Insights and Observations

Economic, Public Policy, and Fed Developments

- While one month does not make a trend, July was a very good one for US economic releases and the Federal Reserve’s fight against inflation. Both CPI and PCE both showed improvement, with the headline CPI and PCE garnering much attention for falling to +3.0%, just above the Fed’s +2% annual target. Markets were ebullient.

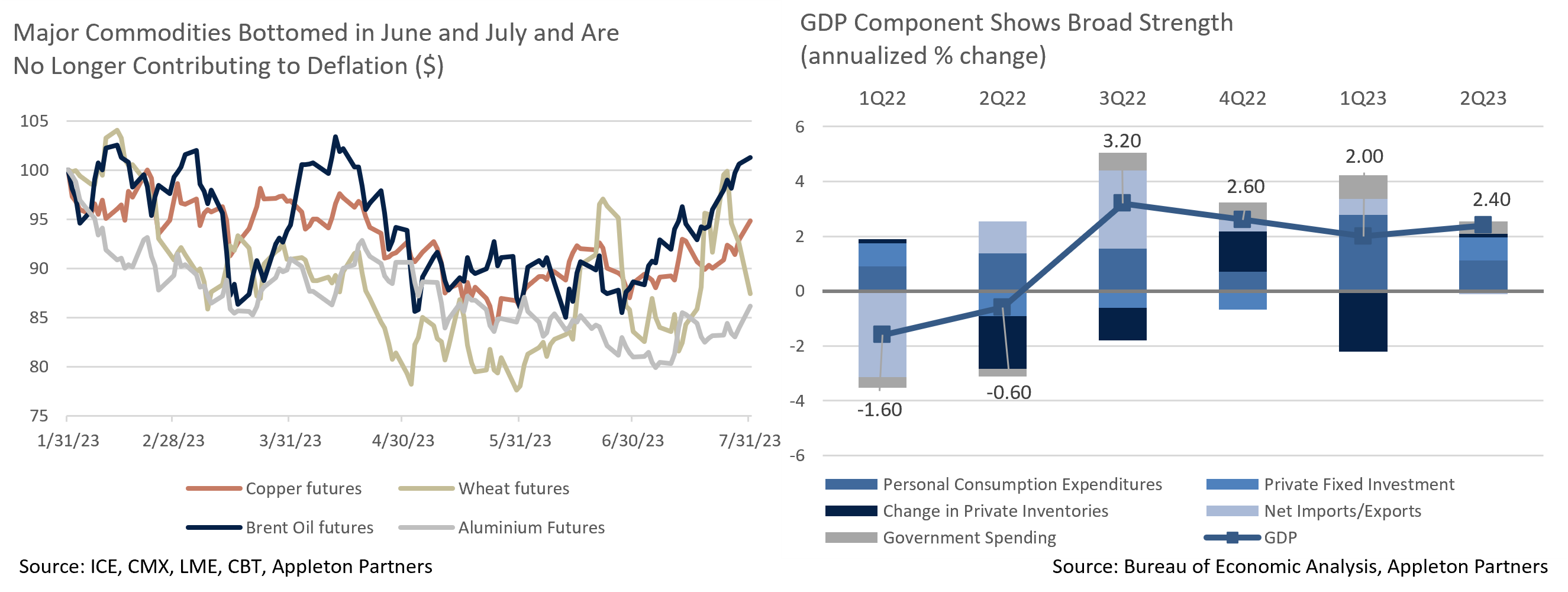

- Q2 GDP followed suit, coming in at +2.4% vs. consensus expectations of +1.8%. The list of underlying components showing strength was broad. Notably, final sales to private domestic purchasers tracked the headline closely at +2.3%, implying robust underlying demand. The PCE price deflator was also milder than expected, with core two-tenths below expectations at +3.8%. While this is still too high for the Fed, in many ways the release felt like a Goldilocks report after two years of flirting with stagflation.

- But, this is the crux of the problem; inflation may have moderated, but not for sustainable reasons, and not by enough. Much of the improvement in headline has been the combination of favorable base effects, which are now behind us, and falling commodity prices, which appear to have bottomed out over the past two months and are now rising. Core is still too high, with CPI at +4.8% and PCE at +4.1%, and progress to date has been slow. We expect headline inflation to start rising back towards core, absent a fundamental shift in consumer behavior.

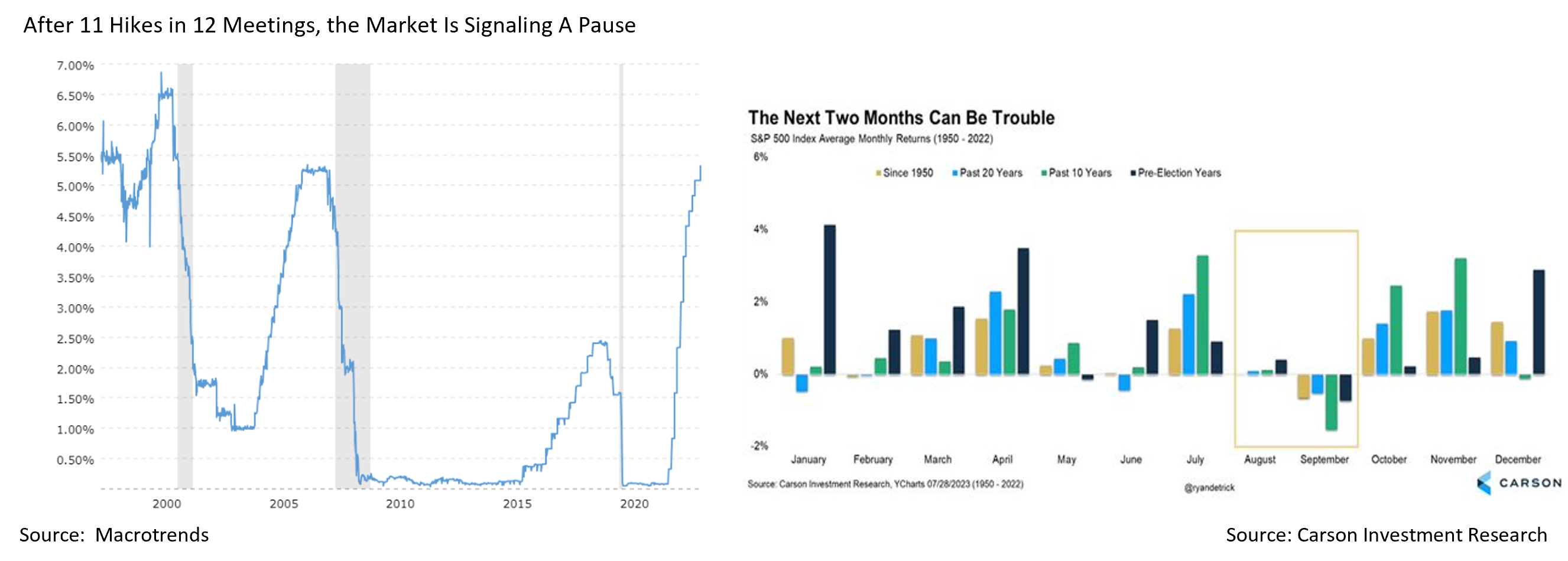

- Fed Governor Chris Waller laid out a two-pronged argument in July on why the “long and variable lags” of monetary policy may be shorter than in years past and largely behind us. First, the Fed’s transparency around forward guidance led to markets beginning to tighten in advance of rate hikes, and second, with the speed at which rates were hiked, in 50 and 75bp increments, households and businesses were forced to respond faster to changing credit conditions. This is a credible argument and another reason why we expect further hikes will be necessary.

- In his July press conference, Powell remained carefully noncommittal on rate policy, stressing that the Fed will remain data dependent as they assess a September decision. Markets interpreted that as favoring a skip and now assess the chance of hiking at only one-in-six. We think that may be misguided for two reasons; the Jackson Hole conference in August creates a natural skip in the Fed’s calendar anyway and, for the reasons discussed above, we expect inflation to reaccelerate.

- However, we also believe a cyclical peak of longer-term rates is near. The 10Yr UST has remained rangebound with only short deviations outside 3.50-4.00% for the past nine months, and short-term rate increases have recently led to greater curve inversion. With the market positioned for a Fed now on hold, a more aggressive Fed willing to risk recession to tame inflation suggests the next move in long rates is more likely downwards than upwards, on lower forward inflation and growth expectations.

- A risk we remain vigilant about is the prospect of substantial Chinese stimulus spending. The country’s growth continues to stall, with GDP falling to +0.8% for the quarter and +6.4% for the trailing 12-month period in the government’s official reporting. After a slate of mild rule tweaks intended to stimulate growth failed to impress markets, we think significant stimulus spending is a possibility, and would expect to see spillover inflationary impacts on the rest of the world economy.

- Fitch downgraded US long-term debt from AAA to AA+ on August 1st. While newsworthy, the US Treasury bond is still the safest and most liquid asset in the global financial system, and we do not expect to see much market impact. At the August 2nd close, yields were only modestly higher, with the 10Yr rising 5bps on a day that also saw a strong ADP jobs report.

Equity News and Notes

A Look at the Markets

A Remarkable Rally Persists

- Stocks continued to march higher in July as the S&P 500 and Nasdaq pushed their monthly winning streaks to five. The cap weighted S&P 500 gained +3.2% to bring its YTD total return to +20.6%, marking the best initial seven months since 1997. The Nasdaq gained +4.1%, raising YTD total return to a formidable +37.7%, the strongest start to a year since 1975. Not to be outdone, the DJIA (+3.4%) posted a 13-day winning streak this month, while the small cap-oriented Russell 2000 (+6.1%) was the top performer for the second month in a row.

- The path of least resistance remained to the upside in July driven by positive economic data. Notably, Q2 GDP grew +2.4% (vs. +1.8% expected) and consumer confidence hit a two-year high. Amid growing hopes for an economic soft-landing, cyclical pockets of the market outperformed, particularly over the second half of July. Energy, Materials, and Financials led, with Energy the standout at +7.3%. Though all 11 sectors were positive, defensive sectors (Healthcare, Utilities, and Consumer Staples) were relative laggards. Should this cyclical rotation persist, it could translate into outperformance for small-caps and emerging markets, as both sectors have more cyclical exposure than the S&P 500 and Nasdaq.

- Despite another 0.25% hike that raised Fed Funds to its highest level in 22 years, investors have seemingly embraced a “peak-Fed” mindset that has bid up stocks. The latest CPI report showed softer-than-expected headline and core readings, while the Employment Cost Index grew at its slowest pace (+1%) in two years. Core PCE (+4.1%) was the lowest since Sept 2021 and is now only 0.2% away from the Fed’s 2023 forecast of 3.9%. Nonetheless, work remains to be done on the inflation front and the “last mile” is likely going to be the most challenging. However, the market is now pricing in a Fed pause with the CME futures market price peaking at only ~33% of a hike at the November meeting.

A Skeptical Response to Earnings

- Q2 earnings season was just over halfway completed at the end of July and results to date have been mixed. Beat rates are trending well at 80% for earnings and 64% for revenues, yet the blended earnings growth rate for Q2 of -7.3% fell below June 30th expectations of -7.0%. Although mega cap tech stocks have helped drive index returns higher, investors have generally been selling the average company’s earnings news. Companies beating expectations have traded down -0.2% around announcements, while those missing have fallen an average of -0.7% over the two days before and after the report. We believe these negative reactions, even on earnings beats, is symptomatic of a market with lofty valuation that has defied expectations. The S&P 500 traded at a 19.4x forward P/E as of July 31st, above the 5-year average of 18.6x and the 10-year average of 17.4x. We emphasize though that valuation in a vacuum has historically been a poor market timing tool and has demonstrated very low short-term correlation with forward returns. Nonetheless, a resumption of earnings growth in the back half of 2023 and into 2024 is needed to justify today’s valuations. Until then, the margin for error for individual stocks and the market is thin.

Contrasting Narratives and a Sobering Seasonality Dynamic

- For now, the bullish narrative revolves around peak inflation, peak Fed, hopes for a soft landing, better-than-feared earnings, a resilient US consumer, a tight labor market, stabilizing housing, and a record $5.5 trillion parked in money market funds. Bears point to a Fed that continues to signal that rates will be “higher for longer”, ongoing quantitative tightening, pockets of sticky inflation, stretched valuations, and hot sentiment as reasons for caution. We’d add seasonality as August and September have historically been the weakest market months, particularly in pre-election years. Additionally, when the market has been this strong through July (+17.5% or greater), August has only been higher 3 out of 11 times with an average decline of -1.1%. The market could benefit from a bit of consolidation and the calendar might have given it the perfect excuse.

From the Trading Desk

Municipal Markets

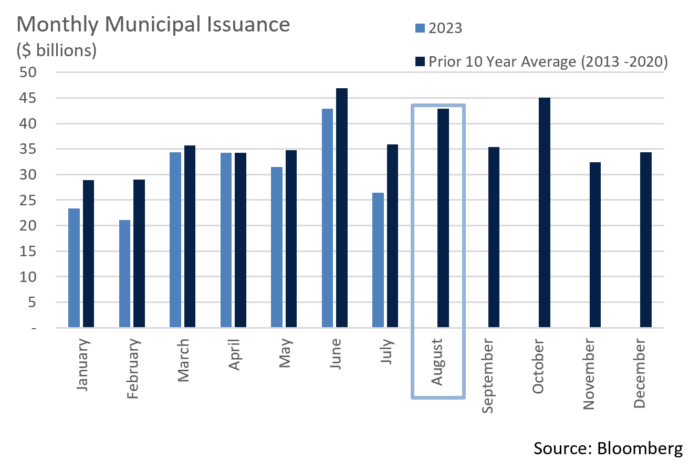

- Municipal bond performance was positive for July, and we are expecting that to continue during August. Negative net supply will most likely increase this month with $48 billion coming back to investors via maturities and a 30-day visible supply calendar of $13.6 billion. Of that anticipated supply, $11.3 billion is being issued during the first week of August. These technical factors, including 11 weeks of consistent positive fund flows, are keeping municipal ratios rich, with the 10-year Muni/UST yield ratio ending July at 65%, as compared to a 12-month moving average of 72%.

- As highlighted in the chart, August has been the third highest issuance month over the past 10 years. This year’s lack of new supply will likely change that trend and can be attributed to both the rising rate environment, as well as state and local governments maintaining significant federal aid left over from pandemic relief. Many municipalities and states without acute funding needs are holding off on issuing new debt. Accordingly, overall YTD issuance is down 16% from the same period of 2022, a dynamic that has bolstered secondary market pricing and created oversubscription of most primary market offerings.

- Yields were more volatile towards the end of July in anticipation of a Fed decision to raise rates again. Over the course of the month, the front end of the curve saw yields rise between 6 and 12bps, while the belly to long-end of the curve was up only 1 – 3bps, exacerbating a highly atypical tax-exempt curve inversion. Municipals were slower to react after the July Fed meeting than Treasuries, in large part given favorable market technical factors.

- We are finding opportunities in 9 to 12-year maturities, the longer portion of our intermediate buying range, as front-end ratios have dipped below 60%. Curve inversion has also prompted us to complement relatively high short yields with some longer issues as a means of maintaining duration targets in our intermediate portfolios. A sluggish new issuance calendar increases the need to seek attractive relative value in the secondary market.

Corporate Bond Markets

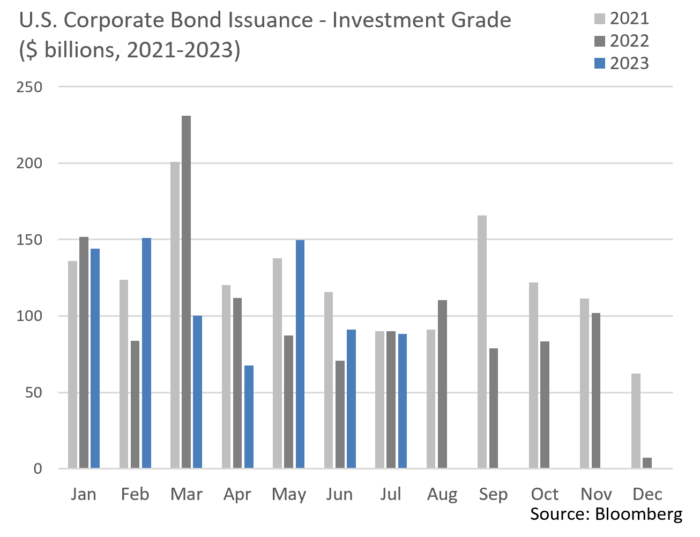

- Fund flows remained strong over the month of July. Through the 26th, Lipper reported that US IG Corporate mutual funds had experienced 8 consecutive weeks of inflows totaling $13.1 billion. Investor appetite for high grade corporate credit has strengthened with a slate of strong economic data greatly reducing market fears of a US recession, at least for the time being.

- Issuers have responded to improving sentiment and sustained demand. July issuance was stronger than expected, as the more than $88 billion of new deals pricing comfortably exceeded initial dealer expectations of $75 billion. Issuance had been at risk of missing expectations before $19.5 billion priced on the last day of the month, right after a strong GDP print. This represents the largest single day of issuance since June.

- Regulators unveiled sweeping new capital rules for banks with assets over $100 billion at the end of July, to align US regulation with the international Basel III rules. The rules would result in an estimated 16% increase in regulatory capital, while forcing banks to carry high quality liquid assets at market value rather than book value when calculating capital ratios (currently only a requirement for institutions over $250 billion). The majority of banks assessed already have adequate capital to meet these new requirements but would have higher barriers to distributing capital to shareholders. From a bondholder perspective, we see this development as positive, even though the rules would likely weigh somewhat on profitability. If adopted, a three-year transition period would begin on July 1, 2025.

Financial Planning Perspectives

College Financing Options for Students and Parents

As the cost of higher education continues to rise, evaluating potential financing options becomes ever more important. Many avenues exist, each introducing specific terms and financial tradeoffs.

As the cost of higher education continues to rise, evaluating potential financing options becomes ever more important. Many avenues exist, each introducing specific terms and financial tradeoffs.

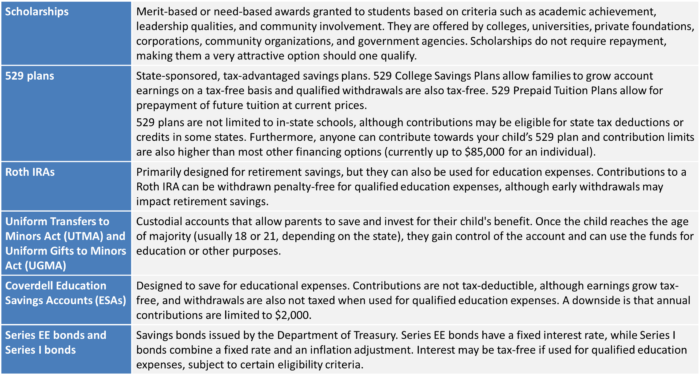

A Range of Financing Options

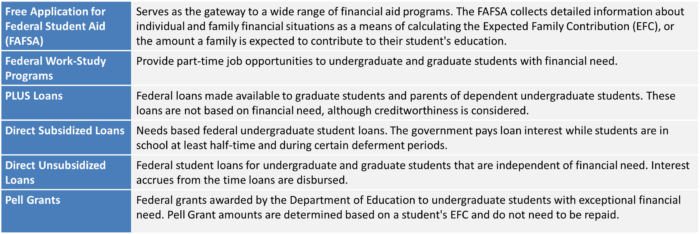

Federally Sponsored Programs Can Complement Private Savings

The pursuit of higher education should not be limited by financial constraints. Fortunately, many options exist to help families develop a comprehensive, personalized financing strategy.

For questions concerning our financial planning or wealth management services, please contact:

Jim O’Neil, Managing Director

617-338-0700 x775 | [email protected]