Insights and Observations

Economic, Public Policy, and Fed Developments

- Most of the world defines recessions as at least two consecutive quarters of GDP contraction. The US relies instead on an assessment by the National Bureau of Economic Research, which has not yet ruled. However, the release of the Q2 GDP advance estimate revealed a “technical recession” with a drop of -0.9%, slightly better than our expectations but well below the Bloomberg consensus estimate of +0.4%. Talk of recession has gained new urgency.

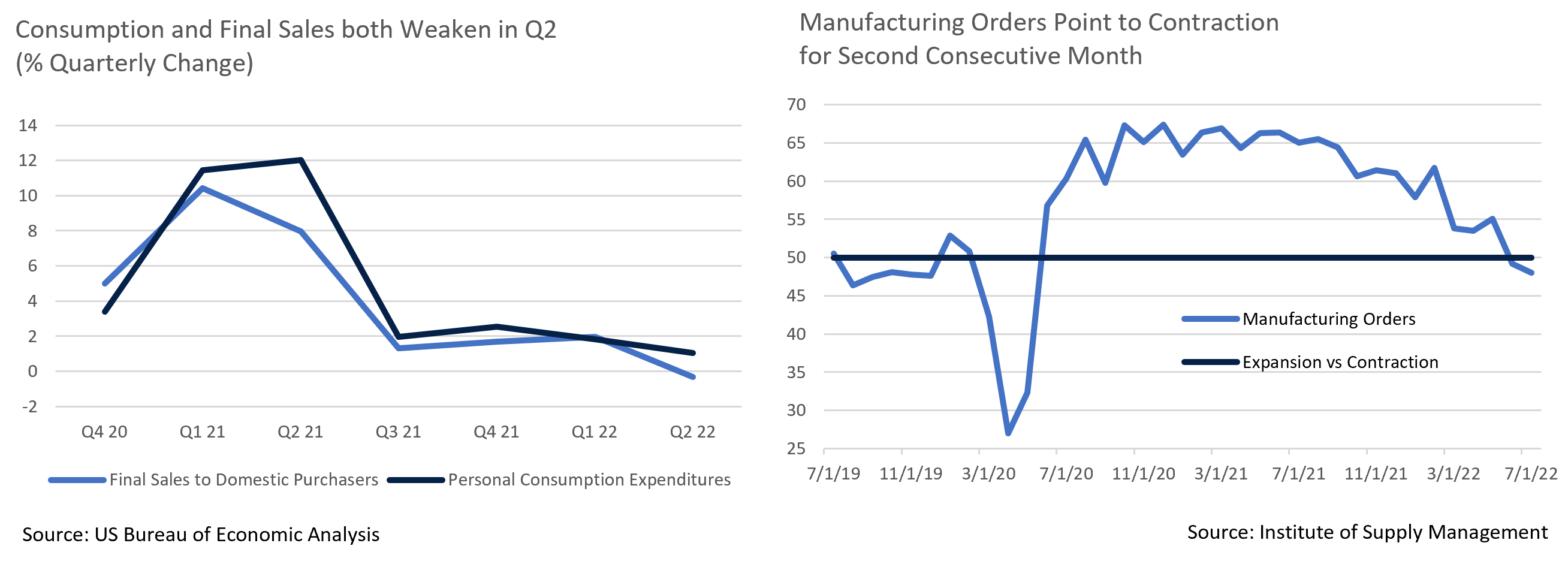

- While there is room to nitpick Q1’s contraction, the Q2 reading was unequivocally weak. A sharp drop in consumption and Final Sales to Domestic Purchasers falling from Q1’s +2.0% to -0.3% suggest broadening demand weakness. Other economic indicators also point to worsening conditions, most notably the ISM Manufacturing PMI now showing two consecutive contractions in their New Orders sub-index, and retail spending reports revealing spending falling in real terms. We believe the economy may already be in recession, but if not, it will be soon.

- The Biden Administration has pushed back on talk of recession, pointing to strong labor markets. And, while the June jobs report showed a stronger-than-expected 372k increase in unemployment, there is reason for concern. The accompanying household survey reported a contraction in employment of 315k jobs, closely in line with a 350k drop in the size of the workforce, which opens the door to a possible sizable downward revision in the June employment release. This would change the labor market narrative. Unemployment claims are still low but have ticked up steadily of late, and the number of job openings to unemployed workers is falling from elevated heights.

- In his press conference on July 28th, Chairman Powell made headlines for three related statements; the Fed would be dropping forward guidance and would become more data dependent, the future pace of interest rate hikes would likely slow, and the Fed had raised rates to a neutral level. We believe Powell’s remarks were misunderstood by the markets. Powell elaborated that the Fed’s last Summary of Economic Projections are still the best guide to their thinking, and they had communicated an anticipated slower pace in the fall for several months. Powell also described the neutral Fed Funds range as 2.25-2.50% based on a targeted inflation rate of 2%. Inflation is currently well above this level, indicating that the Fed’s current policy is still highly accommodative.

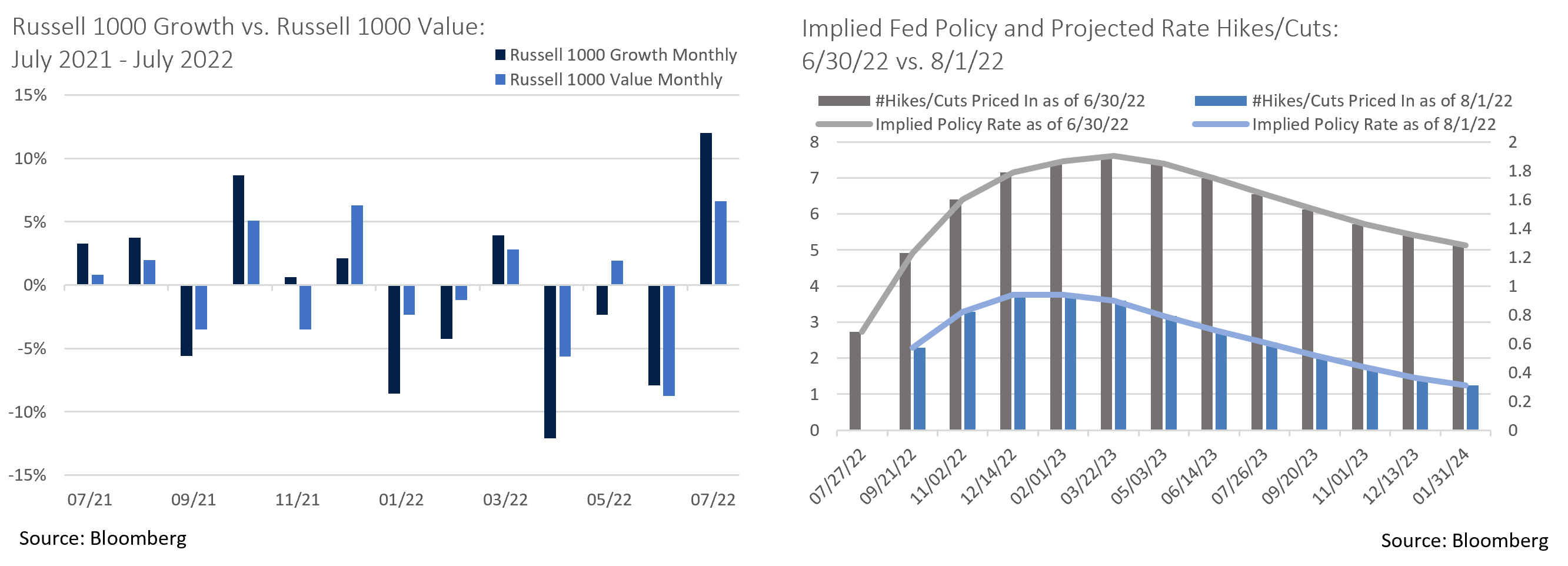

- The market took Powell’s comments as a suggestion the Fed would halt its interest rate increases sooner than expected, and rates – particularly shorter rates – fell sharply on the news. We think this interpretation is off base. The Fed has been transparent that inflation is its top priority and slowing demand to match a series of supply shocks is now a policy goal. The move in long term rates is more consistent with lowered expectations for economic growth over the next ten years, whereas the front of the curve, which is more closely tied to Fed Funds Rate policy, now appears mispriced. As a result, we expect the yield curve to invert further as market expectations adjust and shorter rates rise.

- Regardless of Fed policy, headline inflation should slow in August and September. A sizable drop in oil and gas prices occurred in June after the end of the CPI observation period and has continued through July. And while the impact may miss the July observation, a deal negotiated by Turkey and the EU allowed Ukraine to begin exporting grain from its port city of Odessa. Shortages had pushed global food prices higher and grain prices are now retreating. Core inflation very likely will prove stickier, and while a headline inflation decline would be welcome, we expect the Fed to remain focused on core.“

Equity News and Notes

A Look at the Markets

- Stocks moved sharply higher in July with the S&P 500 gaining 9.2%, bringing the YTD total return to -12.6%. July marked the Index’s best month since November 2020. All eleven economic sectors were decidedly positive with Consumer Discretionary and Technology, two of the worst performers YTD, up double digits. The Nasdaq enjoyed an even larger +12.4% gain but remains nearly 8% behind the S&P 500 YTD.

- July’s rally came despite the first back-to-back 75 bps hikes in Fed history. The start of the rally can be traced back to a June 16th S&P 500 YTD low of 3,666, a date that not coincidentally corresponded with the June FOMC meeting and a 10Yr UST yield of ~3.5%, an 11-year high. Since that time, the market has reacted to decelerating global economic data, a downdraft in commodity prices, and an incrementally more dovish tone from various Fed members. On this last point, the culmination appeared to be the July FOMC meeting in which Chairman Powell’s comments suggested a possible transition from guiding to rate hikes to a more data-dependent approach.

- Consecutive negative GDP reports has sparked considerable recession talk, a “bad news is good news” scenario that soon prompted speculation that Fed rate increases may slow. Markets are forward-looking, and futures have been extrapolating weak July data and repricing the anticipated path of Fed policy. With no upcoming meeting, the market will be looking towards the Fed Chair’s Jackson Hole speech in late August for signals.

- From a style standpoint, signs of a moderating rate outlook have fueled a comeback for growth-oriented equities. With real rates dropping and eyes on recession, growth is at a premium and the Russell 1000 Growth responded in July by outperforming the Russell 1000 Value +12.0% to +6.6%. Some of the largest Technology companies, including AMZN, GOOG, AAPL, and MSFT, reported results that beat subdued expectations, giving the sector and overall market a lift.

- More broadly, with just over half of the S&P 500 reporting, 73% have beaten on EPS and 65% have beaten on revenues. These results are solid but short of recent averages, and earnings and revenue momentum are tenuous. The average beat margin of +3.1% fell well below the 5-year average of +8.8%. The blended reported growth rate of +6% marks the lowest YoY growth rate since Q4 2020. All that said, investor expectations going into earnings season were low and much of the pain had been priced in, therefore the market reaction has been largely favorable.

- Volatility is likely to persist, and caution is warranted as the market anxiously evaluates prospects for a “soft landing” (moderating inflation without an overly onerous economic slowdown). Recent equity strength has returned the S&P 500’s forward earnings multiple to 17.1x, a valuation that is not cheap and may be challenging to maintain. Investors are still dealing with a Fed that is tightening and monetary policy acts with a lag. Corporate earnings will be a critical variable and some current forward estimates may prove to be optimistic. Whether recent positive performance was a bear rally or something more durable is a question likely to ultimately be answered by economic data, Fed policy, and corporate earnings.

- Our baseline expectation is for a weakening economy, possibly marked by mild recessionary conditions, over the remainder of 2022 and into 2023, along with moderate but still positive corporate earnings momentum. This scenario offers a reasonably good backdrop for equity markets to move modestly higher from current levels. It bares emphasizing that eight out of the last nine times the US has experienced two quarters of negative GDP growth, the stock market has been higher six and twelve months out, with a median 12-month gain of 30%.

From the Trading Desk

Municipal Markets

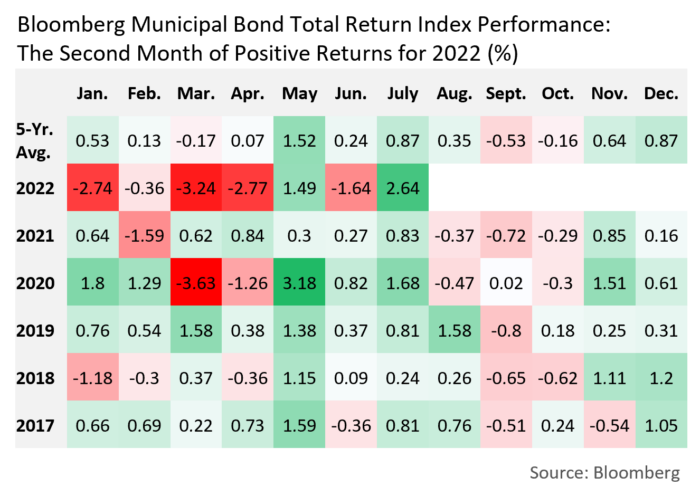

- Municipal bonds ended July with a positive month-end total return, performance that stood in stark contrast to losses posted at the end of June. July’s gains were driven largely by receding yield levels in the face of a slowing economy, seasonal cash roll creating more favorable technicals, and an uptick in retail flows. With $45 billion coming back into the market from maturities and reinvestment, we expect August to bring sustained demand.

- The week ended July 27th saw net fund inflows of $236 million reverse what had previously been 28 consecutive weeks of outflows according to Lipper Inc. The market’s tone has been stronger of late given lack of supply and a sense of urgency among buyers. Year-to-date issuance lags 2021 by 12%, and July issuance declined by 25% on a YoY basis with many deals oversubscribed. Less than $5 billion came to the new issue market over the last week. The bid side has been much stronger, leading municipals to outperform USTs.

- The month ended on a slow note as the market waited for the Fed meeting. Now that a 75 bps rate hike has been confirmed and Chairman Powell’s comments digested, traders are more assertively looking to move bonds and investors are seeking to get cash invested. This dynamic is making it challenging to find bonds at times but is supportive of bond prices.

- The front end of the municipal curve moved in tandem with longer maturities on Fed rate hikes, and unlike USTs, the curve remains solidly upwardly sloping. Spreads on the AAA curve between 2 and 10-year maturities stand at 61 bps, while the intermediate range between 5 and 10-years offers 41 bps of steepness. Longer maturity yield differentials widened considerably in July with 10 to 30-year spreads increasing from a relatively flat 25 bps to 69 bps.

Corporate Bond Markets

- In a reversal of the previous month’s direction, IG spreads retreated from a YTD OAS high of 160 bps to 144 bps. Risk assets rallied on increased recession fears and a slightly more dovish Fed tone. In addition, the surprisingly negative GDP number added to concerns about a slowing economy and weaker future growth prospects. Credit spread direction depends in part on how the Fed responds to economic conditions, although technical factors, which have been fairly stable, remain near term drivers. In our view, IG spreads should remain range bound and a breakout in either direction is unlikely.

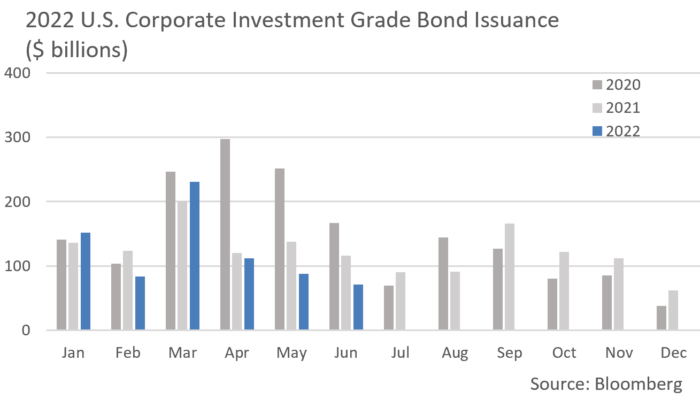

- A healthy return of issuance in July was well received by buyers. The month is typically a robust one in the primary market, particularly among financials, as issuers are fresh off earnings reports. Of the $90 billion in new debt brought to market, ~$58 billion came from financials. We have seen a shift in new issuance structure across sectors as issuers are favoring the front end of the curve. While shorter maturity UST rates are elevated, issuers appear to be weighing demand for shorter paper against higher concessions on longer term bonds. Lighter supply has been evident throughout 2022, as market volatility and uncertainty deters positive investor sentiment. Shorter maturity issuance should be the new norm for awhile, and we see stabilization of the primary market as a positive for credit spreads.

- High yield has been in favor as the risk asset rally was more pronounced than in IG. High yield spreads and yields dropped by the largest amount in nearly two years on the hope that the Fed will cool its rate hike momentum. In addition, better than expected earnings also contributed to the rally.

- A lack of issuance has been a contributor to spread action as only $1.835 billion hit the primary market last month, the slowest July in 16 years. Year-to-date issuance of $70 billion is the weakest since 2008. Although we do not buy high yield bonds, market conditions are an indicator of credit sentiment, and July’s high yield spread tightening may have been hasty given ongoing macro uncertainty.

Financial Planning Perspectives

Pay Attention to Minor Details

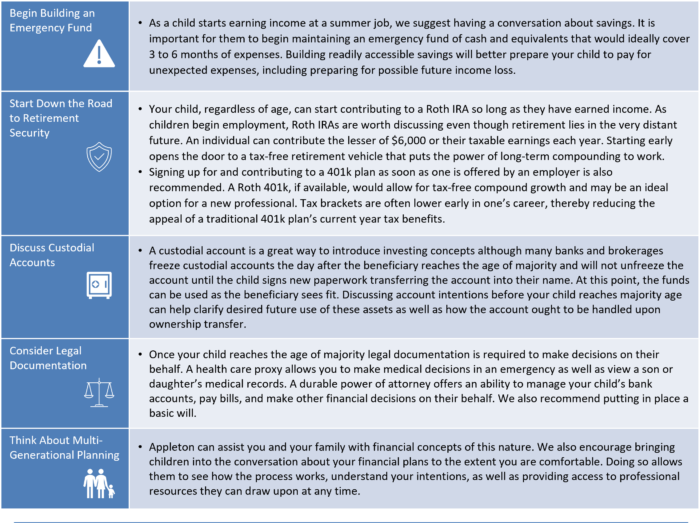

Summer is always a good time to revisit money management strategies with your children, and accordingly we are reemphasizing some important concepts. Whether your kids are getting ready to head off to college for the first time or are still in high school and starting a summer job, several financial planning disciplines often prove valuable.

Massachusetts Estate Tax Exemption Increase Proposal In Limbo

The July 31st deadline for the General Court to pass a pending $4B Economic Development Bill came and went without a vote, leaving $500M of permanent tax cuts contained in the bill in jeopardy. These tax cuts would include an increase in the Massachusetts Estate Tax exemption from $1M to $2M and remove the so-called “cliff effect.” The bill will be kept in conference committee and the bill or parts thereof could be addressed in an informal legislative session, provided there is unanimous consent. The informal legislative session will formally end in January 2023.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]