An Abrupt Shift in the Capital Markets

We will refrain from offering a comprehensive year-end market retrospective as the financial media has thoroughly covered that ground, and some may prefer not to revisit the details. Instead, our objective is simply to draw upon 2022’s investment experience as a means of reinforcing more personal, timeless planning guidance.

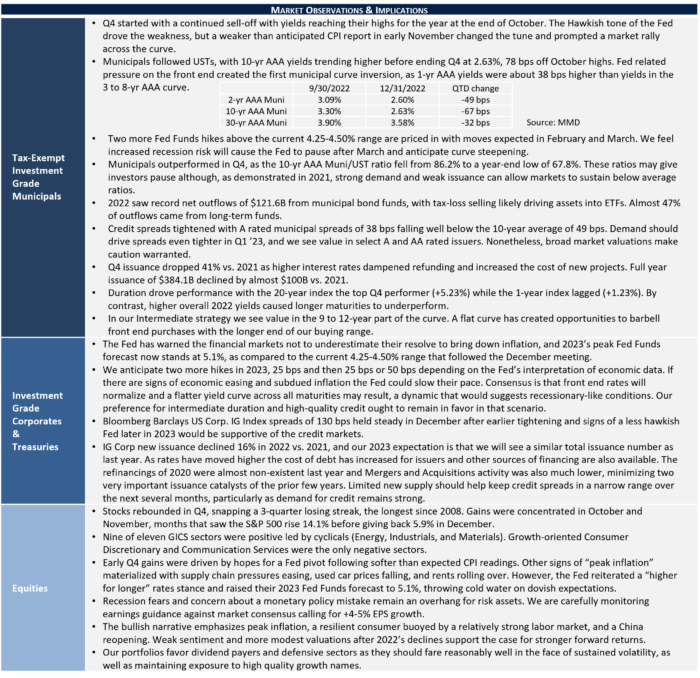

Inflation framed last year’s narrative, with a June YoY CPI print of +9.1% representing the highest reading since 1981. Although the latest CPI release moderated to +7.1%, the dragon has hardly been slayed, a reality emphasized by Federal Reserve Chairman Jerome Powell. The latest inflation report was also influenced by statistical base effects and remains far in excess of the Fed’s +2% annual target. In response to these pressures, the Fed Funds rate increased more rapidly than ever before in 2022, with four 0.75% hikes followed by a 0.50% December increase. The latest median Fed forecast calls for a peak 5.1% Fed Funds rate, as compared to near zero rates from April 2020 through the first quarter of 2022.

Risk appetite was shaken in response, and volatility characterized the equity markets with 121 trading days producing greater than +/- 1% S&P 500 returns, an anomaly only seen in two prior years. As investors grappled with an abrupt end of extremely loose monetary policy and growing recession concerns, stocks and bonds simultaneously incurred significant losses. In fact, 60/40 balanced strategies suffered their second worst year since 1976.

In today’s multi-media world much of the chatter is “inside Wall Street” scorekeeping that is perhaps best disregarded. Our belief in the value of diversified, risk-focused asset allocation has not changed. Clients should also consider that today’s more modest equity valuations and higher bond yields suggest a probability of more attractive future returns than might have been expected a year ago when asset values were much higher.

Little Things Make a Difference

Bringing 2022’s experience closer to Main Street, we are experiencing a reversal of an interest rate environment that had long punished savers and rewarded borrowers. Sharply higher rates impact many aspects of economic activity, including mortgages (30-year average fixed rates have surged from roughly 3% to 6.60%), consumer finance costs, and business loans. The tide has clearly turned as 2-year Treasury yields have risen from 0.75% to 4.35%, a reality to which we must all adjust.

Sometimes, simple steps can be meaningful, and we suggest starting by making sure bank and investment account income is not an afterthought. Subject to liquidity and other suitability considerations, moving idle cash into income-producing options such as short-term, high quality municipal bonds or US Treasuries makes sense. Investment grade municipals of somewhat greater maturity may also be attractive for those seeking tax-advantaged income, as 10-year AAA rated taxable equivalent yields exceed 4.50% for those in high tax bracket, high tax states despite a recent rally in bond prices.

Conversely, the cost of consumer debt has significantly increased. We encourage clients to also look at the liability side of their balance sheets as debt linked to prevailing interest rates imposes a much greater burden than a year ago. Paying down variable rate debt may be warranted with Fed policy no longer suppressing borrowing costs.

Silver linings are often found amid difficulties, and in private wealth management mining portfolios for tax management purposes can be one of them. November’s Review and Outlook discussed the value of selectively realizing losses to reduce net tax liability. Although the 2022 window has passed, tax loss harvesting can still be valuable in 2023 and beyond. We have also long emphasized other tax related financial planning strategies, such as maximizing retirement plan contributions, timing retirement distributions, and strategically implementing charitable giving plans.

Let Fundamentals Chart Your Path

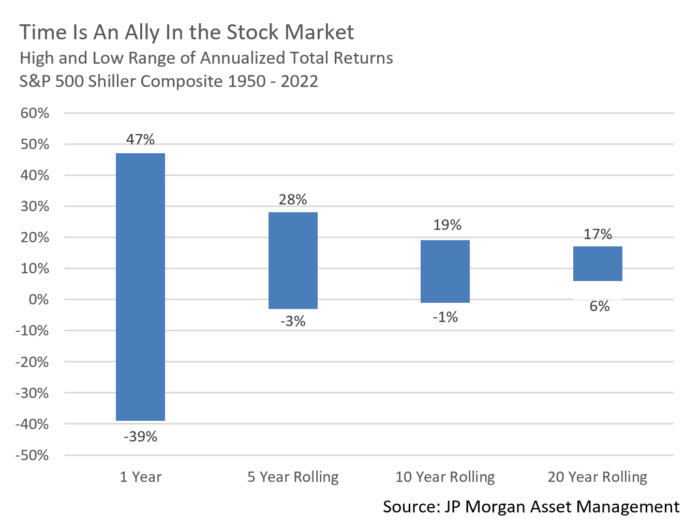

Appleton’s wealth management process is built around client specific risk and objective-based planning. Risk is inherently linked to return, and we have no particular ability to predict short-term market movements. Instead, we seek to mitigate risk through timeless disciplines such as personalized asset allocation, portfolio diversification, and avoiding imprudent, speculative forays. Doing so allows time to become your ally, as the likelihood of negative equity market returns diminishes the longer one is invested. This speaks to the value of staying invested unless your circumstances change, while also periodically rebalancing back to asset allocation targets.

The ultimate measure of our success lies in the extent to which we can help individuals and their families achieve their objectives. That is why we think about risk in the context of financial planning goals, not just relative to institutional benchmarks, and try to help clients manage through turbulent times. With the calendar having turned to 2023, we look forward to smoother sailing and wish you and your families a healthy and happy new year.