Insights & Observations

Economic, Public Policy, and Fed Developments

- The whipsawing of President Trump’s trade war that intensified on April 2nd will have many unintended consequences. One will be that incoming economic data will be extremely hard to interpret for at least the next several months. Before discussing specific releases, we’d like to pause and think about the various ways we expect data to be distorted.

- First, the occurrence of tariff “front-running,” both at the importer and consumer level, is well documented. The amount that ends up in retail inventories versus in purchasers’ homes has implications for how long it takes for tariffs to fully impact prices. And whether consumers can afford to keep spending as prices rise will impact retailer behavior and help dictate how “sticky” those price increases will be. The extent to which US supply chains can stretch and compress is likely to “flatten the curve” of tariff inflation and demand effects, making it hard to get a clear picture in real-time.

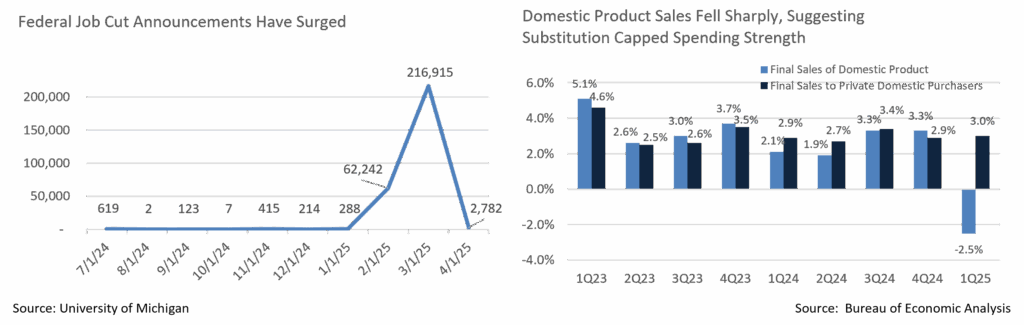

- This was evident in the Q1 GDP report, as growth contracted for the first time since 2022, with the economy shrinking at a rate of -0.3%. Beneath the surface, the picture was more complicated. A massive 50% increase in imports led to net trade detracting from growth, but that was partially offset by inventory buildup. Trade is easy to measure, inventories harder, so this first estimate is likely to be revised. An unwinding of the imports surge in Q2’s GDP may boost that quarter, but this should be looked through in both quarters.

- Underlying demand remains solid, with final sales to private domestic purchasers growing at +3.0%, although a 2.5% decline in purchases of domestic goods suggests that there was significant substitution as consumers stockpiled imports, and that their capacity to spend was likely nearing its peak. Personal consumption data implies this as well. After several months of positive savings growth, consumer spending growth exceeded income growth in March, supporting what was likely temporarily high spending. Muted inflation in March helped both CPI and PCE, but these releases are backward-looking and were largely overlooked by a market focused on tariffs.

- An encouraging note came in the March retail sales data with a rebound in spending on dining out. January and February saw sharp drops, potentially as worried consumers pulled back, although this occurred during a series of nationwide cold snaps. March’s rebound still leaves YTD restaurant spending running slightly below last year’s rate, suggesting a degree of pullback, but it now looks like weather was the bigger cause of weakness.

- While we remain concerned about the impact of DOGE-initiated layoffs, we have not yet seen them in any meaningful way in the employment results. April was strong, but with the downward prior revisions, it should be considered in line. The February and March Challenger reports indicate that a combined 280k government layoffs are in the pipeline that have not yet become unemployment claims. With a common rubric being that each federal layoff leads to two federal contractor layoffs, this is very close to the level where a +0.5% unemployment rate increase becomes a risk. This would strain the ability of US households to spend, just as tariff-related price increases begin to flow through to consumers.

- We also expect the Fed to be on hold near term. As we expect the initial wave of tariff inflation to take more than a month or two to play out, the calendar of economic releases is unlikely to give the Fed enough data to have confidence cutting rates until July at the earliest, at which point they will have inflation releases through June. More likely, it will take until September for the tariff inflation wave to begin to unwind. With the current 90-day hold on reciprocal tariffs, the more likely outcome is that it just further extends the wave. While the short-term effects here were positive, this delay is not especially good news; we still believe continued uncertainty is itself one of the biggest risks the market faces.

Sources: Bureau of Economic Analysis, Bureau of Labor Statistics, US Census Bureau, Challenger, Grey, & Christmas, Inc., Bloomberg

Equity News and Notes

A Look At The Markets

- Stocks were mixed in April as the S&P 500 fell for the 3rd month in a row despite recouping most of its early-month losses. The S&P 500 finished April down a modest -0.8% after falling as much as -11.2% over the first six trading days. The DJIA and Russell 2000 both trailed the S&P for the month, although the Nasdaq was able to gain +0.9% after rallying +14% off its April 8th closing low. Sector performance was mixed with leadership from growth (Tech +1.6%, Comm Services +0.6%) and defensives (Staples +1.1%, Utilities +0.1%). Energy was a notable laggard, falling by -13.7% as concerns about economic growth and demand, as well as OPEC+ supply increases, sent WTI crude down -18.5% to $58 per barrel.

- Following “Liberation Day,” heightened policy uncertainty and subsequent economic growth worries triggered widespread selling as investors rushed to price in a recession. Geopolitical ties, the Fed’s independence, and the “US exceptionalism” trade were all under fire in April as stocks, bonds, and the US dollar each experienced volatility. Despite commentary to the contrary, the Administration spent most of the second half of April walking back many of their initial declarations. It remains to be seen how many trade deals are struck, where tariffs end up, and what the ultimate impact on the economy, corporations, and consumers will be. Until then, investors at least have a slight level of comfort that the Administration appears to have a pain threshold when it comes to markets.

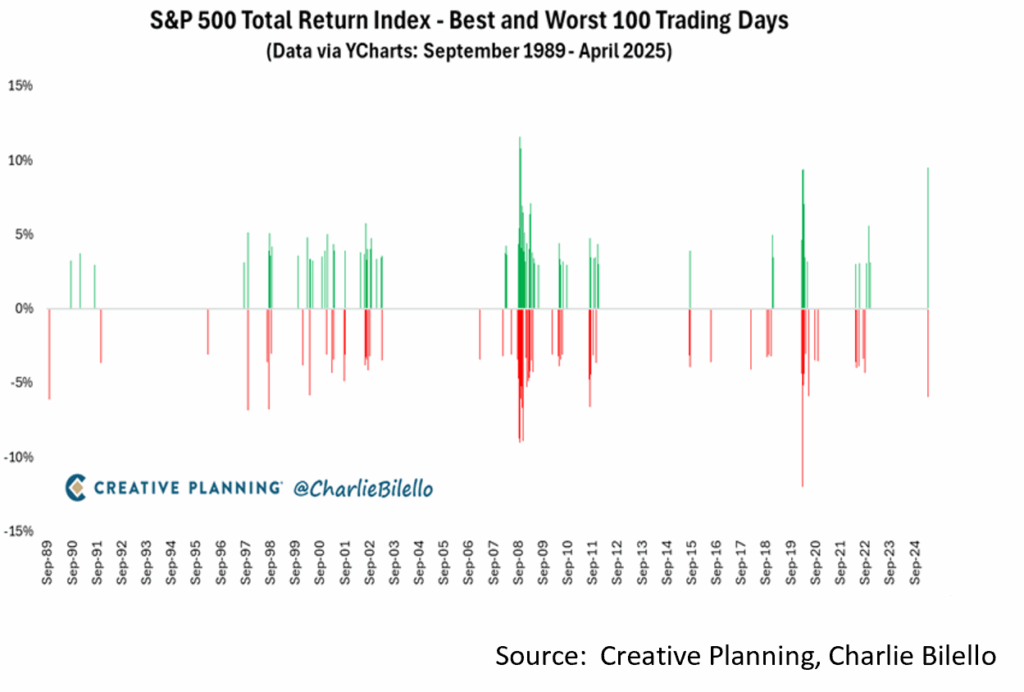

- April will likely go down as one of the more volatile months investors have had to deal with, as the S&P 500 has not traded within a 1% intraday range since March 25th. On April 4th, the S&P 500 posted its worst two-day performance (-10.5%) since March 2020 on the way to its worst week (-9%) since the Covid lows. The subsequent turnaround was breathtaking as the index posted its best day (+9.5%) since October 2008, three days later as part of its best week since November 2023. On April 8th, the VIX closed at 52, its highest level since Covid, signaling fear, only to collapse by the most on record (-18.7) the following day. While the causes of volatility vary, the playbook remains largely the same. The superlatives, “best” and “worst,” tend to cluster together during periods of heightened volatility, and one goes with the other. Trying to time markets risks missing some of the very best days, which can stymie your long-term returns.

- Q1 earnings season is underway and has provided a pillar of the recent stock rally based on better-than-expected results. With nearly 3/4 of the S&P 500 having reported, 76% of companies have beaten analysts’ expectations by an average margin of 8.6%. That’s lifted the blended earnings growth rate to +12.8% for the quarter. This compares favorably to the +7.2% expected as recently as March 31st, and the 11.7% expected at the end of last year. If +12.8% holds, it will mark the seventh quarter in a row of YoY growth, hardly recessionary at this point. Interestingly, fewer companies than normal (1% vs 5%) are withdrawing earnings guidance, as most are opting to make no changes due to uncertainty over tariffs and the economy. We are, however, seeing some pullback in capex spending as corporations assess the future of tariffs and the economy.

- Analysts are struggling with whether a market bottom has been put in, or if stocks need to retest or even undercut the early April lows before recovering. The state of the economy will go a long way in answering that question, and although soft data has been awful, hard data has been resilient to this point, and we are closely following the jobs market for clues. Monetary (Fed) and fiscal (Congress) policy will be a major factor as rate cuts and/or tax cuts are likely needed to offset the impact of tariffs.

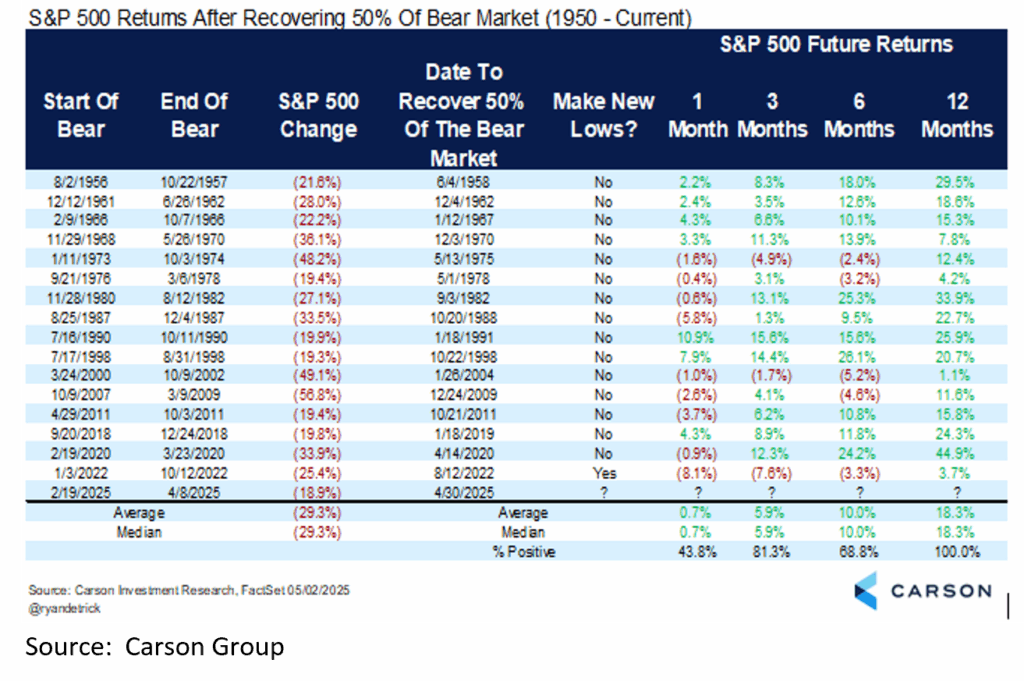

- Looking at prior instances when the market has fallen ~20% and then regained over half, only once since 1950 has the market gone on to make new lows. This time could certainly be different, though, and if April taught us anything, it is that the situation is fluid and can change with a single headline. Sticking with a plan, avoiding emotional decisions, and adhering to long-term allocations is the best strategy for volatile times.

Sources: Bloomberg, FactSet

From the Trading Desk

Municipal Markets

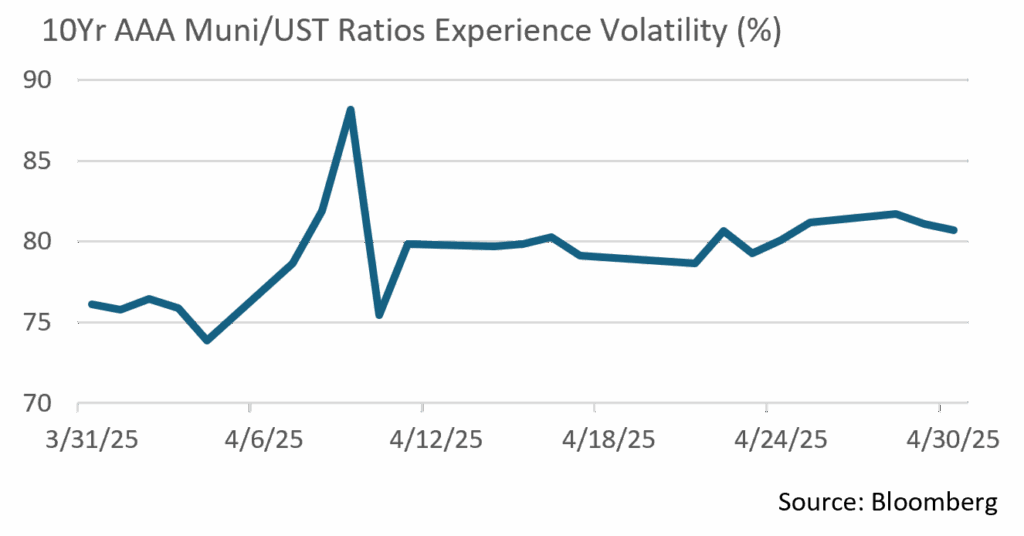

- The municipal curve bear flattened in April, with the front end closing the month higher in yield by 20-28bps, and 5 to 30-year maturities seeing more moderate moves as yields rose 8 to 14bps. However, the end-of-month net yield changes are a snapshot that does not capture the full picture of intra-month performance. Specifically, municipal yields exhibited near record volatility in April, spiking as much as 98bps through the first half of the month. This was largely due to macro factors driving UST rates higher, along with weak seasonal dynamics characterized by high supply, tax-related selling, and fund redemptions.

- In an environment of sustained Treasury volatility, municipals closed the month slightly cheaper than USTs over maturities of 7 years and longer, while the front end cheapened more dramatically. The 10-year AAA Muni/UST ratio ended at approximately 80%, a level that offers investors a higher relative value than has been the case in the recent years.

- April also saw strong issuance of $45 billion, marking an $11 billion increase vs. the 5-year average of $34 billion and a 13% increase over April 2024. The volatility created disruption in the new issue market by causing previously scheduled deals to be postponed and added to the calendar in later weeks. Adding to the glut of supply, municipal funds also experienced outflows totaling $3.6 billion, largely focused on long-term, national, and high-yield funds, thus straining market liquidity even more drastically.

Corporate Markets

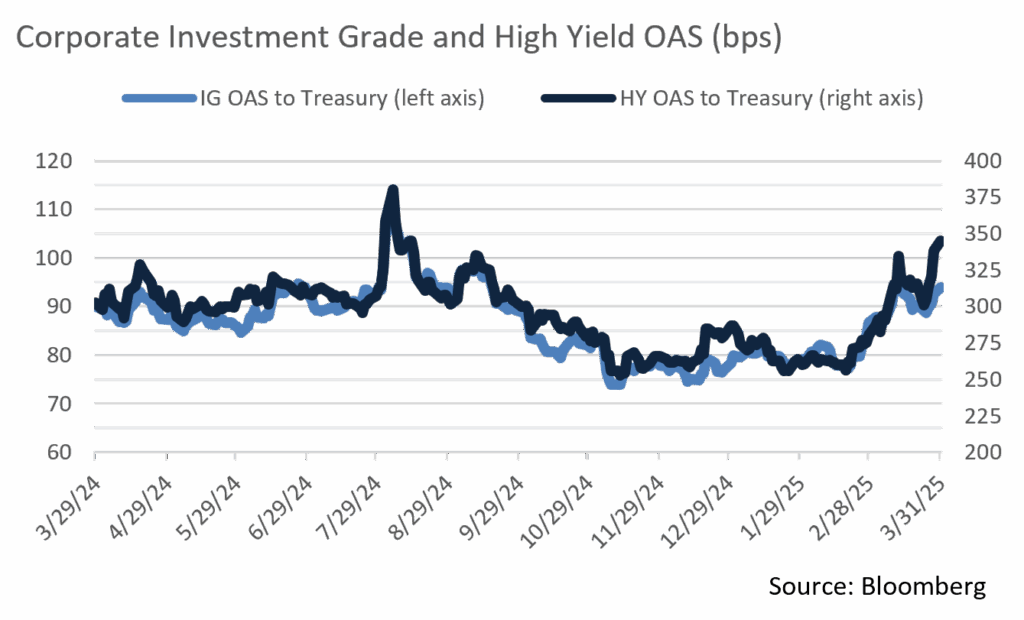

- Investment Grade Corporate credit spreads sprang to YTD highs to begin April as details surrounding Trump’s sweeping US tariff hikes were announced. The self-proclaimed “Liberation Day” drove markets into sell–off mode, and the OAS on the Bloomberg US Corporate Bond Index rose from 93bps to 116bps over the next four days. This generated a tremendous amount of volatility and tested market liquidity, especially among lower-quality credits, where the sell-off was more dramatic. OAS on the US Corporate High Yield Index spiked from 334bps to 453bps over those same few trading days.

- Uncertainty persists, although both Investment Grade (IG) and High Yield (HY) spreads eventually retreated to close to where they began the month as the White House announced a 90-day pause on non-China tariffs and signaled other potential tariff moderation. Market participants are still operating with trepidation, and we expect volatility to remain, an environment that warrants attention to one’s risk tolerance.

- During times of volatility, mutual fund flows reported by Lipper offer a sense of investor sentiment. IG flows have been highly positive for some time, although the last four weeks of April saw a reversal amid tariff-induced instability. Over that period, IG and HY mutual funds reported net outflows of -$13.34 billion and -$12.37 billion, respectively, a clear indication of investor unease. The -$6.08 billion in net outflows from IG funds reported over the week ending April 9th was the largest since 2023, while net outflows from HY funds reached $9.63 billion that same week, the most since 2005. As would be expected in turbulent times, UST funds saw net inflows of +$18.75 billion.

- Despite a volatile month, issuers were able to successfully bring a great deal of new offerings to market, issuing $105 billion of new debt. This brought the YTD total to a healthy $636 billion, 1% higher than the same period in 2024. Nonetheless, some cracks in demand have become evident as investors struggle to evaluate the forward outlook for the economy, Fed policy, and bond market yields. Concessions required to close IG deals have increased modestly, but overall, deals were well bid. We expect robust issuance to continue, although we anticipate the process will be bumpy as perceived risk aligns with demand.

- The UST curve steepened in April as shorter rates declined on growing anticipation of Fed easing. April closed with 3Yr USTs at 3.60%, down from 3.88%. Meanwhile, the 30Yr long bond rose 10bps to 4.68% and the spread between 2s and 10s widened to 56bps from 33bps. Front-end rate pressure is likely to persist due to a slowing economy and recession fears, increasing pressure on the Federal Reserve.

Sources: MMD, Bloomberg, Bond Buyer

Financial Planning Perspectives

Date of Death and Alternate Valuation Dates

Appleton’s Wealth Management team collaborates closely with clients and their families on a multitude of financial and non-financial matters. One of the most important involves estate and multi-generational planning, a process that often involves working with a client’s attorney to establish flexible estate plans and navigating the trust settlement process. One of the more difficult circumstances occurs when a client passes away, a development that introduces a great deal of sadness and uncertainty. First and foremost, our goal is to help clients effectively manage such future eventualities, in part by addressing important planning matters well in advance of illness, incapacity or death. A common question we face when a client passes away lies in the ability to “step up” assets after a death.

The Internal Revenue Code Section 1014 “Basis of Property Acquired from a Decedent” allows for a step up in basis on assets owned or controlled by individuals at their passing to their date of death value. This provision effectively eliminates any capital gain on assets owned by the decedent at his or her passing, allowing the property’s basis to be reset to the fair market value of the asset on the date of death. The starting point for determining basis is the original asset purchase price. Depending on the type of assets owned during one’s lifetime, the basis in a particular asset may move up or down. For example, if a stock is originally purchased at $100, the basis in the stock is the $100 purchase price. If the stock rises in price to $200 and is sold, the capital gain is the difference between cost and the sale price ($100). Cost basis in other assets such as a home may increase over time through capital improvements, or the basis may decrease in value due to the asset being annually depreciated. When someone passes away, it is important to value all assets owned by the decedent, either individually, jointly, or in a revocable trust.

To properly capitalize on the step up in basis rule under Section 1014, a date of death valuation must be completed for each asset owned by the decedent. For investment assets such as stocks and bonds, the IRS requires that the asset be valued on the date of death using the high/low mean average of the asset on the day in question. For other assets such as real estate or business interests, an appraisal of the asset must be completed. For estates that may be subject to either a state or federal estate tax filing, the personal representative of the estate must include these formal valuations with the estate tax return.

In circumstances where estate assets drop in price after the date of death valuation has been completed, there is estate tax relief built into the Internal Revenue Code. Section 2032, “Alternate Valuation” allows the estate to use an alternate valuation date of six months after the date of death so that an estate does not pay estate taxes on the higher valuation amount. In order for an executor to take advantage of the six-month alternate valuation date:

- The estate must be federally taxable (over $13,990,000 in 2025);

- The gross value of the estate must be lower than the date of death valuation; and

- The overall estate tax due must be lower.

The relief provided by an alternate valuation is an all-or-nothing proposition in that the executor cannot choose certain assets and ignore others. Either the date of death valuation is to be used in its entirety, or the alternate valuation must be used in its entirety. Additionally, the election to use the alternate valuation date is irrevocable and the election is made on the federal estate tax return (Form 706).

These valuation matters can be highly technical and somewhat confusing, but there may be substantial tax impact relating to how inherited assets are valued. If we can be of assistance, please reach out to your Wealth Manager or Jim O’Neil.

Sources: Internal Revenue Code (IRC), Sections 1014 and 2032, Appleton Partners, Inc.

Appleton Partners is pleased to announce that our colleague, Jennifer Hall, Wealth Manager, is a 2025 co-recipient of the Boston Estate Planning Council’s (BEPC) President’s Award in recognition of her contributions to BEPC’s mission. Jen serves as co-chair of BEPC’s Community Engagement Committee, through which she works to provide BEPC members with opportunities to give back by teaching financial literacy to underserved populations in the Boston area. She has also participated in the Financial Literacy Program for women at the Suffolk House of Corrections by leading classes in budgeting, debt, and professional development, among others. Congratulations to Jen on this recognition.

Neither industry recognitions nor awards by unaffiliated rating services, publications, media, or other organizations, nor the achievement of any professional designation, certification, degree, or license, membership in any professional organization, or any amount of prior experience or success, should be construed by a client or prospective client as a guarantee that the client will experience a certain level of results if the investment professional or the investment professional’s firm is engaged, or continues to be engaged, to provide investment advisory services.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.