Insights and Observations

Economic, Public Policy, and Fed Developments

- The end of the longest bull market of the modern era came suddenly, with investors experiencing the fastest 30% drop on record as much of the world’s economy ground to a near halt once Coronavirus mitigation efforts accelerated.

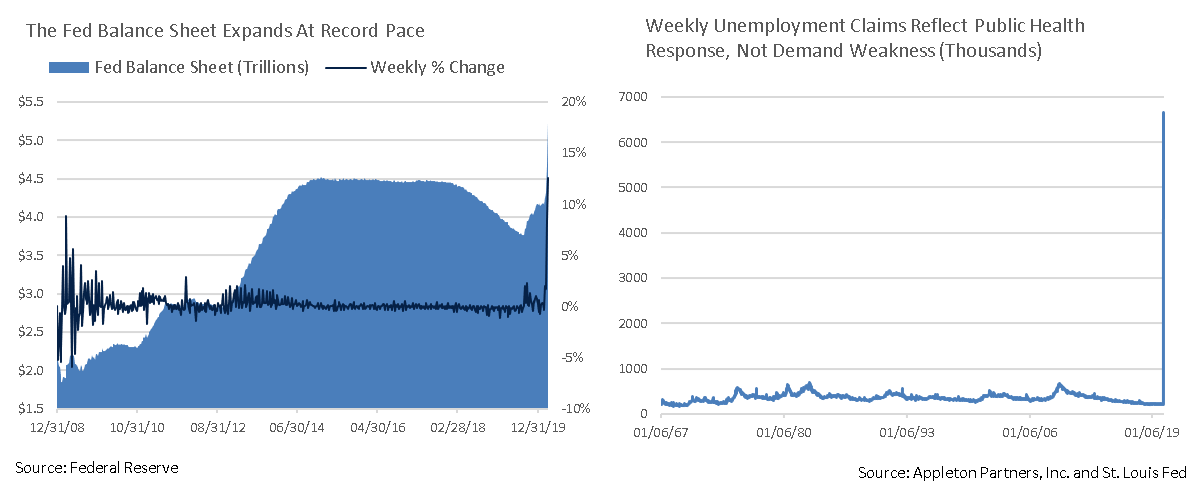

- The Fed responded with unprecedented policy action. While their initial “everything but the kitchen sink” surprise weekend package – cutting the Fed Funds Rate to 0-0.25%, announcing $700B in QE, and cutting reserve requirements while offering essentially unlimited repo capacities – left participants worried that the Fed had fully exhausted their stimulus capacity, those fears proved unfounded. The “plenty of space” Chairman Powell saw for future response ultimately included reopening a CP purchase authority to calm short term markets, unlimited QE, direct purchases of shorter maturity IG municipal and corporate debt, and $300B in small business lending.

- The breakneck speed of this market correction may be unprecedented, but the Fed’s response is as well, and their stepping in as the “buyer and lender of last resort” has helped restore order to capital markets and a degree of investor confidence. The Fed’s balance sheet has already exceeded previous records, and Bloomberg estimates it could reach $12T in coming months. Global central banks have followed suit.

- The speed with which containment measures have been implemented has heavily damaged the US workforce – jobless claims surged to 6.6M over the week ended 4/3 on top of 3.3M the prior week. Job losses during recessions usually occur over years, whereas today’s highly compressed layoffs reflect a shutdown of non-essential businesses, not slackening demand. While we will very likely exceed the levels of the Recession of 2008, the frightening current pace of job losses doesn’t necessarily tell the full story.

- One encouraging note is that US manufacturing demand has been stronger than forecast. Chicago’s Manufacturing PMI was reasonably good, all things considered, at 47.8, and a plurality of respondents expected new orders to be largely unchanged in 3 months’ time. More than a quarter expected orders to be higher. Service PMI indices have been badly bruised, but manufacturing appears to be holding up better.

- The relationship between Russia and OPEC, specifically Saudi Arabia, has been a geopolitical variable that has contributed to market turbulence and remains uncertain. Conflict began as OPEC was preparing for a cut in production in response to sustained demand weakness. Russia promptly increased production. Saudi Arabia, who had already been impacted by oil production cuts in January, followed with significant price discounts for the US, Europe, and China. The price of WTI Crude Futures began the month at $47.33 but subsequently collapsed below $20 a barrel before recovering to $20.31 to close the month. This has put significant pressure on the entire energy sector, particularly HY debt, where spreads have been highly unstable.

- Our base case is now that Q1 GDP growth will be essentially flat and that Q2 will show a very large and likely record-breaking contraction. How quickly and forcefully economic strength returns is highly dependent on how quickly and to what extent Coronavirus mitigation efforts can be lifted. In the meantime, massive stimulus efforts and Fed support are helping to bridge the gap.

From the Trading Desk

Municipal Markets

- As we wrote in a recent market brief, Federal Reserve stabilization efforts have been swift and sizeable, with $450B already authorized in purchases of short-term municipals and IG corporates. The Fed is also proactively seeking to stabilize the short-term funding markets, including support for VRDNs.

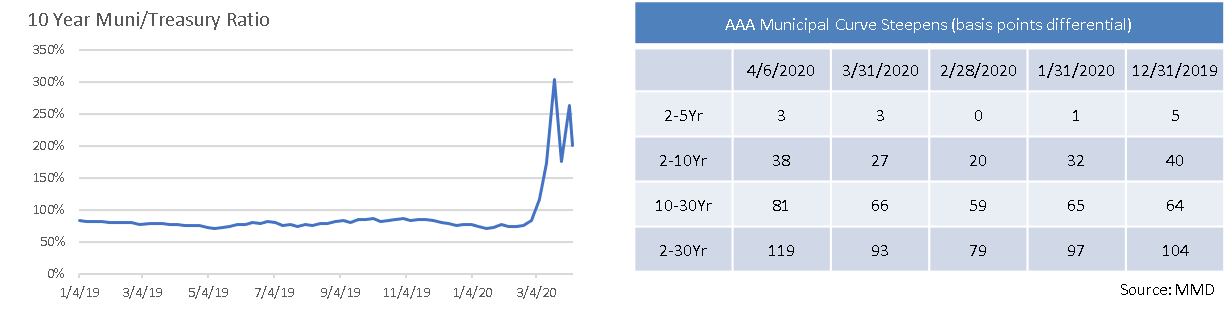

- Amid sustained economic uncertainty, municipals continue to lag Treasuries. The 10Yr AAA Muni/UST ratio ended April 6 trading at an elevated 200% level. The short-end is even more distorted with the 2Yr ratio at 377%, creating favorable opportunities to swap out UST for high-quality municipals.

- Steepness is returning to the municipal curve, with the spread between 2 and 10Yr AAA issues back up to 38 bps, a development we feel is adding incremental value along the yield curve.

- Tax-exempt issuance is currently limited, with many borrowers waiting to see how market conditions develop before coming to market. Many issuers on the sidelines will likely bring bond deals should recent market stability prove to be sustained.

- After 61 consecutive weeks of inflows, we have now experienced 4 weeks of net mutual fund outflows. The most recent week’s $4.9B net outflow brings the YTD total to -$5.8 billion. This has produced forced selling into already strained markets, creating what we see as buying opportunities in certain names.

Corporate Bond Markets

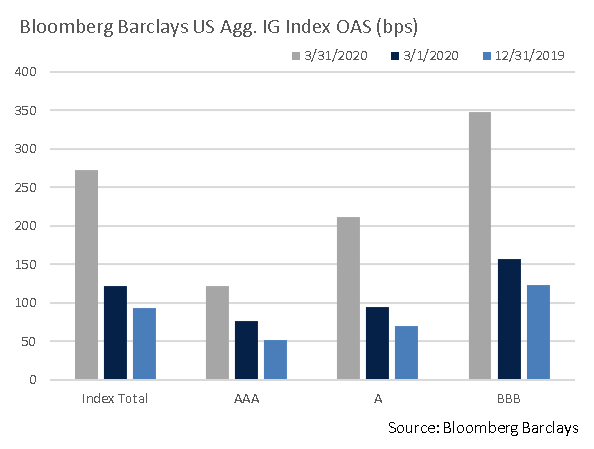

- Although massive Fed stabilization efforts have helped investor confidence begin to re-emerge, we remain vigilant and only invest in what we feel are high quality, IG corporate issuers. Our credit research team is carefully reviewing each name we own and believes they are well positioned to manage through this very difficult economic period.

- IG risk appetite improved at the end of an extraordinarily volatile month, with spreads narrowing by 23 bps over the week ended 4/3. Dealers became net buyers and overall trading liquidity firmed. After hitting a high of 373 on 3/23, IG corporate spreads ended March at 272.

- The high-grade corporate market has recently seen an unprecedented surge in primary market debt sales as companies look to fortify balance sheet liquidity. March’s $259.2B of total new issuance was 46% greater than the previous record of $177.7B priced in May 2016. The $117B issued over the last week of the month was the highest on record despite above average concessions.

- Nonetheless, credit agencies are re-evaluating corporate ratings and, according to BofA Global Research, there were $560B of net downgrades in March. Certain names held in our portfolios will inevitably be impacted and we are assessing quality and relative value on a case-by-case basis.

- Retail flows remain sluggish, with Lipper reporting net outflows of $8.47B in IG mutual funds over the weekly period ended 4/1, although HY funds saw positive flows. Continued stabilization of the HY market, led by energy, would be a positive sign for the broader credit markets.

Public Sector Watch

Credit Comments

Stimulus Bill Supports Municipalities Facing Fiscal Strain

The $2T CARES Act offers several provisions that aid state and local governments and municipal agencies grappling with the Coronavirus health crisis and its economic fallout. Congressional efforts have been dramatic in speed and scope. However, the package is not a panacea and another round of financial support to municipalities will likely be needed, along with budget cuts and tapping of reserves.

- $454B to corporations, state and municipalities – provides capital for the Federal Reserve to purchase obligations either directly from an issuer or on the secondary market, and to make direct loans to issuers. This could be levered up to $4T, although municipalities will need to compete against corporations for this allocation. This is positive for market conditions as the Fed now has the capacity to mitigate potential dislocation, while loans offer a bridge to help cover lower and delayed tax revenues.

- $150B direct aid to states and municipalities – provides funding specifically to offset Coronavirus outbreak costs, a positive for municipal credit, but not enough to offset lost tax revenues.

- $100B in aid for hospitals – funds are grants for Coronavirus-related expenses and lost revenue. Bank of America equity analysts stated it would “provide significant offsets to lost elective procedures and higher costs. . . and limit downside”, an opinion we see as optimistic, but encouraging.

- $13.5B for local school districts – This should be moderately positive although more likely to impact FY 2021 budgets. K-12 spending cuts are anticipated.

- $14.5B for higher education – aid is for both students and institutions coping with the effects of the health crisis and school closures. Funding is likely to be nominal relative to all-in expense impact. Fall 2020 enrollment levels will be key variables to monitor.

- $10B for airports – $7.4B of aid will be complemented by $50B in total eligible aid for the airline industry. These funds are badly needed as it will help in dealing with dramatic revenue declines. Airports will be dependent on aid and internal reserves until more normal travel levels return.

- $25B for transit – distributed through four different aid and grant programs, these funds are for mass transit providers struggling with steep declines in passenger volume and farebox revenue. The funding is welcome from an operational standpoint, although most mass transit providers issue tax-exempt sales tax-backed bonds.

How Are States Managing Delayed Tax Filing Deadlines?

The IRS extension of the 2019 Federal income tax filing and payment deadline to July 15, 2020 prompted 35 states to follow suit. This is a practical response, but one that will further strain state budgets.

The 41 states that levy personal income taxes collect them throughout the year via employer withholding and quarterly payments. Nonetheless, states typically collect 13-15% of total personal income taxes in April and the delay will move most of these revenues into next year’s budget. This will require proactive measures to bridge current gaps, including cash-flow based borrowing, expense reductions and reserve drawdowns.

The Fed’s expansion of its lending facilities to municipalities, and the ability of state and local governments to tap short-term borrowing at favorable rates, should prove highly beneficial. Reserves have also been bolstered by multiple years of revenue growth, and through February, state personal income tax collections were running 6.6% ahead of last year (Urban Institute).

Credit Due Diligence

Federal stimulus aid will provide a bridge over the near-term for many municipal issuers. Nonetheless, we are also stress-testing liquidity and reserves without factoring in extraordinary support from the Federal government. Our goal is to ensure that our holdings can stand on their own even under a prolonged economic downturn scenario.

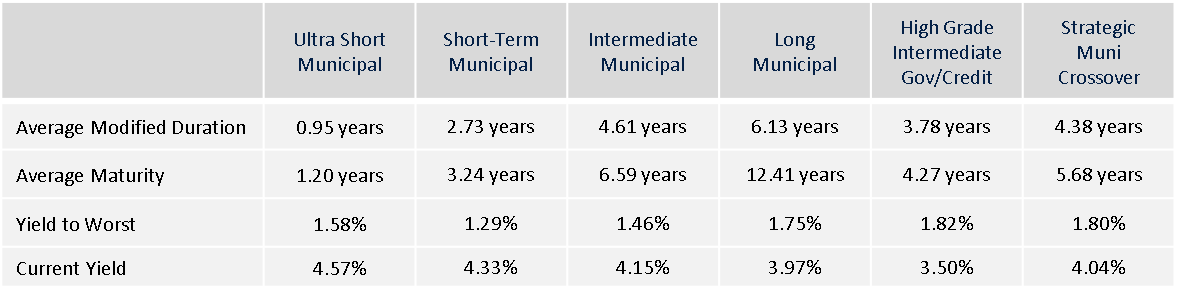

Strategy Overview

Portfolio Positioning as of 3/31/20

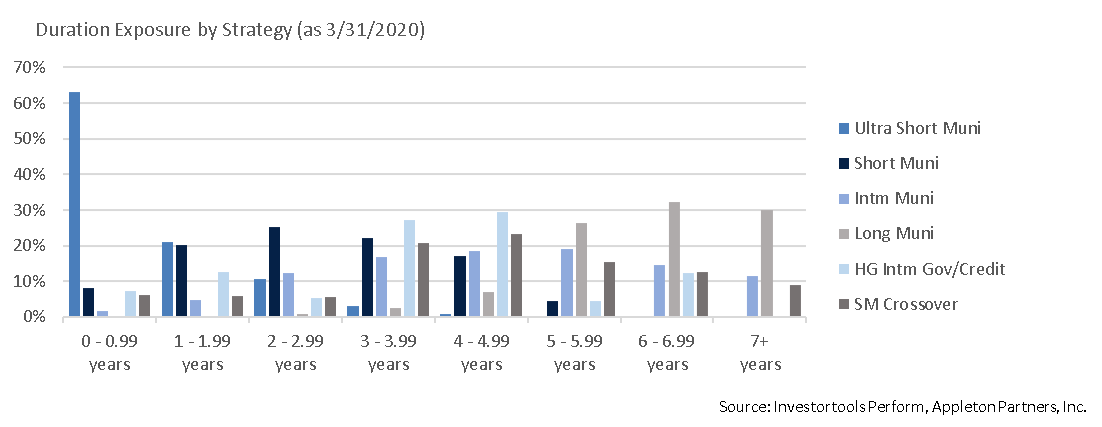

Duration Exposure by Strategy as of 3/31/20

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.