Insights and Observations

Economic, Public Policy, and Fed Developments

- Last month we flagged October’s Beige Book as a potential inflection point in economic activity, with the summer’s gangbuster’s growth seemingly slowing to a crawl in late September. Since then, economic data has supported a sudden slowdown.

- Weakness was broad-based over the month. A flat CPI print missing expectations of +0.1%, and an outright PPI contraction at -0.5% vs. an expected +0.1% garnered the most attention. However, PCE and personal consumption came in light as well, and while retail sales beat, they merely contracted less than expected. Meanwhile the Fed’s preferred “supercore” inflation measure unexpectedly dropped to +0.15%, suggesting service price pressures are easing too. The result was a broad market rally; Treasuries fell more than 70bps, closing at 4.22% on 12/1, while equities hit new YTD highs.

- A lot will depend on how services hold up relative to goods from here, but the smaller goods portion of the economy is already in recession. ISM Manufacturing has been in contraction for 13 straight months now and failed to rebound after the end of the UAW strike as many market participants expected. The more forward-looking New Orders sub-index at least rose somewhat but remained firmly in contraction for the 15th straight month. While these are survey measures, factory orders data released on 12/4 also showed softness, contracting more than expected on the back of a downwards prior revision. As this was an October period release (vs. November ISM data), it is possible the release may have been influenced by the UAW strike, but even ex-transportation, the report was weak.

- Meanwhile, November’s Beige Book release provides further cause for concern. Participants attributed October’s weakness to strikes (an explanation we reject) and were looking for a November bounce back. This failed to materialize, with two thirds of the districts reporting either flat growth or contraction. While Q3’s GDP growth rate was revised up to +5.2%, the Atlanta’s Q4 GDPNowcast continues to fall, and had dropped from an initial +2.2% to +1.2% at last read. A slower Q4 was almost universally expected after a strong Q3; we believe it may be even weaker than expected.

- Elsewhere, House Speaker Mike Johnson managed to avert a shutdown in mid-November by passing a clean bipartisan continuing resolution funding the government through 1/19 or 2/2 depending on department. It is unclear if he will be able to deliver again, as far right members were vocal about their unhappiness, and the House’s bipartisan expulsion of George Santos lowered the GOP’s majority to three seats.

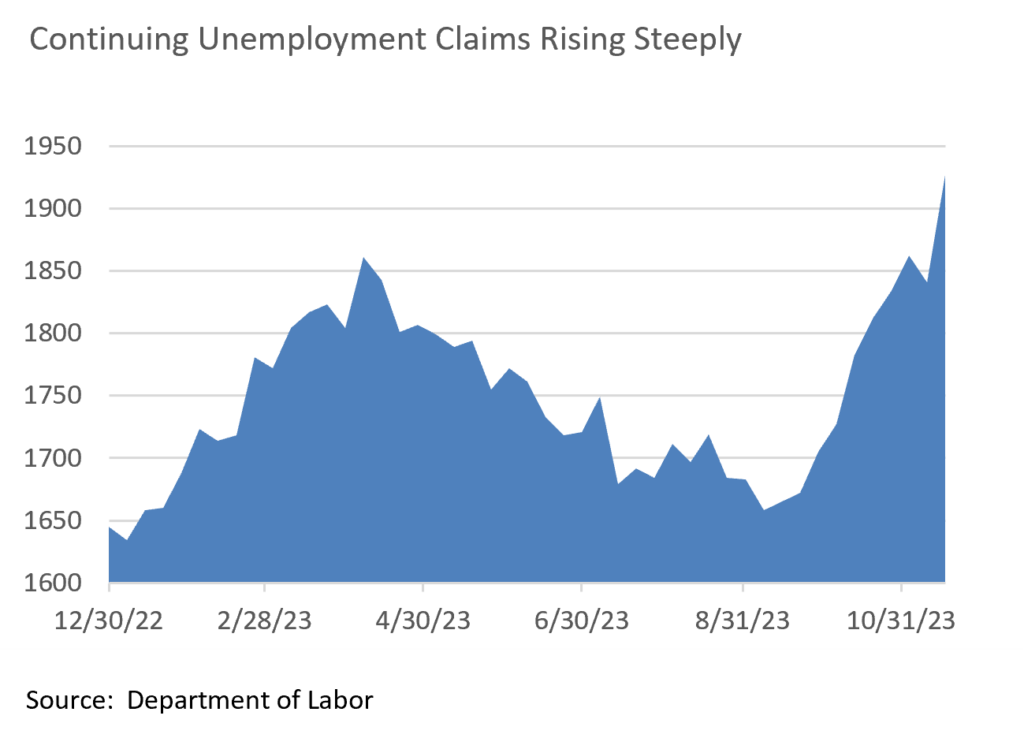

- Friday’s jobs report will also be an important test for the market. The last two Beige Book releases suggest labor slowness but not contraction. Continuing unemployment claims reached 1.93 million in November, however, the highest in two years, and with a large split between the establishment and household surveys in October, risks for November’s report are to the downside.

- The final Federal Reserve meeting of the year on the 13th should pass without incident, with rates almost universally expected to remain unchanged. The Fed has been the dominant economic story for the last two years, but as inflation fades the Central Bank’s influence should recede in importance. We see one last Fed surprise, however; we have been in a “bad news is good news” economy for the last several years, but at some point this will change. We feel a market expecting Powell to continue the “Bernanke put” and cut rates at the first sign of equity market strife is likely to be disappointed so long as inflation is even slightly elevated, and the transition back to bad news being bad news may not be easy.

Equity News and Notes

A Look at the Markets

- November has historically been the best month of the year for stocks, a trend that stayed true to form as the S&P 500 broke a 3-month losing streak in style, gaining +8.9% and bolstering YTD total return to +20.8%. It was the second-best November in the past 40 years. The Nasdaq outperformed with a +10.7% advance, while the DJIA and Russell 2000 were both up +8.8%. Each of the 11 sectors gained on the month other than Energy, which closed lower by -1.6% as WTI crude extended its slide, closing near $75/barrel.

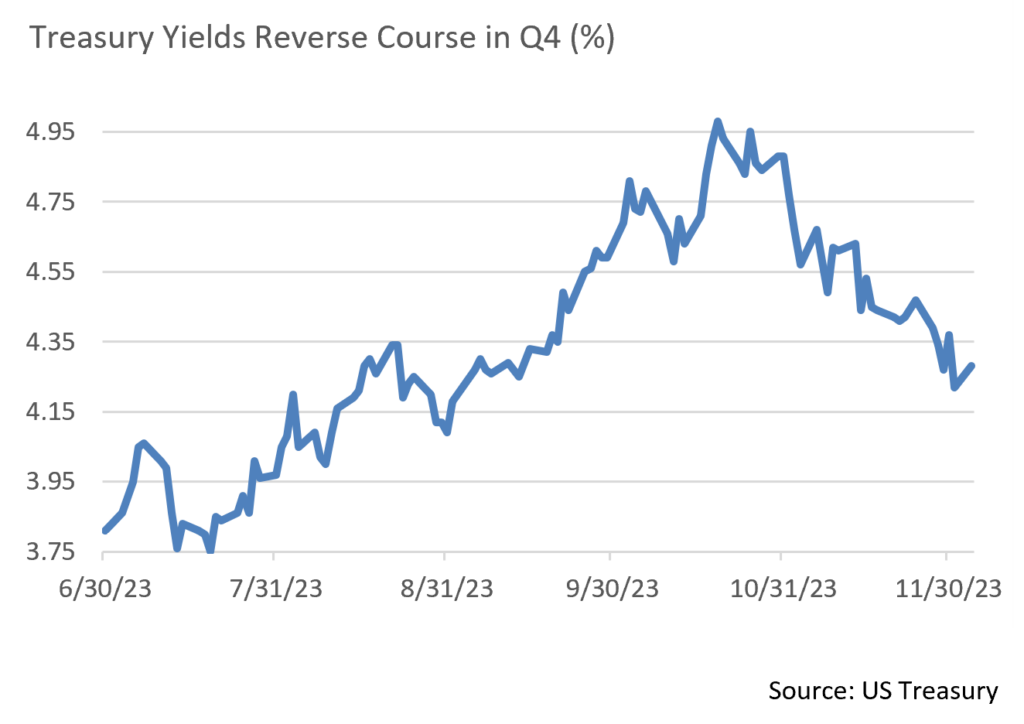

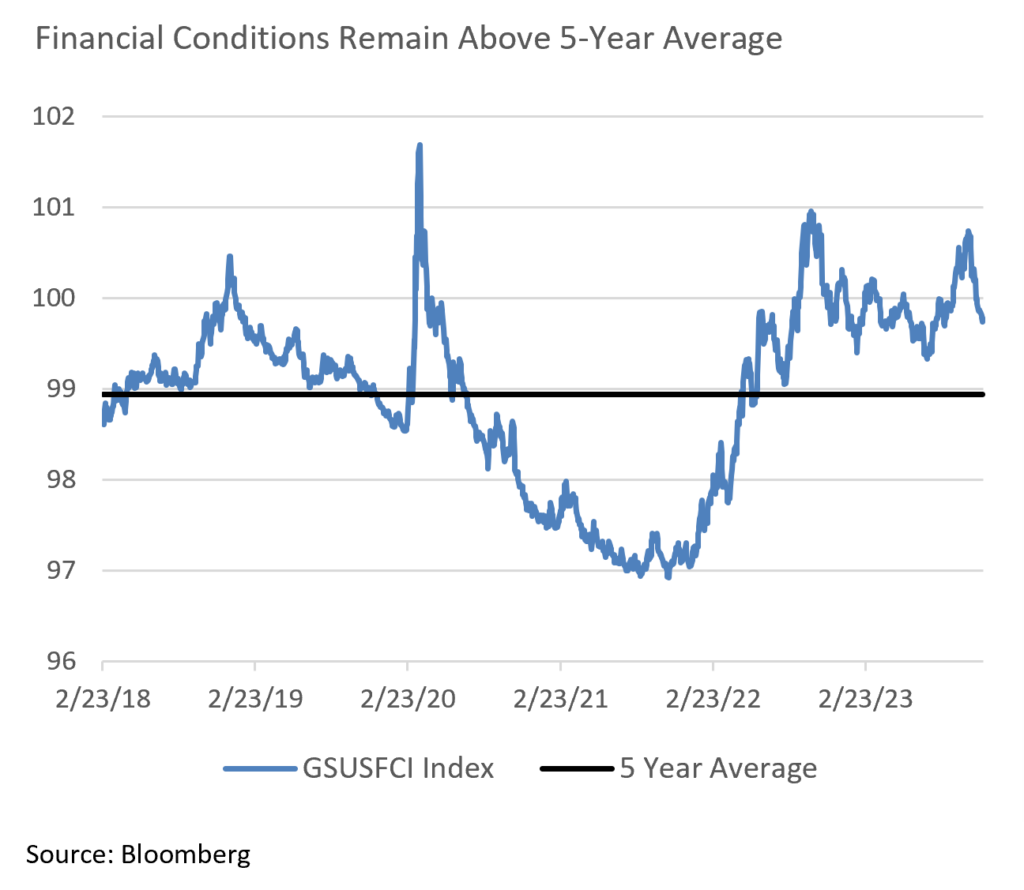

- The main driver behind November’s robust “risk-on” rally was a sharp drop in interest rates across the yield curve as benign inflation readings fueled speculation that the Fed was done hiking rates. Over the month, the market repriced the implied future path of interest rates with the odds of a first cut moving from July ’24 up to March ’24. A total of ~5 cuts (was ~3) are now expected by the end of next year. The yield on the 10-Year Treasury dropped by roughly 60bps in November, sparking a huge rally in the Bloomberg Aggregate Bond Index, which enjoyed its best month since 1985. The drop in bond yields was accompanied by a loosening of financial conditions, for which metrics revealed one of the largest monthly drops on record. Nonetheless, financial conditions remain tight relative to their 5-year average with real yields firmly in positive territory. The Fed appears to be growing more confident in the inflation outlook and the moderate pace of economic activity, a backdrop that set the stage for a very strong November.

- While the stock market has been rallying on the hope of rate cuts, we offer a word of caution… be careful what you wish for. The only reason the Fed would cut rates 5 times in 2024 in our view are if inflation comes down dramatically or if the economy shows signs of material weakness. We believe that inflation has peaked, but do not think that it will get back to the Fed’s 2% target in linear fashion as the last mile is likely to be the hardest. If that’s the case, a 5-rate cut scenario is likely to be accompanied by an economic downturn which in turn hits earnings and stock values. This can be seen in the chart showing stocks doing well when the Fed pauses (the case today) rather than cuts, which tends to produce subsequent volatility.

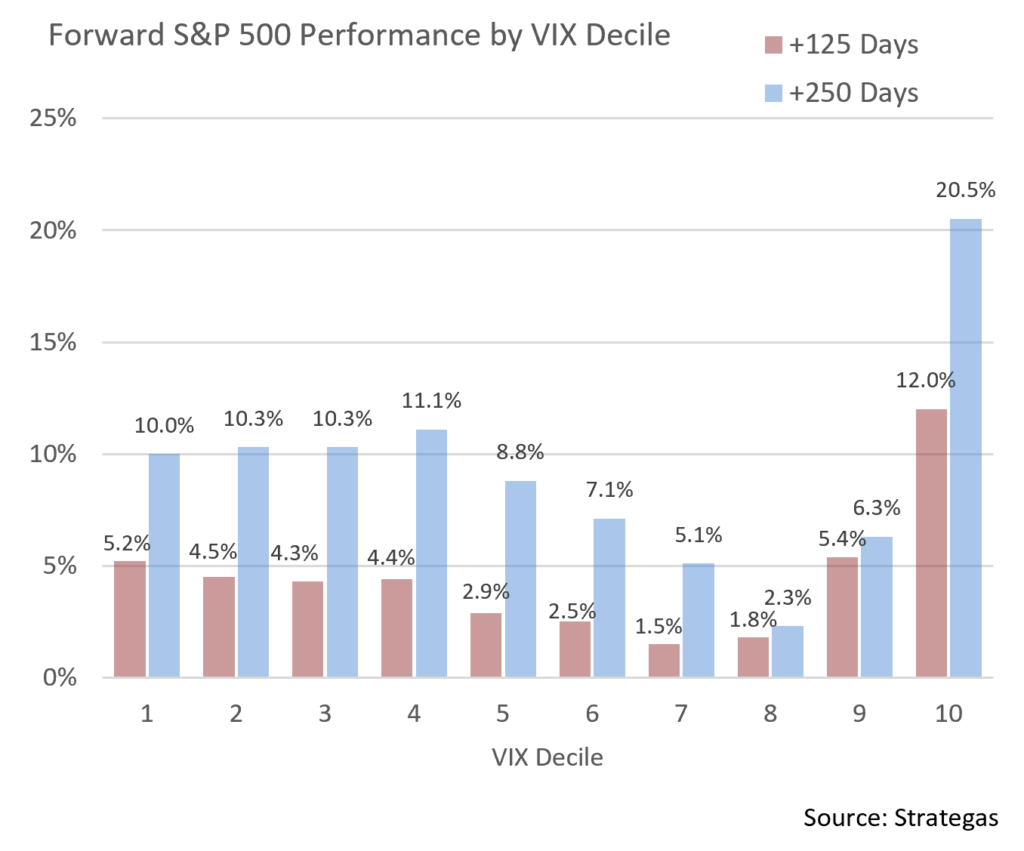

- With the melt up in the stocks, the VIX (CBOE’s Volatility Index, otherwise know as Wall Street’s fear gauge) fell nearly 30% in November, hitting 12.5 at one point, marking the lowest level since January 2020. The VIX is sometimes used as a contrarian signal with low readings signaling complacency that is often interpreted as a bearish sign. Like other measures of technical strength, the VIX does not typically align with forward market returns in a linear manner. Market returns come more often when fear is rampant. However, investors often enjoy better than average returns, particularly in the short term, when the VIX is low. There is a strong rationale for the saying “never short a dull market” as markets can stay overbought for prolonged periods.

- As the final month of the year begins, we anticipate a rangebound stock market as investors digest recent strength and look towards earnings. Positioning is less of a tailwind than it was a month ago as sentiment has improved. As the Fed monitors the lag effect of higher rates, we continue to watch the labor market for signs of slowing as it this is considered one of the Fed’s preferred measures of economic impact. Lastly, tight fixed income credit spreads bear monitoring for signs of stress, as this offers insight into equity market conditions.

From the Trading Desk

Municipal Markets

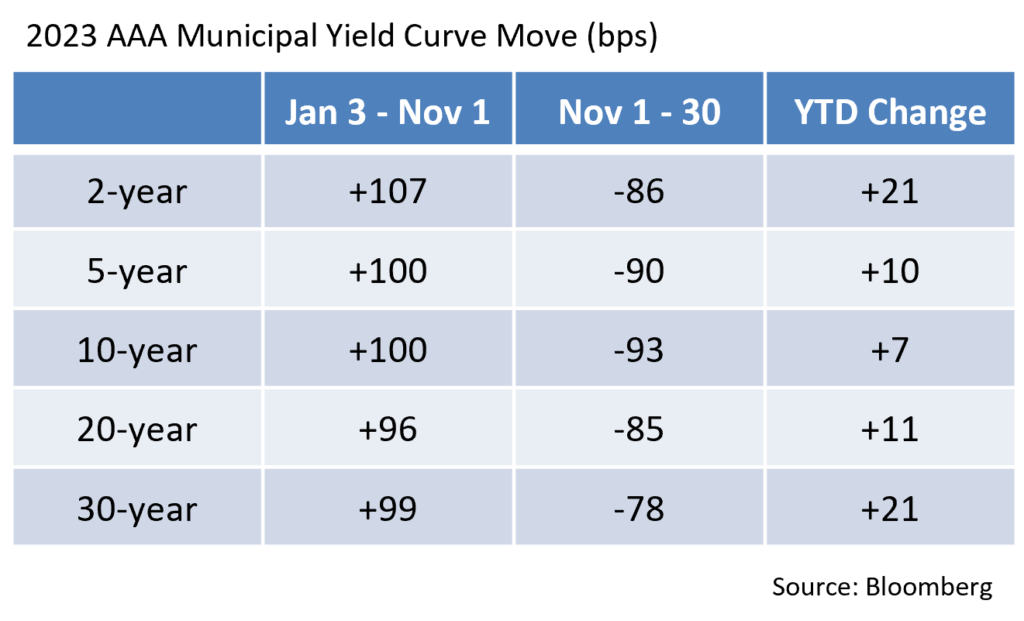

- Municipal bond yields experienced a sharp move downward in November, a reversal driven by what appears to be the end of a six-month uptrend in Treasury yields. A massive rally saw municipal yields drop by 86, 90 and 93bps on the 2, 5 and 10-year points on the AAA curve, respectively. This surge in bond prices produced some of the best returns seen in decades, erasing the losses of the three previous months. On a YTD basis, the Bloomberg Managed Money Short/Intermediate Index now posts a +2.51% return heading into the final month of 2023.

- Municipals rallied even more strongly than Treasuries, dropping the 10-year AAA Muni/Treasury ratio from 73% to 62% at month end. Despite relatively rich valuations, we are still finding considerable value in the 8 to 12-year part of the curve and are positioning portfolios to garner additional yield pick-up in the roll to 2024.

- November’s issuance increased considerably as $35 billion came to market, 29% above the same month of last year. The jump in issuance is largely attributed to a nearly 100 bps fall in rates, which brought several deals off the sidelines. On a YTD basis, tax-exempt issuance is $306 billion, 3% above 2022 and 2% higher than the 5-year average for the period. With December supply expected to fall short of demand and an estimated $46.8 billion coming back to investors, up from $35 billion in November, we expect technicals to offer performance support. A Fed meeting and holiday shortened weeks will also be factors in keeping municipal issuance down in December.

- This month will be active in the secondary market as managers look to harvest tax loss positions and put cash back to work. Primary market offerings have frequently been oversubscribed, limiting the allocations of new issue bonds. We remain focused on sourcing bonds at attractive relative values in both the primary and secondary market.

Corporate Bond Markets

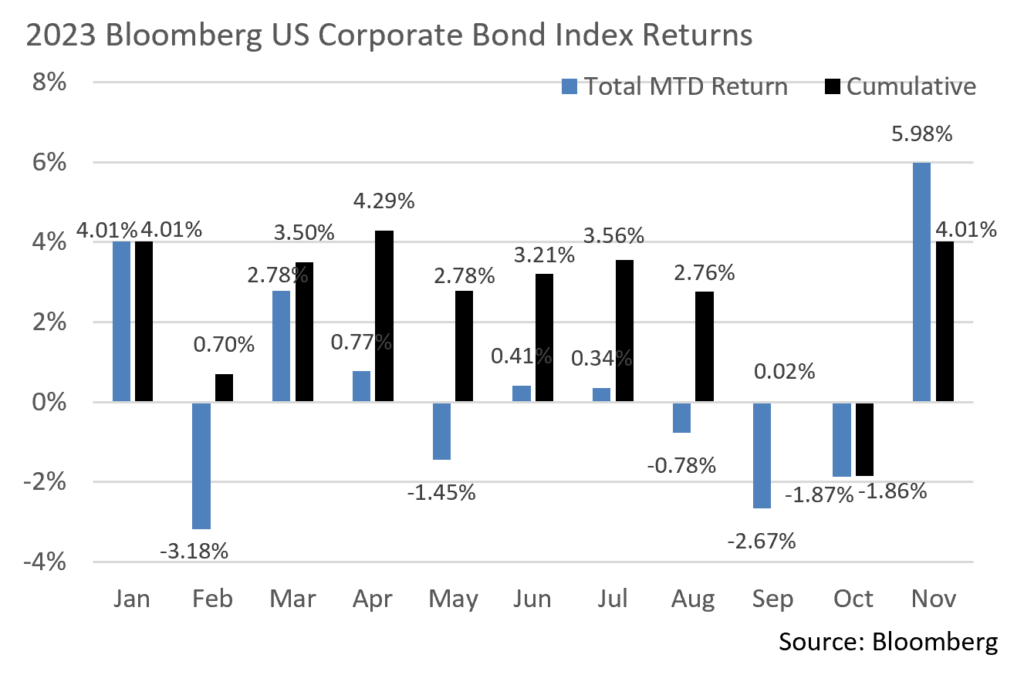

- Risk tone was strong over the course of November and Investment Grade returns were sizable as a result. A significant rally in USTs produced a robust +5.98% monthly return on the Bloomberg Barclays US Corporate Bond index, raising YTD performance to +4.01%. November’s bond rally represented the best single monthly return since December of 2008. In a “risk-on” environment, longer dated, lower quality bonds performed better than their intermediate, high-quality counterparts. Market momentum going into December remains positive and we do not anticipate surprises from the Fed or in this month’s economic data.

- In combination with a rally in rates, credit spreads narrowed to YTD lows. Spreads on the Bloomberg Barclays US Corporate Bond index touched a low of 104 OAS on 11/30, 11 bps below February’s 115 OAS. The strength of Investment Grade credit sentiment is supported by these relatively tight spread levels, the lowest since February of 2022. This credit rally seems to be driven much more by investors taking advantage of elevated yields before they decrease, as opposed to a material reduction in credit risk. While risk remains a factor we carefully assess, credit strength in the higher quality portions of the market is generally improving. Unless there is deterioration in the liquidity environment, we could see modest additional spread compression over the last few weeks of the year.

- The Investment Grade primary market is still strong, although timing is everything and issuers are picking their spots after a lumpy 2023. Expectations for November issuance called for about $100 billion and actual new supply of $98.6 billion closely followed suit. November is generally a strong month as it represents a final push before the holidays and year-end. Deal performance remains solid with new issue concessions hovering around 8 bps and order books over 3 times covered. Spread compression in the days following new deals has often been significant as some participants are finding it difficult to get fully allocated in the primary market. December will be a quiet month with an expected $30-$35 billion offered, a level that would produce very similar annual issuance as 2022.

Financial Planning Perspectives

2023 Year-End Tax Planning Checklist

As 2023 draws to a close, we encourage clients to consider several tax planning strategies. The list below includes items that you may want to discuss with your Portfolio Manager.

General Financial Planning

- Review wills, trusts and retirement account beneficiaries for accuracy and make plans with an estate attorney to implement any appropriate changes. We are happy to offer a referral if you are not currently working with an estate attorney.

- Remember that credit reporting companies are required to provide a free credit report annually. Periodically reviewing your credit report can prevent mistakes from negatively impacting your credit score, while also helping to reduce the risk of identity theft.

- Reviewing your budget at year-end is a great way to prepare 2024 spending plans, especially if major expenses are on the horizon. Please communicate any major anticipated expenses and their timing to your Portfolio Manager.

Retirement Accounts

- Remember to take Required Minimum Distributions (RMDs) from retirement accounts, if applicable.

- For Inherited IRA account holders, remember to take an RMD if required and assess whether it is a good idea to take a distribution larger than the RMD considering the new 10-year rule. As our recent Secure Act 2.0 webinar emphasized, Inherited IRA RMDs can be complicated, and we would be happy to assist you in determining what is necessary.

- Be sure to maximize contributions to retirement accounts such as a Roth IRA, traditional IRA, or 401(k) if you are able. Maximum contributions for 2023 are $22,500 for a 401(k) and $6,500 for an IRA ($30,000 and $7,500 respectively for those age 50 or older).

- Consider the benefits of a Roth conversion. Despite introducing a potentially sizeable current taxable event, a Roth conversion may make sense given its ability to eliminate taxes upon distribution.

- If your child has earned income, consider opening a Roth account for them in their own name. The maximum contribution is the lesser of the child’s total 2023 earned income, or $6,500.

Income Taxes

- Consider adjusting your tax withholding or estimated tax payments if you have had or anticipate a significant 2023 taxable event such as a bonus, Roth conversion, or large withdrawal from an IRA or other retirement account.

- Please communicate tax loss harvesting needs to your Portfolio Manager.

Gifting

- As a reminder, $17,000 can be gifted per recipient on a tax-free basis during 2023. This is a useful tool to pass wealth on to future generations. Direct payments towards educational or medical expenses on behalf of an individual are not subject to this limit.

Charitable Giving

- Consider opening and funding a donor advised fund (DAF). Grouping charitable donations intended to be made over a long period of time and funding a DAF in that amount enables one to take a large current year charitable deduction, while still offering flexibility concerning the timing of charitable gifts.

- If you choose to itemize, be mindful of timing when making charitable gifts. To qualify for a deduction, gifts must be received by a 501(c)(3) organization by December 31st.

Prepare for 2024: Updated Tax Figures and Contribution Limits

| Elective deferrals into 401k, 403b, 457, and TSP plans: | $23,000 |

| IRA or Roth IRA contribution limits: | $7,000 |

| Roth IRA phaseout: | $146,000 – $161,000 of taxable income (single individuals and head-of-households) $230,000 – $240,000 of taxable income (married filing jointly) |

| Standard deduction: | $14,600 (single and married filing separately) $29,200 (married filing jointly) $21,900 (head-of-household) |

| Annual Gift Exclusion: | $18,000 |

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.