Insights and Observations

Economic, Public Policy, and Fed Developments

- Primarily a regional concern in July, the Delta variant erupted nationally in August to become a legitimate threat to the economic recovery. While thankfully vaccines appear to be holding up and breakthrough cases have mostly been relatively benign, total cases are surging and there is growing evidence that this latest wave is impacting consumer behavior. The University of Michigan Consumer Sentiment Index plummeted at the start of the month, followed by a decline in the Market PMI Goods and Services indices. The report noted ongoing inflation pressures but attributed the drop to a sharp COVID-related slowdown in consumer activity. Risks have not just been domestic; acute issues in Southeast Asia are worsening microchip shortages. The pandemic has also created fresh logistics challenges by reducing shipping capacity and causing ever-shifting supply chain reroutes. Increasingly, the narrative will need to evolve from “post-pandemic recovery” to maintaining economic growth in the middle of a pandemic, as COVID-19 is far from over.

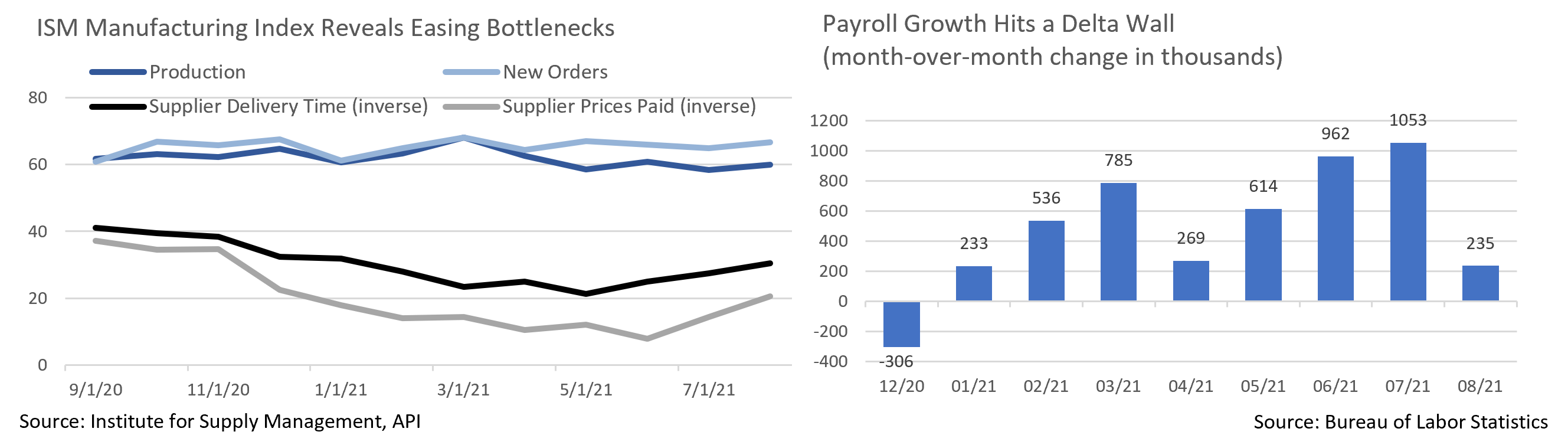

- These strains have also added considerable nuance to the inflation picture. The period of base effects impacting YoY inflation is now behind us, and economic indicators paint a picture of moderating demand that should cause inflation to slow. Retail spending remains high, although it contracted in July (-1.1% vs. expectations of -0.3%) as the impact of stimulus fades. Notably, the survey period was before Delta took hold, so there is a reasonable probability that August’s numbers will moderate further. The ISM Manufacturing Index offered additional clarity, as both production and orders accelerated, suggesting demand remains strong and companies are better able to meet that demand.

- However, the ISM Manufacturing report also noted that labor shortages are creating a drag. The Delta wave will not help here, and indeed August’s Employment Report came in a half million jobs under expectations with weakness concentrated in leisure and hospitality, and 5.6 million Americans unable to work due to the pandemic, up 400k from the prior month. This makes arguments that enhanced pandemic unemployment benefits were keeping Americans off payrolls harder to make. Hiring will remain a challenge without fundamental improvement in the fight against COVID-19. As with economic growth, the inflation discussion increasingly needs to account for the likelihood that the pandemic will exert both inflationary and deflationary pressures as the situation evolves.

- We noted last month that the 67-32 vote to open debate on a $1B “hard” infrastructure bill was an encouraging sign for its passage; the bill ultimately did pass by a slightly wider 69-30 vote, with support from Minority Leader McConnell and 18 other Republicans. The bill includes $550B in new funding, high speed internet access expansion, sizeable roads and bridges outlays, and the largest Amtrak funding since its creation in 1971. Most of this money would be spent over the medium to long term, so there is little risk to the inflation outlook, and we note that most of these “hard” infrastructure projects are badly needed. The $3.5B “human infrastructure” bill’s process began with a party-line Senate vote followed immediately by Senators Manchin and Sinema stating that they couldn’t support the price tag. Given they had just voted to do exactly that, this seems more of a negotiating position than serious resistance, although the Biden Administration has an incredibly narrow path to get a bill moderate enough to pass the Senate yet sufficiently progressive to pass the House.

- Jerome Powell’s speech at Jackson Hole was largely uneventful; his remarks mostly reiterated the Fed’s July meeting statement, although two incremental developments are worth mentioning. First, Powell explicitly included himself within the majority of FOMC participants who believed the Fed had met its “significant progress” test needed to begin tapering. Second, he focused on the disinflationary pressures that have kept inflation below 2% with sub-4% unemployment before the pandemic, noting that “…there is little reason to think that they have suddenly reversed or abated.” Overall, the Fed appears poised to begin tapering at year-end, yet with a very dovish outlook while doing so.

Equity News and Notes

A Look at the Markets

- The S&P 500 gained 3% in August to raise its YTD total return to +21.6%. The Index is now riding a 7-month win streak, its longest since the 10-month run that ended in January 2018. The “melt-up” has seen the Index hit 53 all-time closing highs this year, including 12 in August alone. The S&P’s YTD return through August is the sixth best since 1950.

- The current rally resembles 2017 in that any pullbacks have been modest and short-lived. The Index hasn’t fallen more than 5% since October 2020. This year’s maximum drawdown of -4% is the third shallowest since 1980, trailing only -3% drawdowns in 1995 and 2017. The S&P has also been trading more than 8% above its 200-day moving average, a well-followed technical trend line, for over 200 trading days. That is the longest such streak in 40 years. While overbought conditions can persist, a median gain of +0.3% over the following 2 months in such situations tells us that a period of consolidation often follows.

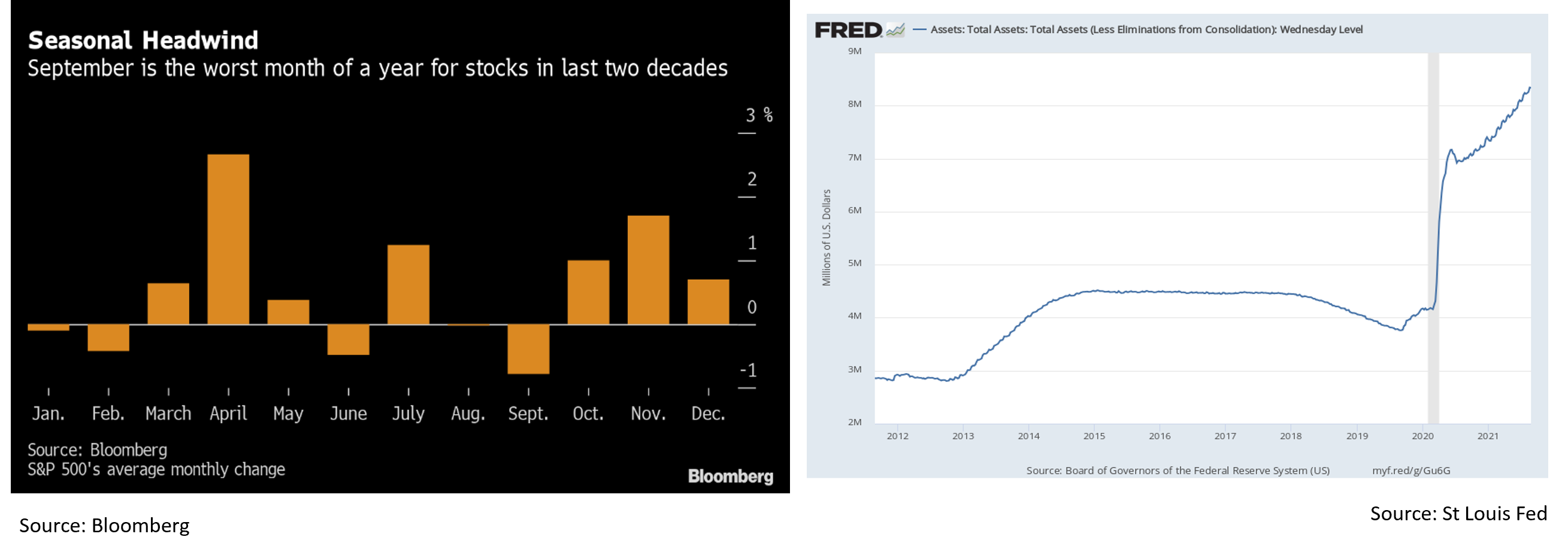

- We also must be mindful of the calendar as the market enters what has been its worst month over the past 2 decades. While September has historically been a weak month for stocks, the trend line matters. When in an uptrend, as we are now, September’s average performance has been +0.3% vs -2.7% if entering the month on a downtrend. We would view any seasonal weakness in the coming month as a buying opportunity.

- Investors were looking towards the Fed’s Jackson Hole symposium as an opportunity for Chairman Powell to announce a tapering of the Fed’s bond buying program. The recent rise in COVID cases due to the Delta variant has hurt consumer confidence and likely impacted the job market, as seen in the latest BLS report which showed the economy only added 235K new jobs vs. estimates of +750K. These developments have likely enhanced the Fed’s patience in initiating tapering plans, a reason the stock market has been able to advance despite the slowing pace of the economic recovery. That said, a reduction in Fed asset purchases is widely anticipated and is not likely to prompt an adverse market reaction akin to 2013’s famous taper tantrum. The Fed’s balance sheet actually increased by nearly $1T after Chairman Bernanke hinted at tapering back in 2013. The Fed’s balance sheet then remained roughly flatlined at $4.4T for the following 4 years. The market initially dropped -5.8% from May 22nd to June 24th, yet by the time 10Yr UST yields peaked in early September, the S&P 500 had gained it back and then some. Measured over the time yields bottomed at 1.63% on May 2nd to when they peaked at 2.99% on September 5th, the S&P gained over 4%. We do not know how things will play out this time around, but investors are likely to use 2013 as a template.

- After topping out at over 1.7% in late March, the 10Yr UST yield briefly traded below 1.2% in early August. With the decline in interest rates, global negative yielding debt has increased by roughly $4T and now sits just under $16T. We have often discussed how low levels of interest rates are typically correlated with higher equity valuations, and the powerful TINA (“There Is No Alternative”) trade still appears to be providing a tailwind for risk assets.

From the Trading Desk

Municipal Markets

- Municipal market conditions remain characterized by intense demand (66 of the past 67 weeks have produced positive net mutual fund flows), modest tax-exempt supply (YTD is running 2% above the trailing 5-year average), and sustained risk appetite (lower quality credits have largely outperformed YTD).

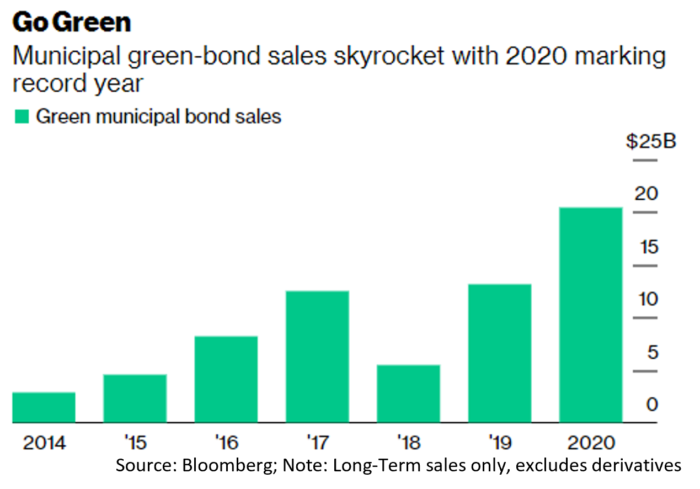

- The explosion of interest in ESG investing has been well chronicled. Although far more prominent amongst corporates, 1,973 US municipal bonds designated as “green” were added to the Climate Bonds Green Bond Database in 2020, and total issuance rose 66% over the prior year.1 We anticipate a further surge in new tax-exempt green supply in 2021, particularly if Congress approves President Biden’s environmentally conscious infrastructure plan. Analyst estimates for the remainder of the year generally fall in a $30-35B range, a modest yet welcome increase.

- Over recent years, municipal green certified issuance has been led by California and New York, although the Climate Bonds Initiative reports that other large states such as Florida and many municipalities are following suit. Here in our backyard, the City of Boston recently offered green bonds to support energy efficiency and climate resilience projects.

- This niche area of the $4T tax-exempt market remains relatively small and not clearly defined, as far more debt is subjectively viewed as “green” by market participants than the 1% or so officially certified as such. At this stage, many issues are of modest size (typically <$100M) and tend to be somewhat longer in duration, although the market is rapidly evolving. At Appleton, we see growing client demand for customized impact solutions, and are focusing considerable attention on both ESG bond analysis and product innovation.

Corporate Bond Markets

- August is typically a month that rolls on by in the investment grade credit markets with minimal fanfare and this year was no exception. With many market participants out on holiday there was little reason for issuers to come to market. New issuance of just under $90B was mostly brought to market in the first two weeks and was met with solid price action. We expect September to initially ramp up new supply but then taper off as a Federal Reserve meeting later in the month approaches.

- Investment grade credit spreads were unchanged over the month, resting at 87 OAS to USTs. We have nothing exciting to project in that regard over the near-term as we anticipate spreads will remain range bound given resilient credit appetite. Investment grade credit demand remains robust with +$123.1B in net mutual fund flows YTD, including another +$4.3B over the last week in August.

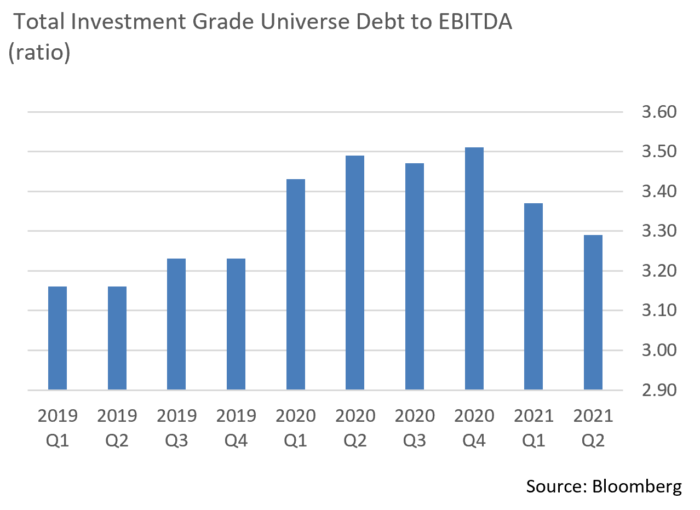

- Over the past several months we have touched on the sustained technical and fundamental strength of the investment grade universe. With earnings reports behind us, these conditions remain intact as the creditworthiness of most corporations is still quite strong. Q2 saw companies report sizable income and revenue increases and the rating agencies have been taking notice with net upgrades to downgrades (as a total of the overall index) positive over the past two quarters.

- Furthermore, median debt leverage ratios have steadily declined. Improvement since the pandemic has been significant as companies have proactively fortified their balance sheets. Bank loan borrowing has also sharply dropped due to the relatively low cost of accessing the public debt markets.

Financial Planning Perspectives

The Massachusetts Estate Tax in Focus

With the prospect of changes to Federal income taxes, capital gains, and estate taxes this Fall, clients ought to consider updating their estate plans. While it is uncertain where Federal estate and gift tax exemptions amounts will end up, less attention has been focused on individual state estate tax regimes. Given the current Federal exemption of $11.7M, our experience is that many clients tend to overlook estate tax consequences altogether even though certain states impose considerable burdens.

At present, twelve states and the District of Columbia impose an estate tax, six states have an inheritance tax, and Maryland imposes both an estate tax and an inheritance tax. However, the state with the lowest filing exemption and most punitive estate tax is the Commonwealth of Massachusetts. There have been no substantive updates to the Massachusetts estate tax in two decades. Surprisingly, the Boston Globe Editorial Board declared on August 26, 2021, that “the Massachusetts estate tax is in need of an overhaul: Our tax starts too low – and then reaches even lower.” The Globe advocated for updating and modernizing the estate tax, which is not indexed for inflation and lacks portability, by raising the threshold filing amounts and consolidating the number of tax brackets.

The Massachusetts estate tax filing threshold amount for residents (and non-residents owning real estate in the Commonwealth upon their death) is $1M ($2M if married) and very often hits those who are caught unaware and have not drafted estate plans or implemented gifting programs. As pointed out by the Globe, “A person who has a home appraised at $700,000, plus a combined $275,001 in a 401(k) or IRA, and a vehicle worth $25,000 would hit that level”. Assets considered part of one’s taxable Massachusetts estate not only include real estate, tangible personal property, investment, retirement, and bank accounts, but also life insurance proceeds (even though paid to another).

If applicable, Massachusetts estate taxes are due nine months after the date of death with an automatic six-month extension to file (not pay). Furthermore, what is not well known is that the exemption threshold is not truly an exemption at all. Once a Massachusetts estate surpasses the $1M threshold, assets are taxable back down to $40,000, a so-called “reach down” provision. There are 20 tax brackets ranging from 0.8% at $40,000 all the way up to 16% for taxable estate values above $10.04M.

See https://www.mass.gov/guides/a-guide-to-estate-taxes

What advice can we offer those potentially impacted by future Massachusetts estate taxes? Plan ahead, as the time to act is long before an estate eventually becomes subject to taxes. Individuals and married couples can ensure that their estate plans are drafted to shelter assets (including future growth) in trust rather than subjecting assets to joint tenancy or transfer-on-death designation. Additional considerations include:

- Utilization of the $15,000 annual federal gift exclusion (Massachusetts does not have a gift tax);

- Incorporating charitable giving into your estate plan (either during life or upon death);

- Purchasing/owning life insurance, homes and other assets in irrevocable trusts;

- Paying a child or grandchildren’s tuition or medical bills directly to the provider;

- To the extent feasible, ensuring that each spouse has assets in their name up to the $1M exemption;

- Changing one’s domicile to a more estate tax friendly state; and

- Spending your money while you can enjoy it!

For additional information, please reference our webinar, “Massachusetts Estate Taxes: Proactive Planning Matters” or contact your portfolio manager.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]