Insights and Observations

Economic, Public Policy, and Fed Developments

- September proved an eventful month for Fed watchers. After formally moving from a maximum to average 2% inflation target at the end of August, Fed officials were busy fleshing out the new policy. This was not without hiccups, as Chicago Fed President Charles Evans rattled the markets noting the Fed didn’t have to wait until the inflation rate broke 2% to raise rates, although he was discussing average, not current, inflation. Fed Presidents Clarida and Brainard were subsequently explicit on the Fed’s commitment to worrying about “shortfalls, not deviations,” from maximum employment. The bottom line is that the FOMC dot plot shows lower-bound rates through 2023 and we expect short term rates to remain near zero for the foreseeable future.

- Unexpectedly, Judy Shelton’s nomination to the Federal Reserve board fell back into jeopardy in September, as Senator John Thune publicly noted that her nomination would not be brought to the Senate floor until they were sure she had the votes to be confirmed, and at present they did not. We see Shelton as too overtly political and outside policy mainstream for the Fed’s board and would view a collapse in her nomination as positive for the markets.

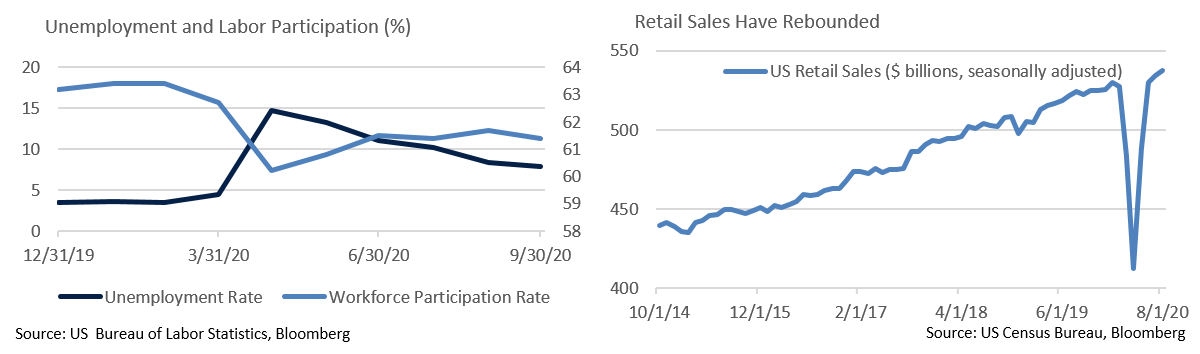

- Retail sales missed in August but remained positive; we have now seen four consecutive months of increases, but at steadily decreasing rates. While growth has been solid enough to return sales to their prior trendline of around 2% growth, the current sales recovery has been positively impacted by a shift in spending from services to goods and may overstate consumer strength.

- Another month of economic releases has brought greater clarity to the shape of the labor market, and while the recovery has been faster than we had anticipated, job growth appears to be slowing. Weekly unemployment and continuing claims data indicated the rate of progress may be decelerating, as confirmed by September’s BLS release. The headline missed, though mostly on public sector activity, as government employment lagged badly while private sector hiring broadly met expectations. Headline unemployment fell more than expected, 7.9% vs 8.4%, though largely due to a sizable decline in the participation rate.

- Lower unemployment attributable almost entirely to more workers permanently leaving the workforce does not point to economic health. Several prominent companies have announced large layoffs as stimulus paycheck protection programs expired. Absent a new stimulus deal supportive of employer payrolls, we expect further labor market deterioration in October.

- Stimulus talks appear to be in limbo with progress slow and fragile, especially after the President tweeted that the White House may pull out of the dialogue. The gap between the parties had narrowed, with Speaker Pelosi at $2.2 trillion and Secretary Mnuchin at $1.6 trillion. However, upcoming Supreme Court confirmation hearings and rapidly approaching elections leaves little room to maneuver. Even with a weakening employment picture offering incentive, a pre-election stimulus deal looks doubtful.

- The final Q2 GDP revision came in at -31.4%, a modest improvement from an initial -34.5% reading and a prior revision of -32.5%. The Fed’s Weekly Economic Index suggests Q3 growth of around +20%. This Index is a good baseline expectation as we wait for the first release of Q3 economic growth. This has been a reasonably strong recovery, but it has been uneven – talk of a “V-shaped” recovery is increasingly giving way to a “K-shaped” one, as different segments of the economy have had very different experiences. Expect to hear more of this metaphor, especially as Q4 is looking relatively fragile.

- A chaotic first Presidential Debate did little to sooth increasingly concerned markets. Democratic nominee Biden has enjoyed sizeable, stable leads in national polls and remains favored to win, but a combative Trump pointedly refused to confirm he would accept the outcome if he lost. Futures markets that price volatility suggest that traders are bracing for equity market turmoil in November and paying unprecedented premiums for protection, implying the market is growing concerned about a 2000-like protracted battle. We share traders’ worries about the damage a lengthy court battle to settle the election could have on the markets. President Trump’s COVID-19 diagnosis adds further uncertainty with the election less than a month away.

Equity News and Notes

A Look at the Markets

- September’s equity market performance stayed true to historically weak seasonal form. The S&P 500 declined 3.8%, breaking a 5-month winning streak. After touching an all-time high on 9/2, the index quickly dipped into correction territory (-10%) before rallying during the final week of the quarter. The S&P 500’s recent high was up over 60% from its 3/23 low, so modest weakness ought to be kept in perspective. Despite the pullback, the index enjoyed its second strongest 6-month stretch since the 1930s, bested only by 2009’s move off the low.

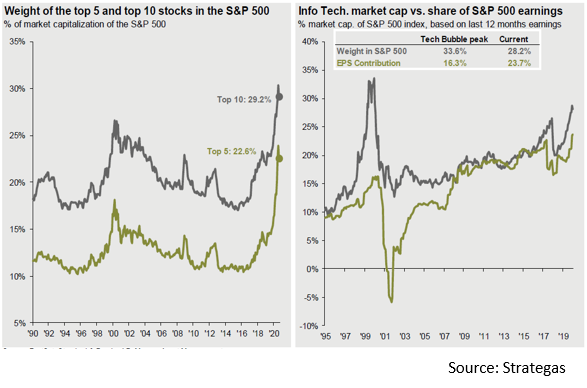

- Weakness in the large-cap growth and momentum segments of the market, particularly Technology, has captured considerable attention. With no specific catalyst for the weakness, crowded positioning in mega cap leaders and stretched valuations were among the go-to explanations. We too feel that recent price action is much more a reflection of price than it is a shift in fundamentals. Given index concentration among mega cap tech names, many harkened back to 2001. But as the accompanying chart demonstrates, the Technology sector contributes a disproportionate share of today’s market’s earnings.

- Ongoing debate on Capitol Hill and in the White House over an additional round of fiscal stimulus has recently preoccupied investors. Whether there will be any package at all, or if there is one, the size and scope of a potential deal, is still being debated. Nonetheless, we believe some level of stimulus is needed to spur demand and bridge the gap to a vaccine. In our consumption-based economy, consumer spending is likely to remain tepid until people feel safe returning to pre-pandemic activity. The Fed has made it abundantly clear that they are not going to raise interest rates for the foreseeable future. The monetary policy response has taken solvency and liquidity risk off the table … now we need the fiscal side to boost demand to help soak up all that liquidity.

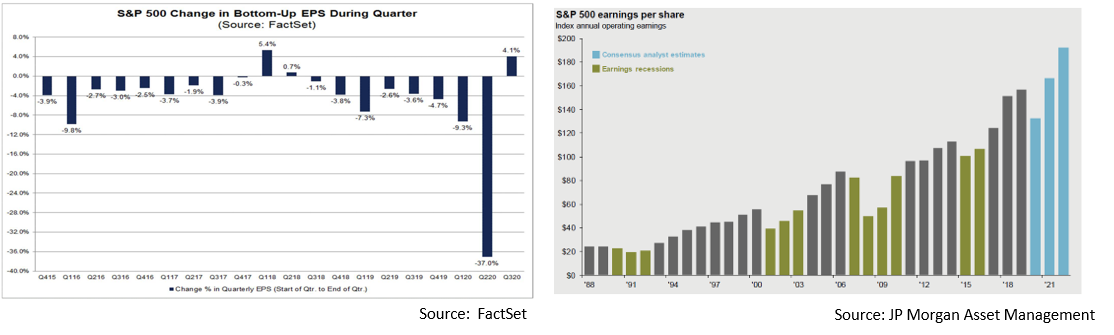

- Q3 earnings season starts in mid-October, and investors are anxiously waiting to see how companies handled the economic downturn and nascent recovery. Analysts are calling for a decline of 21%, which would mark the second largest earnings fall since 2009 (-27%). However, quarterly earnings estimates have increased over the past three months. This is atypical as the only other time period over the past five years in which estimates increased occurred amid corporate tax reform in early 2018. Companies typically top lowered expectations, although we welcome an inflection higher in estimates and feel it is necessary for the index to grow into its valuation. As often referenced, today’s high market valuations (S&P 500 forward P/E of 21.6x) are partly due to investors looking ahead to an earnings recovery in 2021/22.

- Fall has often presented challenges to investors, with September’s seasonal weakness followed by October, an historically volatile month. There are reasons to be nervous with a lack of stimulus progress, second wave COVID fears, ongoing economic concerns, and the pending election. While we expect volatility, we are cautiously optimistic on the medium-term outlook. An accommodative Fed, stable credit spreads, low inflation and interest rates, a weaker dollar, global economic recovery, and vaccine hopes offer a favorable backdrop for equities. And moving the election from an unknown to a known factor may itself be enough to give markets a lift in Q4.

From the Trading Desk

Municipal Markets

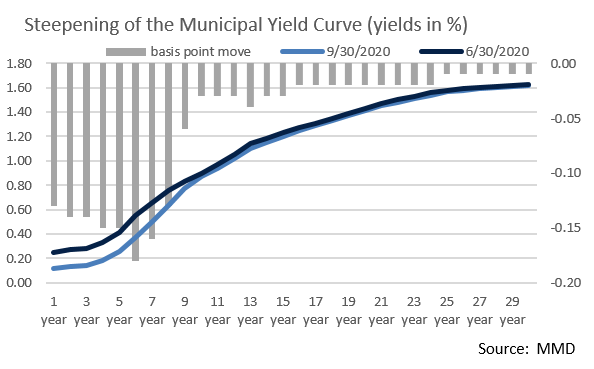

- The muni curve steepened over the course of Q3 with front end yields dropping by 13 to 14 basis points to leave the 2Yr at 13 basis points, while yields on the 10Yr to 30Yr end of the curve were essentially unchanged. Steepness from 2Yr to 10Yr on the AAA municipal curve is now 74 basis points, versus 63 basis points at the beginning of the quarter. This means that investors are being paid incrementally more for buying longer maturities through 10 years and we are actively looking for bonds in the 6 to 9-year portion of the curve.

- Yields on short maturities are still quite limited given the influence of Fed policy and very strong investor demand, the latter influenced by consistently high flows into short and limited maturity tax-exempt mutual funds. The 2Yr AAA municipal curve yielded 0.13% as of 9/30, down from 0.27% at the end of Q2. With the front-end anchored, cash alternatives like Variable Rate Demand Notes (VRDNs) remain low. SIFMA, the VRDN benchmark, closed September at only 11 bps.

- The 10Yr AAA municipal/UST ratio still suggests there is relative value in the high-quality tax-exempt markets. This often-cited ratio ended Q3 at 126%, as compared to a post-1990 average of 86.8%. As referenced earlier, relative value is somewhat reduced, yet still above long-term historical averages, at short (2Yr ratio of 100.0%) and long (30Yr ratio of 110.96%) maturities (as of 9/30).

Corporate Bond Markets

- September followed a similar pattern as the past few preceding months with bond issuers accelerating debt offerings given today’s stubbornly low rates and tight credit spreads. The $164 billion issued surpassed all other prior Septembers and is the seventh largest month on record. The persistence of this year’s IG Corporate issuance surge is noteworthy, as five of the largest historical monthly totals have been realized in 2020.

- On a year-over-year basis issuance is up 67% vs. 2019, with $1.54 trillion coming to market YTD, most of which is debt refinancing. The market has digested these offerings extremely well, although issuance may have peaked. As the election approaches and political and economic uncertainty grows, market sentiment could be impacted. The broker syndicate is estimating that October issuance may only reach $75 billion.

- With buyer demand remaining high, new issues have performed very well. Most offerings have been oversubscribed as investor demand has generally far exceeded the amount of bonds being offered. Strong fund flows and appetite for yield in the high-grade space has been persistent. This has helped keep IG spreads tight and a potential slowdown in new issuance would be another supportive factor.

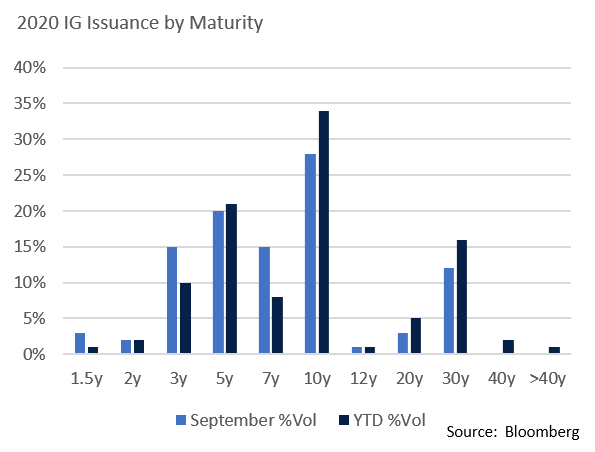

- Investor appetite for duration risk seems to be waning, as new issues are mostly coming inside of 10 years. Breaking down September issuance by maturity reveals that 83% was under 10 years vs. 70% on a YTD basis. The yield curve inside of 5 years and beyond 12 years is flat, although in between there is greater steepness and value for investors maintaining duration. This allows investors to pick up additional yield while maintaining duration risk and issuers are taking advantage of the demand.

- On an OAS basis, the spread on the Bloomberg Barclays Investment Grade Index began the year at 94 basis points and climbed to a high of 381 basis points on 3/23. There has since been a steady retraction and the Index’s OAS ended September at 134 basis points. It has been a very good couple of quarters for IG corporate investors.

Financial Planning Perspectives

Financial Consequences of Adulthood

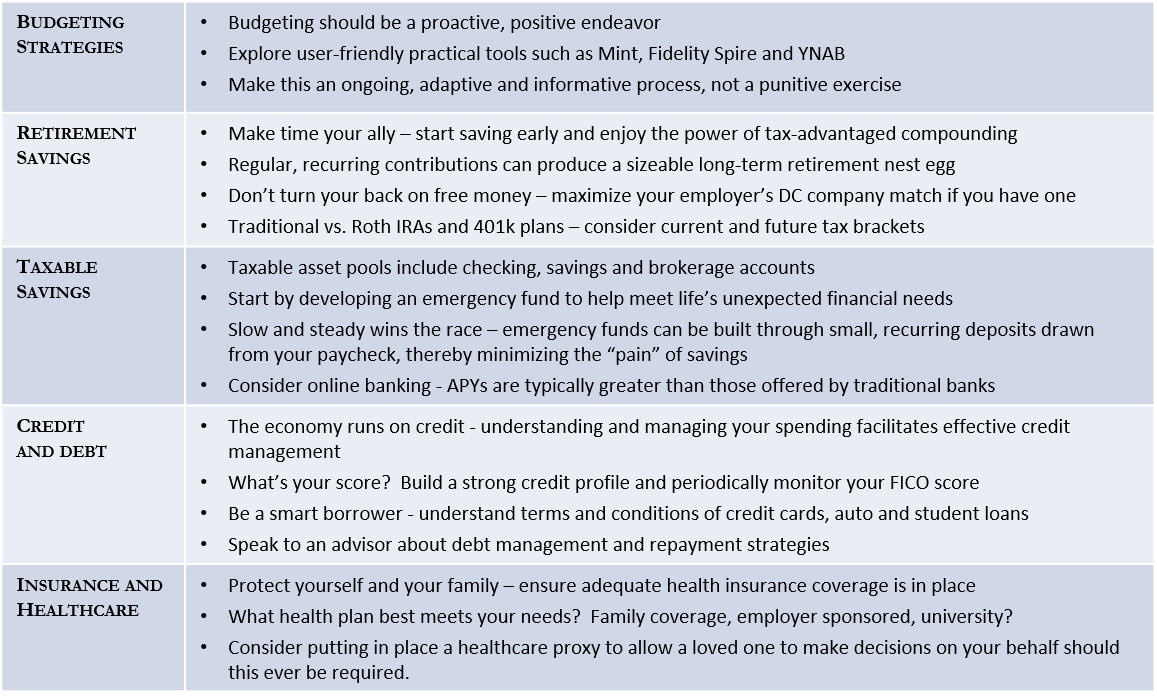

Multi-generational financial planning is typically associated with undertakings such as asset allocation strategy, retirement savings, and estate planning. While these are very important components, an often-overlooked element involves preparing younger generations to independently tackle the financial challenges of adulthood. Our recent webinar discussed this theme, and we recap several key points below.

Multi-generational financial planning is typically associated with undertakings such as asset allocation strategy, retirement savings, and estate planning. While these are very important components, an often-overlooked element involves preparing younger generations to independently tackle the financial challenges of adulthood. Our recent webinar discussed this theme, and we recap several key points below.

Life is a dynamic adventure and early adulthood can be an exciting and rewarding time of change. At Appleton, helping our clients’ younger family members meet their current financial needs while laying the groundwork for a secure tomorrow is an important element of our financial planning services. The issues referenced above merely scratch the surface. Reach out to us with questions as everyone’s circumstances differ. We would be happy to help.

We are proud to announce that Jim O’Neil, SVP and Managing Director of Private Client Services, has been named to the Board of Directors of the National Association of Estate Planners & Councils (NAEPC). This prestigious organization serves roughly 30,000 members nationwide and is comprised of 270 estate planning councils. Congratulations Jim! www.naepc.org/about

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]