Insights and Observations

Economic, Public Policy, and Fed Developments

- Georgia has commanded much political attention in recent days and reports now indicate that the Democrats have narrowly won both Senate run-off elections with control of the upper chamber at stake. While we do not understate the importance of these races, their impact on the Biden agenda may be overstated by the markets and media. The Senate will remain highly dependent on moderate Senators to pass legislation under either party’s control, and concern about a progressive agenda that influenced a recent uptick in Treasury yields is likely unwarranted. The biggest benefit to the Biden agenda of a Democratic Senate will be through operational control of the chamber; the ability to decide what legislation to take up, to form subcommittees, and to weaken the GOP’s ability to use procedural means to block legislation.

- Meanwhile, as Biden’s cabinet picks are being evaluated by the markets, we find the nomination of Pete Buttigieg as Secretary of Transportation especially interesting. Buttigieg’s endorsement of Biden came at a critical juncture, and we feel his nomination increases the likelihood that federal investment in transportation infrastructure will be a priority.

- On a final political note, President Trump has refused to formally concede, and has been fighting a protracted campaign to overturn the results of the presidential election, culminating in violent protests on Capitol Hill prior to Congressional certification of the Electoral College votes. The President’s increasingly defiant actions may introduce short-term volatility over the next two weeks.

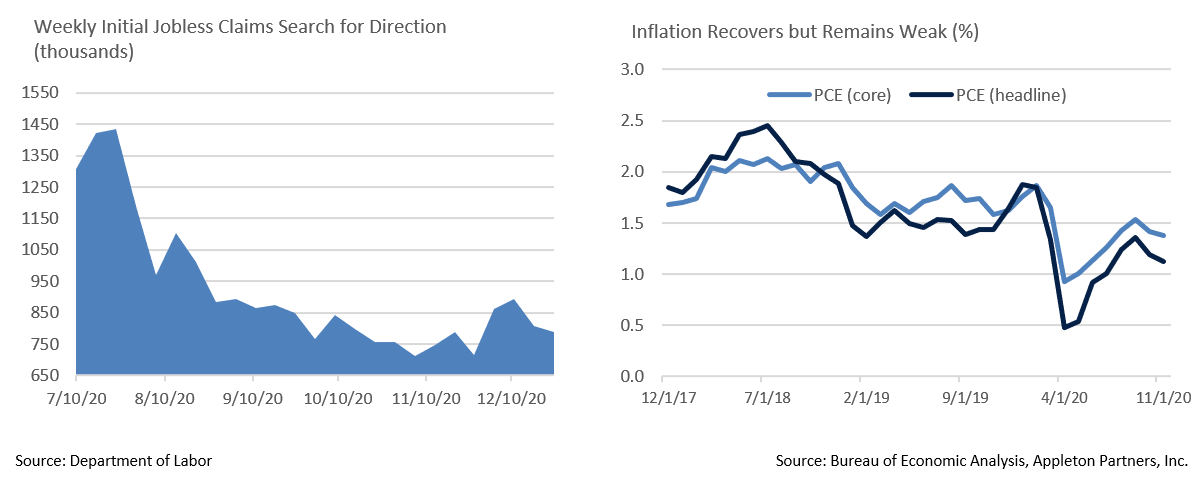

- The employment situation remains murky and recent releases have not been especially promising. A recent rise in new unemployment claims reversed at the end of December, a development that was likely impacted by a state-level crackdown on fraudulent claims and the (brief) expiration of temporary pandemic unemployment benefits in the final week of the month. With COVID-19 cases surging and PUA benefits resuming at the start of January we expect new claims to continue to rise. In any event, claims remain higher than they were in mid-October, when a pronounced downtrend was still in effect, and well above normal non-recessionary levels.

- Meanwhile, personal income and consumption both dropped more than expected in November, another sign of economic weakness. Income came in at -1.1%, below expectations of -0.3%, while consumption missed expectations of -0.2%, at -0.4%, driven in part by the start of a gradual phase-out of pandemic benefits and uncertainty over the fate of the second stimulus bill. The PCE deflator, the Fed’s preferred measure of inflation, came in flat at both headline and core, bringing YoY headline to +1.1% and core to +1.4%. Despite concern over unprecedented monetary stimulus, evidence of inflation remains scarce even as demand for pandemic-impacted goods has accelerated. Durable goods orders have recently been a bright spot, although services spending slipped for the first time since April as case counts rose and weather cooled.

- Jerome Powell used his final press conference of the year to reiterate that short term rates would remain at zero for quite some time while continuing asset purchases, despite today’s negative real rates well into the recovery. We expect the Fed to remain accommodative for a long time to come, and to clearly telegraph any change in monetary policy well in advance of acting. This policy stance should be highly supportive of markets as we begin 2021.

Equity News and Notes

A Look at the Markets

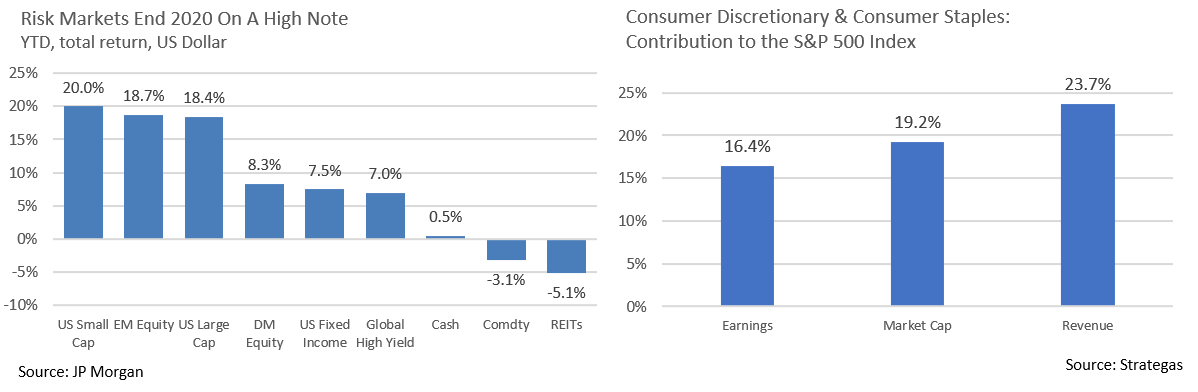

- Stocks rallied into year-end as the S&P 500 gained 3.8% in December, bringing 2020’s total return to 18.4%. The index enjoyed its best Q4 (+12.2%) since 1999, and its top final two months ever, posting a gain of 15% over November and December. Positive momentum reflected investors looking past worsening COVID-19 trends towards vaccine progress and additional fiscal stimulus. The Nasdaq Composite produced its best year since 1999, gaining 44% as the technology-heavy index benefited from the stay-at-home trade.

- Market breadth was also strong during Q4, unlike most of the year when the major averages were buoyed by a handful of stocks. The equal-weighted S&P 500 Index outperformed its market-cap weighted counterpart over most of Q4 but traded relatively flat in December as the market-cap index (notably Apple) reasserted itself. Breadth was most evident in small caps which posted a remarkable +31% quarter to overtake the S&P 500 in YTD performance. This turnaround is most impressive given that small caps were at the epicenter of the COVID-19 pandemic, down 40% at its late March trough, and had lagged the large cap S&P 500 by 16% as recently as early September. We welcome small cap resurgence (and emerging markets), as strength in these asset classes is often associated with early bull market behavior and suggests that investors are anticipating favorable near-term conditions.

- It appears that both Democratic candidates have won their respective Senate run-offs in Georgia. Financial markets had been pricing in a Republican victory in at least one seat although more recent pre-election day momentum was moving in the Democrats’ direction. Investor consensus had appeared to favor a split Congress and a balance of power. A Democratic sweep could bring volatility as investors grapple with the potential for higher taxes and tighter regulations. Short-term weakness could represent a buying opportunity for two reasons. First, it is likely that any meaningful tax and regulatory changes get phased in or delayed given what would still be difficult political prospects and a fragile economy. Second, a Democratic sweep could bring increased stimulus spending (climate, infrastructure, education, state aid) that would offset the potential policy changes markets fear.

- Investors spent much of 2020 trying to reconcile how the stock market could advance so strongly in the face of an economy facing severe challenges and areas of acute weakness. A rationale worth noting is the glaring distinction between the market and economy in terms of leverage to the consumer. The US economy is led by consumers, who are responsible for nearly 70% of GDP. However, when breaking out S&P 500 components, the consumer sectors account for far less direct influence. Even though consumer spending makes its way into other sectors of the stock market, this comparison demonstrates that Wall Street is not Main Street.

- One may ask how much of the positive equity market news has already been priced in. With a forward S&P 500 P/E now at 22.4x, the stock market advance of 2020 came purely on the back of multiple expansion as prices rose despite a drop in corporate earnings. Realistically, we need to see earnings materialize to justify these lofty valuations. This bears close attention, especially as Q4 earnings season approaches.

- As we look out into 2021, we also must keep an eye on interest rates. The Fed has vowed to keep short-term interest rates anchored, but market forces determine the rest of the interest rate curve and inflation expectations could push the longer end higher. Low rates have fueled a sustained rally in risk assets (TINA trade), especially in growth-oriented stocks. Though we do not see it as an imminent threat, inflation expectations could eventually begin to run hot enough to catch the Fed’s attention and trigger a less accommodative monetary stance.

From the Trading Desk

Municipal Markets

- Robust demand for municipals remains intact with mutual funds gathering another $20 billion of net flows in Q4, bringing 2020’s total to $39.7 billion despite almost $47 billion of outflows during a 5-week period in April and May. We expect positive fund flows to continue in January.

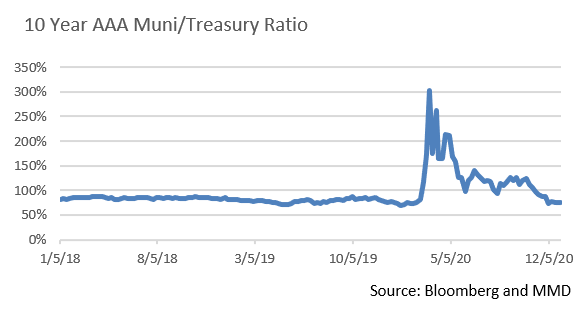

- As 2020 drew to a close the municipal curve flattened somewhat with 10-year AAA yields falling 16 bps over the quarter. Buyers have been willing to go a bit further out on the curve and inventory remains limited. This caused a reduction in the 2-10Yr AAA municipal spread from 74 bps on 9/30 to only 57 bps at year-end. Several municipal strategists are predicting increased supply in 2021 based on an expectation that governments will borrow sizeable sums to help with pandemic related challenges.

- Taxable municipals ended a strong year on a high note with 2020 doubling the prior year’s issuance at $145.2 billion. Taxable supply should remain healthy absent a significant uptick in yields or a reversal of the restriction on tax-exempt refinancing. Crossover and other flexible municipal portfolios can selectively find after-tax incremental value in taxable municipals, although a good deal of that supply is slightly longer than the Intermediate buying range.

- A more favorable forward economic outlook pushed UST yields higher with the 10Yr ending December at 0.93%, triggering a decline in the 10Yr AAA muni/UST ratio to 77.2% after beginning Q4 at 112.8%. This represents a return to long term average ranges prior to pandemic induced spikes earlier in 2020. Our current trading expectation is 0.80 – 1.25% on the 10Yr UST, and with ratios below their long-term average of 86%, we are duration neutral versus the benchmark on our Intermediate Municipal portfolio at about 4.60 years. As 2021 begins, the high-grade municipal curve remains steepest in the 6 to 10-year range, thus making it an attractive portion of the curve.

Corporate Bond Markets

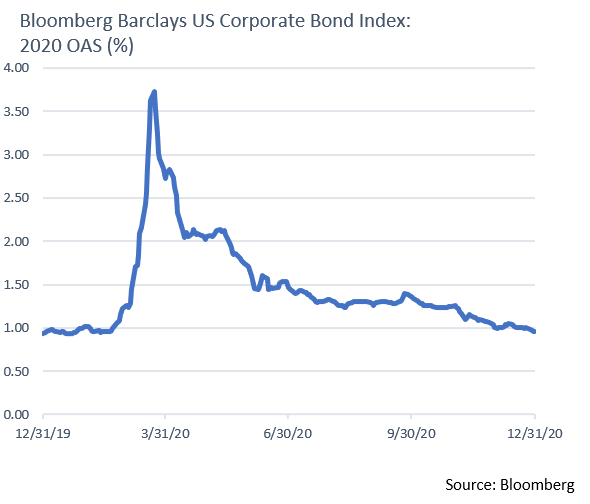

- Sustaining recent momentum, new debt hitting the IG Corporate market during the typically slow month of December came in at $38 billion, beating estimates of $25-30 billion. This brought the YTD total to just shy of $1.75 trillion, the largest annual total in history. Extremely low interest rates and tight credit spreads continue to make it advantageous for corporate issuers to come to market. Borrowers capitalized on this favorable environment throughout the second half of the year by raising cash and enhancing liquidity amid highly uncertain economic times. Market consensus calls for 2021 issuance to normalize towards about $1.1 trillion.

- An improving macroeconomic backdrop in 2021 should strengthen corporate fundamentals and we anticipate demand for IG credit to remain strong. After a volatile year in which balance sheet fortification was the norm, the prospects for M&A activity to pick up substantially in 2021 are good, although we do not see this significantly impacting the higher quality credits we favor.

- Modest credit spread tightening in December represented a continuation of a trend that began in March with the Federal Reserve’s move to backstop then turbulent credit markets. Amazingly, December’s 5 basis point move from an OAS of 101 to 96 left IG Corporate spreads just 2 bps above the 93 level seen at the end of 2019, pandemic and recession notwithstanding.

- With very low short-term rates expected through 2022 we anticipate spreads remaining range bound for a sustained time. Global rates also remain repressed, and in some cases negative, leaving foreign investment in place as a favorable technical factor in US IG markets.

Financial Planning Perspectives

The Latest Federal Stimulus Legislation: What It Means to You

After much political consternation, The Consolidated Appropriations Act, 2021 was signed into law on December 27, 2020, another in a series of federal responses to the COVID-19 pandemic. Despite last-minute concerns that the bill would be subject to a Presidential pocket-veto, the legislation was enacted and offers a number of provisions impacting individuals and corporations.

After much political consternation, The Consolidated Appropriations Act, 2021 was signed into law on December 27, 2020, another in a series of federal responses to the COVID-19 pandemic. Despite last-minute concerns that the bill would be subject to a Presidential pocket-veto, the legislation was enacted and offers a number of provisions impacting individuals and corporations.

Individual Provisions

At an individual level, the $900 billion relief package primarily focuses on a $600 refundable income tax credit per eligible taxpayer, as well as $600 per qualifying child (eligibly similar to the CARES Act enacted in March). The tax credit begins phasing out at $75,000 of modified adjusted gross income (MAGI) for single filers and $150,000 for married filers (capping out at $112,500 and $174,000 of MAGI respectively). This legislation also includes:

- An additional $300 per week of unemployment benefits through March 14, 2021;

- A $300 income tax deduction for non-itemizing taxpayers ($600 if married filing jointly) for charitable deductions made in 2021 (not permanent);

- Extending through 2021 the modified limits for charitable contributions for itemized deductions (100% deductibility of cash donations to public charities);

- Permanently establishing a threshold for deducting medical payments at 7.5% of adjusted gross income (AGI), down from a previously scheduled 2021 increase to 10%; and

- Allowing those eligible to claim an educator expense deduction that includes PPE and other supplies used for the prevention of COVID-19 spread to make deductions retroactively back to March 12, 2020.

Business Provisions:

The latest stimulus legislation emphasizes economic support for small businesses:

- $300 billion of additional funding for forgivable loans is being made available under the Pension Protection Program (PPP).

- “Second draws” of PPP loans are limited to borrowers with fewer than 300 employees, a provision that ensures a small business funding emphasis.

- Businesses drawing again from PPP loans must demonstrate an intent to use the full amount of the PPP loan. Employers will need to document at least a 25% reduction in gross business receipts in any quarter of 2020 vs. the same period of 2019. PPP loans that are forgiven will not be considered.

Pandemic response has produced considerable additional tax law changes impacting the tax years 2020 and beyond. If you have any questions as to how tax legislation might affect you, please reach out to your Portfolio Manager.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]