Insights and Observations

Economic, Public Policy, and Fed Developments

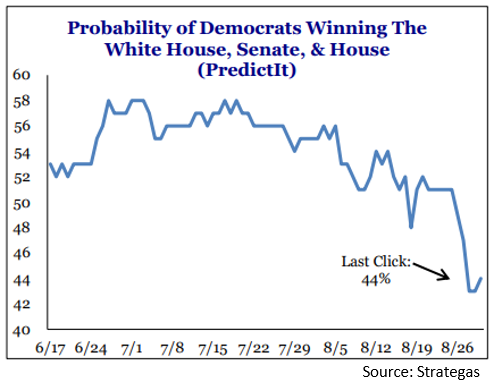

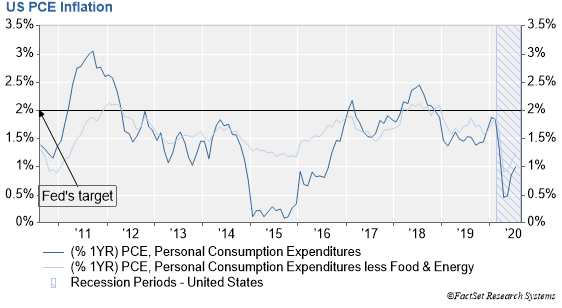

- In a relatively quiet month, Fed Chairman Jerome Powell made the biggest macro news during a virtual Jackson Hole speech. He announced the conclusion of the Fed’s year-long policy review, and the adoption of a 2% average inflation target, indicating that inflation would be allowed to modestly overshoot after a period of failure to meet targets. Powell noted persistent inflation shortfalls led to persistently low rates even during times of expansion, tying the Fed’s hands during contractions. He also discussed the benefits of maximum employment on income inequality. In practice, this solidifies the Fed’s commitment to maintain ultra-low short-term rates for the foreseeable future, and modestly increases inflation expectations. The Treasury curve steepened slightly in response. We expect this shift to eventually lead to higher rates, although not for some time to come.

- The workforce picture remains muddled. The unemployment rate fell in July to 10.2%, beating expectations of 10.6%, and the lingering misclassification issue we have referred to in the past continued to shrink. However, the weekly unemployment reports are still volatile – two consecutive better than expected drops in new unemployment claims stoked the market and brought new claims under a million for the first time since before the pandemic. However, new claims subsequently spiked on 8/20, with 1.106M exceeding the highest estimate in Bloomberg’s survey. The 8/27 claims were in line with expectations although hopes for a much faster-than-expected recovery were dented. Our belief is that the labor market recovery will be slow, and with recent large layoff announcements after the expiration of stimulus funds, notably American Airlines, we worry about a second wave of layoffs.

- Speaking of the stimulus deal, negotiations remain in stalemate, with Congress on break until early September. Major sticking points include liability protection for schools and companies following CDC guidelines on the right, and aid for state and local governments and for the USPS on the left. There is also disagreement on the size of the stimulus bill. Democrats are reportedly open to their version of a “skinny” deal that will buy time until a broader deal after the election, but ultimately, we believe negotiations will be driven by the trajectory of the pandemic and the extent to which improving economic conditions hold. However, consumer confidence fell in August, likely as a biproduct of the collapse in stimulus talks. The current political stalemate comes at a cost.

- The economic picture is not without bright spots, at least. Despite a headline miss, retail sales were surprisingly robust under the surface, with ex-autos and gas surprising to the upside, and with autos being extremely strong in the prior period, timing may have been a factor in the headline miss. Housing has also been a source of strength, as American preferences appear to be shifting from workplace proximity to space in short order. ISM Services also surprised to the upside in August, led by strength in New Orders (61.5 to 67.7) and Production (62.1 to 67.2).

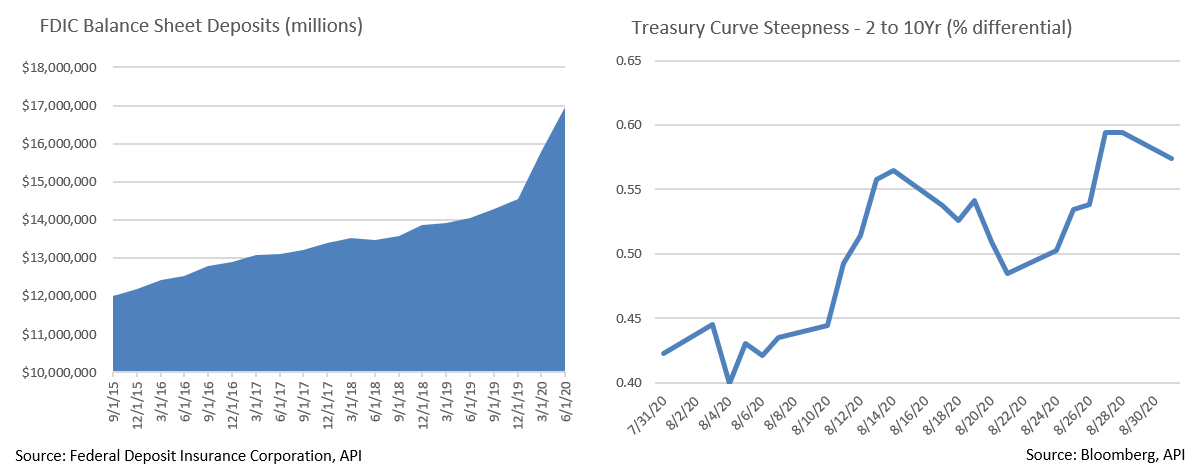

- Finally, while the household savings rate has been unusually high for some time, further evidence of an improvement in consumer balance sheets came in the form of the FDIC quarterly report. Deposits spiked in Q2, up roughly $1.2 trillion, or nearly 21% from a year ago, the highest annual jump in record. The odds of a rapid recovery are low, but consumers are well positioned to weather a sustained slowdown and if the pandemic were to resolve faster than expected there is considerable dry powder to fuel an expansion.

Equity News and Notes

A Look at the Markets

- Stocks rallied sharply last month as the S&P 500 enjoyed its best August since 1984 (+7.2%). The index was positive in all but 5 trading days, reaching a fresh all-time high late in the month. The S&P has been positive each month from April through August for only the 6th time since WWII and posted its best 5-month return since 1938 (+35.6%). The return to all-time highs also marks the fastest rebound following a 30% drop in the index’s history. Since 1945, there have been 6 declines of 30% or more with the average recovery to a new high taking roughly 3.5 years. This one took only 5 months.

- The market narrative has remained largely unchanged. Massive fiscal and monetary stimulus, the “TINA dynamic” (which we wrote about last month), low rates, stable credit, a weaker US$, increased M&A, and vaccine optimism were all tailwinds for stocks, offsetting growing tensions with China and a lack of stimulus progress. A new development that we feel has helped sentiment was an apparent narrowing of the gap in the polls between Biden and Trump. A perceived risk for investors has been the possibility of a Democratic sweep in November and the potential for less business-friendly policies. As the accompanying Strategas chart suggests, the odds of a sweep dropped to 44% after spending much of the summer in the mid-50s.

- At the Federal Reserve’s annual Jackson Hole Symposium (held virtually this year), Chairman Powell adjusted the Fed’s policy framework with a new goal, “to achieve inflation that averages 2 percent over time”. The Fed’s willingness to let inflation run above 2% for a time, combined with Powell’s June comment of “not even thinking about thinking about raising rates”, is an explicit message to investors that the Fed will remain accommodative for an extended period of time, potentially lengthening a favorable capital markets cycle. With lower rates, ample liquidity in the system must find a home. We continue to favor growth stocks, particularly in the Technology sector, which have shown a historical negative correlation to bond yields.

- Given the Fed’s 2% inflation bogey, we need to be mindful of potential triggers. Under old regimes, a strong economy with full employment prompted rate hikes. This new framework will target higher inflation, albeit with no tangible plan on how to achieve it. Inflation hawks point to historic levels of government spending as inevitably inflationary, but we would look to another potential source. The globalization of the workforce and supply chains with cheap overseas labor, historically deflationary, is likely to reverse trend to an extent as a result of the COVID pandemic. This is a longer-term concern though, as inflation is likely to remain stubbornly low in the short term. Price inflation is hard to come by absent wage increases, and with unemployment north of 10%, the Fed has their work cut out for them to get inflation above 2%.

- Despite the stock market’s return to all-time highs, there are several risks of which to be mindful. Breadth has been lackluster as the headline index has advanced largely on the strength of a smaller group of megacap names. Traditional valuation measures are elevated (forward P/E > 23x), prices have extended from their moving averages (+13% above the 200-day), and we have seen an uptick in various sentiment surveys which are thought to be contrarian indicators. Lastly, seasonality could be a factor heading into September, historically the market’s weakest month.

- The financial press is also actively discussing a “K-shaped” recovery. The thought is that after a sharp drop there have been diverging and highly unequal recovery paths as depicted by the upper and lower right portions of a “K”. The market has rewarded the “haves” relative to the “have nots”, as companies with strong balance sheets, robust relative growth, and leverage to the digital economy are strongly outperforming those companies more vulnerable to the pandemic. We believe prudent portfolio construction warrants diversifying risk factor and asset exposures, although the drop in correlation between companies and sectors provides an opportunity for active management to shine. As referenced, our preference remains in more growth-oriented, large cap names.

From the Trading Desk

Municipal Markets

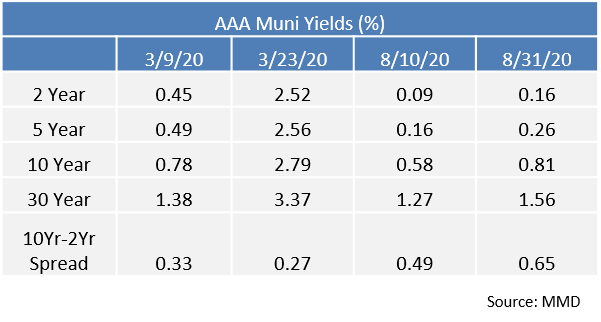

- The municipal market is now six months from March’s COVID-19-induced price lows, a remarkable period in which yields have retraced back to below pre-pandemic lows. The 10Yr AAA MMD hit a high of 2.79% on 3/23 before receding to a new low of 0.58% on 8/10. The same factors have continued to drive market performance – sustained retail demand, paltry alternative yield options, and a robust Federal Reserve backstop.

- Towards the end of August rates drifted slightly higher as a period of seasonal extremes for municipal demand tapered. June to August produced roughly $40 billion of net negative issuance, a trend that is expected to end in September when issuance is likely to increase. This may modestly pressure yields as we move into the fall.

- The 10Yr AAA MMD ended August at 81 basis points. The bid at shorter to intermediate levels has remained stronger than on the longer end and the municipal curve added steepness late in the month. The spread between 2Yr and 10Yr AAA municipals ended August at 65 basis points, affording investors greater relative compensation when adding duration.

- A good part of the volatility six months ago at the onset of the pandemic was driven by mutual fund flows. To illustrate how quickly market conditions changed, during March and early April net outflows from tax-exempt funds exceed $47 billion over a five-week period. This subsequently reversed and fund flows have now been positive for 15 consecutive weeks. YTD tax-exempt fund flows are net positive $14.2 billion despite the five-week period of dramatic outflows earlier in the year.

Corporate Bond Markets

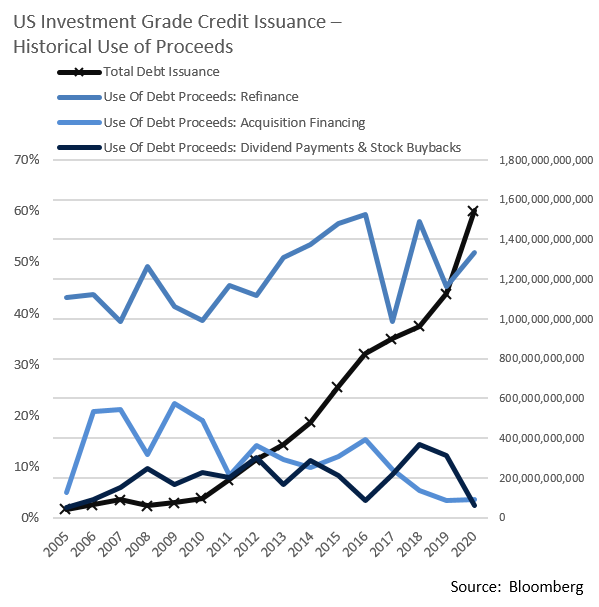

- Investment Grade corporate bond Issuance continues to hit on all cylinders, as $136.3 billion in new debt sales established an August record. That brings the YTD total to $1.377 trillion, 80% above the $764 billion offered at this point last year. A great many issuers continue to utilize proceeds to refinance debt, a positive for credit quality. Over the last 15 years debt refinancing has accounted for an average of 47% of total issuance. So far this year it has accounted for 43%.

- Acquisition financing is another common use of corporate debt proceeds, averaging nearly 20% of issuance over the last 5 years. This year has seen that number drop to just under 5%. Additionally, offering new debt to fund stock buybacks and dividends has accounted for only slightly more than 2% of 2020 issuance.

- September is slated to remain robust with syndicate estimates of around $140 billion. Sustained demand for high grade debt coupled with low rates and tight credit spreads should continue to make refinancing and other debt offerings appealing for corporations.

- Retail continues to be a pillar of support for new bond supply. Last week’s $6 billion of net flows into Investment Grade mutual funds marked the 20th straight week of positive flows. Since the end of March Bloomberg estimates that $87.88 billion has been added to IG corporate mutual funds, a key reason yields have remained compressed.

- The Treasury markets recently experienced a bear steepener, as the 10Yr UST increased 17 basis points in August while the 30Yr spiked 28 basis points. Growth in supply was the biggest contributor, as it has weighed on the long end of the UST curve.

Financial Planning Perspectives

Making Sense of Long-Term Care Insurance

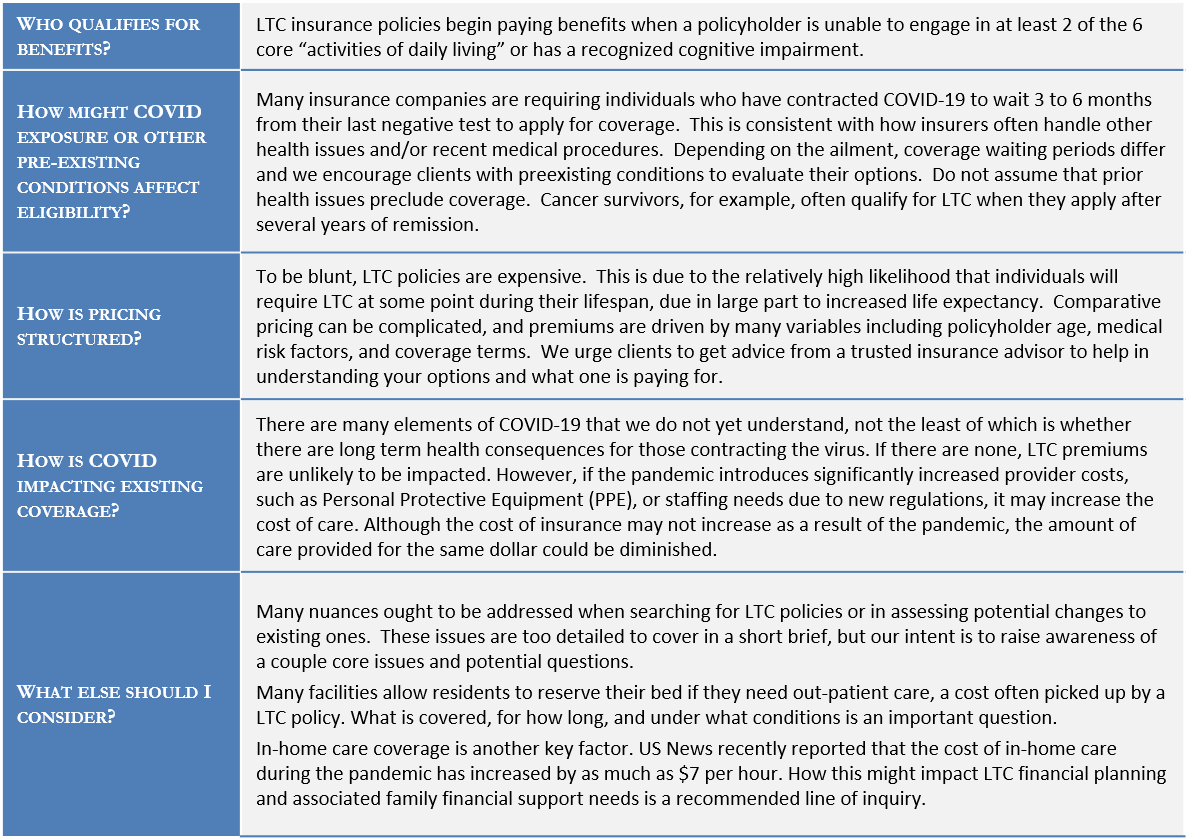

As America’s population ages, long-term care (LTC) insurance has become an integral part of the financial planning equation, yet it is a subject rife with complexity and, all too often, indecision. The industry is still relatively young, with policies only being introduced on a mass scale since the 1970s. Since then, market participants and policy choices have changed considerably, raising many questions, several of which we highlight below.

We cannot emphasize enough the extent to which individual policies differ and many have terms that may change over time. Consulting with advisors and insurers may not sound appealing but it can help you and your family gain a more complete understanding of LTC policy options. If we can be of assistance, please let us know.

Appleton’s Financial Planning Webinar Series Will Continue in September:

“Massachusetts Estate Taxes: Proactive Planning Matters” (Sept. 15, 2020)

“Financial Consequences of Adulthood” (Sept. 22, 2020)

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]