Insights and Observations

Economic, Public Policy, and Fed Developments

- As expected, the Federal Reserve raised the Fed Funds Rate to a range of 2-2.25% in September and dropped “accommodative” from their assessment of monetary policy. The Fed’s “dot plot” shows 12 of the 16 officials favor a fourth hike in 2018, and the median projection is for a further three in 2019. This would bring the Fed Funds Rate to a range of 3-3.35%, slightly above the Fed’s long-range projection of 3.0%. The odds of a fourth hike in December implied by futures markets now stand at about 71.5%, up from roughly a coin flip at the start of the month.

- That said, while the market has priced in a December hike, the inflation picture cooled slightly in September. Headline CPI declined from 2.9% to 2.7%, while core fell from 2.4% to 2.2%. Meanwhile, the core PCE deflator, the Fed’s preferred inflation measure, came in flat in August, missing expectations for modest 0.1% monthly growth. While year-over-year inflation remains at 2.0%, that rate may start to trend downwards as more robust growth at the start of the trailing year period begins to drop out. If this were to happen, we believe the Fed will struggle to raise the Fed Funds Rate the anticipated three times in 2019.

- On September 19th Trump announced the nomination of former Fed economist Nellie Liang to the Federal Reserve board. This is somewhat of a surprising choice; Liang was the former head of the Division of Financial Stability and has been a staunch defender of both Dodd Frank and the Fed’s response to the Great Recession. She is also a registered Democrat. Ms. Liang is an excellent, highly qualified pick; our only concern with her selection is that it furthers the tension between Trump’s public criticism of Fed policy, and his nomination of moderates who are likely to continue those policies. We see this dynamic as raising the risk of a destabilizing showdown should the economy begin to falter.

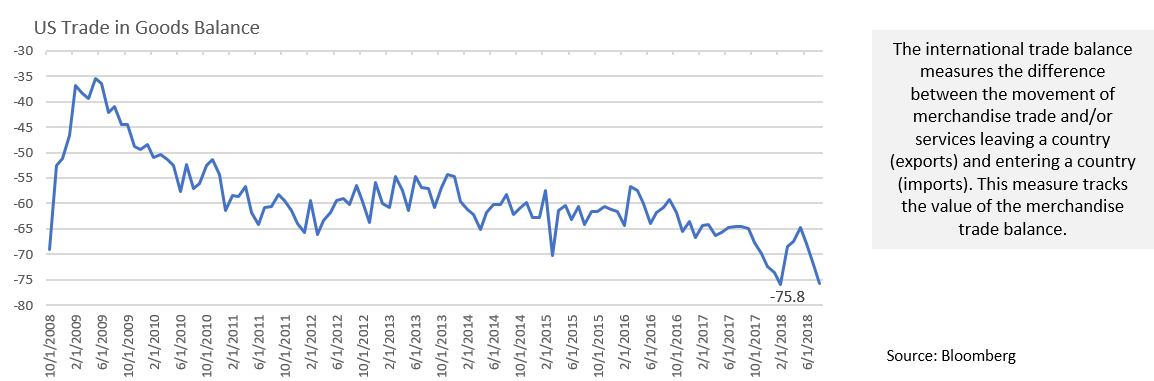

- As usual, it was also a big month for trade news. Despite the Trump Administration’s prediction that Chinese negotiations would take a back seat to negotiations with Canada, Chinese trade tensions dominated September. After two weeks of delay, Trump announced tariffs on $200B in goods on the 24th, initially at 10% but stepping up to 25% on January 1st. China responded with $60B in tariffs of their own, as well as cancelling planned trade talks, indicating they would not resume so long as the US continued to threaten further tariffs. The delayed step-up in the latest round of tariffs appears to be a tacit acknowledgement that the tariffs are beginning to effect US consumers, and the step-up pushes the impact past the holiday shopping season. A widening trade deficit to near-record highs in August provides further evidence that retaliatory tariffs may be impacting the balance of trade and leaves us more confident in our view that GDP growth will slow in Q3.

- Meanwhile, after a month of little incremental news, the Trump administration announced a renegotiated NAFTA, named the United States Mexico Canada Agreement (USMCA), on the 30th. Markets rallied on the news, less because of actual changes to the trade pact than in relief that the risk of the US terminating NAFTA was taken off the table. The new agreement now heads to Congress for a vote, although one is not likely until early 2019.

Equity News & Notes

Sell in May and Go Away? Not This Year

- The stock market continues to advance, with September marking the sixth straight month of S&P 500 gains. The index was up 7.7% during Q3, the highest quarterly gain since Q4 2013 (+10.5%). Both the S&P and Dow have been up 11 of the past 12 quarters, and the Nasdaq positive 9 straight quarters. This despite several headwinds; trade tensions, geopolitical noise, emerging market concerns, and anxiety surrounding the lifespan of this aging bull. Given these risks, we find the lack of volatility to be remarkable. The S&P 500 did not have a single daily move of 1% in either direction during Q3. For reference, the Index averages 50 daily moves of at least 1% annually and produced 36 in the first half of the year.

- Why such strength? Are investors overly complacent? We believe investors have become somewhat inured to the political rhetoric and stories of the day. When you cut through the noise, you’ll find an extremely robust corporate earnings picture. According to FactSet, the S&P 500 is expected to report earnings growth of 19.3% during the upcoming Q3 earnings season. That is on the heels of roughly 25% earnings growth in Q1 and Q2. Revenue growth and profit margins remain strong as well. Fundamentals matter, and for now, they are telling us to stay the course.

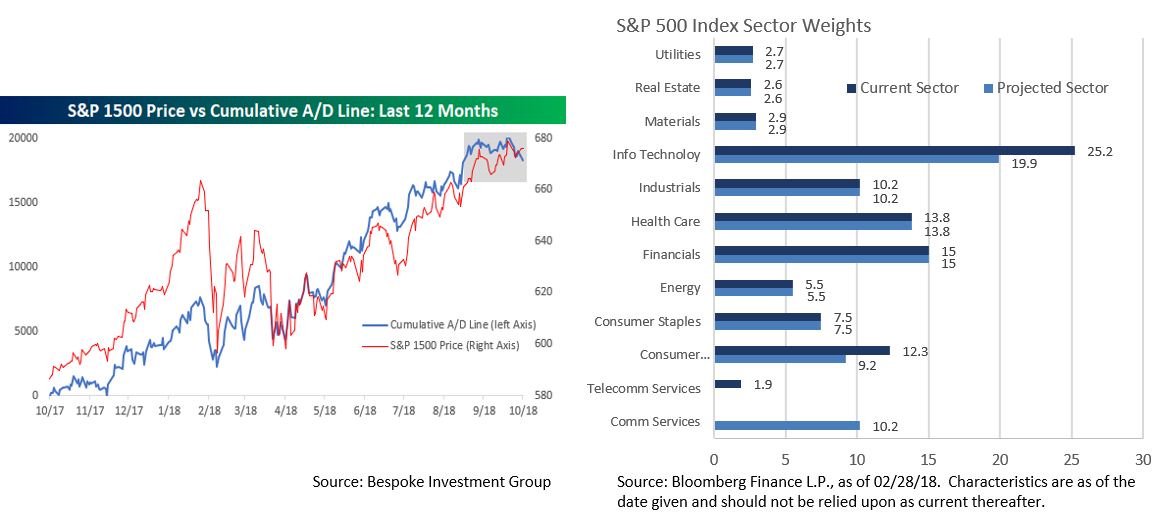

- With the S&P 500 and Dow reaching all-time highs, some skeptics are pointing to the outsized impact of the high-flying FANG stocks. There is no denying that the Apple’s and Amazon’s are contributing greatly to the market’s historic run. But to us, that only tells part of the story, and shortchanges the market’s strength. Market breadth has been solid for much of the year. Over the past 3-month and 6-month periods, all 11 S&P sectors are positive. The equal-weighted S&P 500, which gives equal importance to each stock rather than cap weighting, also hit an all-time high in September. The cumulative advance/decline line, a market breadth indicator, has flattened out (positive trade developments have hurt small caps relative to larger names), but hasn’t diverged meaningfully from market levels.

- Speaking of the FANGs, three out of the four now have a new home. Global Industry Classification Standard (GICS) structure will undergo its largest change in history as the old Telecommunication sector becomes Communication Services. The move is meant to better reflect the true economic nature of the underlying companies. The new sector will be home to various digital media (FB, TWTR, GOOG, NFLX) and traditional media firms (DIS, CMCSA, FOX). While this development will alter the profile of these sectors, it should have little impact on the individual stocks. Given Appleton’s approach to portfolio construction, which is driven by individual stock selection and broader asset class level ETFs, there should also be minimal effect on our clients’ portfolios. The largest impact should occur among sector ETFs.

- We have also recently observed several sector rotations, a trend we feel is positive. When rates rise, Financials have generally outperformed. Energy stocks have responded to higher oil prices, and Materials stocks have risen with higher commodity prices which are supported by a weaker US Dollar. Reliance on a range of industries and stocks to maintain positive market momentum is indicative of strength. While recently surfaced regulatory concerns have emerged within the Technology sector, we feel the majority of recent Tech and Consumer Discretionary weakness is a function of healthy leadership rotation.

From the Trading Desk

Municipal Markets

- The municipal market is presenting considerable challenges to investors despite strong overall issuer credit strength. Primary issuance is running 14% behind last year’s pace. Lack of supply and investors’ desire for tax-advantaged yield has kept the credit curve very tight. At month’s end, the average spread between AAA and A bonds stood at just 47 basis points. Tight risk premiums across the quality spectrum makes credit selection particularly important, as investors are not being well compensated for taking on greater risk. Furthermore, a modest upward shift in the yield curve over the course of 2018 has contributed to more or less flat muni returns. With yields drifting up, reinvestment rates should increase, although navigating today’s tight market requires research and trading expertise, as well as tactical flexibility.

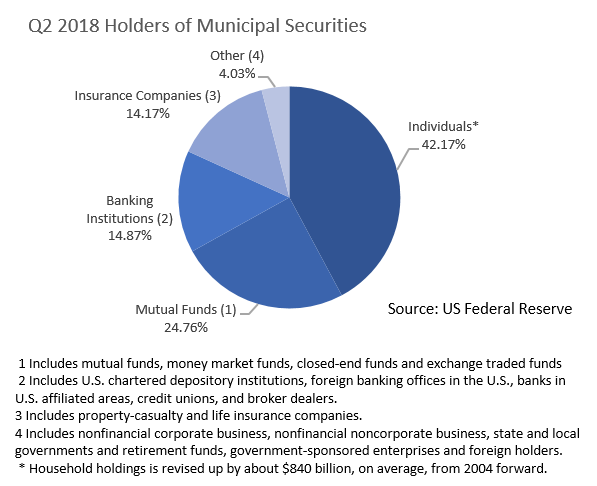

- Who owns municipal securities? Households account for 42.2% of muni ownership, with mutual funds the next largest holder, at 24.8%. These predominantly retail buyers are supported by a healthy institutional asset base. Banks hold 14.9% of outstanding muni issues after selling $26.7 billion YTD. The net selling was largely a result of a decrease in corporate tax rates. P&C Insurance and Life Insurance companies added moderately to their muni holdings over the quarter. The overall muni market now stands at $3.853 trillion, down $92 billion from a 4Q2010 peak of $3.945 trillion. As we look at the first three quarters of 2018, it is worth noting that the muni market has weathered major changes in corporate and personal income tax rates well, with aggregate demand remaining strong.

- According to MMA, in the years following the Financial Crisis the number of independent ratings on bond transactions has steadily declined. Through 2017, triple-rated (Moody’s, S&P, and Fitch) transactions dropped to 34% from 55% in 2007, while dual-rated and single-rated par transactions increased. YTD dual and triple-rated par transactions have declined for the first time, while single-rated par has picked up, growing to 25% of par vs. 21% in 2017. Strong demand, thin supply, compressed spreads, and a search for yield give issuers little incentive to pay for multiple ratings. This speaks to the value of independent credit analysis and proprietary ratings.

Taxable Markets

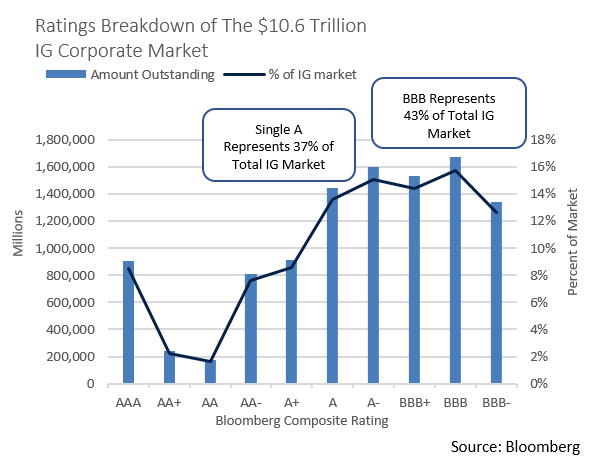

- Investment Grade issuance was just over $940 billion on a YTD basis, down 6% vs. 2017. Of that total, $131 billion came to market in September, the largest monthly figure this year. Of note is that 47% of YTD issuance was within the BBB bucket, the first stop above high yield. This is down from last year’s 52%, although outstanding Investment Grade Corporate debt rated BBB has been steadily rising and now represents 43% of the entire Investment Grade market. We see this trend continuing, driven by robust M&A activity and a willingness to add leverage in a low rate environment. While there is slightly higher yield available in the low tier of BBB, we feel the risk premium for going down in credit is quite modest and may prove insufficient in many cases. Maintaining high quality can help portfolios better absorb a risk-off environment, as lower tier quality and spread credit deterioration can occur quickly.

Financial Planning Perspectives

Planning in a Digital World

The massive societal changes ushered in by the internet age have impacted not just our social and professional lives, but also introduced modern estate planning challenges. While the benefits of interacting with friends and family in real time are clear, the need to address one’s digital assets may be overlooked.

In the past, when a loved one passed away, the personal representative of the estate would pass down the “tangible personal property” as directed by the last will & testament. This typically included contents of the safe deposit box, account statements, utility bills, family photo albums, and various heirlooms. In today’s high-tech society, we feel it is imperative that clients also address their digital world in planning for incapacity or death. This involves far more than social media – it cuts to the core of one’s personal needs. Common digital assets to be “administered” include:

- On-line financial accounts

- Legal and personal documents held in the Cloud

- Cryptocurrencies

- Social media accounts

- E-Mail accounts

- Apps, websites, personal directories

- Shopping/Sales Sites

In an ongoing effort to codify the rules surrounding digital asset planning, the Uniform Law Commission (ULC) approved Revised Uniform Fiduciary Access to Digital Assets Act (RUFADAA) in July 2015. RUFADAA, which has now been adopted by 40 states, applies to all fiduciaries, not just personal representatives, and creates a three-tier system for dealing with digital assets.

- Tier One: Online Tools

- Tier Two: Legal Documents

- Tier Three: Online Providers Terms of Service

RUFADAA provides a roadmap of how digital assets are to be handled by a fiduciary seeking access during life and/or upon death. On-line providers may offer end-users the ability to specify who may be granted access to their digital accounts. Doing so ahead of time is highly recommended.

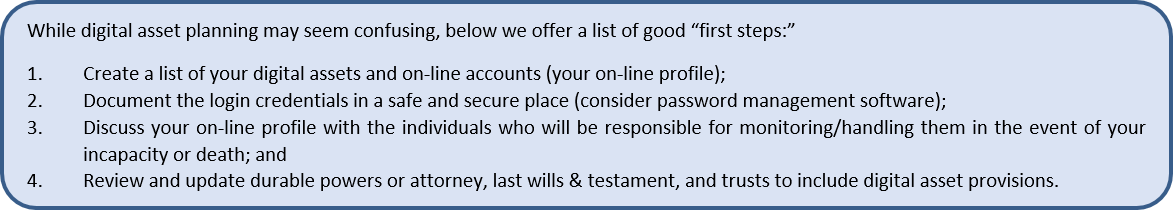

RUFADAA also allows digital assets to be accounted for in traditional legal documents such as powers of attorney, wills, and trusts. If estate plans do not account for digital assets, then, by default, the on-line provider’s terms of service will apply. This is potentially problematic, as terms of service agreements may not align with one’s personal wishes concerning access and related privileges. Imagine losing access to all your on-line pictures and personal family information.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]