Insights and Observations

Economic, Public Policy, and Fed Developments

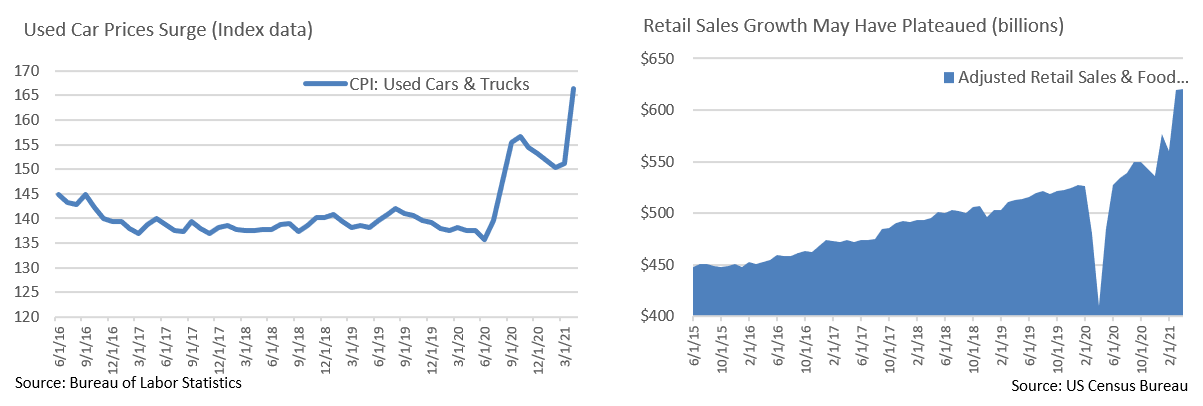

- The long-awaited “transitory” inflation spike arrived in a big way in April (data reported in May), with headline and core CPI handily beating expectations at 0.8% and 0.9% respectively, bringing core to 3.0% YoY. Meanwhile PPI doubled monthly expectations of 0.3%, coming in at +0.6%. Some of this is “reflation” more than true inflation – airfare and hotel prices, for example, made sizable contributions, yet are merely returning to pre-pandemic levels. However, supply chain bottlenecks are also pushing prices up. The impact of microchip shortages on car production is well known – used car prices have surged nearly 20% from the end of 2019. Chinese crackdown on commodities speculation will also likely take some pressure off commodity prices. The Fed – and we at Appleton – still believe the uptick in inflation will be transitory, but it will not fully pass until global supply chain pressures ease.

- Consumer demand may also be plateauing. April’s retail sales were flat vs 1% expectations. While it was on the back of a prior period revision from 9.8% to 10.7% and the nominal level was essentially as forecast, meteoric post-pandemic sales growth seems to be slowing. Meanwhile, a sharp -13.1% drop in personal income was entirely driven by a fall in transfer payments as stimulus payments ended. This should dampen consumers’ heightened ability to spend in coming months. Demand appears to still be strong, but it should soon fall from current stratospheric levels.

- The state of the US workforce remains challenging to read. Weekly unemployment claims have trended down for the last several months, although 406k reported on May 22 was still well above historical norms. However, declines in continuing claims have largely been offset by increases in pandemic emergency unemployment coverage, suggesting that people are dropping off unemployment not because they have found new jobs, but because they had shifted to emergency benefits after conventional unemployment benefits expired. In an economy where labor is in high demand, there is growing evidence of bifurcation and long-term unemployed workers struggling to find work.

- The April unemployment report did little to clarify the labor picture, either. The report missed badly, with 266k new jobs reported vs. expectations of one million. Below the surface the picture was more nuanced; leisure and hospitality employment growth was decent, with 366k new jobs created. There was also a pronounced drop in those reporting they were unable to work or had lost hours due to the pandemic, from 11.4M to 9.4M. Widespread underemployment, with employers cutting hours rather than positions, muted last year’s job losses, but this could also be hindering job gains as the recovery unfolds. All in, the employment report was probably not as dire as the headline number suggests and may be ripe for revision anyway.

- Despite protestations that it was “too early to be thinking about thinking about tapering,” the Fed surprised market participants when their minutes from the April 27-28th meeting revealed that they had been doing just that. The Fed opened with an internal report on market expectations concerning the rate of tapering. The timeline revealed an announcement is not likely before January 2022, tapering beginning in March and ending in December, and initial rate hikes unlikely before September 2023. Several meeting participants indicated that if economic data continues to come in stronger than expected, they may need to discuss preparing the market for an earlier taper. While yields initially spiked on the news, they quickly traded back down. The release went on to indicate that any deviation from market expectations was, at present, not appropriate, and would need to be clearly communicated well in advance. Still, a close reading of Fed minutes and statements in coming months will be important to see if the minority view that earlier moves may be needed gathers support.

Equity News and Notes

A Look at the Markets

- Stocks were mostly positive in May as the S&P advanced a modest +0.7% to raise YTD total return to +12.6%. The only major index in the red was Nasdaq which snapped a 6-month winning streak, posting a -1.4% return yet remaining firmly in the green YTD at +7.0%. Stocks tied to a reopening economy led the way as Materials, Financials, and Energy were the top 3 sectors. Secular growth trailed with Technology, Consumer Discretion, and Communication Services among the laggards. Correspondingly, large-cap value widened its YTD lead over formerly high flying large-cap growth at +18.4% vs. +6.3%.

- Of note, despite rotations under the surface, the overall market has remained resilient. Corrective and arguably healthy price action have recently been evident in more speculative pockets of the market such as SPACs, IPOs, cryptocurrencies, and in certain unprofitable, high-valuation stocks. Market breadth is also a significant positive in our view and broader participation from the average stock is evident. This trend can be seen by looking at the outperformance of the equal weighted S&P 500 versus its market cap weighted counterpart.

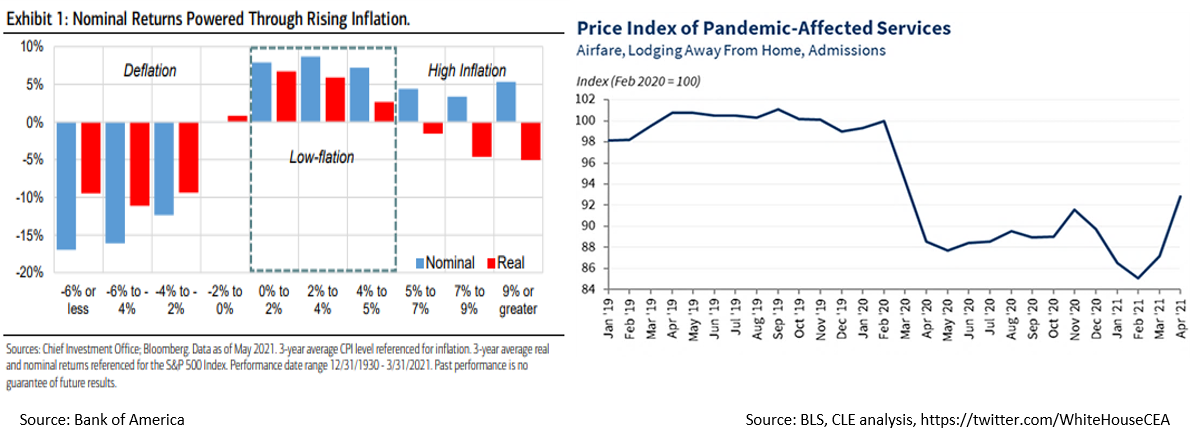

- The big debate taking place across the capital markets involves inflation. Is it transitory or structural? Are we seeing the onset of troublesome inflation or healthy reflation? How hot will the Fed let it run before acting? The answers to those questions will only be revealed in hindsight and probably not for some time. What we know is that recent CPI/PPI/PCE readings were all above trend as commodity and labor shortages, supply chain issues, and pent-up demand all contributed. However, a more nuanced view is warranted.

- The areas where inflation is running hottest are largely tied to economic reopening, (i.e., autos, airlines, and lodging), whereas categories such as Owner’s Equivalent Rent and healthcare have been up only very modestly or not at all. We doubt those areas will sustain persistent price increases once the economy fully reopens and supply bottlenecks are sorted out. Many items currently experiencing large percentage increases remain below pre-pandemic levels, suggesting a healthy reflation after last year’s economic turmoil. At this stage, we see inflation as largely price level resets that reflect economic normalization.

- Another pressing question for equity investors is what these seemingly hot inflation readings will mean for Fed policy. The Fed has been consistent in their belief that higher inflation readings will largely be transitory and that they are willing to let it run for a period. The Fed’s ability to accurately forecast can be debated, but we also think it is important to remember they have a dual mandate – price stability and maximum employment. With nonfarm payrolls still roughly 8M below last year’s peak, we expect the Fed to stay accommodative even as they begin thinking about gradually reducing the size of their asset purchases.

- The market’s ability to brush off inflation fears allowed the S&P 500 to close May within 1% of an all-time high. A large part of this is owed to the relative stability of the bond market. Treasury yields have remained in check, and credit and credit default swap spreads remain near record tight levels. It bears emphasizing that stocks have historically done well with low levels of inflation. Our clients may take solace from knowing that we are not expecting sustained above 5% inflation, levels that have historically been problematic for real returns. We will however pay close attention to economic developments.

From the Trading Desk

Municipal Markets

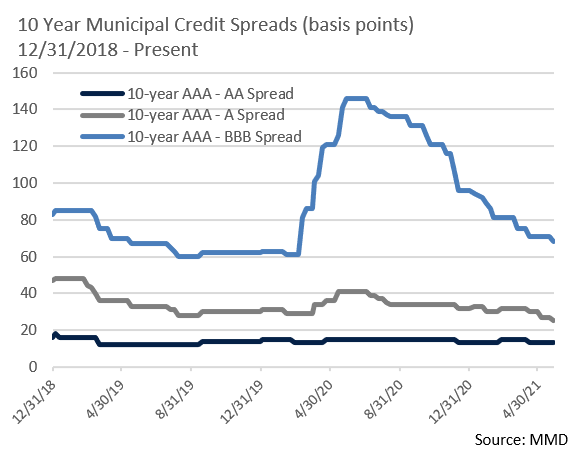

- Despite intramonth volatility, the 2Yr and 10Yr AAA municipal curve returned at month’s end to the same place it began May, with the 2Yr at 10 bps and the 10Yr at 99 bps. What remains noteworthy is relative value within the intermediate portions of the curve, as 89 bps of spread between 2Yr and 10Yr maturities offers an integral component of total return as bonds “roll down the curve”.

- Retail demand for municipal bonds remains a constant as evidenced by mutual fund inflows. YTD net inflows have reached $48B, already more than half of 2019’s “normalized” full year inflows of $93.6B. Consistency of demand is evidenced by 34 consecutive weeks of positive net inflows dating back to October 2020. The Biden Administration’s policy agenda is likely to intensify demand for tax-advantaged investments, and with credit quality strengthening for the most part, we anticipate a sustained strong bid for municipal securities.

- Municipal demand is also evident when looking at compression across the credit curve. State of Illinois GO bonds maturing in 10 years are now the tightest they have been since the 2008-’09 financial crisis. While, in this example, some spread compression can be attributed to credit improvement and extensive Federal support over the course of the pandemic, much of the move has also been driven by investor demand for yield. Anecdotally, we continue to see credit spread tightening and are actively looking for issuers and structures offering incremental relative value while avoiding taking on inadequately compensated credit risk.

Corporate Bond Markets

- Investment grade corporate credit spreads traded narrowly for most of May with very little movement and well contained volatility. This was followed by a month-end rally that drove spreads to 14-year lows. The 84 bps OAS on the Bloomberg Barclays Corporate Bond Index is at a level not seen since January 2007. It is worth emphasizing that the 10Yr UST was trading at 4.80% at that time, as opposed to 1.60% as we write. Historically speaking, these are not the lowest IG spreads on record. That honor belongs to the first half of 1997 when IG corporate spreads fell to a mid-50 bps range. What this indicates to us is that investor demand and credit confidence matter most, and corporate OAS can be driven quite low during very different yield environments.

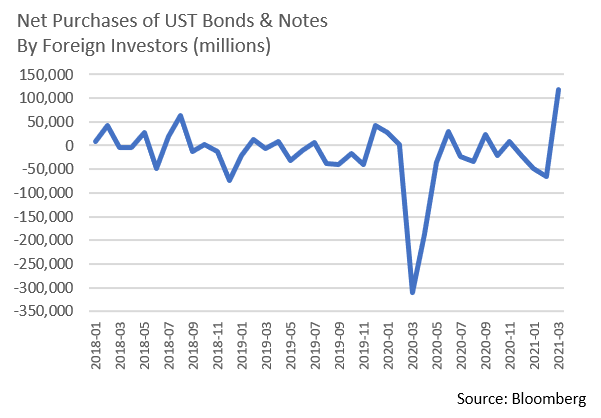

- Demand for Investment Grade credit continues to be exceptionally strong with a noticeable uptick in foreign buying across the US fixed income markets. According to the Treasury International Capital System (TIC), which is on a 2-month lag, net purchases of USTs by foreigners reached $118.9B in March vs. net outflows of $65.5B in February. Total net corporate bonds purchased rose to $43.1B in March, up from $14.5B the month prior. The combination of incrementally higher nominal yields, strong US credit conditions, and favorable hedge adjusted yields have all fueled growing non-US buying demand.

- Historically low borrowing costs have also helped corporate issuance remain solid. Although the $136B in new issuance in May was lower than expected, the overall tone allowed issuers to pay minimal to zero concessions relative to outstanding debt. That is also evident within the lowest tiers of the Investment Grade credit spectrum as the BBB ratings category makes up almost 52% of the overall market. Compression between BBB and Single A credit spreads is getting narrower and consolidation in the BBB ratings bucket is apparent.

Financial Planning Perspectives

Introducing Appleton Municipal Impact: A Unique Impact-Driven Separate Account Offering

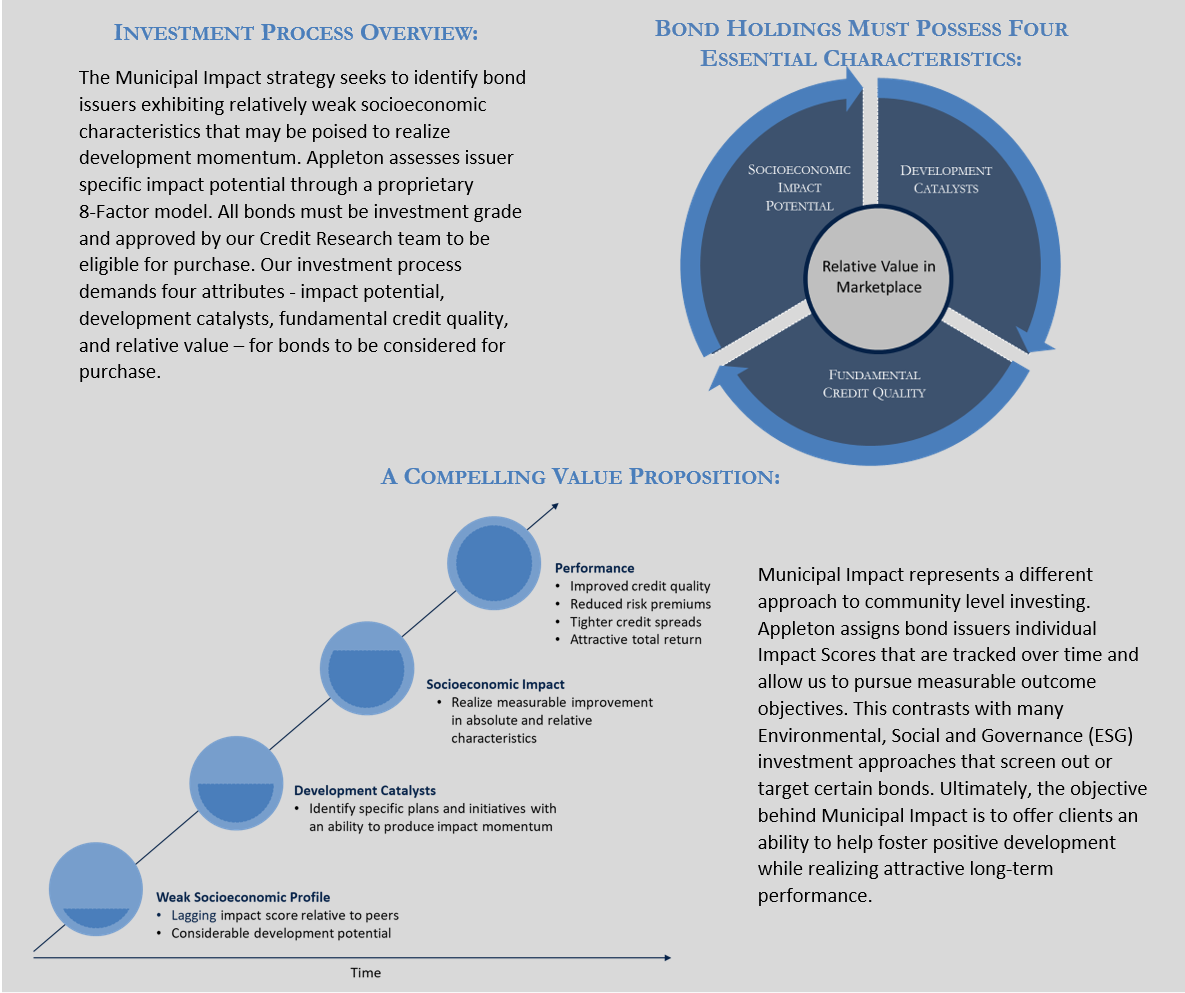

We are excited to introduce our newest investment capability – Appleton Municipal Impact – a strategy offering tax-exempt investors an ability to direct capital to American communities where it is needed while potentially enhancing income and total return. This new offering was developed by our Credit Research and Portfolio Management teams based on opportunities in the market and as a means of addressing impact driven client motivations.

Please reach out to your portfolio manager if you have interest in learning more. We would be eager to discuss how Municipal Impact might fit into your asset allocation strategy.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]