Psychological barriers often present financial planning challenges and managing one’s emotions can be a key ingredient in achieving long-term success. This dynamic typically considers factors such as accepting risk as an inherent element of return and in finding a balance that makes your personal asset allocation strategy effective. However, we believe that emotional obstacles can also hinder other aspects of financial planning.

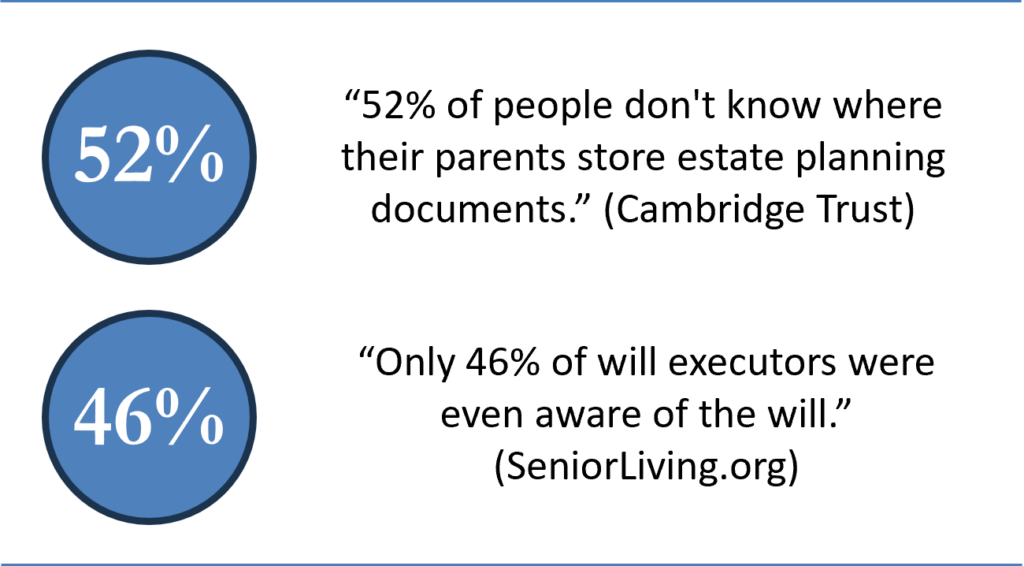

It is not uncommon for clients to struggle with how to involve their adult children in wealth management and legacy planning. We recognize the sensitivity of this issue but have seen that doing so to the extent you feel able can be beneficial. It all starts with communication, most notably sharing elements of your legacy plans and introducing your Wealth Manager and other professional advisors to loved ones. Doing so can help ensure that your personal objectives are understood, streamline eventual asset transitions, minimize legal and other expenses, reduce the risk of family conflict, and better prepare your heirs to successfully manage inherited wealth.

Every family is unique, and there is no single blueprint to follow. A degree of transparency concerning wealth and estate plans that is comfortable for one client may be a nonstarter for others. Nonetheless, thinking about what’s right for your family is a good first step.

Sharing what’s most important to you in terms of values and goals offers valuable context to the estate plans that will eventually be revealed. Think of this as a baseline conversation centered around wealth transfer plans, educational funding objectives, and philanthropic goals. Discussing broad objectives long before a transition begins helps prepare your heirs for the future, and it can be done without revealing details of your wealth.

The mechanics of trust structures and estate planning strategies are often emphasized, yet the reasons they were implemented are not always shared with the next generation. Depending on a family’s circumstances and objectives, charitable trusts, generation-skipping trusts, or other vehicles may be in place, and if so, it is also important to explain their purpose.

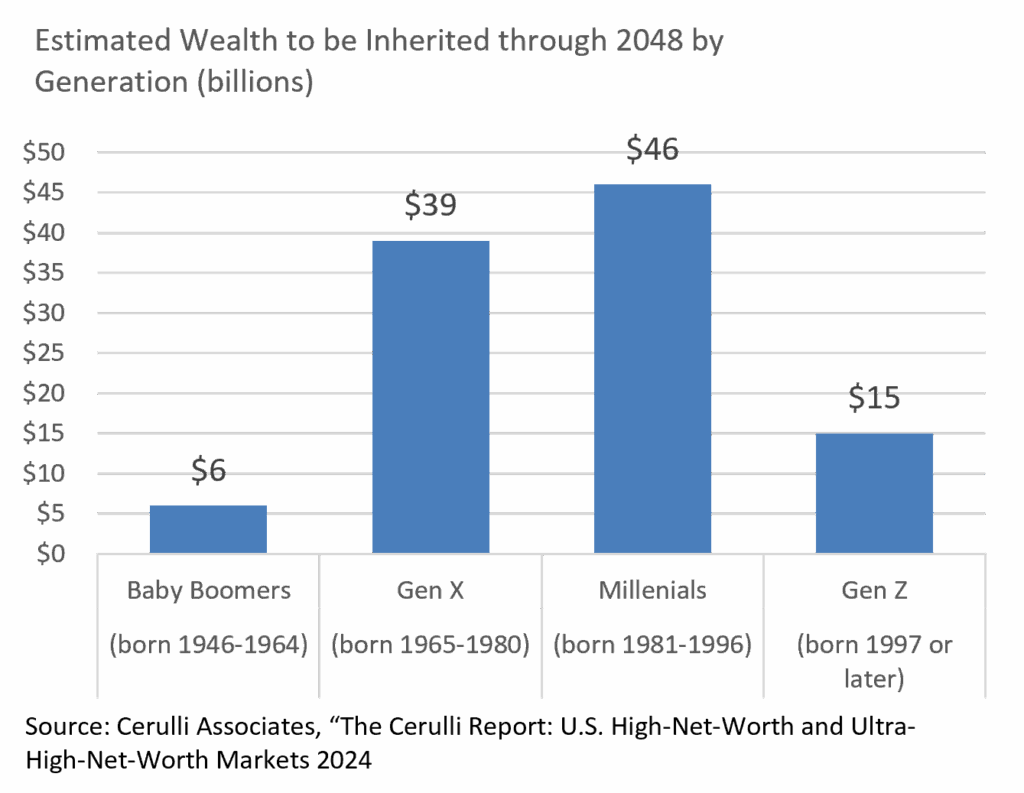

Intention and action can be distinct, and industry studies reveal a significant gap exists in multigenerational wealth transfer. According to survey research conducted by Edward Jones, 71% of American adults with children reported feeling comfortable having generational wealth discussions, yet only 27% have actually had that dialogue.1

Relationships matter in all aspects of our lives, and we believe that establishing lines of communication between your adult children and your Wealth Manager, legal advisors, and accountants long before asset transfer occurs serves everyone’s interests. Facilitating conversations with your advisors better enables the next generation to more confidently implement an eventual estate transition and make sound long-term financial decisions of their own.

Family dynamics can be complicated, and what’s right for one client may not be for another. While legal documents govern your estate plan, too often the human elements are given short shrift. Explaining your legacy goals and estate plans is not always easy, but it’s a useful exercise. We believe that being a trusted wealth management partner demands much more than implementing investment strategies. Our business is highly personal, and fostering multigenerational transitional planning is a core element of what we do.

At Appleton, we are committed to comprehensive, estate planning and stand ready to help our clients and their families manage what can be a confusing and emotionally challenging process. Addressing these issues can provide clients with the peace of mind of knowing that their assets will eventually pass on in an efficient manner. Please let us know how we can help you and your family.

- Edward Jones, “The Great Wealth Transfer Starts With the Great Wealth Talk,” February 27, 2024.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill, acumen, or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.