Sector Overview & Outlook: States are coming off another year of strong tax collections, although recent softening likely points to more muted 2023 performance. Inflation had a multi-fold effect on State credit conditions in 2022. First, inflation provided a temporary boost to tax revenues, as wages and prices for goods supported income and sales tax collections. That surge appears to be wearing off due largely to persistent inflation and Federal Reserve monetary policy that has tightened economic conditions. These influences have led to slowing tax revenues as revealed by monthly state reporting. Budget officers have reacted accordingly by adopting more conservative budgets for the current fiscal year, a stance we applaud.

According to the National Association of State Budget Officers, average nominal spending growth in FY 2023 is projected to be +6.7%, although inflation-adjusted figures will likely be closer to flat YoY and some states may experience declines. Spending expectations for the coming fiscal year are largely in-line with those prospects.

We also note that most States maintain healthy reserve funds, which collectively are expected to close FY 2023 at $136.8 billion, or 11.9% of expenses.1 These funds offer the flexibility needed to mitigate weaker operating performance and support our “Stable” credit outlook. While federal aid and strong tax collections lifted all ships over the last two years, 2023 is likely to reveal much greater dispersion in State financial performance, a factor our credit analysis always considers.

We also note that most States maintain healthy reserve funds, which collectively are expected to close FY 2023 at $136.8 billion, or 11.9% of expenses.1 These funds offer the flexibility needed to mitigate weaker operating performance and support our “Stable” credit outlook. While federal aid and strong tax collections lifted all ships over the last two years, 2023 is likely to reveal much greater dispersion in State financial performance, a factor our credit analysis always considers.

National Association of State Budget Officers, Fall 2022 Survey

Local Governments

Outlook: Stable (downgraded from Positive)

Sector Overview & Outlook: Our “stable” outlook is supported by resilient property tax revenue streams, strong reserve fund balances, and the essentiality of municipal services. Although the housing market is rapidly cooling and prices are likely to decline, robust growth in home prices over the last 12-24 months has provided a foundation that remains supportive of Local Government credit.

Key credit factors include embedded lags between market price action and local government property assessment, as well as the availability of tools that allow local governments to maintain a degree of consistency in property tax revenues even in the face of housing price swings.

While the residential real estate market is expected to remain a stabilizing factor, urban centers with a high degree of commercial real estate will face revenue pressure. Pandemic health restrictions and the onset of widespread hybrid work arrangements have significantly impacted office utilization rates, which has a follow-on effect on retail stores, restaurants, and leisure. A large portion of the workforce is not coming back to offices on a full-time basis, a secular dynamic that has created many challenges, particularly for local governments that rely on bustling urban business centers. This trend is well understood, and city leaders are not sitting idly by as tax revenues decline. Our job is to identify those issuers best able to meet these structural challenges.

Local Governments are also still benefiting from pandemic aid, although to a lesser extent than their State counterparts. Winding down this aid will reveal whether Local Governments used these funds as a temporary band-aid or to fix structural problems and better align long-term finances. Many weaker pre-pandemic credits will find themselves in similar positions once external support is gone. Cities, counties, and school districts with elevated reliance on State funding may also face greater challenges in 2023 should a weaker economy force mid-year budget adjustments.

We favor Local Governments that benefit from large and expansive tax bases, are home to a diverse range of employers, demonstrate prudent reserve and liquidity management, and those which are proactively managing debt and pension liabilities. Despite the challenges some urban centers face, many cities are seeing population growth and attracting corporate relocations due to climate, cost of living, and tax policies. These considerations are integral to our research process as we evaluate issuer credit quality.

Healthcare

Outlook: Cautious (unchanged)

Sector Overview & Outlook: The healthcare sector has faced acute challenges since the onset of the pandemic, including considerable pressure on staffing and supplies. Healthcare systems have also more recently been dealing with revenue declines and a lack of further stimulus funding, leading to another year of weak operating performance and compressed margins.

Inflation will continue to burden healthcare providers given the impact of labor and supply shortages. While inflationary periods tend to increase expenses at an above average rate, the current environment also hindered revenue growth, an unusual development in a sector that typically exhibits high demand inelasticity. Hospitals have been facing deferred high-priced elective medical procedures given cost of living constraints. Hospitals have also experienced greater use of ambulatory care sites, facilities that generate lower revenue than inpatient facilities, a trend influenced both by insurers and patient decision-making. Expense and revenue challenges will cause margins to remain compressed, and hospitals are also not expected to receive additional federal stimulus funding that has propped up margins over the past two years.

We expect 2023 to be another difficult year for most hospital systems, a view influenced by Kaufman Hall’s expectation that 53% of hospitals will post negative profit margins when 2022 accounting is completed. Credit differentiation is essential in this environment, and despite a hazy sector outlook we are finding attractive opportunities in select large multistate systems that retain significant resources. Issuers we like include those with seasoned management teams equipped to make the operational decisions needed to navigate today’s difficult environment, while positioning themselves to excel during more normalized times.

Airports

Outlook: Stable (downgraded from Positive)

Sector Overview & Outlook:

Airports have incurred an uneven recovery in 2022 with volatile TSA throughput separating those that recovered quickly from airports experiencing more sluggish volume.

In aggregate, throughput activity as of 12/19/22 increased 31% YoY off somewhat depressed levels according to TSA, and now trails 2019 levels by just 10%. Nonetheless, an uneven sector recovery will persist if not deepen in the coming year, due largely to the impact of inflation, recessionary pressures, and airline capacity constraints. We anticipate muted volume growth in 2023 and are adjusting our outlook from “Positive” to “Stable.”

Capacity constraints fueled by equipment shortages and staffing issues persist, along with increased cost pressures. These conditions are contributing to higher airfares and have created a headwind in consumer air travel demand. These challenges coupled with higher base-year comparisons will make significant passenger volume growth very difficult to achieve. Borrowing costs are also pushing up operating expenses and capital project costs. Historically, airports could delay large scale capital plans when funding costs were pressured, however today’s management teams face deadlines to spend Covid aid money and many will choose to proceed at greater expense.

On a positive note, most airports possess substantial liquidity, with the sector average of almost 800 days cash on hand, an all-time high. This creates considerably more flexibility to work through financial challenges and reduces the need to add debt at higher interest rates. Additionally, even conservative passenger usage assumptions reveal overall activity returning to pre-pandemic levels in 2023, a dynamic that should facilitate a return to a less volatile operating environment.

Our credit research process favors large, hub airports along with select regional airports that maintain dominant market positions. We look for issuers with seasoned, capable management and a history of reasonably consistent passenger demand.

Public Power

Outlook: Stable (downgraded from Positive)

Sector Overview & Outlook: We are downgrading our outlook for the Public Power sector to “Stable” from “Positive.” Public Power is considered a defensive sector given most issuers’ ability to pass on increased expenses to consumers through unregulated rate increases. During past inflationary and recession cycles, collection rates have remained high, a function of service essentiality. Utility systems must now strike a delicate balance as rates increases are needed, although going too far risks overwhelming customers and prompting increased delinquency rates. Effective management teams have historically demonstrated an ability to do so, and identifying those issuers best positioned to manage this dynamic will be imperative in 2023. Our “stable” rating reflects these realities.

The public power sector will be challenged longer term by a need to invest in renewable resources in order to meet regulations under the US Inflation Reduction Act. While rising interest rates increase the cost of such projects, federal subsidies over a 10-year period will help offset the need for increased leverage. Utility systems have also benefitted from a long period of low interest rates and energy costs, factors that have enabled many systems to build considerable financial reserves. This is a credit factor we value as it increases financial flexibility and reduces the need for costly borrowing.

We prefer Public Power issuers with strong, reliable service bases, consistent debt service coverage, and ample liquidity and financial resources. We also favor systems that have demonstrated renewable power generation development progress, as these systems will be better positioned to meet Federal expectations, likely lessening future debt burdens.

Higher Education

Outlook: Stable (Unchanged)

Sector Overview & Outlook: The higher education sector remains challenged by lower investment returns, weakening demographic trends, and a shifting view on the value of a college degree. It bears emphasizing that these pressures are hardly uniform as more selective private universities and large, financially strong flagship state universities enjoy steady to improving performance. In aggregate, we rate the sector as “stable”, although significant issuer credit differentiation lies below the surface.

Endowment returns followed the broader market, posting a FY22 decline of more than 10%.1 Thankfully, this weak investment performance comes on the heels of very strong FY21 results.

Skepticism in some quarters concerning the cost/benefit tradeoff associated with a college education is mitigated by extensive analysis that points to the long-term financial benefits of a four-year degree, namely higher wages and lower unemployment. Nonetheless, students are becoming more discerning when choosing schools. A growing number of employers are also accepting industry-specific training programs and/or shorter degree programs coupled with on-the-job training in lieu of a four-year degree. These shifts are altering the calculus of prospective students as evidenced by a 20-year low of 61.8% of high school graduates choosing to attend a four-year college in 2021 vs. more than 69% in 2018.2

Colleges and universities are also preparing to face what some are calling a longer term “enrollment cliff”; essentially a sharp drop in the college-aged population expected to arrive in 2025 due to a declining US birth rate. This demographic trend will produce a decreasing pool of students from which colleges and universities draw. As in so many other industries, quality will prevail, and this calculus drives our credit research process.

A growing focus on cost is keeping tuition revenue growth muted across the sector, with Moody’s Investors Service reporting both public and private universities project net tuition revenue increases of less than 3% YoY in FY 2023. This significantly trails inflation, adding pressure on operating margins. While large state universities and those institutions with strong brand recognition should retain a degree of pricing power, smaller regional players will be challenged. Public universities also benefit from sustained state support, although funding is likely to fall in a recessionary environment.

We prefer large flagship state universities, as well as well known, highly selective private colleges and universities. Robust endowments and strong management teams typically back issuers of this nature. Sustained student demand allows our approved university credits to increase tuition while maintaining favorable admission and matriculation rates. Overall, we see the sector as one in which distinct issuer differentiation exists between those with stable to improving credit profiles and challenged institutions we intend to avoid.

Wilshire Trust Universe Comparison Service

Bureau of Labor Statistics, US Dept. of Labor

Toll Roads

Outlook: Stable (downgraded from Positive)

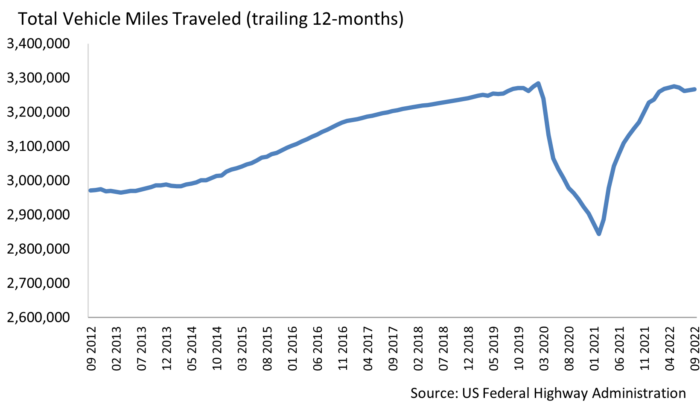

Sector Overview & Outlook: Toll roads enjoyed a healthy recovery throughout 2022, with commercial and passenger transactions trending higher. Total miles traveled in the US as of 9/22/22 rose by almost 15% on a 12-month trailing basis vs. pandemic lows and are now down just 0.5% from pre-pandemic highs.1 Commercial volumes have surpassed prior levels due to a combination of easing supply chain bottlenecks, pent-up demand, and high consumer spending supported by the Covid aid packages.

Credit vigilance is warranted though, as some of these tailwinds are winding down with inflation and a potential recession beginning to reduce consumer spending and commercial traffic. These concerns are impacting passenger volumes, and very modest growth is expected in the coming year.

High inflation is also increasing the costs of capital projects, forcing management teams to consider delaying or adjusting project size, or covering additional costs through debt or cash reserves. Capital management decisions and other aspects of financial management are important credit considerations.

The Toll Road sector has maintained a very strong liquidity profile in aggregate, with issuers averaging almost 1,000 days cash on hand in FY 2022.2 Some systems also maintain unlimited rate setting authority, and those with more constrained CPI-linked toll adjustment policies are in a unique position to significantly increase tolls. Issuers with these characteristics will likely enjoy healthy revenue growth even if traffic volume increases moderate.

Against this backdrop, we are adjusting our “Positive” outlook on the sector down to “Stable” for 2023.

At the issuer level, we prefer toll systems that provide essential travel routes covering service areas characterized by economic vibrancy and positive demographic profiles. We also look for credits with adequate liquidity and comfortable all-in debt service coverage.

Federal Reserve Economic Data

Merritt Research Services

Water & Sewer

Outlook: Stable (downgraded from Positive)

Sector Overview & Outlook: Slowing economic conditions should only moderately impact Water & Sewer issuers, as customers require utility services regardless of economic conditions, supporting our “stable” outlook. In the event of a deeper, prolonged recession, the Water & Sewer sector could become a safe haven for municipal investors as issuers enjoy inelastic demand and sustained revenue generating capability. Given the capital intense nature of their operations, efficient capital markets access is imperative, and this creates a powerful incentive for municipal utilities to maintain favorable credit profiles.

Persistent drought and water scarcity remain long-term risks for many water utilities, particularly those in the Western US. The impact is already being seen through higher customer rates as water utilities pay up for expensive imported water and/or take on costly projects to expand supply.

An anticipated regional shift in financial performance is already evident, as Water Utilities in the West exhibit lower median operating margins (18.3%) than the remainder of the country (24.5% – 29.4%).1 Appleton’s investment process is credit intensive, and we are focused on identifying creditworthy Western Water Utilities with bonds trading at attractive relative values, although security selection in this geographic region takes on heightened importance.

We favor utilities with access to sustainable water resources, those that demonstrate a viable long-term supply plan, and that serve economically vibrant areas capable of supporting future infrastructure needs.

Merritt Research Services

Mass Transit

Outlook: Cautious (downgraded from Stable)

Sector Overview & Outlook: | A “Cautious” outlook for the Mass Transit sector in 2023 is in place due to sluggish recovery in ridership and the risk that recessionary conditions could negatively impact other revenue streams that support mass transit operations.

The Mass Transit sector has faced acute ridership declines since the onset of the pandemic. Many systems are now anticipating ridership may never return to pre-pandemic levels, a secular trend that will cause financial difficulties for transit systems in the absence of substantial actions to combat revenue loss. Federal aid has temporarily bridged the gap, although Covid stimulus funds are drying up as soon as 2024, and transit systems face the need to find new revenue streams and otherwise adjust budgets.

Most systems rely heavily on tax revenues drawn from the economies they serve. For example, MTA, the largest US transit system, has leveraged a “payroll mobility tax” first issued in 2020 to collect additional revenue from private and public sector employers within the New York Metro Commuter Transportation District. MTA leaned heavily on this revenue source in 2022 to compensate for weak fare collections. We view incorporating new revenue sources as positive and necessary, particularly as a recession would negatively impact core dedicated tax revenues, resulting in further budget gaps if not addressed in the upcoming budgeting process.

While revenues will be challenged over the coming years, transit systems are essential to the workforce and economy and enjoy strong support from States and the Federal government. We believe these transit systems will continue to receive significant governmental support but are evaluating how each issuer plans to raise revenue and stabilize long-term financial budgets.

We favor Mass Transit systems characterized by economic essentiality, strong voter support, above average reliance on dedicated tax revenue, and healthy local economic conditions. Our preference is for issuer debt to be secured by dedicated taxes, and like to see reasonable revenue stability, ample debt service coverage, and an ability to segregate revenue to fund debt service before general business operations.

Housing

Outlook: Stable (unchanged)

Sector Overview & Outlook: Appleton has assigned a “stable” outlook to the municipal Housing sector, a view supported by solid balance sheets and well-structured loan portfolios that can be expected to help offset anticipated weakness in the housing market.

These challenges are driven by recently elevated mortgage rates and stubborn affordability constraints. Surprisingly, higher financing costs and a cooling housing market produce mixed results for public finance housing issuers. Higher mortgage rates increase the spread between issuers’ tax-exempt financing expense and commercial loan offerings, improving the ability of Housing Agencies to offer attractive mortgage rates. In fact, 10-year AAA municipal yields increased by 160 basis points over the course of 2022, while Freddie Mac’s 30-year fixed rate mortgage jumped 331 basis points.1 This abrupt change in consumer mortgage financing costs will likely drive many home buyers to opt for lower-cost Housing Agency loans, thereby supporting revenue growth among many Housing issuers.

Headwinds also exist led by weaker economic expectations, a cyclical factor that prompts job losses, higher delinquencies, and increased foreclosures. Housing Agencies are better prepared for this cycle having learned valuable lessons from the 2008-09 housing crisis. Many issuers have substantially increased their exposure to government enhanced loans, structures designed to partially mitigate losses associated with a borrower’s inability to pay.

Our Credit team favors State Housing Agencies given their large and seasoned loan portfolios, traditionally conservative underwriting standards, and access to sizeable financial reserves. Housing bonds with narrower underlying geographies, affordable housing, or single-site projects are likely to face more difficult conditions in 2023, characteristics that cause us to pass on most credits of this nature.

Freddie Mac, Thomson Reuters

Ports

Outlook: Stable (downgraded from Positive)

Sector Overview & Outlook: Ports have performed exceptionally well throughout the pandemic due to healthy consumer spending and an outsized demand for shipped goods. Container cargo volume is expected to slow significantly in 2023 compared to recent years, although growth should remain modestly positive. Headwinds include slowing consumer demand and increasing likelihood of a recession.

We expect container cargo growth to fall into a 0-2% range, although absolute volume should remain historically high, and cumulative growth is likely to exceed pre-pandemic levels by almost 20%. Ports also benefit from their essentiality to the US economy given the critical need to transport and deliver goods throughout the nation. Port congestion has already eased significantly, and we expect cargo to move efficiently in the year ahead.

Prudent credit assessment must also account for the impact of inflation related troubles on labor negotiations, as well as the possibility of strikes disrupting port operations.

We prefer port issuers based in economically strong areas that retain dominant market positions. We also look for those that have invested in advanced infrastructure and are supported by stable financial profiles. We favor “landlord” ports that derive a substantial portion of their revenue from long-term leases as this facilitates greater operational stability during volatile times, a characteristic that could prove beneficial in 2023.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience.

"Moody’s Investor Services downgraded the US Government’s credit rating from Aaa/negative to Aa1/stable on May 16th, reflecting accelerating deficit growth and associated borrowing requirements, a fiscal situation exacerbated by recently elevated borrowing costs. Despite considerable attention being paid to federal spending cuts, Moody’s noted a lack of faith in the willingness of Congress to actually reduce the deficit, and US debt levels have now reached thresholds that are materially weaker than other Aaa-rated peers..."

"The high-grade tax-exempt markets are typically characterized by relative price stability, particularly when contrasted with lower grade credits, let alone equities. But it’s been anything but the case so far in April, as extreme volatility has driven up municipal yields at an unusual pace. Advisors and investors are understandably looking for answers, and we aim to provide some below. The primary driver of this turbulence is a liquidity crunch, which has been exacerbated by the factors noted below..."

"Cutting through the “noise” during times of high market volatility can be challenging but this piece attempts to do so by offering our perspective concerning recent market events, some historical context, and a few forward thoughts. Appleton’s Wealth Managers are available to discuss your personal circumstances, so please reach out..."

Economic & Market Commentary

01.17.2023

2023 Municipal Sector Outlook

State Governments

Outlook: Stable (downgraded from Positive)

Sector Overview & Outlook:

States are coming off another year of strong tax collections, although recent softening likely points to more muted 2023 performance. Inflation had a multi-fold effect on State credit conditions in 2022. First, inflation provided a temporary boost to tax revenues, as wages and prices for goods supported income and sales tax collections. That surge appears to be wearing off due largely to persistent inflation and Federal Reserve monetary policy that has tightened economic conditions. These influences have led to slowing tax revenues as revealed by monthly state reporting. Budget officers have reacted accordingly by adopting more conservative budgets for the current fiscal year, a stance we applaud.

According to the National Association of State Budget Officers, average nominal spending growth in FY 2023 is projected to be +6.7%, although inflation-adjusted figures will likely be closer to flat YoY and some states may experience declines. Spending expectations for the coming fiscal year are largely in-line with those prospects.

We also note that most States maintain healthy reserve funds, which collectively are expected to close FY 2023 at $136.8 billion, or 11.9% of expenses.1 These funds offer the flexibility needed to mitigate weaker operating performance and support our “Stable” credit outlook. While federal aid and strong tax collections lifted all ships over the last two years, 2023 is likely to reveal much greater dispersion in State financial performance, a factor our credit analysis always considers.

Local Governments

Outlook: Stable (downgraded from Positive)

Sector Overview & Outlook:

Our “stable” outlook is supported by resilient property tax revenue streams, strong reserve fund balances, and the essentiality of municipal services. Although the housing market is rapidly cooling and prices are likely to decline, robust growth in home prices over the last 12-24 months has provided a foundation that remains supportive of Local Government credit.

Key credit factors include embedded lags between market price action and local government property assessment, as well as the availability of tools that allow local governments to maintain a degree of consistency in property tax revenues even in the face of housing price swings.

Local Governments are also still benefiting from pandemic aid, although to a lesser extent than their State counterparts. Winding down this aid will reveal whether Local Governments used these funds as a temporary band-aid or to fix structural problems and better align long-term finances. Many weaker pre-pandemic credits will find themselves in similar positions once external support is gone. Cities, counties, and school districts with elevated reliance on State funding may also face greater challenges in 2023 should a weaker economy force mid-year budget adjustments.

We favor Local Governments that benefit from large and expansive tax bases, are home to a diverse range of employers, demonstrate prudent reserve and liquidity management, and those which are proactively managing debt and pension liabilities. Despite the challenges some urban centers face, many cities are seeing population growth and attracting corporate relocations due to climate, cost of living, and tax policies. These considerations are integral to our research process as we evaluate issuer credit quality.

Healthcare

Outlook: Cautious (unchanged)

Sector Overview & Outlook:

The healthcare sector has faced acute challenges since the onset of the pandemic, including considerable pressure on staffing and supplies. Healthcare systems have also more recently been dealing with revenue declines and a lack of further stimulus funding, leading to another year of weak operating performance and compressed margins.

Inflation will continue to burden healthcare providers given the impact of labor and supply shortages. While inflationary periods tend to increase expenses at an above average rate, the current environment also hindered revenue growth, an unusual development in a sector that typically exhibits high demand inelasticity. Hospitals have been facing deferred high-priced elective medical procedures given cost of living constraints. Hospitals have also experienced greater use of ambulatory care sites, facilities that generate lower revenue than inpatient facilities, a trend influenced both by insurers and patient decision-making. Expense and revenue challenges will cause margins to remain compressed, and hospitals are also not expected to receive additional federal stimulus funding that has propped up margins over the past two years.

We expect 2023 to be another difficult year for most hospital systems, a view influenced by Kaufman Hall’s expectation that 53% of hospitals will post negative profit margins when 2022 accounting is completed. Credit differentiation is essential in this environment, and despite a hazy sector outlook we are finding attractive opportunities in select large multistate systems that retain significant resources. Issuers we like include those with seasoned management teams equipped to make the operational decisions needed to navigate today’s difficult environment, while positioning themselves to excel during more normalized times.

Airports

Outlook: Stable (downgraded from Positive)

Sector Overview & Outlook:

In aggregate, throughput activity as of 12/19/22 increased 31% YoY off somewhat depressed levels according to TSA, and now trails 2019 levels by just 10%. Nonetheless, an uneven sector recovery will persist if not deepen in the coming year, due largely to the impact of inflation, recessionary pressures, and airline capacity constraints. We anticipate muted volume growth in 2023 and are adjusting our outlook from “Positive” to “Stable.”

Capacity constraints fueled by equipment shortages and staffing issues persist, along with increased cost pressures. These conditions are contributing to higher airfares and have created a headwind in consumer air travel demand. These challenges coupled with higher base-year comparisons will make significant passenger volume growth very difficult to achieve. Borrowing costs are also pushing up operating expenses and capital project costs. Historically, airports could delay large scale capital plans when funding costs were pressured, however today’s management teams face deadlines to spend Covid aid money and many will choose to proceed at greater expense.

On a positive note, most airports possess substantial liquidity, with the sector average of almost 800 days cash on hand, an all-time high. This creates considerably more flexibility to work through financial challenges and reduces the need to add debt at higher interest rates. Additionally, even conservative passenger usage assumptions reveal overall activity returning to pre-pandemic levels in 2023, a dynamic that should facilitate a return to a less volatile operating environment.

Our credit research process favors large, hub airports along with select regional airports that maintain dominant market positions. We look for issuers with seasoned, capable management and a history of reasonably consistent passenger demand.

Public Power

Outlook: Stable (downgraded from Positive)

Sector Overview & Outlook:

We are downgrading our outlook for the Public Power sector to “Stable” from “Positive.” Public Power is considered a defensive sector given most issuers’ ability to pass on increased expenses to consumers through unregulated rate increases. During past inflationary and recession cycles, collection rates have remained high, a function of service essentiality. Utility systems must now strike a delicate balance as rates increases are needed, although going too far risks overwhelming customers and prompting increased delinquency rates. Effective management teams have historically demonstrated an ability to do so, and identifying those issuers best positioned to manage this dynamic will be imperative in 2023. Our “stable” rating reflects these realities.

The public power sector will be challenged longer term by a need to invest in renewable resources in order to meet regulations under the US Inflation Reduction Act. While rising interest rates increase the cost of such projects, federal subsidies over a 10-year period will help offset the need for increased leverage. Utility systems have also benefitted from a long period of low interest rates and energy costs, factors that have enabled many systems to build considerable financial reserves. This is a credit factor we value as it increases financial flexibility and reduces the need for costly borrowing.

We prefer Public Power issuers with strong, reliable service bases, consistent debt service coverage, and ample liquidity and financial resources. We also favor systems that have demonstrated renewable power generation development progress, as these systems will be better positioned to meet Federal expectations, likely lessening future debt burdens.

Higher Education

Outlook: Stable (Unchanged)

Sector Overview & Outlook:

The higher education sector remains challenged by lower investment returns, weakening demographic trends, and a shifting view on the value of a college degree. It bears emphasizing that these pressures are hardly uniform as more selective private universities and large, financially strong flagship state universities enjoy steady to improving performance. In aggregate, we rate the sector as “stable”, although significant issuer credit differentiation lies below the surface.

Endowment returns followed the broader market, posting a FY22 decline of more than 10%.1 Thankfully, this weak investment performance comes on the heels of very strong FY21 results.

Skepticism in some quarters concerning the cost/benefit tradeoff associated with a college education is mitigated by extensive analysis that points to the long-term financial benefits of a four-year degree, namely higher wages and lower unemployment. Nonetheless, students are becoming more discerning when choosing schools. A growing number of employers are also accepting industry-specific training programs and/or shorter degree programs coupled with on-the-job training in lieu of a four-year degree. These shifts are altering the calculus of prospective students as evidenced by a 20-year low of 61.8% of high school graduates choosing to attend a four-year college in 2021 vs. more than 69% in 2018.2

Colleges and universities are also preparing to face what some are calling a longer term “enrollment cliff”; essentially a sharp drop in the college-aged population expected to arrive in 2025 due to a declining US birth rate. This demographic trend will produce a decreasing pool of students from which colleges and universities draw. As in so many other industries, quality will prevail, and this calculus drives our credit research process.

A growing focus on cost is keeping tuition revenue growth muted across the sector, with Moody’s Investors Service reporting both public and private universities project net tuition revenue increases of less than 3% YoY in FY 2023. This significantly trails inflation, adding pressure on operating margins. While large state universities and those institutions with strong brand recognition should retain a degree of pricing power, smaller regional players will be challenged. Public universities also benefit from sustained state support, although funding is likely to fall in a recessionary environment.

We prefer large flagship state universities, as well as well known, highly selective private colleges and universities. Robust endowments and strong management teams typically back issuers of this nature. Sustained student demand allows our approved university credits to increase tuition while maintaining favorable admission and matriculation rates. Overall, we see the sector as one in which distinct issuer differentiation exists between those with stable to improving credit profiles and challenged institutions we intend to avoid.

Toll Roads

Outlook: Stable (downgraded from Positive)

Sector Overview & Outlook:

Toll roads enjoyed a healthy recovery throughout 2022, with commercial and passenger transactions trending higher. Total miles traveled in the US as of 9/22/22 rose by almost 15% on a 12-month trailing basis vs. pandemic lows and are now down just 0.5% from pre-pandemic highs.1 Commercial volumes have surpassed prior levels due to a combination of easing supply chain bottlenecks, pent-up demand, and high consumer spending supported by the Covid aid packages.

Toll roads enjoyed a healthy recovery throughout 2022, with commercial and passenger transactions trending higher. Total miles traveled in the US as of 9/22/22 rose by almost 15% on a 12-month trailing basis vs. pandemic lows and are now down just 0.5% from pre-pandemic highs.1 Commercial volumes have surpassed prior levels due to a combination of easing supply chain bottlenecks, pent-up demand, and high consumer spending supported by the Covid aid packages.

Credit vigilance is warranted though, as some of these tailwinds are winding down with inflation and a potential recession beginning to reduce consumer spending and commercial traffic. These concerns are impacting passenger volumes, and very modest growth is expected in the coming year.

High inflation is also increasing the costs of capital projects, forcing management teams to consider delaying or adjusting project size, or covering additional costs through debt or cash reserves. Capital management decisions and other aspects of financial management are important credit considerations.

The Toll Road sector has maintained a very strong liquidity profile in aggregate, with issuers averaging almost 1,000 days cash on hand in FY 2022.2 Some systems also maintain unlimited rate setting authority, and those with more constrained CPI-linked toll adjustment policies are in a unique position to significantly increase tolls. Issuers with these characteristics will likely enjoy healthy revenue growth even if traffic volume increases moderate.

Against this backdrop, we are adjusting our “Positive” outlook on the sector down to “Stable” for 2023.

At the issuer level, we prefer toll systems that provide essential travel routes covering service areas characterized by economic vibrancy and positive demographic profiles. We also look for credits with adequate liquidity and comfortable all-in debt service coverage.

Water & Sewer

Outlook: Stable (downgraded from Positive)

Sector Overview & Outlook:

Slowing economic conditions should only moderately impact Water & Sewer issuers, as customers require utility services regardless of economic conditions, supporting our “stable” outlook. In the event of a deeper, prolonged recession, the Water & Sewer sector could become a safe haven for municipal investors as issuers enjoy inelastic demand and sustained revenue generating capability. Given the capital intense nature of their operations, efficient capital markets access is imperative, and this creates a powerful incentive for municipal utilities to maintain favorable credit profiles.

Persistent drought and water scarcity remain long-term risks for many water utilities, particularly those in the Western US. The impact is already being seen through higher customer rates as water utilities pay up for expensive imported water and/or take on costly projects to expand supply.

An anticipated regional shift in financial performance is already evident, as Water Utilities in the West exhibit lower median operating margins (18.3%) than the remainder of the country (24.5% – 29.4%).1 Appleton’s investment process is credit intensive, and we are focused on identifying creditworthy Western Water Utilities with bonds trading at attractive relative values, although security selection in this geographic region takes on heightened importance.

We favor utilities with access to sustainable water resources, those that demonstrate a viable long-term supply plan, and that serve economically vibrant areas capable of supporting future infrastructure needs.

Mass Transit

Outlook: Cautious (downgraded from Stable)

Sector Overview & Outlook: |

A “Cautious” outlook for the Mass Transit sector in 2023 is in place due to sluggish recovery in ridership and the risk that recessionary conditions could negatively impact other revenue streams that support mass transit operations.

The Mass Transit sector has faced acute ridership declines since the onset of the pandemic. Many systems are now anticipating ridership may never return to pre-pandemic levels, a secular trend that will cause financial difficulties for transit systems in the absence of substantial actions to combat revenue loss. Federal aid has temporarily bridged the gap, although Covid stimulus funds are drying up as soon as 2024, and transit systems face the need to find new revenue streams and otherwise adjust budgets.

While revenues will be challenged over the coming years, transit systems are essential to the workforce and economy and enjoy strong support from States and the Federal government. We believe these transit systems will continue to receive significant governmental support but are evaluating how each issuer plans to raise revenue and stabilize long-term financial budgets.

We favor Mass Transit systems characterized by economic essentiality, strong voter support, above average reliance on dedicated tax revenue, and healthy local economic conditions. Our preference is for issuer debt to be secured by dedicated taxes, and like to see reasonable revenue stability, ample debt service coverage, and an ability to segregate revenue to fund debt service before general business operations.

Housing

Outlook: Stable (unchanged)

Sector Overview & Outlook:

Appleton has assigned a “stable” outlook to the municipal Housing sector, a view supported by solid balance sheets and well-structured loan portfolios that can be expected to help offset anticipated weakness in the housing market.

Headwinds also exist led by weaker economic expectations, a cyclical factor that prompts job losses, higher delinquencies, and increased foreclosures. Housing Agencies are better prepared for this cycle having learned valuable lessons from the 2008-09 housing crisis. Many issuers have substantially increased their exposure to government enhanced loans, structures designed to partially mitigate losses associated with a borrower’s inability to pay.

Our Credit team favors State Housing Agencies given their large and seasoned loan portfolios, traditionally conservative underwriting standards, and access to sizeable financial reserves. Housing bonds with narrower underlying geographies, affordable housing, or single-site projects are likely to face more difficult conditions in 2023, characteristics that cause us to pass on most credits of this nature.

Ports

Outlook: Stable (downgraded from Positive)

Sector Overview & Outlook:

Ports have performed exceptionally well throughout the pandemic due to healthy consumer spending and an outsized demand for shipped goods. Container cargo volume is expected to slow significantly in 2023 compared to recent years, although growth should remain modestly positive. Headwinds include slowing consumer demand and increasing likelihood of a recession.

We expect container cargo growth to fall into a 0-2% range, although absolute volume should remain historically high, and cumulative growth is likely to exceed pre-pandemic levels by almost 20%. Ports also benefit from their essentiality to the US economy given the critical need to transport and deliver goods throughout the nation. Port congestion has already eased significantly, and we expect cargo to move efficiently in the year ahead.

Prudent credit assessment must also account for the impact of inflation related troubles on labor negotiations, as well as the possibility of strikes disrupting port operations.

We prefer port issuers based in economically strong areas that retain dominant market positions. We also look for those that have invested in advanced infrastructure and are supported by stable financial profiles. We favor “landlord” ports that derive a substantial portion of their revenue from long-term leases as this facilitates greater operational stability during volatile times, a characteristic that could prove beneficial in 2023.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience.

Limited Bond Market Impact Expected From US Debt Downgrade

What’s Behind Municipal Market Dislocation?

Tariff Turmoil: Observations and Advice