So often geopolitical crises can seem abstract, far removed from our daily lives. We live in an age of stunning prosperity and overall quality of life relative to preceding generations, and perspective can easily be lost. Unfortunately, disasters of various forms periodically produce shock, upset, and perhaps renewed reflection. What occurs far from our borders may seem remote, and a sense of powerlessness is an understandable reaction. The war in Ukraine is a tragedy on many dimensions, and along with our sympathies and concern for all those impacted, we offer a few wealth management and financial planning thoughts.

So often geopolitical crises can seem abstract, far removed from our daily lives. We live in an age of stunning prosperity and overall quality of life relative to preceding generations, and perspective can easily be lost. Unfortunately, disasters of various forms periodically produce shock, upset, and perhaps renewed reflection. What occurs far from our borders may seem remote, and a sense of powerlessness is an understandable reaction. The war in Ukraine is a tragedy on many dimensions, and along with our sympathies and concern for all those impacted, we offer a few wealth management and financial planning thoughts.

Maintaining a Prudent Long-Term Perspective

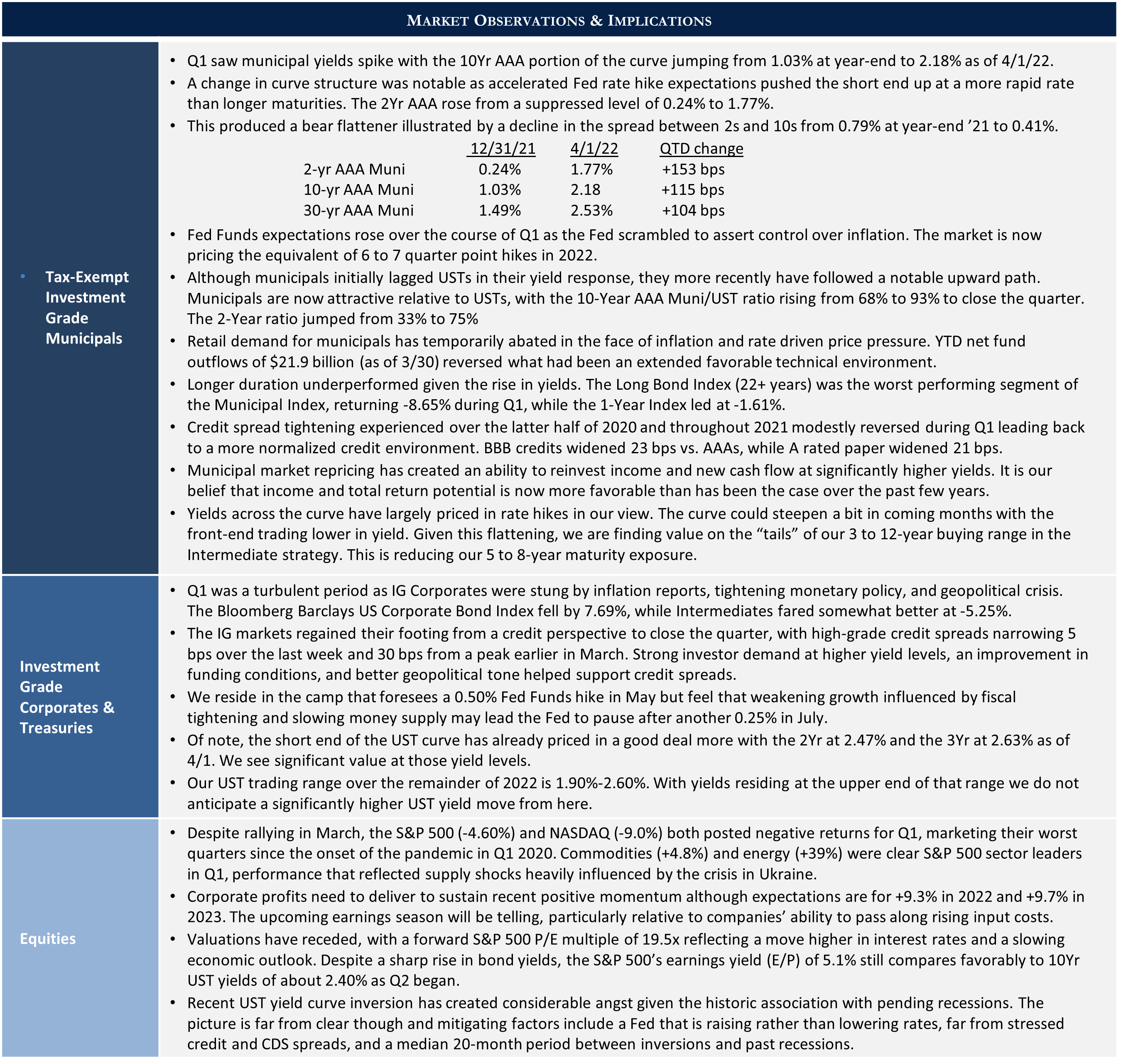

As investment advisors we must remain focused on our fiduciary responsibilities to clients. High levels of volatility typically characterize markets during geopolitical crisis, and the buildup, onset, and initial fallout of the Russian invasion of Ukraine has been no exception. The Chicago Board Options Exchange’s (CBOE) VIX Index, a common measure of volatility, nearly doubled in January over three short weeks as the Russian buildup became increasingly ominous. Equity markets have reacted accordingly with numerous high volatility days in both directions after a long period of relative tranquility.

“Risk-off” flights to quality are often associated with troubling geopolitical events, although longer term impact on the equity markets has historically been much more benign. LPL Financial recently published data detailing 21 geopolitical crises from 1941 to the present and found that on average it took the equity markets 21 calendar days to bottom and only 45 days to subsequently recover.1 As our market commentary of February 24th emphasized, the Ukrainian crisis, while heartbreaking on a human level, has not materially impacted our municipal or high grade corporate fixed income portfolio positioning.

In any environment, Appleton’s investment process emphasizes quality in both bond analysis and stock selection. Our belief is that doing so helps preserve capital and enhances the long-term risk-reward profile of client portfolios. Developing an asset allocation strategy that aligns well with personal risk tolerance, liquidity needs, and financial objectives must take place long before dislocation hits the markets. The best insurance against panic selling or other potentially counterproductive emotional responses lies in knowing that one’s financial plans and asset allocation strategy already factor in inevitable periods of market volatility.

Maximize the Effectiveness of Charitable Giving

Philanthropy is an essential contributor to society’s ability to meet acute needs, particularly in times of crisis. Helping individuals and families with tax-efficient charitable giving is an important element of financial planning. When considering charitable donations individuals face two decisions – where to direct their support and by what means.

Tax-exempt organizations are not created equal as some are more efficient stewards of charitable donations than others. Evaluating whether an organization’s mission aligns with your goals requires some research, and information of that nature is generally publicly available. Assuming you are comfortable with the stated mission, IRS Form 990 offers considerable detail concerning a charity’s management and financial records. For example, one can see the percentage of donations that directly support the stated cause as opposed to funding overhead or marketing. Background concerning the Board of Directors and the extent to which there is independent Board oversight is also available. Form 990 and an organization’s annual report can typically be found on their website or through resources such as GuideStar, 990 Finder, or Foundation Directory Online.

Tax Efficient Giving Strategies

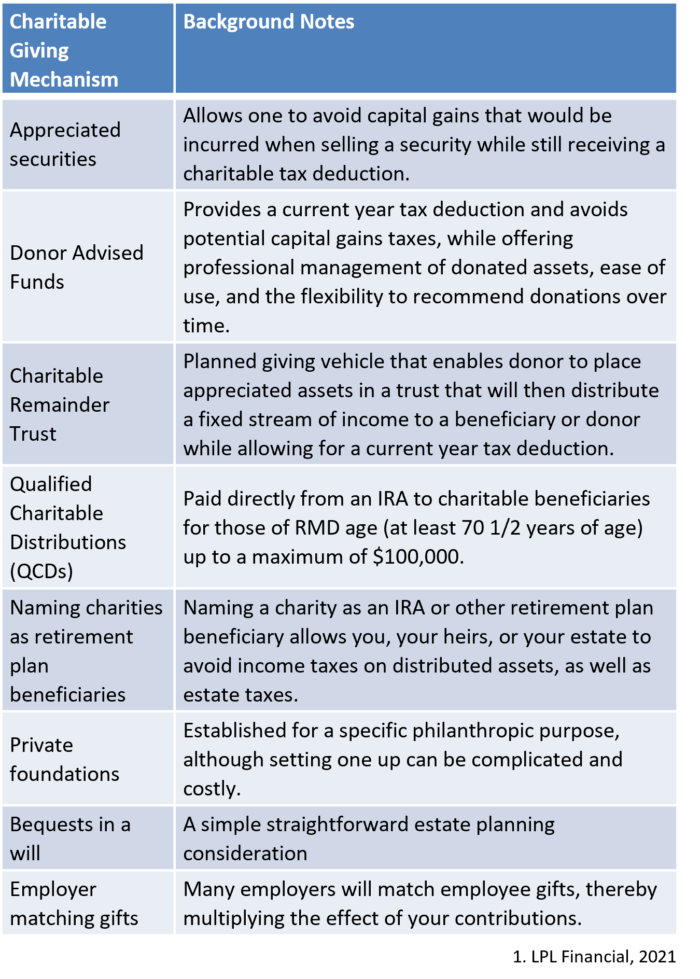

As outlined below, there are many ways to support worthy causes and Appleton can be a resource in determining what best meets your objectives. To discuss, please contact your portfolio manager.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.