Insights and Observations

Economic, Public Policy, and Fed Developments

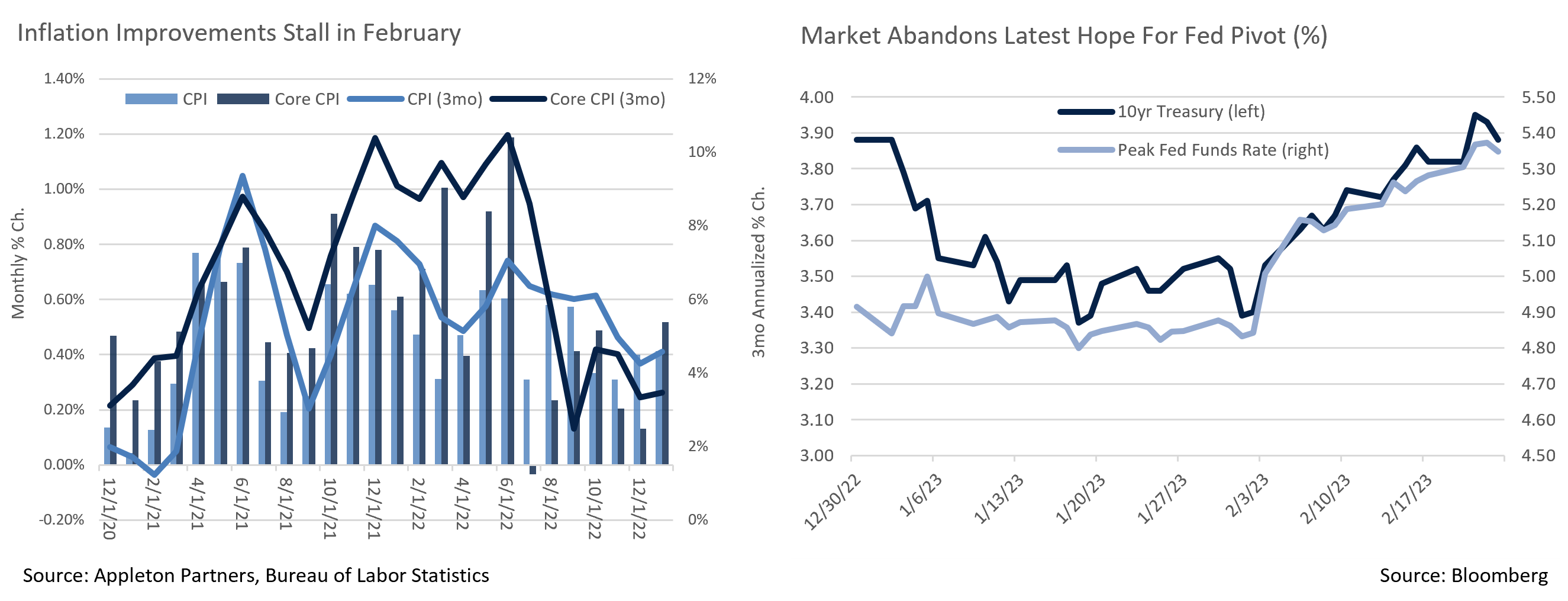

- The “immaculate deflation” narrative ended abruptly at the beginning of February after a series of data points dashed hopes for an early end to the Federal Reserve’s hiking cycle. An unexpectedly strong jobs report followed by hot CPI and PPI prints threw cold water on the markets and led to a rapid repricing of interest rate expectations.

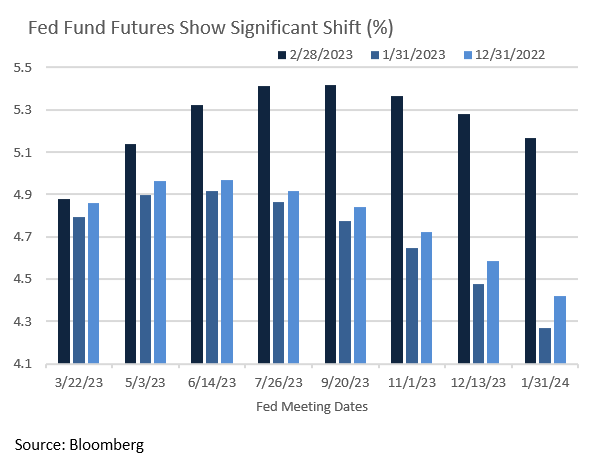

- The Consumer Price Index technically only met expectations, but with a monthly headline number of +0.5% and core at +0.4%, this was still a hot report. The YoY rate fell less than expected and both headline and core now reveal an accelerating trend. The Producer Price Index inflation reported an upside miss, with the +0.7% headline nearly doubling an expected +0.4%. Optimists pointed to a fall in the annualized rate, neglecting that this was due to even higher prior year rates dropping out of the trailing 12-month period. Bond yields rose in response and the futures market began pricing a terminal Fed Funds Rate of nearly 5.4%, one that lies above the Fed’s last projection of 5.1%. With the next Summary of Economic Projections due out in late March, the Fed’s projection is likely to meet or exceed current market expectations.

- Consumption data also surprised to the upside last month. The January retail sales report was expected to show a rebound of +2%, in part due to a cold December and warm January; the actual report came in much higher at +3%. Retail sales are heavily geared towards goods spending and an unexpectedly strong January reading suggests that late Q4 weakness may have been influenced by unseasonable weather and an earlier holiday season, and/or a delay rather than reduction in spending. On one hand, with the first GDP revision showing Q4 consumption even weaker and inventory buildup higher than initially estimated, strong consumer demand should allow Q1 growth to be better than feared; on the other, this is hardly welcome news to a Federal Reserve looking for inflation to fall.

- January’s PCE report offered evidence of a rebound in spending and an uptick in inflation, with expenditures rising +1.1% in real terms, and the PCE Deflator (the Fed’s preferred inflation gauge) surprising, with headline and core both +0.6%. The December headline number was revised from +0.1% to +0.2%, and core from +0.3% to +0.4%, figures that suggest inflation was slightly hotter than previously thought. Unlike CPI and PPI, these increases were large enough to trump base effects, and annual numbers both rose.

- Another reason we expect Fed policy to lean hawkish in the next few months came with the resignation of FOMC Vice Chair Lael Brainard after President Biden nominated her to head the National Economic Council. In her absence, Cleveland Fed President Loretta Mester will be a voting member until a nominee is confirmed. Mester is considered more hawkish than Brainard, and she (along with non-voting member James Bullard) have indicated that a 50bps hike in February would have been appropriate.

- Treasury yields exceeded 5% last month for the first time since the Great Financial Crisis when T-Bills maturing in late August (around the time Treasury expects to hit the debt ceiling) rose above this symbolic level. This maturity is trading at a modest premium to bills maturing immediately before and after, a pricing dynamic we feel suggests the market expects debt ceiling brinksmanship, but that a deal will eventually be reached.

Equity News and Notes

A Look at the Markets

- February saw stocks give back some of January’s gains as the S&P 500 fell over the final three weeks, producing a -2.6% monthly decline. The loss reduces the YTD gain to +3.4%, although the index remains 11% above its October 2022 low. Amid this volatility styles shifted with Nasdaq outperforming, falling a more modest -1.1%, whereas the DJIA was hit hardest at -4.2%. Technology was the only sector able to eke out a gain in February, whereas last year’s relative winners, Energy and Utilities, were laggards.

- Repricing the future path of rate hikes was the theme of the month, which made the growth style’s outperformance somewhat surprising. Going into last month, markets has been interpreting easing inflation readings as suggesting that rates would plateau and subsequently begin receding, and that the odds of a soft landing were increasing. However, the latest PPI/CPI/PCE readings threw cold water on that notion by reminding investors that the disinflationary road will not be a smooth one given that inflation remains sticky.

- Stronger than expected economic data proved to be a double-edged sword with real consumer spending (~68% of GDP) coming in at +1.8% for January, the highest since March 2021, and retail sales handily beating expectations. Those data points coupled with a still tight labor market collectively support the Fed’s “higher for longer” message.

- Expectations for the Fed’s terminal rate subsequently moved from 4.9% to 5.4%, two hikes higher than previously priced. Yield moves in the back end of the curve were even more dramatic as the market now expects an end-of-2023 Fed Funds rate closer to 5.3% vs. 4.5% at the end of January. With the market trading above the Fed’s last Summary of Economic Projections (5.0-5.25%), it will be interesting to see if Fed dialogue continues to lean hawkish or begins to strike a more neutral tone.

- Given a stark change in monetary policy expectations, February’s price action felt like 2022 in that there were few places to hide. The 2Yr UST yield rose 60bps to its highest level since 2007, the 10Yr increased 40bps, and the US Dollar was up four consecutive weeks. These bearish factors pressured risk assets and led to negative fixed income and equity returns. Even commodities have felt the pain of higher rates and weakening economic expectations with oil down 8 of the past 9 months.

- As referenced above, a notable distinction in last month’s “risk off” environment was found within the equity market. Large Value trounced Large Growth by over 20% in 2022, yet February’s performance flipped with Growth beating Value by 2.4%, raising the Growth style’s YTD outperformance to +5.8%. We see this trend as a not-so-subtle indication that last year’s repricing downward of high-profile growth names may have nearly run its course. This further supports our decision not to abandon growth names despite their underperformance last year, and we maintain focused on quality growth at a reasonable price.

- The market’s “wall of worry” has several components beyond the Fed, interest rates, and the economy. Geopolitical tensions flared again in February as US-China relations chilled and Putin reupped on the war in Ukraine. Domestically, the debt ceiling is very likely to remain a headwind at least through the summer.

- Fundamentally, we are emphasizing corporate earnings and recognize that the latest results have been underwhelming. The earnings beat rate, beat margin, and overall growth (-4.8%) were all weaker than average and more companies than usual lowered guidance for the coming quarter. That said, market reaction to earnings misses was reassuring, signaling that investors may have already priced in a good degree of weakness. The market is a forward-looking animal, although a worse than expected economic slowdown could put more downward pressure on estimates than is currently reflected in valuations. This is a dynamic to which we are acutely attuned.

- With the market under pressure, it was good to see the S&P 500 hold its 200-day moving average at 3,940. In addition to an improving technical pattern, seasonality is also with us as the market moves out of what has historically been a challenging time. With Q4’s earnings in the rearview mirror, we will be looking at important upcoming releases led by the jobs report on 3/10, February’s CPI reveal on 3/14, and then another FOMC meeting on 3/22.

From the Trading Desk

Municipal Markets

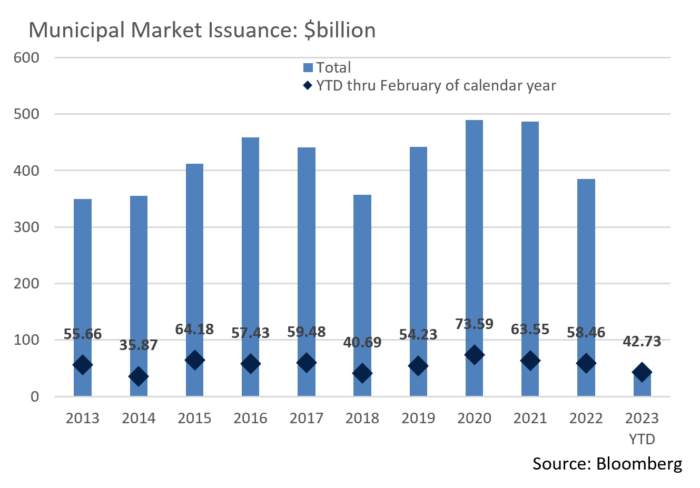

- The Municipal market is highly influenced by technical factors, and February brought declining primary market issuance, as new supply trailed 2022 levels by 40%. Coupled with demand supported by cash flow from January bond maturities, municipal ratios have declined to atypically low levels with the 10-year ratio resting at 66.4% as of March 3rd.

- The yield curve inversion deepened in February with 2-year AAAs at 3.17% compared to 10-year yields of only 2.64%. Given minimal issuance and an atypical curve structure, we recently made purchases on the shorter end (2024 & 2025) of our usual intermediate strategy buying range. The belly of the curve is relatively rich, and we are simultaneously seeking opportunities to complement these shorter positions by adding duration through selective buys longer on the curve. Given the persistence of inflationary pressures and the Fed’s determination to dampen it, we also believe interest rates will remain elevated for the time being and see March as an opportunity to build out the longer duration portion of our portfolios.

- March and April are normally characterized by fewer bond maturities than other times during the year. Reduced cash coming back into the market from maturities should alleviate some recent buying pressure, especially on the front end of the curve.

- The SIFMA Municipal Swap Index, a 7-day high grade index comprised of tax-exempt VRDN reset rates, began February with a yield of 1.87% before doubling on technical pressure over the course of a week to yield 3.74%. By mid-February, rates had bumped up slightly to 3.98% before receding at month’s end to 3.42%. We expect SIFMA yields to continue to decline and move closer to 65-70% of Fed Funds.

Corporate Bond Markets

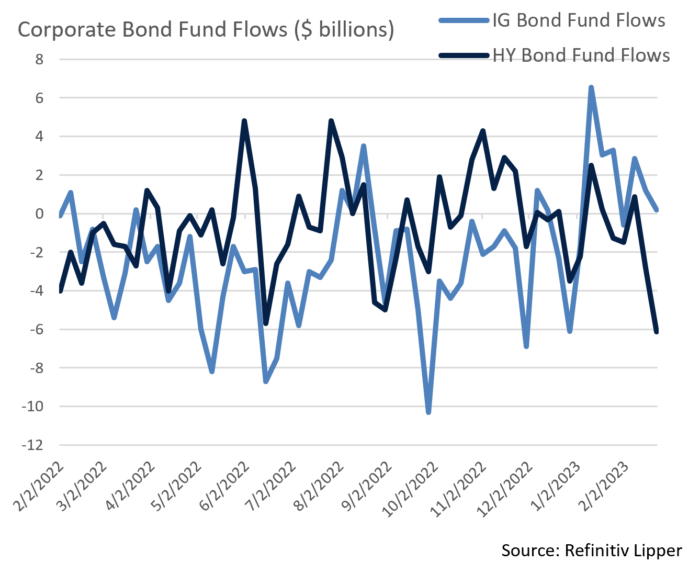

- Investment grade credit spreads remained largely range bound in February. The Bloomberg US Corporate Bond Index began the month at a YTD low OAS of 115bps before ticking higher to 124bps at month’s end. A large move higher in US Treasury yields caused the overall monthly return on the Index to fall by -3.18%, although corporate spreads in isolation only lagged by -0.54% and have posted positive excess returns of +0.61% YTD. Longer duration underperformed intermediate bonds with 7 to 10-year issues being the best performing maturity range, a move supportive of our preference for intermediate duration. Our high-quality credit bias has also been rewarded as A rated credits have held in nicely.

- The primary market is still firing on all cylinders with a record $150.9 billion of new issuance recorded in February, comfortably outpacing the prior record of $113.0 billion (February 2021) and raising YTD issuance to $294.8 billion. Just over 40% of this year’s new supply has come from the financial sector and close to 60% has come to market with maturities inside of 10 years. New issue concession averages have increased of late after being significantly lower than 2021’s average. Recent deals were priced a modest 20-25 bps lower than initial price talk, a signal that demand for high quality taxable bonds largely remains intact. We expect primary market activity to be sustained, although issuers will be vigilant about the timing of when they come to market.

- IG fund flows were positive $3.6 billion on the month bringing the YTD total to $14.8 billion, another factor positively influencing spreads. High Yield flows have not faired as well with -$9.5 billion of outflows over the same time period and a massive -$6.1 billion leaving over the last week. For now, quality is a corporate risk factor in favor.

Financial Planning Perspectives

Women’s History Month: Wealth, Legacy and the Future

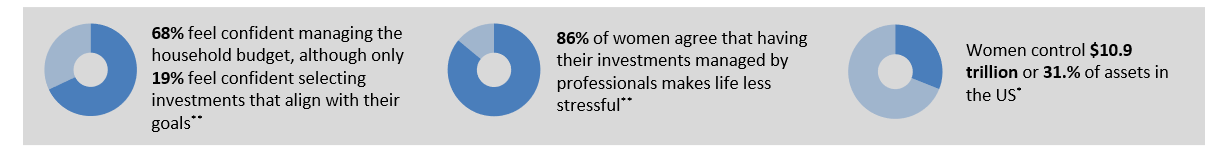

In celebration of Women’s History Month and International Women’s Day on March 8th, we highlight an initiative at Appleton Partners that aims to educate, serve, mentor, and promote the needs of our female clients and colleagues. The financial needs of women not only differ considerably from one person to the next, they are also distinct from other demographic groups.

It is important to understand the dynamics female investors face for several reasons. Statistically, women live longer and make less money than their male colleagues. Further, women are generally underrepresented and often lack effective mentorship in finance. Women may need greater information, resources, and skill development to make sure the pay gap does not become a long-term wealth gap. At Appleton, we strive to understand these financial issues and aim to promote financial confidence and preparedness at each stage of a woman’s life.

The reality is that “by 2030, American women are expected to control much of the $30 trillion in financial assets that baby boomers will possess—a potential wealth transfer of such magnitude that it approaches the annual GDP of the United States.”* This paradigm shift demands that women possess the tools needed to effectively manage their financial lives. Fidelity’s recent study revealed that roughly 77% of women indicated that they believe if they had a financial advisor to help them invest, they would feel more confident in their financial future. Please reach out to your Portfolio Manager should you have any thoughts or questions.

If you are interested in learning more about this topic, Appleton hosted a webinar in December 2020 entitled Women and Financial Planning: Taking Control of Wealth and Legacy that can be found on the Private Client Services section of our website.

*Women as the next wave of growth in US wealth management, McKinsey & Co.

**Fidelity Investments® 2021 Women and Investing Study.