Insights and Observations

Economic, Public Policy, and Fed Developments

- Geopolitical risk roiled the markets in January. A US drone airstrike killed a prominent Iranian general at the start of the month leaving the equity and oil markets on edge, although a limited Iranian retaliation helped calm markets. A Coronavirus outbreak in Wuhan, China subsequently spooked investors, sparking a Treasury flight to quality and a mild yield curve inversion even though equities have remained resilient. The virus has thankfully so far been mild, and the human cost appears likely to remain relatively low. However, aggressive containment measures, coming during the Chinese New Year where services demand is elevated, will weigh on the Chinese economy and are disrupting global supply chains. Bloomberg estimates even a contained pandemic not stretching widely beyond China could lower their domestic GDP to 4.5% for the quarter and pull full-year growth below 6%. US growth is also likely to be modestly impacted. Goldman Sachs estimated at month’s end that Coronavirus will slow US GDP by 0.4% in Q1 ’20 due to hits to tourism and trade.

- The “Phase One” trade deal was signed on January 15th. Markets largely shrugged off the news; the agreement contained less detail than was hoped, setting import targets but not specifying which goods would be bought, left Chinese tariffs on US imports in place, and offered minimal specifics concerning how China would reach the target of $200 billion above 2017 import levels. Still, we view the Phase One signing, and the signing of the USMCA on the 29th, as good news, as they make further escalation of global trade wars less likely. This removes a source of uncertainty and risk that should improve business confidence.

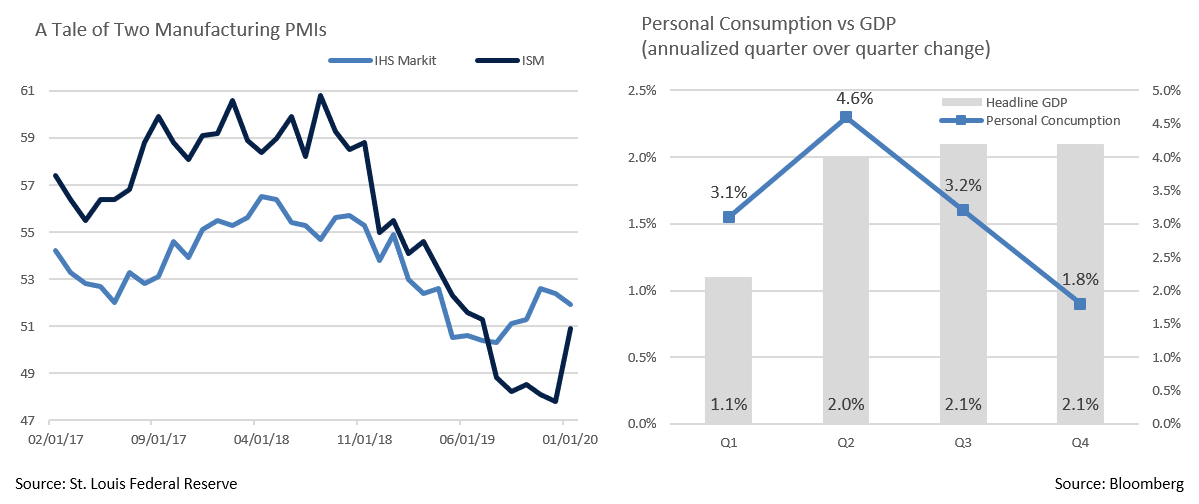

- An early sign of this improvement came with January’s ISM manufacturing report. After December’s worst reading since 2009, the index rebounded to 50.9, handily beating expectations of 48.5. In a December blog post accompanying their release, competitor IHS Markit had theorized part of the reason for the IHS index consistently exceeding the ISM in recent months was the former’s being explicitly limited to US conditions; ISM’s surge in the wake of the two trade deals being signed would support this interpretation. While still not especially strong, ISM’s return to expansion after six months of contraction was a welcome surprise, and while the Coronavirus could still impact future periods, it seems the impact on US manufacturing has so far been modest.

- The preliminary estimate of Q4 GDP released at the end of January showed growth of 2.1%, unchanged from the prior quarter. Beneath the decent headline number, though, consumption continued to slow, rising 1.8%, in line with a decelerating trend from 4.6% in Q2 and 3.2% in Q3. Business investment was also weak. The PCE deflator rose a modest 1.6% headline and 1.3% core, and the tepid pace of inflation suggests the Fed’s hope that inflation will soon return to 2% is, for the time being, just that; hope. Full year GDP growth stands at 2.3%, down from 2018’s 2.9%.

- The Federal Reserve kept short term rates unchanged, with no adjustment to outlook or risk factors in their release. Chairman Powell indicated he was intent on avoiding a permanent reduction in inflation expectations, noting “we have seen this dynamic play out in other countries.” While trading is volatile, the market now believes a rate cut is likely to occur before the November election, with two possible before year-end.

Equity News and Notes

A Look at the Markets

- After a positive start to the year, the S&P 500 suffered its first back-to-back 1% weekly declines since late August to finish the month with a return of -0.16%. Many of the same factors that characterized 2019 have remained in place: Growth over Value, Large Cap over Small Cap, Technology and US equities outperforming, and Energy and foreign stocks underperforming.

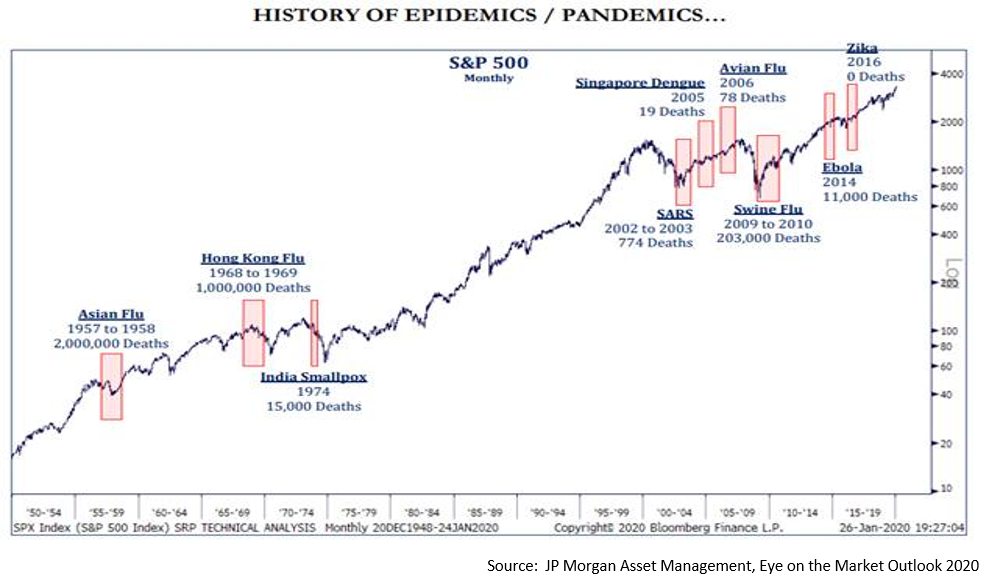

- The main volatility driver in January was the outbreak of the Coronavirus. There is no way to know how long the outbreak will last or what the ultimate human impact will be. For historical perspective, the chart below looks at past epidemics and pandemics mapped against the S&P 500. Equity returns have ultimately followed positive earnings growth and economic expansion despite worrying bouts of uncertainty.

- As of this writing, there have been over 490 reported deaths and more than 24,000 reported cases, with a vast majority of confirmed illnesses and all but two of the deaths in mainland China. Equity markets were initially shaken by these developments, although the major global indices have recovered strongly in recent days. An overriding concern is the extent to which the epidemic ultimately impacts the global economy.

- China’s economy should take at least a -1% hit to Q1 GDP, with the full year impact ranging from 0% to -1%. The People’s Bank of China has already committed to injecting over $171 billion of liquidity via the reverse repo market, and they are expected to stay accommodative should the outlook worsen. A pending reduction in US tariffs is also expected to stimulate demand.

- We think comparisons to the SARS outbreak in 2002 aren’t perfect but are a reasonable proxy. The mortality rate on the Coronavirus is running about 2%, significantly lower than SARS (774 deaths) which was closer to 10%. However, what elevates the Coronavirus threat is the magnitude of infections (already >24,000 vs. SARS of ~8,000). Another fundamental distinction is that today China is a much larger part of the global economy than it was in 2002, as it is deeply interwoven into global trade and supply chains. What ails China now risks ailing much of the rest of the world.

- Fortunately, response to Coronavirus has been much faster than SARS, which took months to acknowledge and counter. That may work against the economy in the near term as commerce is being restricted for containment reasons, but it should save lives and help dampen the long-term impact.

- In short, Chinese policymakers appear to be taking the right steps and recent days have brought hope on the pharmaceutical front. More broadly, the stock market is charging ahead, largely because 2019’s bullish narrative is still intact.

- Central banks remain accommodative – The Federal Reserve has been increasing its balance sheet and vowed to keep rates low until we see meaningful inflation. Given recent volatility, the futures market odds of another rate cut in 2020 have jumped to 82%.

- Global economic growth is stabilizing – The manufacturing economy has been hampered by trade conflict and Boeing’s problems, two risks that warrant monitoring. Sustained quiet on the trade front would certainly help manufacturing, although the US consumer remains key to the global economy. Given elevated consumer confidence, a strong labor market, a solid housing outlook, low interest rates, and minimal inflation, we do not foresee a US recession.

- Credit – Given the backdrop of easy central bank policy, corporate credit spreads are likely to stay benign. We’ve seen some curve flattening and the high yield markets are vulnerable should oil prices continue to slide. Nonetheless, credit spreads remain tight and liquidity concerns have not materialized.

- Corporate earnings rebound – As we touched on last month, corporate earnings growth will be needed to generate 2020 equity gains given that last year’s performance was largely a function of multiple expansion. Q4 earnings season is now a little more then halfway complete and the results have been better than expected. The blended earnings growth rate may only be 0.09%, but that is significantly better than a year-end estimate of -1.6%. A key variable to watch is CY2020 S&P 500 earnings which are estimated to increase by 8.5%.

From the Trading Desk

Municipal Markets

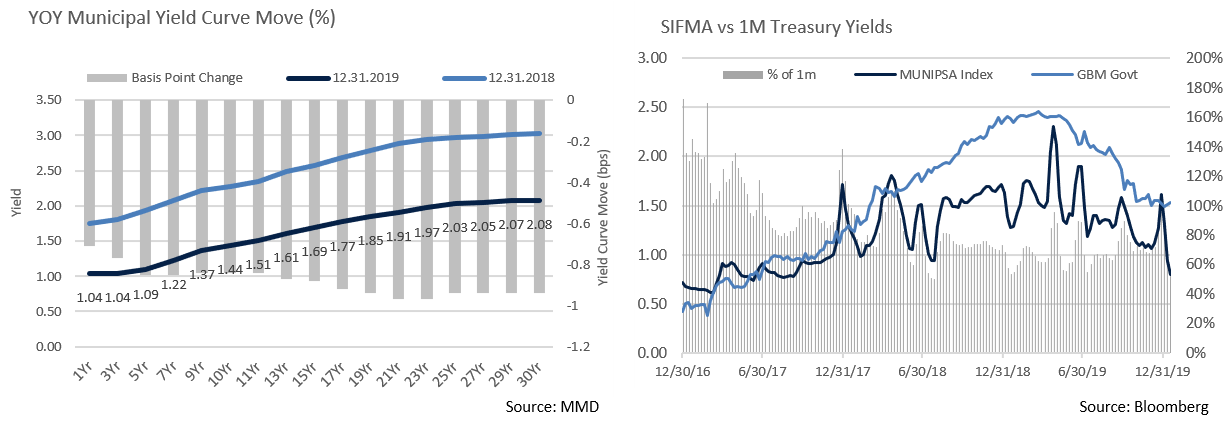

- Operating in a low yield environment is today’s reality for advisors and tax-exempt investors. While compressed yields limit income potential, we still see opportunities for active management to generate incremental value.

- From a relative steepness perspective, we feel the 6 to 12Yr portion of the AAA municipal curve offers the greatest value. The spread between 2-10Yr AAA municipals widened by 20 basis points to 40 basis points during Q4 ’19 before receding modestly to 32 basis points at the end of January. This compares to only a 1 basis point yield spread between 2 and 5 years. Beyond 12 years the curve also flattens out.

- We’ve also long emphasized the value of adding out-of-state exposure to in-state preference portfolios given rich pricing in certain states and limited bond availability. Doing so can open the door to relative value tradeoffs that may enhance after-tax returns after accounting for in-state taxes on bonds domiciled outside one’s state of residence. Looking at two recent AAA-rated, bond offerings of similar structure illustrates this point:

- Southern CA Metropolitan Water District, 10/1/30 callable 10/1/29 was offered at 1.00%

- Richardson, TX GO, 2/15/30 callable 2/15/29 was offered at 1.36%

- A high-tax bracket California resident buying the Richardson, TX bonds would be subject to a 13.3% state income tax, leaving a net after-tax yield of 1.18%, still well in excess of the comparable in-state bond.

- Lastly, we advise paying close attention to cash and equivalent assets. Tactically allocating between VRDNs and very short-term high-quality municipals can be effective given fluctuation in VRDN yields relative to AAA municipals and I month Treasuries.

Taxable Markets

- Investment grade issuance is off to a quick start as $133.69 billion came to market during the typically busy month of January. This marks the second largest month of issuance on record, trailing only January 2017. A flattening US Treasury yield curve continues to push down funding costs and issuers have raced to capitalize. Additionally, a $2.4 billion spike in negative yielding debt across the globe further enhanced the appeal of US debt to global investors starved for income. This seemingly insatiable demand remains highly supportive of new issue bonds and those trading on the secondary markets.

- Investment Grade spreads rallied accordingly through the first few weeks of January and performance remained solid. However, a flight to quality trade was triggered by growing Coronavirus fears and spreads subsequently widened by 5 – 10 basis points. The energy sector was hit hardest with spreads widening by 10 to 15 basis points. Global economic impact worries drove down energy prices, thereby raising credit concerns. High yield is naturally more vulnerable, but we do not see investor demand for investment grade credit waning anytime soon. This should keep the very strong bid for investment grade bonds in place.

Financial Planning Perspectives

Preparing for a Child’s Marriage? Introduce a Dose of Optimism and Protection

Financial advisors and clients regularly discuss risk mitigation as it relates to financial threats. Life, health and property insurance are core elements of financial planning, yet a relatively common life occurrence isn’t broached nearly enough: divorce. Hoping for the best is insufficient, whether it relates to one’s own situation or those of your children.

According to the WSJ1, divorce rates are at a 40-year low. While the divorce rate dropped in 2017 to 16.1 per thousand marriages from 22.6 in 1979, aggregate statistics have no value if the person getting divorced is your daughter or son. Divorce settlements can compromise generational asset transfer and/or wealth creation, along with taking an emotional toll.

We frequently speak with parents concerned about the future risk of a child’s divorce and are often asked what can be done to protect inherited wealth. Our recommendations typically focus on prenuptial agreements and dispositive provisions in estate planning documents.

A prenuptial agreement offers a contractual roadmap concerning the property rights of each spouse in the event of a divorce or separation. In our view, prenuptial agreements are not just for the very rich and famous. Parents concerned about the possibility of a child’s future dissolution of marriage ought to consider the following:

- Review, if only in broad terms, your own wealth, financial and legacy goals and values with your children;

- Discuss the benefits of a prenuptial agreement long before a child’s marriage is on the horizon. This can avoid “stigmatizing” a soon-to-be son or daughter-in-law as the wedding approaches; and

- Prepare for questions and resistance with a sober, but firm rationale

Parents also need to understand how their estate plans are to be distributed to their children. Many estate plans pay out fully upon the death of the surviving spouse, or in sequential payments upon heirs reaching certain ages. These pay-out methods are fixed and, as such cannot easily be changed.

A few estate planning options are worth considering as you think about what might work for your family.

- Maintain assets in trust for your children’s entire lives and discuss why. This is what we’d call a “back door prenup”;

- Add broader, more flexible discretionary distribution language; and

- Name a friendly, knowledgeable Trustee.

We understand that these are not easy conversations. Nonetheless, assessing your options long before a pending marriage can ultimately help protect you and your children. We welcome your thoughts and are happy to talk about your family’s unique circumstances.

The Wall Street Journal, The Divorce Rate Is at a 40-Year Low, Unless You’re 55 or Older, Jo Craven McGinty, June 21, 2019

Appleton Answers: “Lunch and Learn” Workshops

Appleton Partners is pleased to continue hosting a series of “Lunch and Learn” workshops that began this November. Each meeting will gather a small group of clients to discuss a specific topic. Space is limited so please sign up for whatever session(s) is of greatest interest. These interactive workshops will be held in our office at One Post Office Square on the 20th Floor. Parking at The Garage at Post Office Square (across Pearl Street below the park) will be validated.

To sign up, click here: EVENT REGISTRATION. We encourage you to invite a family member, friend or colleague whom you feel would benefit from participating. Please use the same process to register them in their own names.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]