… Don’t Put All Your Eggs in One Basket

As Harry Markowitz, the father of Modern Portfolio Theory, put it, “The only free lunch is diversification.” This quote underscores one of the most fundamental principles of investing: managing risk and reducing volatility by spreading investments across assets and asset classes with distinct risk exposures.

Building Diversified Portfolios

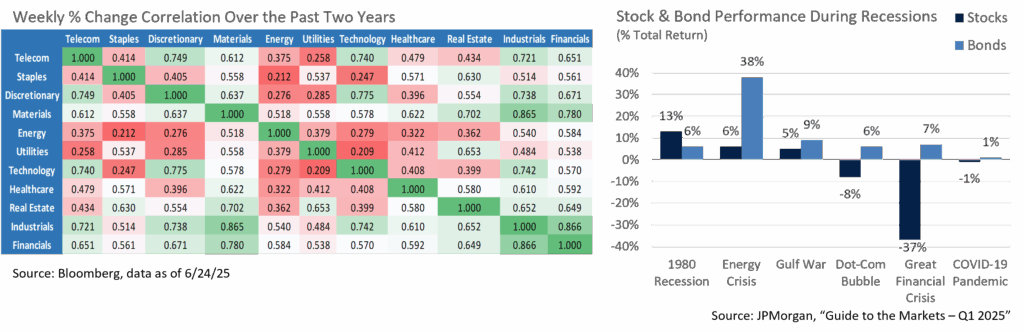

A well diversified portfolio looks different for every investor. For those with an ability to withstand higher than average volatility, an equity-only portfolio with exposure to most of the 11 S&P 500 sectors may adequately manage risk as not all sectors move in the same direction at the same time. For example, during periods of rising interest rates, financial stocks tend to perform well, benefitting from improved net interest margins. By contrast, the technology sector may struggle, as higher borrowing costs squeeze profit margins and lower future growth expectations. The chart below displays the correlation between equity sectors and other asset classes over the past two years. Lower values indicate that the performance of the two variables largely moved independently, enhancing diversification benefits when both are included in a portfolio.

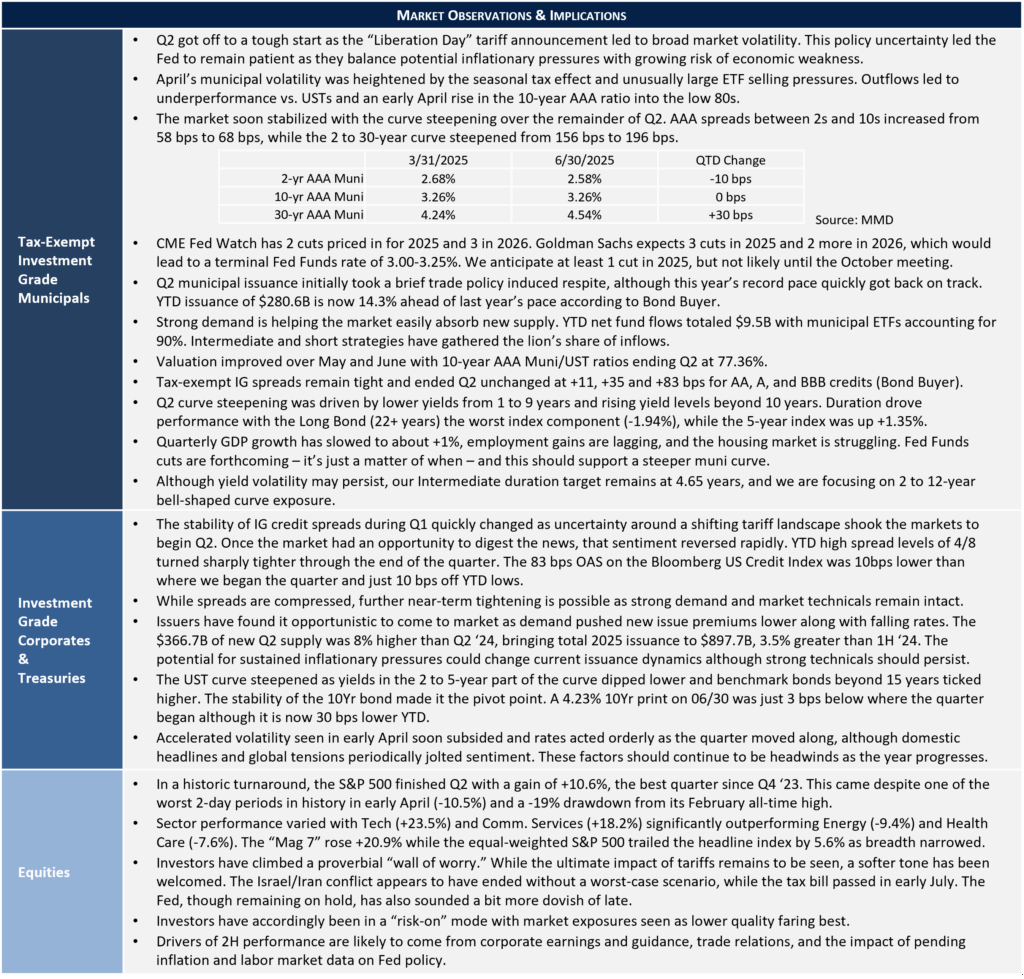

Diversification can also be achieved by investing across asset classes. While equities offer the potential for long-term growth, bonds typically provide stability and income. Adding exposure to real estate, commodities, or alternative investments introduces returns that often behave differently than traditional equities. The objective is to combine assets that do not move with a high degree of correlation, so that when one underperforms others help offset the impact. To this end, the accompanying graphic shows the dichotomy of equity and bond returns during volatile periods.

Common Investor Concerns

Diversification can be extremely valuable in boosting risk-adjusted returns, but harvesting these benefits typically involves assuming a degree of discomfort. We shed light on this by paraphrasing a few common investor laments.

“I am underperforming [asset A]”

Diversified portfolios will always underperform the best performing assets at a given time. Your investments may not garner much cocktail party attention but consider this the price you pay to reduce risk in pursuit of attractive long-term risk-adjusted returns.

“[Asset B] is way down, why do I still own it?”

Each investment should have strategic value in a well constructed portfolio. Point in time returns are rarely average, and it is not unusual for a single asset’s performance to be far above or below the overall portfolio’s return, or that of common market proxies. If you give up on an investment that has diversification value based merely on short-term performance, you may miss out on tomorrow’s winner and/or compromise risk management.

“Why would I sell [Asset C] when it is performing so well?”

Outperforming assets may drift out of their target allocation range, thereby increasing aggregate portfolio risk. Rebalancing is designed to return position sizes to predefined ranges, thereby maintaining intended risk exposures.

Overcoming Behavioral Biases

Human instincts can betray us in investing. Many individuals crave certainty in an uncertain world and seek comfort in what has recently worked, even if that success may be fleeting. This innate tendency to chase performance or overreact to headlines makes it difficult to stay disciplined, especially when markets are volatile.

Diversification doesn’t guarantee favorable performance, but it increases the odds of long-term success by spreading risk and enhancing portfolio efficiency. Doing so helps investors better weather storms, stay invested through volatile cycles, and take advantage of a broader set of market opportunities. Most importantly, it can serve as a behavioral anchor. Diversification is not always immediately rewarding, but much like a seatbelt, it tends to prove its value when you need it the most.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.