exacerbated among lower quality issues. The risk-off tone present since the Jackson Hole meeting should abate as additional market participants return after the end of summer. In our view, although further credit spread widening may occur, it is unlikely to break out in a meaningful way. Spreads should remain range bound over the near term.

- The IG primary market surprised investors with a record-setting pace of issuance during a typically quiet month. In total, $110.25 billion of new debt was brought to market in August with the vast majority hitting in the first two weeks as sentiment generally turned positive. This new supply reflected a sizeable volume that had been waiting on the sidelines for advantageous opportunities to come to market. New issue concessions are still quite high, yet we take comfort that upside breaks in spreads or rates have been prompting issuers to jump in. September tends to see heavy supply and the weeks following Labor Day should be very active. This upcoming period is likely to set the tone for the primary market and we expect demand to pick up, as spread levels suggest value is present in many IG bond issues.

- High grade corporates are clearly affected by UST yields, and a sizeable move inside of 10Yrs drove recent credit underperformance despite modest spread tightening. On the month, the largest move was along the 3Yr UST curve with a 71bps increase driving yields to 3.52%. Aside from the 20Yr bond at 3.57%, 3Yr issues are the highest yielding. The curve remains inverted out to intermediate maturities, with 10Yr yields rising by 54bps in August to 3.20%, a level not seen since mid-June.

- Another interesting note is that the spread differential between the 2 and 10 years began the month at -50bps but narrowed to -25bps to close it out. Both are points not seen in over 20 years. The Fed’s reiteration of its steadfast commitment to fighting inflation in the coming months have driven up short-term rates. The markets will be watching the next round of rate hikes announced at the end of September closely, and the language used by the Fed will likely set the tone for the balance of 2022.

Financial Planning Perspectives

Senior Safe Act of 2018

We are often asked about risk measures in place to protect clients as part of our Compliance/Risk Mitigation program. Several different safeguards have been implemented to better secure client accounts, including verbal identification requirements, signature authorities, and online dual factor authentication. Taking risk mitigation and security a step further involves understanding who has legal authority relating to client accounts, and who is legally authorized to provide direction concerning a client’s investments, asset allocation, account distributions, or tax payments. While this may seem straightforward, as clients age their vulnerability to financial crimes and unfortunate situations of elder abuse may increase.

We are often asked about risk measures in place to protect clients as part of our Compliance/Risk Mitigation program. Several different safeguards have been implemented to better secure client accounts, including verbal identification requirements, signature authorities, and online dual factor authentication. Taking risk mitigation and security a step further involves understanding who has legal authority relating to client accounts, and who is legally authorized to provide direction concerning a client’s investments, asset allocation, account distributions, or tax payments. While this may seem straightforward, as clients age their vulnerability to financial crimes and unfortunate situations of elder abuse may increase.

Congress passed the Senior Safe Act in 2018 to help wealth managers and advisors address these concerns. The legislation was designed to protect employees of “covered financial institutions” (credit unions, depository institutions, investment advisers, etc.) from liability when reporting potential exploitation of a senior citizen (defined as 65 years or older). The immunity provided by the Senior Safe Act is predicated on two requirements:

- Certain employees must receive training on how to identify and report exploitative behavior before making a report; and

- Reports of suspected exploitation must be done in “good faith” and with “reasonable care”.

The goal in the passage of the Senior Safe Act was to encourage organizations on the financial and banking front lines to train staff to identify and report elder abuses to state or federal law enforcement authorities while balancing client privacy. At Appleton Partners, we take our fiduciary duty to protect clients to heart and have developed policies and procedures accordingly.

Appleton’s Senior Investor policy was designed to strengthen our infrastructure and ensure we always work with clients and their families in an informed, ethical, and respectful manner. While not all signs and circumstances surrounding fraud and elder abuse are readily evident, we look for signs that may suggest diminished capacity such as uncharacteristic behavior, inability to appreciate the consequences of one’s decisions, and memory loss. Red flags that could indicate potential elder abuse include unanticipated changes in address, changes in beneficiaries that appear inappropriate, or unexplained distributions or transactions.

It is our responsibility to address signs of diminished client capacity or suspected elder abuse, and our Private Client Services team undertakes annual training to help identify indications that may warrant state or federal intervention. If you have any questions on the Senior Safe Act of 2018 or its application to your Appleton relationship, please feel free to contact your Portfolio Manager or Assistant Portfolio Manager.

It is our responsibility to address signs of diminished client capacity or suspected elder abuse, and our Private Client Services team undertakes annual training to help identify indications that may warrant state or federal intervention. If you have any questions on the Senior Safe Act of 2018 or its application to your Appleton relationship, please feel free to contact your Portfolio Manager or Assistant Portfolio Manager.

https://www.investor.gov/senior-safe-act-fact-sheet

At Appleton, we take great pride in the wealth management and financial planning services provided to our clients.

Is there someone you care about who might benefit from working with us, but you’re unsure how to make the introduction?

If so, please let us know. We’re happy to help.

Please contact your Portfolio Manager or reach out to:

Jim O’Neil, Managing Director

617-338-0700 x775 | [email protected] | www.www.appletonpartners.com