The Importance Of Designating Resources Who Can Act on Your Behalf

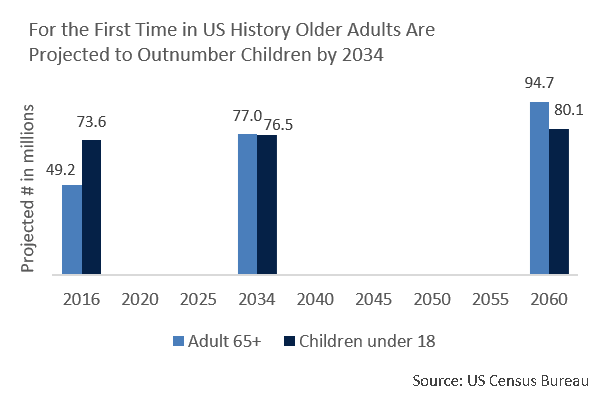

The term “trusted contact” may seem ambiguous and mundane, although that’s hardly the case. As more of the baby boomers move into retirement, the demographics of America are rapidly changing. By 2030, US adults aged 65+ will account for more than 20% of the population, a jump from 15% today according to the US Census Bureau.

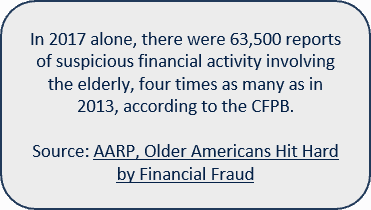

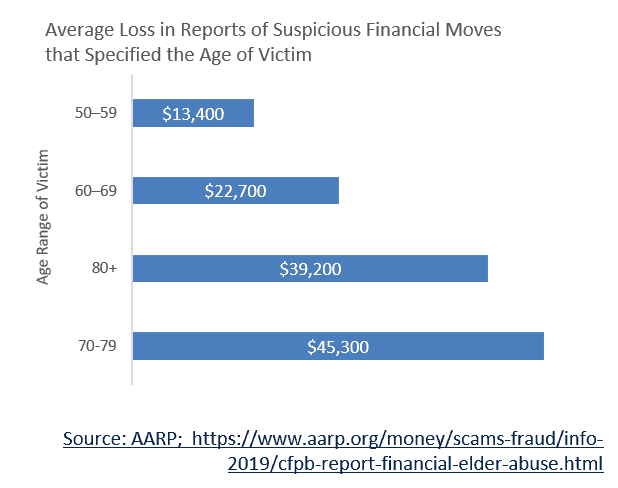

Unfortunately, this senior population is increasingly vulnerable to financial fraud.

According to an analysis published in May of 2017 by the American Journal of Public Health, 1 in 18 “cognitively intact” older adults annually falls victim to financial scams, fraud or abuse.

Senior citizens are now estimated to lose at least $36.5 billion per year to fraud according to a 3rd party study reported in 2018 by the Consumer Financial Protection Bureau.

What Factors Should I Consider?

Senior citizens may be vulnerable to financial exploitation, but there are steps they can take to reduce risk.

A trusted contact, working in collaboration with the client and their advisor or financial institutions, can be authorized to take proactive measures to help protect seniors from exploitation.

With regard to your relationship with Appleton Partners, trusted contacts may be called upon to assist our Portfolio Managers should questions or concerns ever arise concerning requested financial transactions, your health, or decision-making capacity.

Consider it a resource available to help us act on your behalf.

Our Recommendations

At Appleton, we feel strongly about the value of naming a trusted contact. We urge senior clients to think about taking this step if they have not already done so. Accordingly, our account opening paperwork includes the option of adding a trusted contact.

Appleton clients are offered two distinct set up options:

- Name a trusted contact with the ability to share and discuss financial details of the relationship

- Name a trusted contact with the ability to only discuss the whereabouts or well being of a client

How can we help you? Please contact:

Jim O’Neil, Managing Director, 617-338-0700 x775

[email protected]

www.www.appletonpartners.com