A Look At How We Evaluate the Merits of High Growth Stocks

Big Tech Has Recently Dominated the Investment Landscape

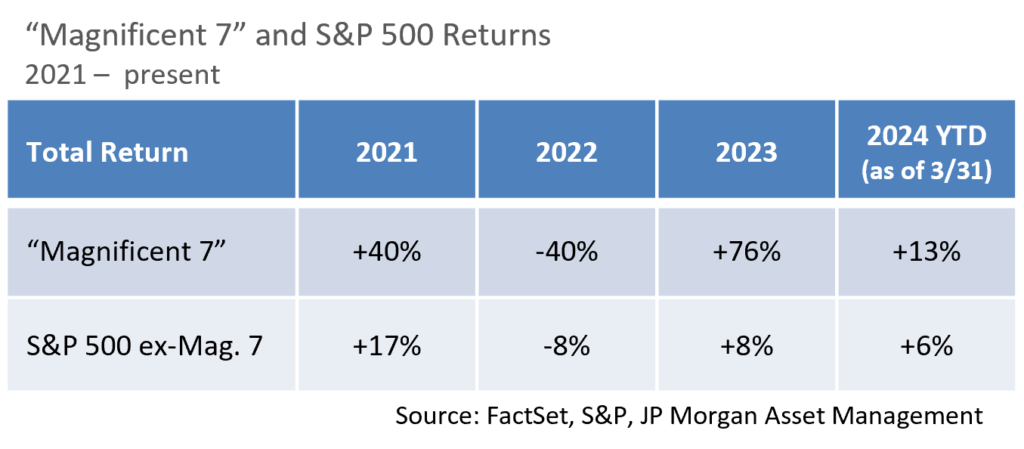

Many years in the equity markets are characterized by a prevailing theme or development, at times something dramatic such as the dot com frenzy of 1999 or the subprime mortgage meltdown of 2007 and 2008 that launched the Great Financial Crisis. The dominance of the so called “Magnificent 7”1, a group of high-flying mega cap growth stocks, is what stood out most this past year. Those seven stocks traded at a lofty average forward price-to-earnings ratio (P/E) of 30.8x as of 3/31/24, as compared to a far more modest 19.1x for the rest of the S&P 500 (ex-the “Magnificent 7”)2. Additionally, they accounted for roughly a 29% weight in the S&P 500. Perhaps of greater importance to investors, JP Morgan recently calculated that 55% of the S&P 500’s performance variance during 2023 was attributed to the weekly price movement of those seven names. In such an environment, an impetus to own market leading stocks is often evident among money managers.

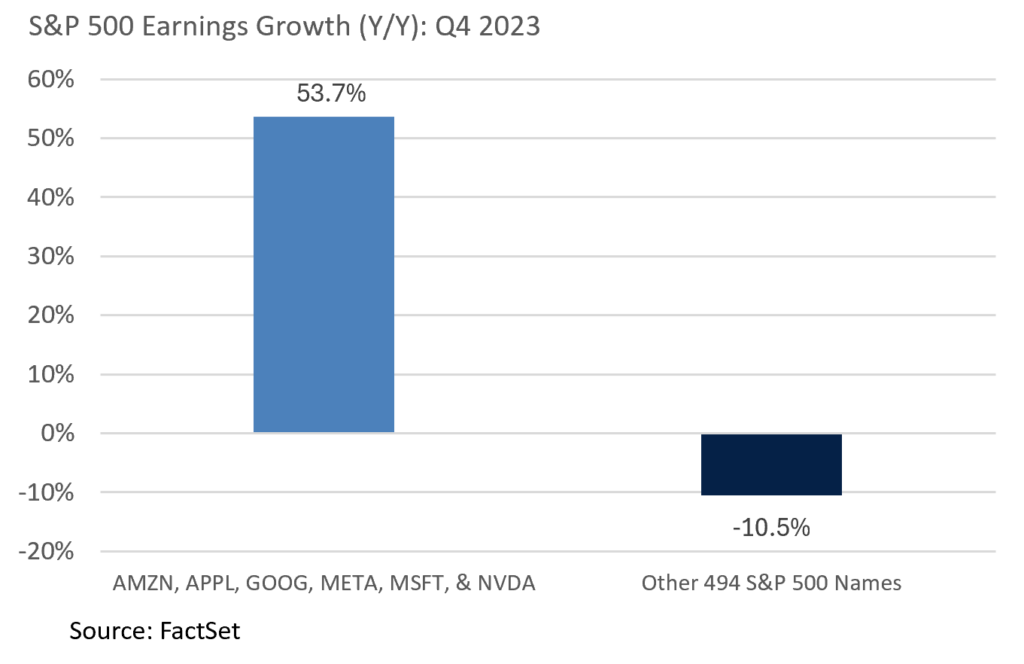

Chasing performance can be dangerous, yet paying a premium to invest in great companies with powerful growth prospects can be highly rewarding. Quite frankly, we actively look for such opportunities. In fact, six of these stocks were collectively expected to post +53.7% earnings growth in Q4 ’23 vs. -10.5% for the other 494 S&P names.3

By contrast, we view speculative momentum as problematic. Herding is a tendency among investors to follow the actions of others rather than relying on independent analysis when making investments. The financial media, our colleagues, and friends often place disproportionate emphasis on “what’s working” as there is usually great interest in perceived winners. Throughout history this element of behavioral finance has contributed to periodic price surges in individual stocks or sectors, which often later reverses course as rallies lacking in substance ultimately fizzle out.

Differentiating Between Sustainably High Growth and Overvalued Momentum

At Appleton, we seek to deliver attractive long-term returns for clients while carefully managing risk. With this in mind, how do we evaluate the merits of stocks exhibiting exciting price action?

Appleton’s large cap growth strategy aims to buy high quality businesses at sustainable valuations. As an example, our research team often weighs a company’s growth expectations relative to its stock price from several perspectives.

1.The price/earnings-to-growth ratio, or “PEG ratio” is a metric that calculates how much you are paying for anticipated earnings growth. A lower PEG ratio may indicate that a company’s expected earnings growth is relatively cheaper than that of a similar company with a higher PEG ratio.

2.We also consider historical valuation as it offers useful context when looking at current stock prices. At times, buying a stock at a rich P/E relative to historical standards may be justified given the company’s future growth prospects, although thoroughly understanding the business and the sustainability of earnings growth is essential.

3.Furthermore, we employ discounted cash flow (“DCF”) analysis to project the unleveraged free cash flow a business is expected to generate over a 5 to 10-year period. Such modeling allows us to assess variables such as revenue growth, margin expansion, and risk when considering whether there is compelling value in the current price of a stock.

Darlings of the market may prove to be extraordinary investments, and lofty valuations often reflect exceptional future growth prospects. Nonetheless, jumping into a fashionable trade that is not grounded in fundamental analysis to us is imprudent. Through proprietary research we seek to uncover those important distinctions.

- Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla

- Source: Bloomberg

- FactSet

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.