Insights and Observations

Economic, Public Policy, and Fed Developments

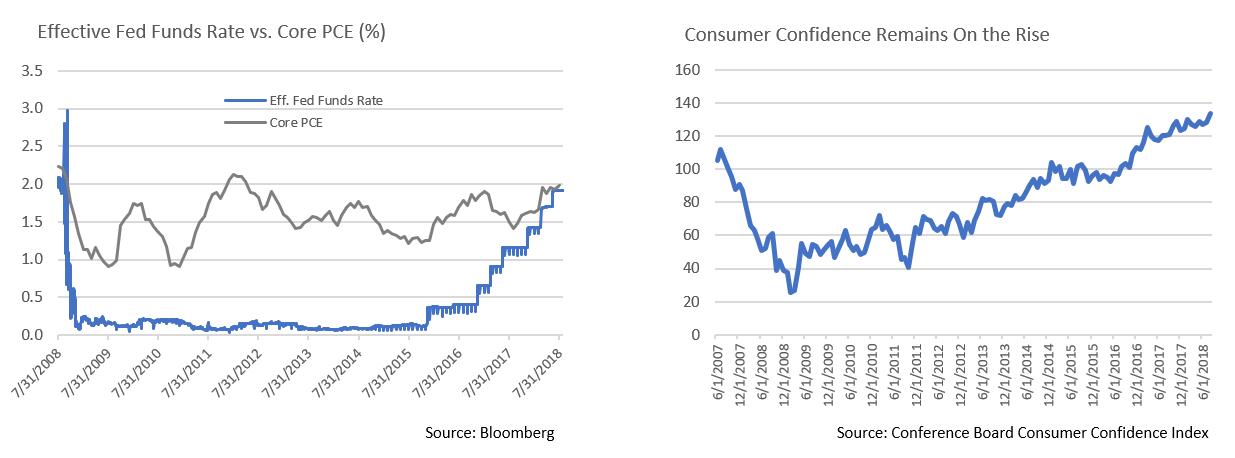

- The economic picture continues to diverge at home and abroad. Domestically, the primary consumer confidence reading surged to 133.4, the highest level in 18 years. This is an exceptionally strong number that supports an expectation of sustained spending in a demand-driven US economy. Global conditions have been much less robust, with weakness in China and many emerging markets.

- Meanwhile, Q2 GDP increased from 4.1% to 4.2% in the first revision. The drag from inventory declines was slightly less than originally reported, though while the adjustment to net trade was positive, it was largely the result of net exports being revised down by less than net imports, hardly an encouraging revision. Despite strong consumer confidence, our Q3 outlook – a modest slowdown from an elevated Q2 to a still healthy Q3 reading – is unchanged.

- Negotiations to revise NAFTA broke down at month end, after a Toronto newspaper leaked off-the-record comments indicating the US would refuse to make concessions to the Canadians. Some form of a deal had looked increasingly likely after the administration had announced the parameters of a potential US-Mexico deal earlier that week. However, with Trump now threatening, over bipartisan opposition, to push for a termination of NAFTA and forge ahead with the bilateral deal with Mexico, the twenty-five-year-old trade agreement’s future has become uncertain. Mexico has indicated they are not interested in pursuing a bilateral deal that excludes Canada, and the power of the President to reverse a Congressionally-approved trade agreement has not yet been tested.

- The setback in NAFTA talks may also have negative implications for trade talks with China. The Trump Administration has indicated they will only turn to China after they have renegotiated NAFTA, delaying any potential resolution. Complicating matters, Trump has indicated he will move forward with an additional $200B of 25% tariffs on Chinese imports with a formal announcement due any day as of present writing, and surprised the markets by mentioning a further $267B in tariffs “ready to go on short notice.” For now, both the US and Chinese have committed to continue discussions.

- The Federal Reserve is widely expected to hike short term interest rates to a range of 2-2.25% on September 26th, with the implied probability of a hike standing at nearly 95% at month end. With the effective Fed Funds Rate at 1.91% and Core PCE inflation at 1.99%, the expected hike would move the “real” overnight rate from modestly negative to modestly positive for the first time since the Great Recession. Indeed, the Fed indicated they may soon drop the word “accommodative” from their assessment of the current policy stance. After more than a decade of stimulus, the return to a normalized short term rate environment is a healthy development and speaks to the strength of the US economy.

Equity News & Notes

An Aging Bull Market Demonstrates Sustained Strength

- Most major US stock indices hit all-time highs in late August, as the bull market staked a claim as the longest in history. Investors are questioning how long the party can last, although bull markets do not simply die of old age. Rather, they tend to reflect economic downturns. That said, recession warning indicators are not flashing red. Money and credit are circulating, while the yield curve has not inverted. The US economy is coming off a 4%+ GDP quarter and is likely to finish with 3%+ growth for the year. Corporate earnings grew roughly 25% in Q1 and Q2 and are expected to increase by 20% in the second half of the year. Profit margins are near all-time highs. Confidence remains high, as shown by “soft data” (surveys) and “hard data” (retail sales and capital expenditures). Lastly, valuation levels are reasonable, with a forward S&P 500 P/E of 16.9x, well below last year’s ending value of 18.3x. There are always risks, best illustrated by current trade tensions, emerging markets contagion concerns, and geopolitical flareups. We will be mindful of these as we head into the historically challenging Fall season.

- It has been hard to ignore the short-term relationship between US equities and the US dollar. When equities have sold-off during recent bouts of volatility, it has generally been associated with sharp dollar strengthening. While unnerving, we see this dynamic as more a reflection of a “risk-off” trade than underlying market fundamentals. A receding dollar has often subsequently boosted equities. Why is this the case? The dollar has long been a “safe-haven” currency, and demand for dollars often follows destabilizing headlines. For example, as trade tensions rise, investors wager that the US will be less impacted than most of our trade partners, thereby bumping the dollar. Unsettling dynamics in countries such as Turkey, Argentina, South Africa and Indonesia have also led traders to seek comfort outside those markets in dollars. Should US interest rates rise more than anticipated, the dollar could push higher which have a negative effect on US exporters. This concern has not yet manifested itself. Corporate fundamentals measured over a much longer time frame than short-term currency swings have driven the US equity market’s trajectory, although we are keeping a close eye on currency.

- August looked like it was going to be a tough month for oil, with Brent prices falling nearly 6% by mid-month. The weakness was driven by a potential slowdown in global growth, spurred on by the ongoing US-China trade dispute and perceived risk to Chinese oil demand. Brent and West Texas Intermediate (WTI) enjoyed a reversal later in the month with prices ending largely unchanged. Prices have responded to reports of crimping Iranian exports, lower than expected US inventory, and hopes that trade tensions might be dialed down. Our interest in oil reflects the importance of a healthy and reasonably stable market price, and we will be assessing economic impact as WTI looks to regain the $70/barrel mark.

From the Trading Desk

Municipal Markets

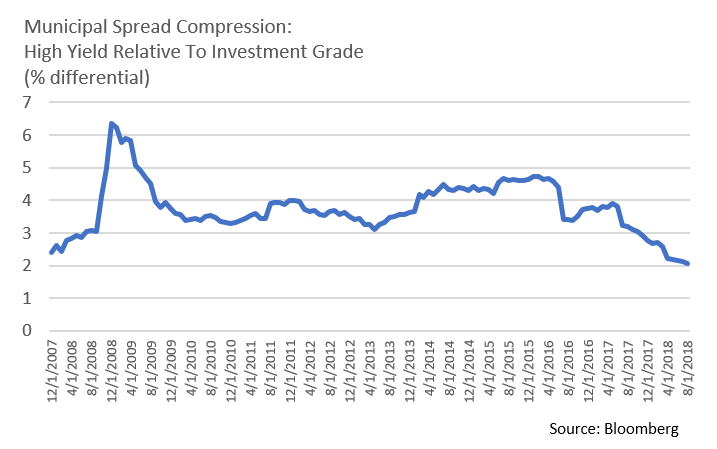

- A long era of accommodative monetary policy, favorable credit conditions, and a thirst for tax-advantaged income have driven yields in the tax-exempt high yield market to record low levels. In fact, the Barclays High Yield Municipal Bond Index yield to worst of 4.74% recorded on 8/31/18 represents the lowest level since the Index’s 1/1/95 inception. The extent to which muni high yield spreads have compressed relative to the investment grade market is also noteworthy. The accompanying chart details the spread between the Barclays Municipal High Yield and Investment Grade indices measured on a yield to worst basis. August ended with a paltry spread of 2.06%, the lowest relative risk premium since 11/30/07, prior to the onset of the Great Recession, a time that also reflected widespread use of 3rd party bond insurance guarantees, a credit backstop that has since largely dissipated.

- In our view, today’s tight high yield spreads introduce a relative value consideration, as advisors and investors assess the adequacy of tax-exempt high yield risk premiums. While nominal tax equivalent high yield coupons may still appear attractive, an extended “risk-on” environment has given investors an opportunity to consider the merits of reallocating a portion of their portfolio into more liquid, higher grade tax-exempt exposure.

Taxable Markets

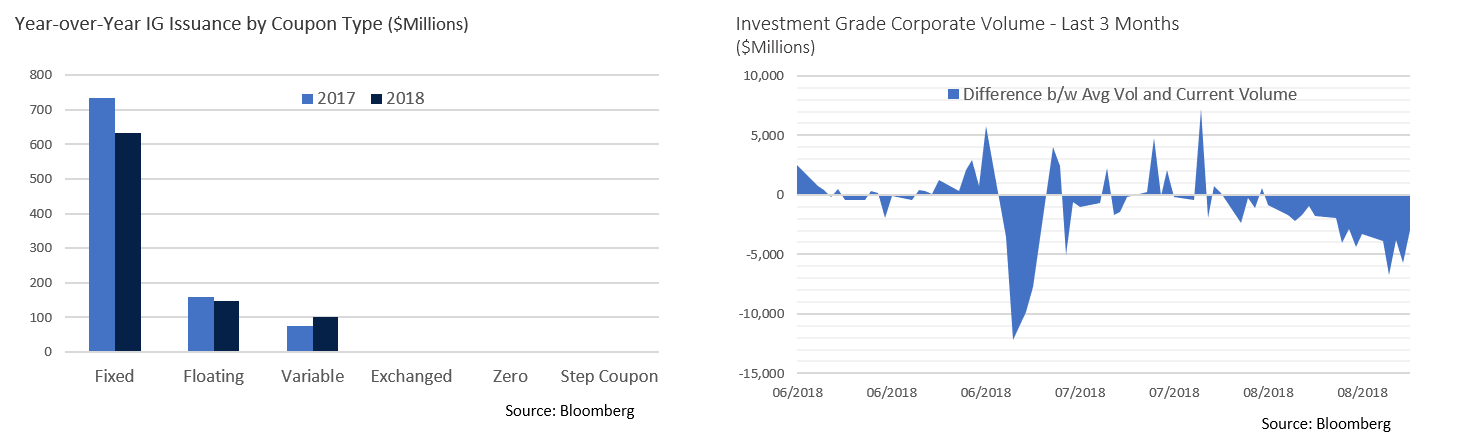

- A sea of red ink at the Federal level is exacerbating US Treasury yield curve fears. As we move into the second half of 2018, the level of outstanding marketable US Treasury debt has climbed to a record level of $15.566 trillion, more than $1 trillion greater than the Treasury had outstanding as recently as the end of 2017. The year-to-date 2018 increase is roughly equal to recession easing issuance during all of 2011. The additional debt is in part needed to offset revenue lost by the Trump tax cut package. An additional $500 billion is expected to be raised by the end of 2018.

- Treasury issuance has been focused on the shorter end of the curve, with the heaviest distribution out to five years. Funding the Treasury’s needs will continue to put pressure on rates at the front end of the yield curve, contributing to the flattening that has given market watchers so much consternation. This supply dynamic is compounded by the Fed’s ongoing efforts to normalize monetary policy, in part by steadily nudging up short-term rates. The market has long demonstrated a willingness and ability to accommodate US debt needs, although the longer term funding cost is something that must be closely watched.

Financial Planning Perspectives

A Personal View Of Risk

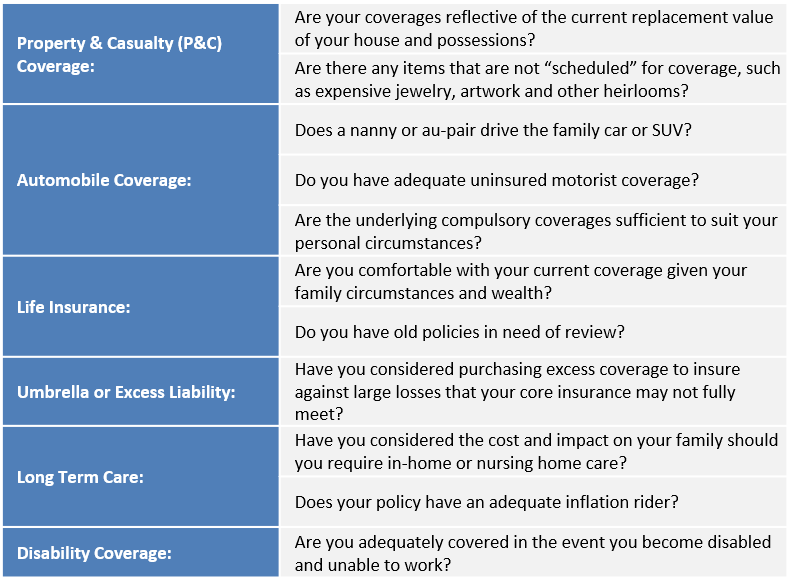

With US equity markets hitting all-time highs, many investors are prudently reassessing their portfolio risk, often with an eye towards refining asset allocation and related investment strategy. This is a process we strongly encourage and incorporate into our private client relationships. While integral to our wealth management services, macroeconomic and market risk is only one part of the risk management and planning equation.

It is important to focus more on individualized risks, namely financial matters that can be easily overlooked. Insuring against real world personal risks is as important to protecting one’s future as optimizing asset allocation strategy.

Insurance is a far less exciting topic than the state of the “FANG” stocks. Nonetheless, failure to properly assess and address these risks can introduce significant and even potentially catastrophic consequences. We recommend our clients perform an annual “insurance checkup” with their insurance professional to ensure that there are no coverage gaps, and that you and your family are adequately protected against the unexpected. Items to consider include:

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]