Insights and Observations

Economic, Public Policy, and Fed Developments

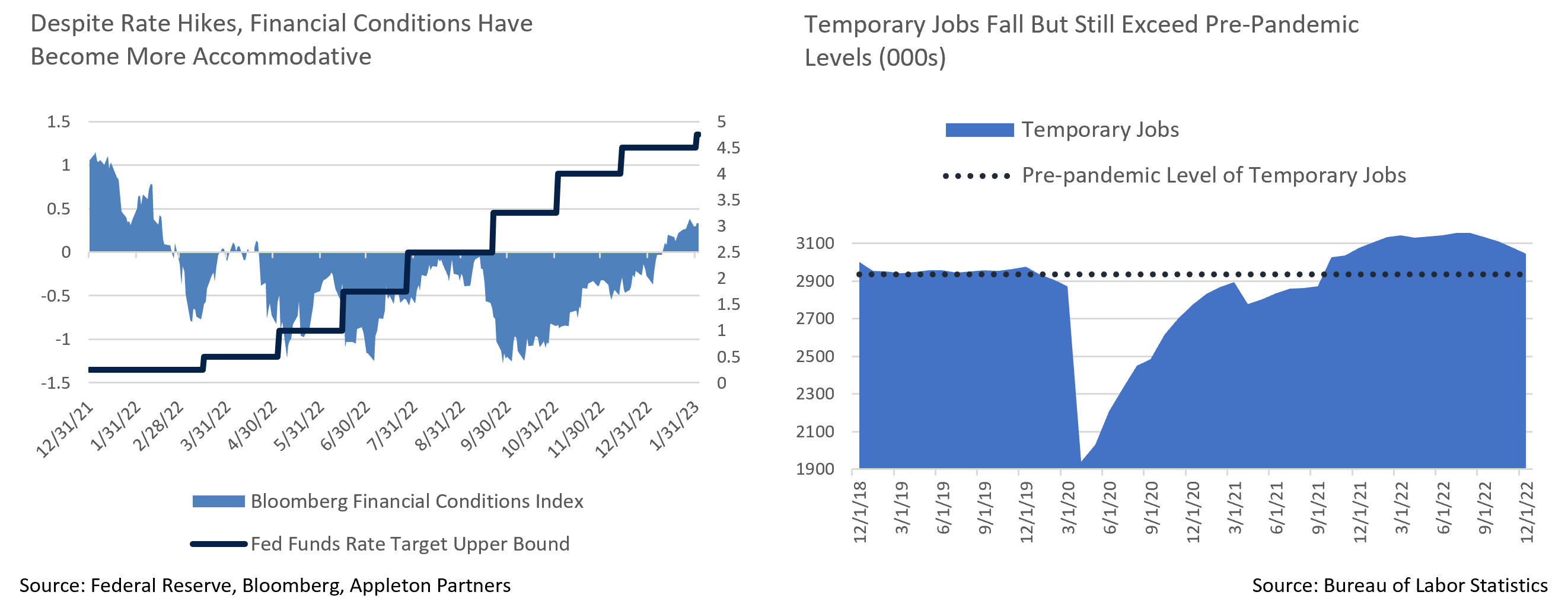

- The standout moment of the Federal Reserve press conference on February 1st was when Chairman Powell was given an opportunity to pivot and push back against market faith but chose not to. This was a surprise, since a recent theme in Fed communications has been how easing market conditions was complicating their campaign against inflation. Powell instead focused on cumulative tightening since the start of the hiking cycle, rather than financial conditions now being looser than at any time since February of 2021 and market-based measures suggesting they are now outright accommodative. Markets surged in response.

- While this made for a far more dovish press conference than anticipated, there was still plenty for the hawks. The FOMC statement’s reference to “ongoing increases,” plural, rather than the one hike the market is still pricing in caused an initial jolt. And while noting the disinflationary process had begun, Powell stressed transitory factors have driven much of the improvement. The Fed remains focused on core services ex-housing, a component representing 56% of the core PCE index that has been running at a too hot 4% annual rate. The most plausible explanation we see for this dichotomy is that Powell sees the Fed hiking to 5-5.25% based on a belief that recent progress in inflation will stall and settle at the core ex-housing rate. Since the market will have to come around to this view one way or another, Powell appears to be letting it do so at its own pace.

- Elsewhere, markets continue to wrestle with the divergence between consumption data and employment data, and what this suggests about inflation and growth. Consumer data from December ranged between weak and abysmal. We caution that retail sales and durable goods orders tilt heavily towards goods spending, and there has been ample evidence of a shift from goods to services for some time. The Personal Consumption Expenditures release was much more nuanced, revealing a slide in goods purchases but flat real services spending (and solid growth in nominal terms), suggesting a slowdown, not a collapse.

- If consumer spending is slowing, it is not because of difficulty finding work. January’s blowout report of 517k new jobs nearly tripled the consensus and pulled the unemployment rate down to a 54-year low. Coupled with 71k in prior upwards revisions, this suggests labor demand is still white hot. The JOLTS job opening report also spiked in January, sending the ratio of openings-to-unemployed back near its peak. The only potential sign of weakness is a fall in temporary employment, but this seems more likely to be evidence of workers using a tight labor market to negotiate permanent roles rather than a decline in hiring.

- The Q4 GDP report first estimate painted a mixed picture; the headline was surprisingly strong at +2.9%, although half this growth was attributable to inventory buildup, effectively borrowing growth from future periods. Final sales to domestic purchasers (GDP ex-inventories and trade) slowed to +0.8%, and to private domestic purchasers (further removing government spending) to +0.2%, both sharply lower than prior quarters. While we are less than halfway through Q1, Atlanta Fed’s GDPNow quarterly growth estimate currently stands at +0.7%; growth is very likely to slow from where it was at year-end.

- Another risk lies with China’s abandonment of “Zero Covid” containment policies. While welcome on the growth front, commodity prices have jumped in response to a resumption of Chinese demand, and in time these increases could also begin to flow through US data, hindering the Fed’s quest to stifle inflation.

From the Trading Desk

Municipal Markets

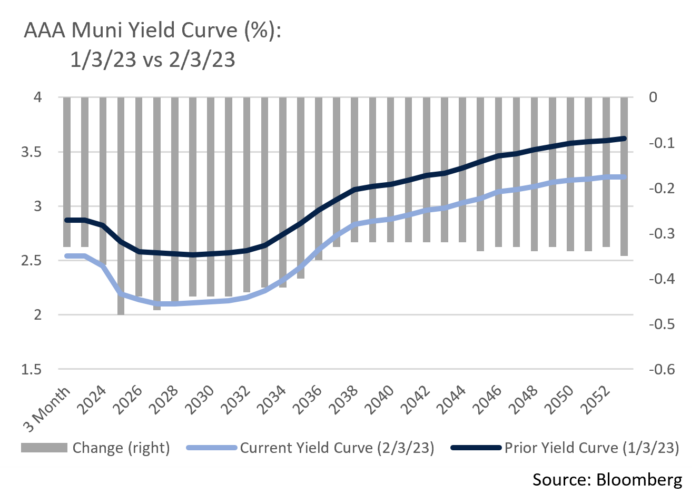

- Municipal bonds enjoyed the best January performance in over 10 years, with the Bloomberg Barclays Managed Money Intermediate Index returning +2.79%, a stark contrast from a year ago when January returns declined -2.74%. Sentiment is improving accordingly, as the last week of the month saw positive net fund flows of $1.3 billion after -$127 billion of net outflows over the preceding 53 weeks.

- Prices have been bolstered by a very limited volume of new offerings, with 30-day visible supply beginning February under $3 billion. Redemptions and maturities of $37 billion should be coming back to investors this month adding significant fuel to an already strong buy side.

- A light calendar has limited buying flexibility and shorter maturities are trading at relatively low yield levels. February began with a good deal of trading pausing in anticipation of the Fed meetings, and tax-exempt secondary purchases fell by 35% from the prior week. This dynamic has further slowed an already cash heavy market and light volume tends to have a tightening effect on already constrained spreads.

- Limited supply and high levels of cash looking for bond inventory has contributed to today’s compressed ratios, particularly among shorter maturities. At present, 5 and 10-year ratios rest at 58% and 63% respectively, as compared to a rolling 52-week average of 72% and 83%. We are finding opportunities slightly longer on the curve that take advantage of relative steepness as there is currently a 21bps spread between 10 and 12-year AAA maturities. In Intermediate accounts, such exposure is often complemented by shorter maturity bonds, enabling us to stay within our 4.50 to 4.65-year duration target.

Corporate Bond Markets

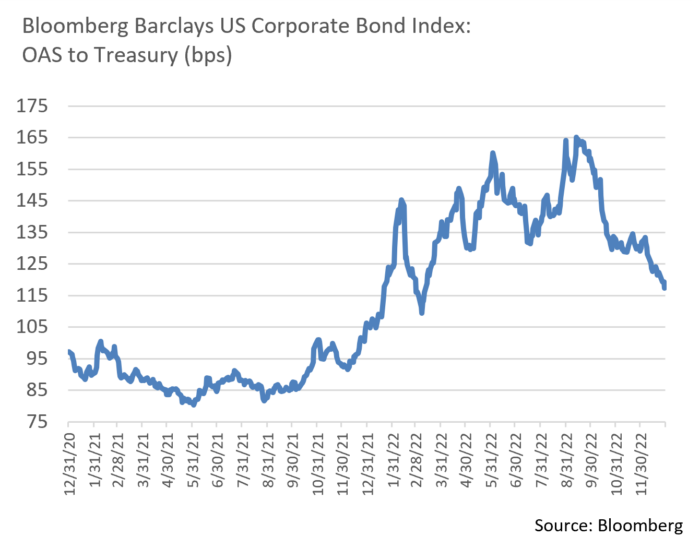

- Yields of 3.62% on the 5Yr UST remain lower than 1Yr USTs and only slightly higher than 2Yr issues, an indication that curve inversion persists but is moderating as economic signs become a bit more favorable. The 5Yr UST yield referenced above compares to 4.42% on 5-Year A Corporates and 4.17% for AA corporate credits. That said, credit spreads are near 9-month lows after reaching YTD highs back in October and are tighter than the one-year average in the 5-year portion of the high-grade corporate curve. Should UST rates normalize via front end yields moving lower over time, that portion of the Investment Grade curve should outperform.

- Demand for corporate credit remains strong and we see the solid market footing that has characterized early 2023 trading persisting. Deterioration of macro fundamentals would likely prompt a return of modest risk-off sentiment, although we do not anticipate returning to 2022 credit spread highs.

- A resurgence of Investment Grade primary market issuance was evident to begin 2023 after a Q4 2022 hiatus. January ended with $143.85 billion of new bonds hitting the market, the second highest total for the first month of the year on record. While we are encouraged by primary market vibrancy, some of the large banks were notably absent as they exited earnings blackouts. A favorable market indication was revealed by falling new issue concessions with demand for bonds, a drop in UST yields, and spread tightening creating a better backdrop for issuers. February supply is estimated at $100 billion, although we could see an uptick if today’s more positive issuance environment is sustained.

- Against this backdrop, YTD performance of investment grade bonds has been solid. High quality issues have performed very well, beating out their lower quality counterparts. While the AAA bond category represents the smallest percentage of the market, the highest quality issues returned +4.73% on the month, exceeding the broader Bloomberg US Corporate Bond Index return of +4.01%. High quality investment grade paper should do well moving forward, as we feel demand will remain strong with investors seeking a balance between yield and credit quality. Our quality bias leads us to remain steadfast in emphasizing credit selection.

Public Sector Watch

Credit Comments

Texas’ School Fund Bond Guarantee Program Nears Capacity

- The Texas Permanent School Fund (PSF) was created in 1854 with a $2 million appropriation by the Texas Legislature for the benefit of public schools in the state. The endowment, funded through investment and land holdings, now totals $54 billion.

- When a district passes a bond package, the PSF promises investors through its bond guarantee program that the state will pay them back if the school district is unable to do so. The PSF program enjoys AAA ratings from both Moody’s and S&P, a stamp of approval that allows school districts to fund bond offerings at more attractive interest rates.

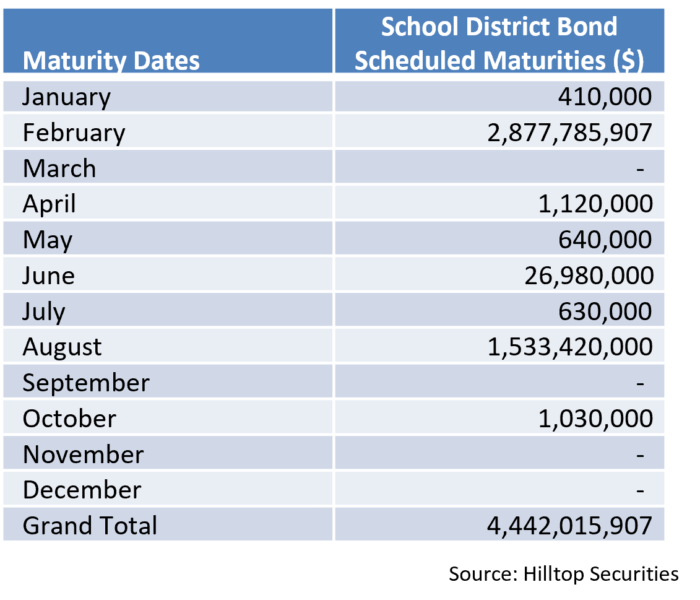

- However, the IRS limits how much debt can be covered at a given time through the PSF guarantee program, a cap that currently stands at about $117 billion. Management estimated that only about $417 million of PSF guarantee capacity remained at the end of November, limiting how much new supply can be offered at advantageous funding rates.

- The program has not reached its limit since 2009, a time when the state’s growing population and student enrollment led to a surge in schools issuing bonds for capital projects. PSF was at capacity for 11 months prior to the IRS raising the limit. Many districts needing to borrow before that time were forced to issue without PSF backing, in many cases paying higher interest rates on their debt.

- Although Texas PSF has not yet officially hit capacity, school districts have once again begun issuing without a bond guarantee. Until the IRS expands capacity, the bond guarantee program is expected to largely be limited to recycled capacity from maturing bonds. There will likely be a mismatch between demand from Texas school bond issuers and available bond guarantee capacity, a dynamic that should result in borrowers coming to market without the PSF for the time being.

- Texas School Districts continue to actively issue debt despite not receiving additional support from the PSF bond guarantee program. We feel the IRS is unlikely to lift the cap in the immediate future, in part given that capacity was originally not expected to be reached until 2025.

- We see this as an opportunity to buy strong Texas School District names at more desirable spreads, although our investment process remains focused on the fundamentals of each underlying district.

- Our research team currently sees the impact of this situation on the PSF’s credit profile as neutral, and we do not expect that view to change should the IRS expand PSF’s capacity.

Strategy Overview

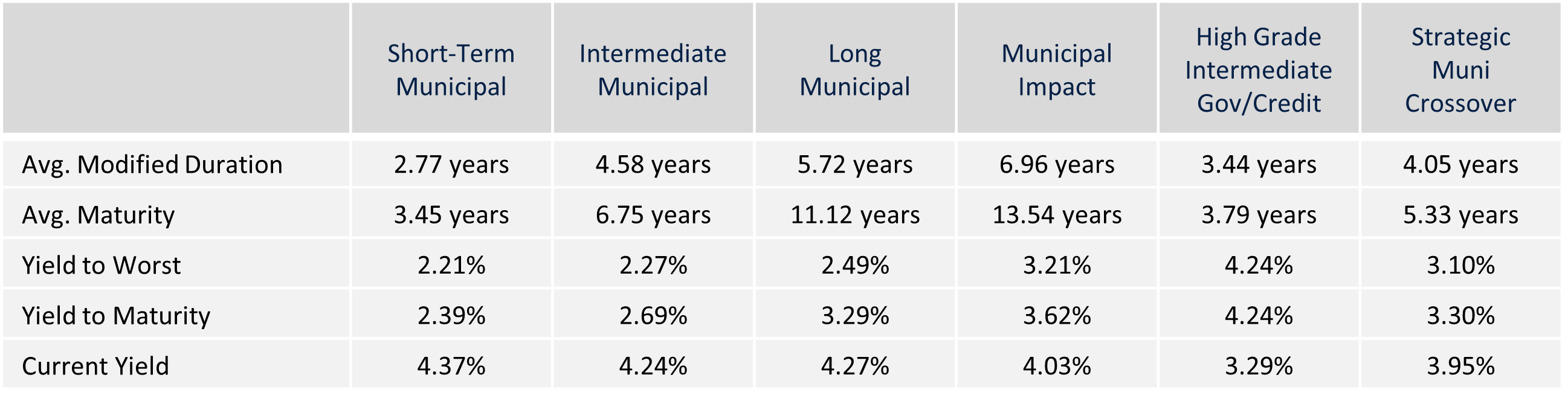

Composite Portfolio Positioning as of 1/31/2023

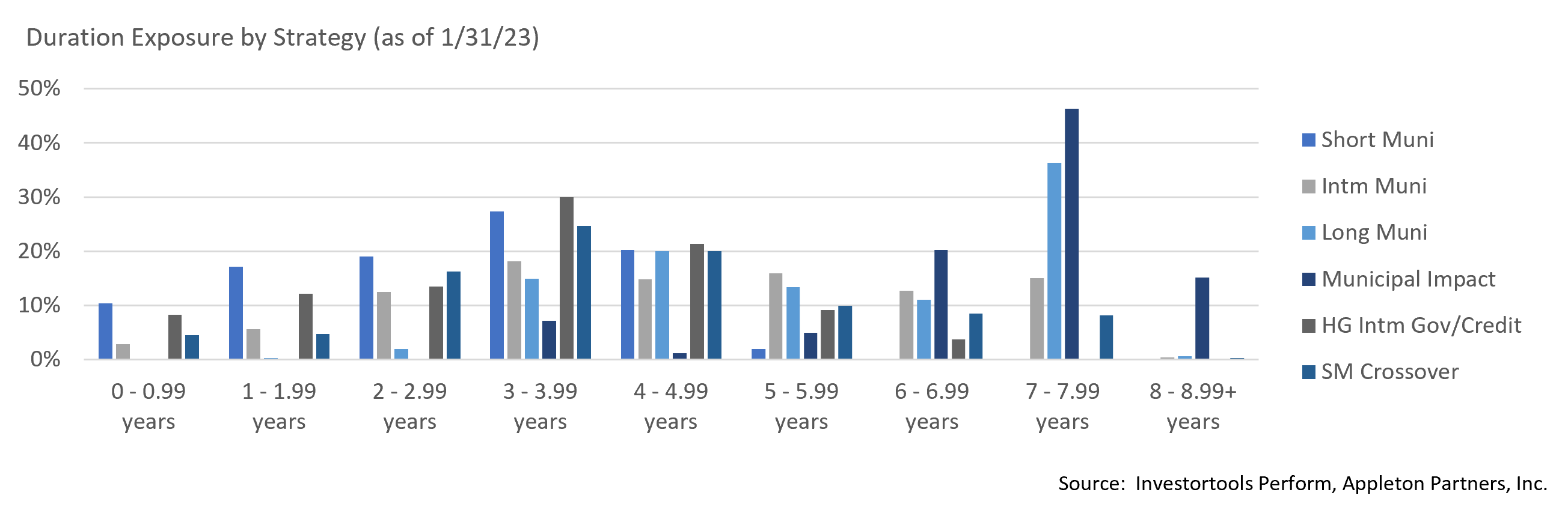

Duration Exposure as of 1/31/2023

The composites used to calculate strategy characteristics (“Characteristic Composites”) are subsets of the account groups used to calculate strategy performance (“Performance Composites”). Characteristic Composites excludes any account in the Performance Composite where cash exceeds 10% of the portfolio. Therefore, Characteristic Composites can be a smaller subset of accounts than Performance Composites. Inclusion of the additional accounts in the Characteristic Composites would likely alter the characteristics displayed above by the excess cash. Please contact us if you would like to see characteristics of Appleton’s Performance Composites.

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.