Insights and Observations

Economic, Public Policy, and Fed Developments

- December brought renewed talk of a Fed “pivot,” and growing expectations for Fed Funds rate cuts met only token resistance from Fed Chairman Jerome Powell. Just as with the last several “Fed pivots,” we’d push back on this characterization; the Fed stopped one hike short of their “dot plot” in June but one higher than they had signaled at the start of the year. If they begin cutting rates in March as the market now expects, they will have been on hold for nearly 9 months, or close to a full year if instead they wait until June. This is still the Fed’s intended “higher for longer” policy trajectory. This didn’t stop the markets from reacting ebulliently, with the 10Yr closing the year 90bps off its October highs at 3.88%, and the stock market soaring. These levels feel a little overbought, and we would have been happier starting the year with a 10Yr over 4%. Still, despite 2023 being relatively painful for fixed income investors for much of the year, calendar year returns for bonds ultimately finished looking rather good.

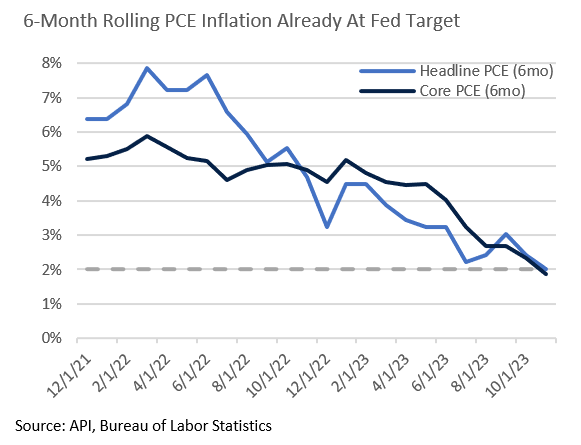

- The other good news for investors in 2024 is, absent any surprises, inflation should be a much smaller part of the economic narrative. Not only is the Fed well ahead of schedule bringing inflation down to its 2% mandate, but by shorter term measures it has likely already done so. Six-month annualized headline and core PCE is now at or below 2%, and base effects are the only thing keeping inflation over the Fed’s target. The Fed’s focus is no longer on lowering inflation so much as it is preventing it from reaccelerating.

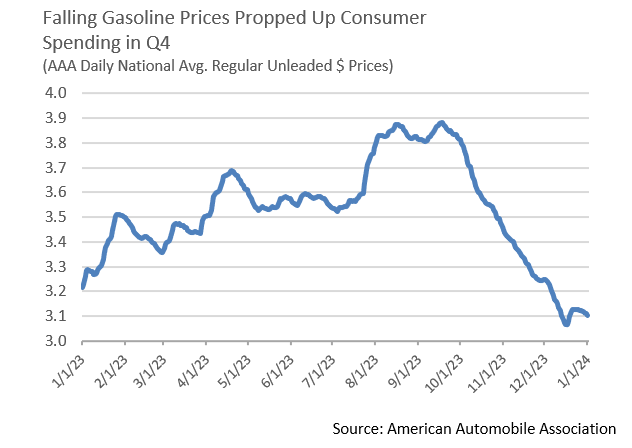

- We have long doubted the Fed’s ability to engineer a soft landing. But, with recent progress on inflation and with growth indicators coming in mostly better than expected, the likelihood of a soft landing has increased. We are not quite ready to declare victory, though. A factor we continue to watch is gas prices, which fell steadily throughout the fourth quarter. With consumers generally buying gas with credit, price changes usually impact spending with a one-month lag. Indeed, after evidence of an early slowdown, spending did pick up as the quarter went along. The extra money in consumers’ pockets has helped keep growth from slowing as much as we had expected in October. This trend may be reversing, however, with gas prices already below levels OPEC+ may find acceptable, and with worsening geopolitical tension in the Middle East. If gas prices rise from here, we expect consumer spending and growth to wane.

- Another risk that markets are overlooking is the expiration of the current continuing resolution funding the federal government in two phases, January 19th and February 2nd. House Speaker Mike Johnson passed the current “clean” resolution, with no changes in the level of spending, with the grudging support of his caucus, arguing he did not have enough time to negotiate a better bill. Subsequent negotiations have not been productive, however, and his narrow majority shrank to three with the expulsion of George Santos. Hardline Republicans have indicated they will not accept a clean resolution again; we expect either a partial shutdown to begin on the 19th, Johnson to lose a no confidence vote, or both.

- The outlook for 2024 will largely depend on whether the Fed is successful in executing a soft landing. If so, the curve will have to un-invert at some point, and with most market commentators expecting a year-end 10Yr yield of about 3.5%, yields will likely surprise somewhat to the upside. If not, then yields are likely to fall as growth softens and 3.5% will start to look optimistically high.

Equity News and Notes

A Look at the Markets

- Stocks rallied throughout December as the major indexes continued to bounce off late October lows. The S&P 500, Nasdaq, and DJIA all ended the month on a 9-week winning streak, the longest for the S&P 500 since 2004. The S&P 500 gained +4.4% to lift its 2023 total return to +26.3%, erasing nearly all of the prior year’s -19% loss and leaving the index just 0.6% away from its January 2022 all-time high. The S&P 500 lagged the other major averages for the month, with the Nasdaq and DJIA gaining +5.5% and +4.8%, respectively. The biggest winner was the Russell 2000 which rose +12.2%, the small-cap index’s best month since November 2020. December’s gains were broad based; Energy was the only sector to finish with a loss as WTI crude oil retreated -5.7%, a third straight monthly decline.

- December’s rally was fueled in large part by a dovish pivot from the Fed at their latest FOMC meeting. With inflation continuing to show signs of decelerating, the Fed’s updated projections reveal a 2024 year-end Fed Funds forecast of 4.6%, suggesting 3 rate cuts this coming year. Investors became even more aggressive by quickly pricing in ~6 cuts, a move that drove yields down across the curve and produced an equity friendly easing of financial conditions. These developments coupled with economic data that suggested a soft landing were enough to propel risk assets higher.

- In a year that will be remembered for the dominance of a handful of mega-cap tech companies known as the “Magnificent 7,” the trend finally showed signs of fatigue in December. The equal-weighted S&P 500 returned +6.4%, well ahead of its market-cap weighted counterpart and the “Magnificent 7” (+3.9%). This broadening was also reflected down the capitalization scale with the Russell 2000 finishing +13.6% in Q4, outpacing large cap stocks for only the second time since Q1 2020. We welcome greater breadth as more participation from the “average stock” produces healthier markets, although it remains to be seen if this is a simple tactical rotation or a lasting trend change.

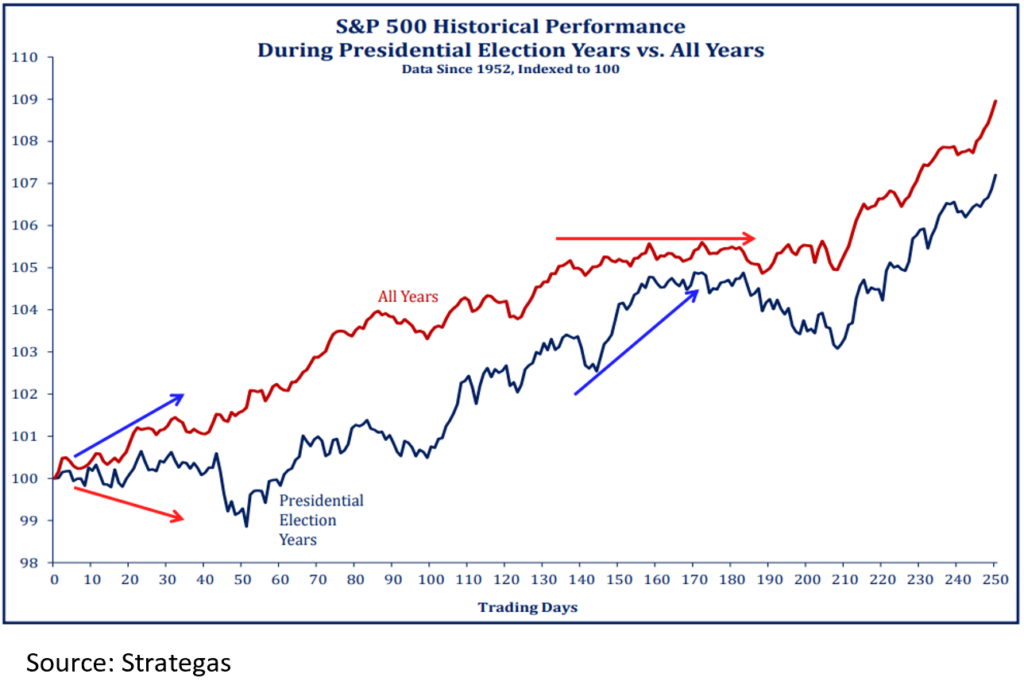

- The stock market begins 2024 with momentum but well into overbought territory. Positioning and investor sentiment have decidedly flipped from bearish to bullish and a host of indicators are signaling the potential for a period of profit-taking, particularly as we enter a new tax year. This set up dovetails with seasonal patterns, especially in the context of the election cycle, which also points towards the possibility of consolidation with gains back-end loaded.

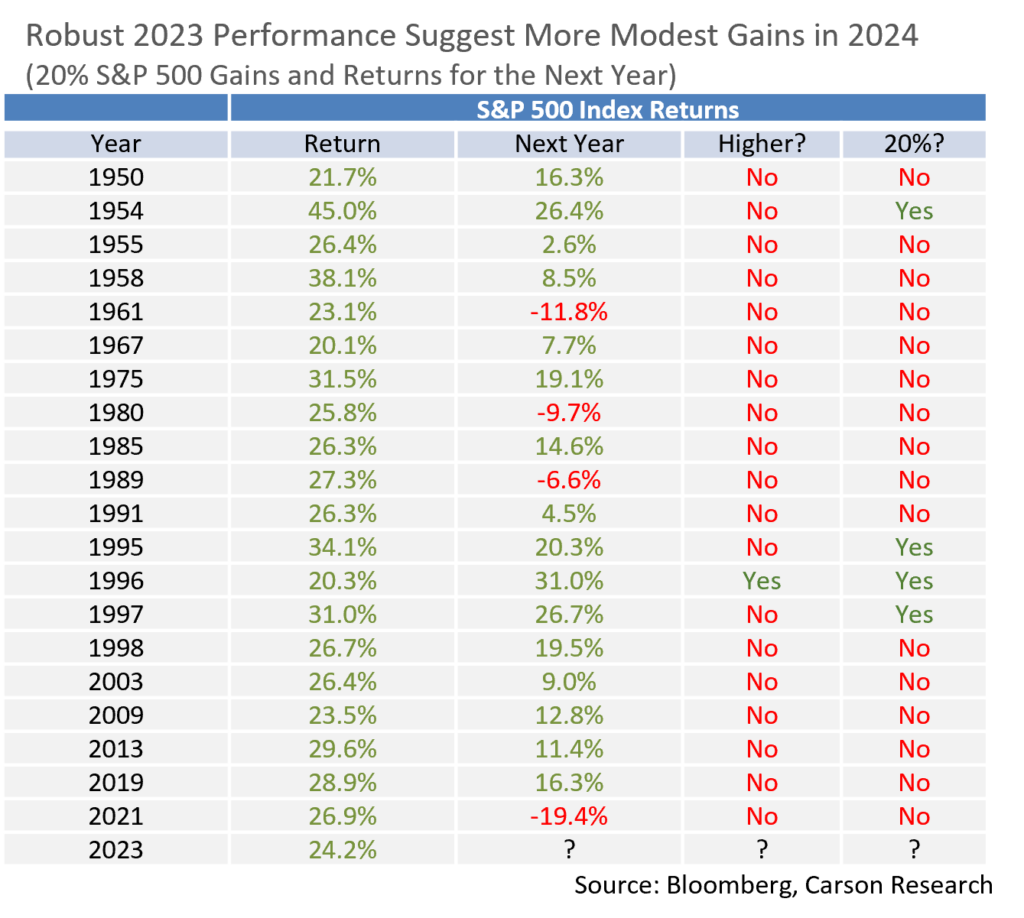

- Predictions are common this time of year, and though humans crave the comfort explicit outlooks offer, we caution against putting too much weight on them. This time last year, many economists felt a recession was all but certain and the average S&P 500 price target of 23 well known strategists was 4,080 (the S&P closed 2023 at 4,770). We say this not to throw stones but rather to highlight that sticking to a plan and staying invested over the long-term trumps following market prognosticators.

- This past year saw the second, third, and fourth largest bank failures in history, 10Yr Treasury yields hit their highest levels since 2008, extensive geopolitical strife, and a medley of other concerns, yet the stock market enjoyed its fifth best year since 2000. We have no way of knowing what 2024 will bring (the election is sure to raise uncertainty), but history says another year of gains, though not quite as strong, could be in the cards.

From the Trading Desk

Municipal Markets

- Total 2023 municipal issuance of $407.8 billion was up $4.2 billion vs. 2022, but still down from a high of $533.9 billion in 2020. California earned the top spot for state municipal issuance at $59.6 billion, followed by Texas and New York. Sluggish issuance continues to limit the availability of often oversubscribed primary market inventory, contributing to rich secondary market bids.

- Over the course of December 10-year AAA municipal yields declined by 33bps, according to MMD. The move is even more noteworthy if one looks back another month. From November 1 through year-end, 10-Year AAA municipal yields fell by 130bps. This significant yield compression could prompt more municipalities to come to market early in 2024 due to lower financing costs.

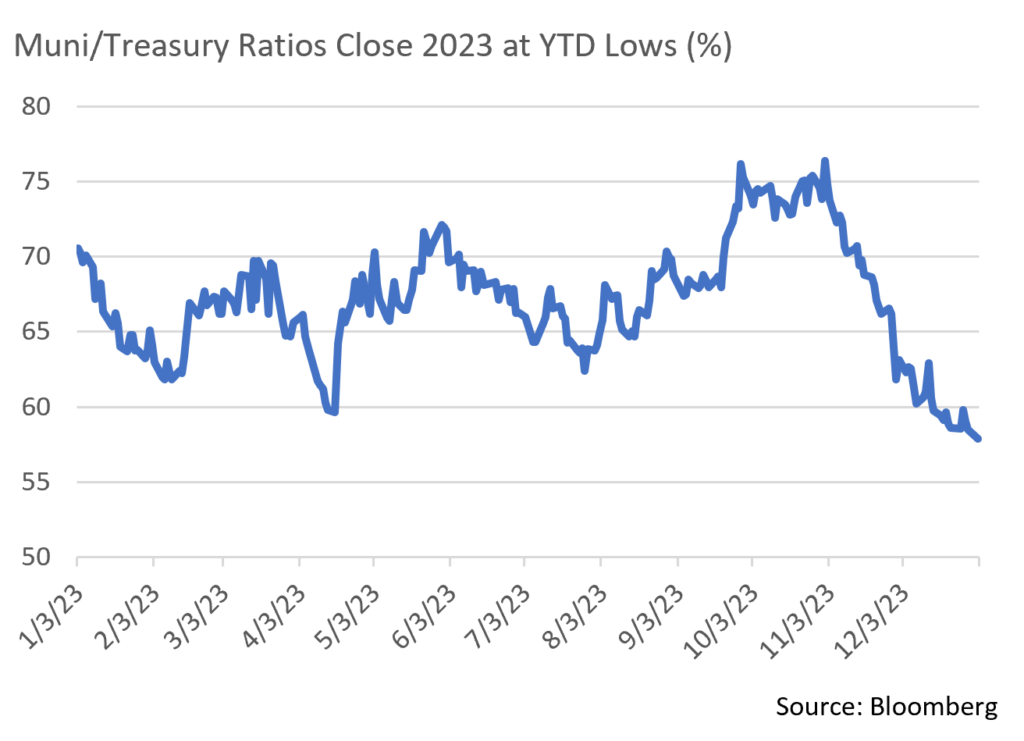

- Given the supply and demand dynamics that drove Q4 outperformance, ratios remain in the high 50% range for most maturities. The 10-Year AAA muni/ Treasury ratio ultimately ended the year at YTD lows of 58.8%. With technical factors expected to remain favorable during Q1, we anticipate that ratios will remain in this range for the immediately foreseeable future.

- Fed policy should continue to weigh heavily on the Treasury and municipal markets, particularly as many expect rate cuts to begin by Q2 2024. Curve normalization is likely to eventually come from receding front-end yields, although a slower than anticipated pace of Fed Funds reductions may delay the return of the traditional upward sloping yield curve.

Corporate Bond Markets

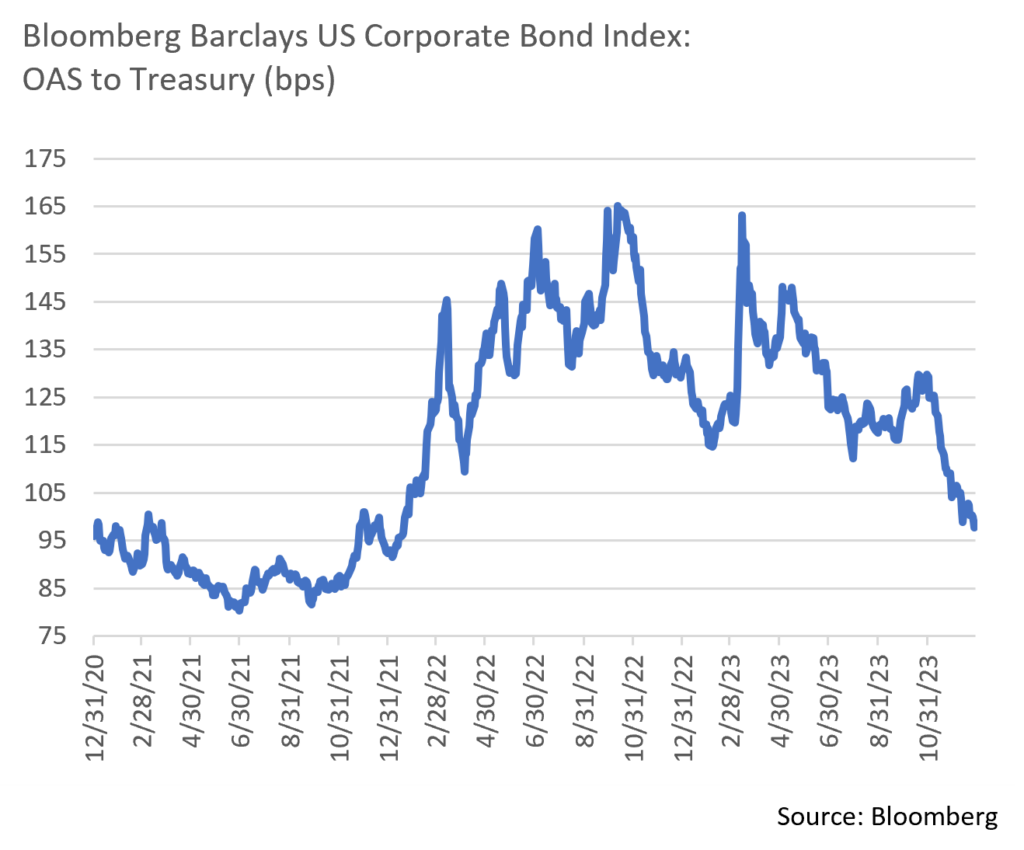

- Investment Grade credit spreads closed December with a flourish. The spread compression that began at the end of October gained momentum into November as the OAS on the Bloomberg Barclays US Corporate Bond Index dropped 5bps to 99bps. A low for the year of 98bps was reached on December 28th, marking the tightest OAS since the end of January 2022 and only 18bps above the 10-year low of 80bps set in June 2021.

- The rally in credit was sparked by declining UST yields in addition to a slowdown in new supply. January tends to be a strong month for Investment Grade credit, and we anticipate a range bound market until such time as the monetary policy and economic picture becomes clearer. At this stage, consensus points to a soft economic landing and an onset of Fed Funds rate reductions by mid-year.

- The US High Grade corporate primary market was quiet to end the year with only $23.6 billion of new offerings. Most of that came at the beginning of the month with buyers eagerly bidding on new supply as the overall bond market rallied. Nonetheless, over the course of the year the new issue market faced periods of sharp volatility and uncertainly that periodically sidelined issuers. It was looking as if total issuance was going to be a good bit lower than 2022 although a late year turnaround raised the total to $1.185 trillion, very close to 2022 and only slightly lower than average. Given a favorable current cost of funding, we expect a robust $160 billion to come to market in January.

- Historically speaking, the beginning of each year tends to be positive for credit spreads as the market begins to absorb sentiment. As inflation seemingly abates, growth and the possibility of a recession becomes a greater threat to both yields and spreads. Given the likelihood of a slowdown at some point and a possible cut in shorter term rates, we continue to proceed defensively while still taking opportunities as they arise.

Financial Planning Perspectives

2024 Retirement Account Contribution Limits

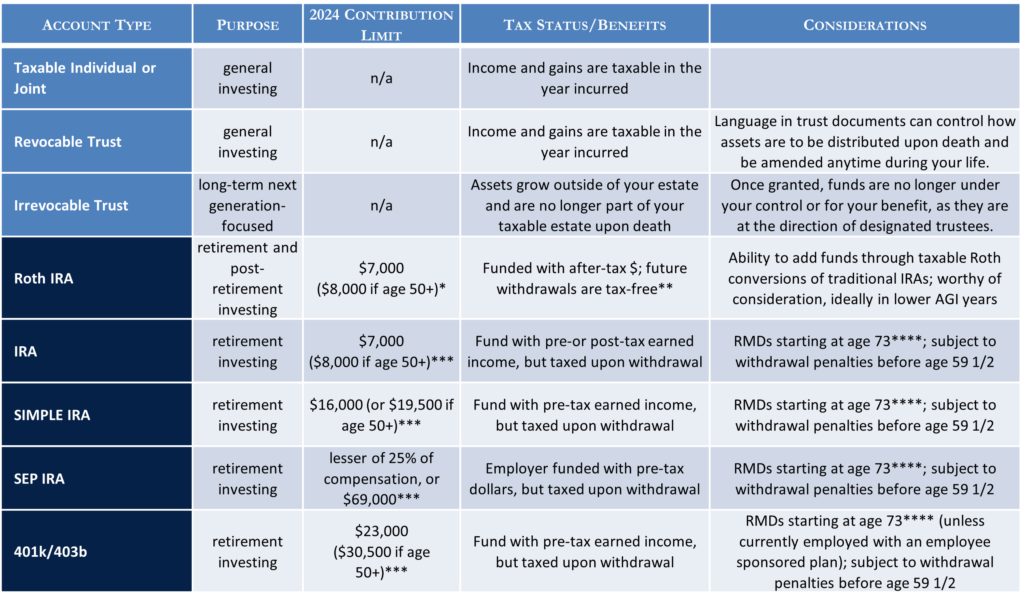

As the New Year begins, we want to take the opportunity to address several noteworthy changes to 2024 retirement account contribution limits. Please note that it may be best to have a conversation with your Portfolio Manager or a tax professional when considering what retirement vehicles are right for you.

*Roth IRAs have contribution limits based on AGI earned; this varies depending on how you file your taxes.

**Subject to withdrawal penalties if held less than 5 years or under age 59 ½. Income limitations may restrict ability to contribute directly. Please consult a tax expert.

***All contributions are limited, and if income is less than stated limit, contributions are capped at earned income limits.

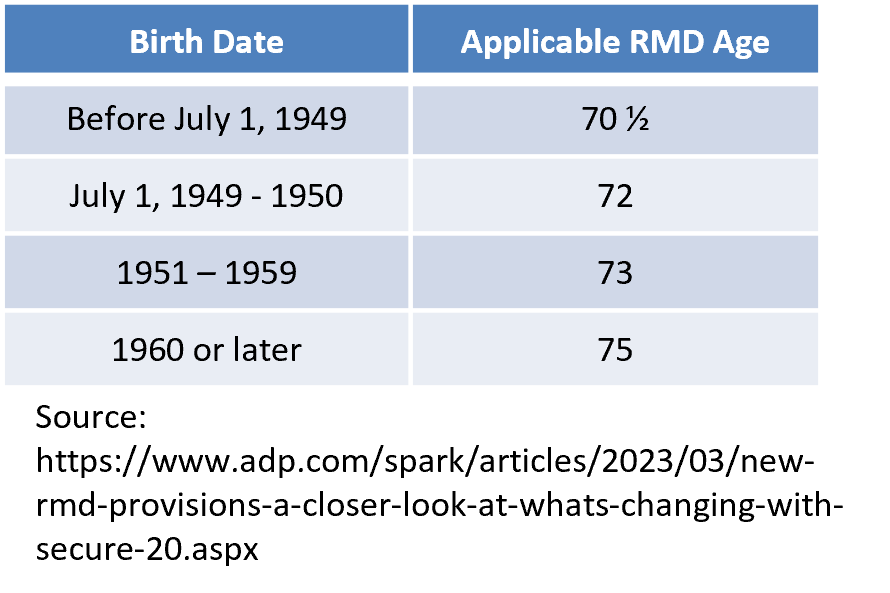

****Secure Act 2.0 made further changes to RMD age. Please refer to the accompanying chart.

Charitable Giving Considerations

- When paired with appropriate estate planning and retirement planning strategies, charitable and personal giving can create valuable tax benefits. We would be happy to have a conversation about gifting and involve appropriate outside parties.

- A reminder that one can make qualified charitable contributions of required minimum distributions to 501c3 charities. We often see operational constraints from custodians at year-end, so please consider making your charitable gifts throughout the year.

- Consider establishing a donor advised fund to front load planned charitable giving as this can potentially produce a significant taxable income offset. We are willing to facilitate a conversation with the charitable departments of our custodians. Federal gift tax exemption thresholds for 2024 annual giving have increased to $18,000 per individual to any other individual.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.