Insights and Observations

Economic, Public Policy, and Fed Developments

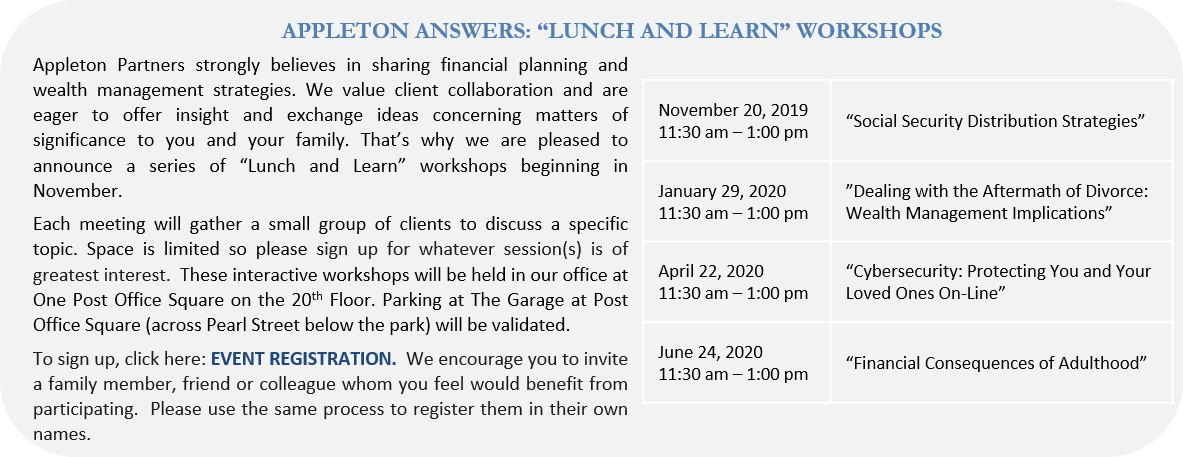

- September saw Treasury rates whipsaw with most of August’s steep decline reversing by mid-month on the back of a not as bad as expected ISM Non-Manufacturing report and trade talk optimism. This lasted until the September 14th attack on Saudi oil fields, a troubling event followed by an evaporation of liquidity in the repo markets several days later. These developments ignited a risk-off sentiment and a reversal in yields. The 10Yr UST ultimately closed the quarter up 18 bps to 1.68%, well off the mid-month high of 1.90%. We considered the spike in Treasury yields in the first half of the month to be reactionary; trade news has been unreliable for some time, and while the Non-Manufacturing Index beat comfortably in August, it was still the fourth weakest reading in the trailing 12 months and a continuation of a downtrend that was confirmed by September’s miss.Regardless, the market has become increasingly skittish and we expect volatility to remain high.

- In trade news, not much of substance changed other than confirmation that high-level talks would occur in October. The Chinese committed to resume soybean and pork purchases. Although the media perceived positive implications from the news, China is facing a swine flu epidemic that is pushing up pork prices nearly everywhere but the US, making this less of a goodwill gesture than it appears at first glance. Even without major new developments, there is growing evidence that trade is weighing on the US economy.

- Moody’s Analytics released a report in September estimating the trade war has already cost the US about 300,000 jobs, a number they believe could reach 450,000 by year-end and 900,000 by 2020 if the current course holds. Further, the ISM Manufacturing report hit 10-year lows in September. The abysmal report evidenced further contraction in US manufacturing – a very nominal portion of the economy but still considered an important leading indicator – as well as a pronounced drop in new export orders, very likely impacted by the slowdown in global trade. The WTO now only expects merchandise trade volume growth of 1.9% in 2019, down from an estimate of 2.6% before the late summer trade war escalation.

- Headline August retail sales were reasonably strong at 0.4% vs 0.2% consensus, though this was largely due to a +1.8% contribution from the auto sector; ex-autos sales were flat. This weakness may represent a substitution effect, with consumers dialing back routine purchasing while still making a big-ticket purchase. However, given that manufacturer-reported auto sales have been sluggish thus far in September, a strong ex-auto retail number would be necessary to support this thesis. Meanwhile, consumer confidence unexpectedly declined in August, dropping to 125.1 from 134.2. While these levels are still high, further degradation would be concerning.

- Political risk reached fever pitch in late September, when a whistleblower scandal alleging Trump had pressured Ukraine to investigate his 2016 and 2020 political rivals while withholding military aid and White House access led the House to formally open impeachment investigations. On the same day, UK courts called Parliament back to session, ruling Boris Johnson’s shutdown was unconstitutional. We view the latter as a modest positive as it decreases the odds of a no-deal Brexit. The former, for the time being, should have minimal market impact; Congress is already gridlocked, and at present the odds of an impeachment ending in Senate conviction are low. Nonetheless, political news is likely to dominate headlines for some time, even if market impact is muted.

Equity News & Notes

A Look at the Markets

- Looking back at September, some might have been pleasantly surprised to see the S&P 500 log a 1.9% gain despite a growing list of fears: slowing economic growth, contracting manufacturing, the ongoing trade war with China, Brexit uncertainty, Iran/Saudi conflict, Hong Kong protests and, of course, a US impeachment inquiry. Despite all the noise, the S&P 500 has accomplished something it hadn’t done since 1997 by posting a 20% total return over the first 9 months of the year.

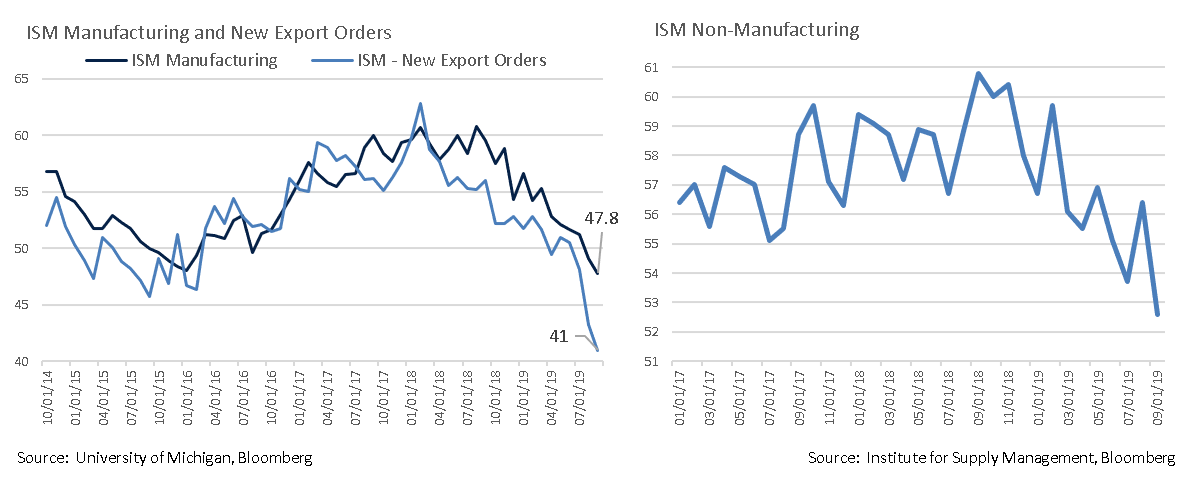

- Digging more deeply, we have recently seen several sizable style and factor rotations. Investors pulled money from growth, momentum, and quality in favor of value and cyclicals. This was largely prompted by a mid-September backup in rates and a long period of favoring growth over value. We feel good about the headline index forging ahead despite this rotation, but need to be mindful of whether this is the start of a longer-term change in leadership or merely another head fake.

- The impeachment inquiry is now dominating the news. How this ultimately plays out remains to be seen, but looking at the Nixon and Clinton eras (a very small sample size), impeachment may not ultimately matter all that much to the markets. Investors over time tend to focus on fundamentals, led by the economy, corporate earnings and interest rates. We caution that it is extremely difficult to invest based on politics, although we will monitor how the impeachment proceedings impact factors such as the trade war with China. While China might not be willing to make concessions if Trump is seen as politically vulnerable, the Administration will likely face pressure to compromise as a means of claiming victory ahead of 2020. Should we see a deal of any sort, it is likely to be a limited agreement, not a grand bargain.

- The next catalyst for stocks could be Q3 earnings season which begins in mid-October. At quarter’s end analysts were calling for a decline in profits of 3.7%, which would mark the 3rd straight negative growth quarter. Despite a clear slowdown, the market has proven resilient and appears focused on projected 2020 earnings growth of 10.3%. Company guidance will be important, as forward expectations are paramount.

- October began in a rocky manner after a weaker than expected manufacturing ISM number reignited recession fears. The reading of 47.8 was the second straight under 50, the demarcation line between expansion and contraction, and the lowest reading since mid-2009. It should be noted that the manufacturing sector generates only a little over 10% of total US GDP. The big question facing investors is whether or not this is a repeat of 2012 and 2015, or 2008. For the signal, we will be watching Non-Manufacturing PMI and upcoming jobs reports for signs of consumer weakness, the main driver of the US economy. Our base case expectation remains slowing growth, no recession, and positive earnings growth in 2020.

From the Trading Desk

Municipal Markets

- As has been the case nearly all year, municipal technicals remain very strong. Retail demand continues to drive the market with YTD net mutual fund inflows of $68.4 billion maintaining a record pace. This has more than offset 8% and 9% YOY declines in bank and P&C insurance company holdings.

- On the supply side, net negative issuance has limited market inventory. JP Morgan is estimating $81 billion of net negative issuance in 2019, and the overall municipal market declined in size by 1.5% through mid-year.

- A combination of sustained demand, constrained supply, and solid credit fundamentals has compressed yields and supported strong municipal performance. Through September 30th, the Bloomberg Barclays Municipal Bond Index has returned 6.75%.

- Weakening global economic expectations contributed to a recent further flattening of the municipal yield curve. Over the course of Q3, AAA 2-10 Year muni spreads fell by 18 bps, while the front end, measured by 1-7 year spreads, barely moved (+1 bp).

- A flat front-end of the muni yield curve coupled with a very low rate environment has prompted many client inquiries. We feel Variable Rate Demand Notes (VRDNs) warrant consideration as a potential short-term, high quality option. SIFMA, a tax-exempt proxy for VRDN yields, ended September at 1.49%. For those looking to put cash to work on a temporary basis, or simply wishing to maintain liquid, high quality assets, ultra-short accounts with an ability to tactically allocate between VRDNs and short munis as relative value changes may have appeal.

Taxable Markets

- There were no rates surprises from the Federal Reserve this month as its well telegraphed 25 bps rate cut was largely a non-event. The range of the Fed Funds target is now 1.75% – 2.00% and the effective rate is 1.88%. The FOMC also reduced its interest rate on required and excess reserves (IOER/IORR) by 30 bps to 1.80%, roughly in line with Federal Funds.

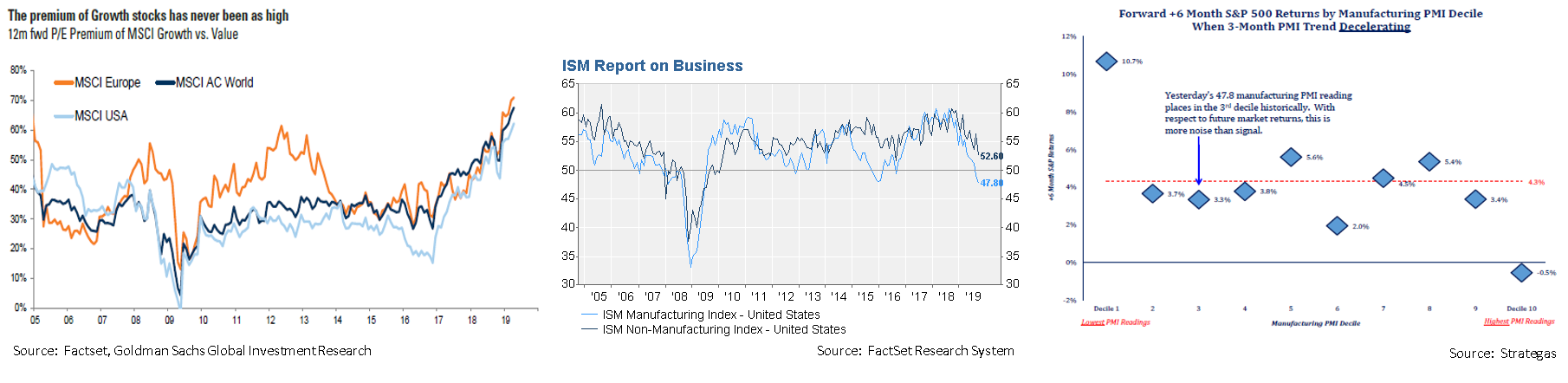

- A notable concern did materialize in September, as banks’ needs for short-term cash began to outweigh cash available to borrow, creating a potentially significant liquidity problem in the repo markets. Banks and other institutions use assets as collateral to fund short-term needs such as tax payments and trading activity. Typically, banks borrow and loan from each other through overnight repo contracts and when cash is not readily available they go to the Fed window. This time around several factors compromised the banking system’s ability to efficiently loan cash, momentarily driving repo costs at certain points in time as high as 9%, creating a need for Fed intervention.

- A contributing factor was the Fed’s sharp reduction in buying activity (i.e. cash infusion) due to a previously communicated objective of reducing its swollen post-Financial Crisis balance sheet.“Accounting 101” emphasizes that Fed assets (Government securities) and Fed liabilities (cash) must “balance out.” In order to lend more cash, thereby alleviating the repo liquidity crunch banks temporarily faced, the Fed must take in more assets and once again grow their balance sheet. That’s exactly what’s been happening, with the Fed recently injecting upwards of $50 billion a day. This intervention has calmed matters by creating the liquidity needed to maintain orderly markets. We are not overly concerned and have not seen material impact to credit conditions, although a return to more permanent and routine interbank funding would be welcome.

Financial Planning Perspectives

Considerations in a Low Interest Rate Environment

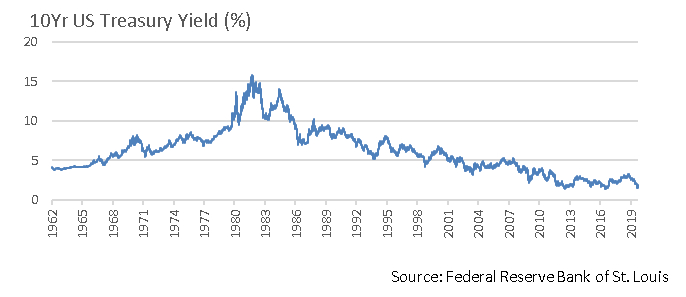

For the better part of a decade you’ve probably often heard that interest rates are historically low. In fact, the 10Yr Treasury has not exceeded 4% since October of 2008. By contrast, prior to breaking through the 4% mark in 2002, the last time 10Yr yields were below that level was back in 1963. Bear in mind that many different barometers measure the interest rate environment, rate-sensitive structures are not all impacted similarly, nor do they move in sync.

That said, today’s environment heavily favors borrowers, not savers.

- Low rates mean bank savings accounts will earn far less interest than in years past;

- Low rates also mean that the yield to maturity on your bond portfolio is likely to be much lower than historical norms;

- Low rates present homeowners with an ability to lock in a low annual percentage rate (APR);

- Low rates are also often associated with increased property values, thereby potentially creating a “wealth effect”

While rates remain low, here are some considerations:

- Is your mortgage interest rate higher than it needs to be? It very well may make sense to refinance. Doing so could allow you to reduce interest costs and/or shorten the remaining years on your mortgage.

- Carefully consider interest sensitive purchases such as homes, cars and boats before proceeding. While capitalizing on low interest rates can make such purchases more affordable, and the time could be right with cash not earning much, we advise caution. Evaluate such purchases independently of interest rates and think about whether it is likely to remain affordable should the environment or your personal circumstances change.

- Maintain a long-term investment strategy designed around your unique needs. Making significant changes to asset allocation based largely on today’s macro environment is not recommended. Market timing is extremely difficult. Those who avoided bonds a few years ago in the face of falling nominal yields, or prematurely anticipated an end to the equity bull market, have incurred considerable opportunity cost.

We’re here to help. Reach out with questions about your financial plan or the markets. We look forward to speaking with you.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]