Atisa Dipamkara, a revered 11th century Buddhist philosopher, once said, “The greatest wisdom is seeing through appearances.” His insight into looking beyond first impressions resonates in today’s investment world. While diversification has long been touted as a means of mitigating risk, we recognize that it is far from solely determined by the number of securities held in an index or portfolio. In a media landscape consumed by daily market performance updates, we thought it would be useful to look beneath the surface of common stock market indices.

Risk Analysis Ought To Be Personalized

As private wealth managers, we seek to develop risk efficient asset allocation strategies in a manner that addresses our clients’ unique financial goals. The liability side of that equation involves personal circumstances and needs, whereas the composition and mix of investment assets in a client’s account reflect portfolio management decisions. For many years, stock investors have embraced index investing, whether through mutual funds, ETFs, or direct indexing. Low costs and defined market exposure are certainly valuable attributes, and at times we complement our own active management with index ETFs that deliver specific sector or asset class coverage.

What’s Behind Your Index?

Our commentary often references factors such as breadth and style when discussing market conditions, as widely reported market performance would benefit from greater context. For example, the largest components in a capitalization weighted index such as the S&P 500 can have a disproportionate influence on aggregate returns, as do the highest price stocks in a 30-stock price weighted index such as the Dow Jones Industrial Average (DJIA). When looking at equity market proxies, a relatively small subset of names often drives a considerable amount of overall performance and accompanying risk exposure. In fact, only 8 names, 1.6% of the stocks in the S&P 500, accounted for 75% of the index’s YTD return as of June 30th. Turning to the DJIA, information technology has produced more than 100% of the overall YTD return. In other words, the DJIA would be down this year if excluding that single sector.

By no means does that mean owning popular mega cap names or others with strong momentum is a bad thing. The point is that the risks an investor assumes, whether derived from individual stocks, sectors, or styles, can be more concentrated than may be apparent at face value. Portfolio returns can be heavily influenced in either direction by narrow, not readily transparent exposures even when holding a seemingly highly diversified index, and simultaneously owning those same stocks in individual accounts or through mutual funds further concentrates risk.

Finding the Right Asset Allocation Fit

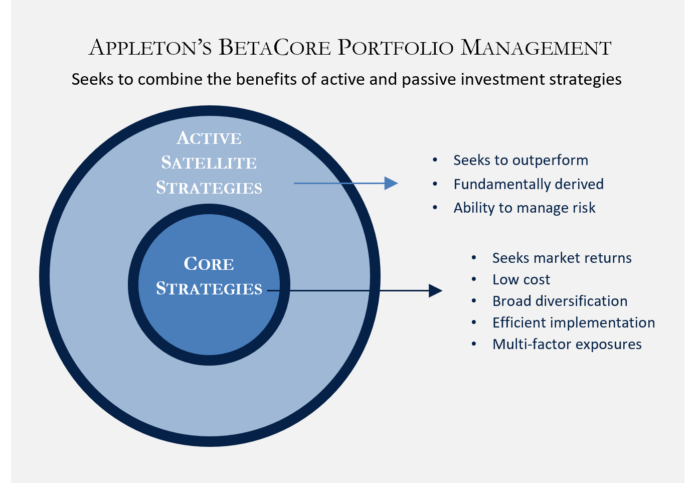

When evaluating a client’s risk profile and asset allocation strategy, we take a holistic approach grounded in individual circumstances. Variables such as cash flow requirements, long-term liability planning, time horizon, and ability to withstand downside volatility all weigh heavily. For many investors, an investment approach that combines the potential of active management to add diversification and excess returns with the ability of passive indices to deliver broad, low-cost exposures may have considerable appeal.

When evaluating a client’s risk profile and asset allocation strategy, we take a holistic approach grounded in individual circumstances. Variables such as cash flow requirements, long-term liability planning, time horizon, and ability to withstand downside volatility all weigh heavily. For many investors, an investment approach that combines the potential of active management to add diversification and excess returns with the ability of passive indices to deliver broad, low-cost exposures may have considerable appeal.

Furthermore, more narrowly focused strategic beta ETFs offer access to risk factors such as size, value, quality, profitability, and momentum that may be beneficial in an asset allocation context. Our proprietary BetaCore asset allocation models were developed with those characteristics and attributes in mind. Through a “core and satellite” investment approach, BetaCore aims to deliver tailored asset allocation solutions that efficiently address long-term performance objectives while carefully managing risk.

There is no single optimal investment solution given the unique nature of individual needs. At its core, we view asset allocation strategy as a roadmap to pursue an investors’ financial goals in a risk conscious manner. Developing and implementing such a gameplan greatly benefits from first knowing what you own, including where performance drivers and risk exposures lie, as managing volatility is more challenging than merely holding an index fund or other portfolio with many stocks. Because “the market” may not always be what it appears at first glance.