An Opportunity to Access Flexible Services

Staying in one’s home, often referred to as “aging-in-place”, has considerable appeal, but it may not be a realistic option for many seniors. As the American population ages, a diverse range of senior housing options has developed.

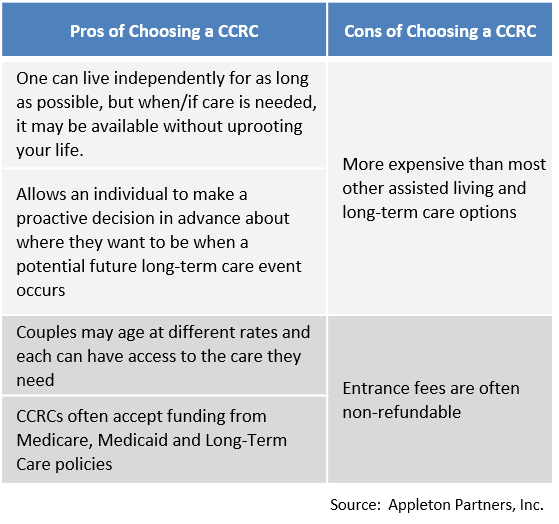

Continuing Care Retirement Communities (CCRCs) are an increasingly popular option as they combine independent living, assisted living, and nursing home care. CCRCs may have appeal as all-inclusive communities offering health services, social activities, meals, housekeeping, transportation, emergency help, and many other services.

What Factors Should I Consider?

When exploring future housing options, several considerations are of paramount importance:

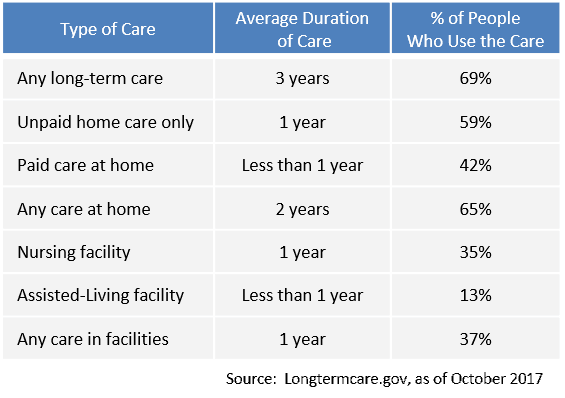

- Your healthcare status and anticipated future needs, as well as that of your spouse (if applicable);

- Your likely need for household support services such as transportation, shopping and maintenance;

- Your lifestyle and social preferences;

- Your long-term housing and healthcare budget

CCRCs vary significantly in cost based on size, type of living space, location and the nature of care. In some instances, the entry fee is partially refundable if you leave within a few years of moving in, while other options include partial refund terms for the resident or their heirs.

Proactively buying into a CCRC before your healthcare or other needs change also offers an ability to age in a comfortable residence where advanced care availability is present should it eventually be needed.

Our Recommendations

First and foremost, we recommend clients speak with their families and trusted advisors well ahead of having to make housing decisions. Housing and healthcare services are rapidly evolving and gathering as much information as possible now can lead to better decisions later. Whether one desires to age-in-place, transition to a CCRC, or feels another housing option makes the most sense, getting assistance in identifying the right fit, range of services and budget parameters is critical.

How can we help you? Please contact:

Jim O’Neil, Managing Director, 617-338-0700 x775

www.www.appletonpartners.com