Insights and Observations

Economic, Public Policy, and Fed Developments

- As expected, the Federal Reserve kept rates on hold during their final meeting of 2019. Chairman Powell was explicit in his post-meeting remarks, stating rates would remain on hold absent a “material reassessment” of economic conditions. The majority of Fed Governors no longer expect a 2020 rate move based on the latest “dot plot” of their forecasts. Futures markets disagree and suggest that a cut is possible before year-end. In recent years disagreement between the Fed and the market have been resolved in the market’s favor; the Fed may face pressure to loosen policy during or immediately after the upcoming presidential election.

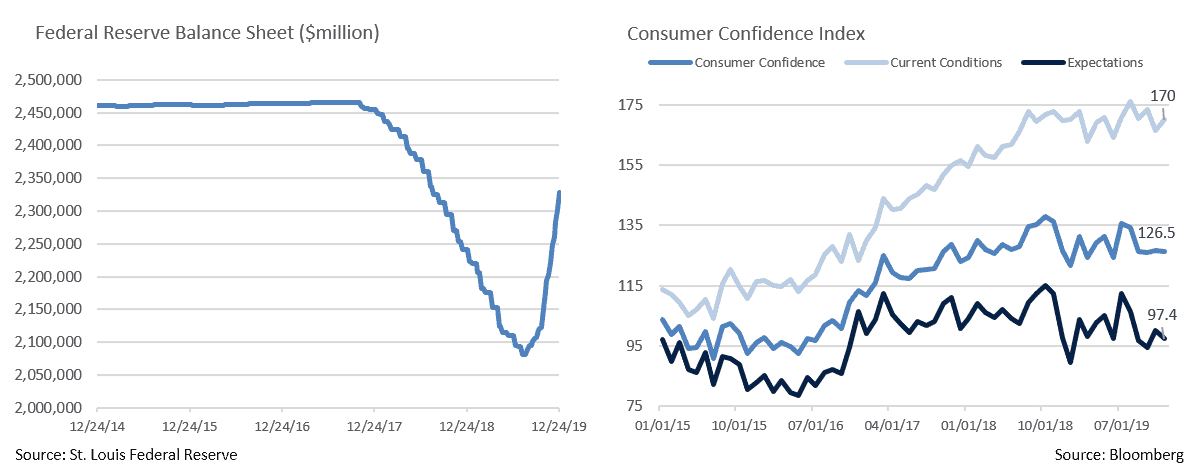

- While the Fed’s “QE by any other name” bond buying program announced in October has been widely reported, the impact has been notable. The Fed’s balance sheet has increased $248B from August lows (when the Fed began purchasing securities to calm repo markets), reversing roughly 2/3 of the runoff since late 2017. While still modest compared to QEII and QEIII, recent bond buying has already nearly matched the liquidity provided in the first round of QE in 2009 and is an underappreciated source of market support.

- The consumer has been a bright spot in the US economy, but in December this picture clouded somewhat. November retail sales growth of 0.2% missed expectations of +0.5%, conflicting with anecdotal reports of an extremely strong Black Friday weekend and “record breaking” holiday sales at Amazon. A late Thanksgiving pushing Cyber Monday into December may be a factor, and we feel the bulk of evidence still points to a strong holiday season and healthy consumer spending. An unusually large gap between current conditions and forward expectations is worth watching though, as a decline in consumer confidence would be worrisome.

- Durable Goods orders were also weaker than expected, down 2.0% vs. expectations of a 1.5% gain. Most of the weakness was due to a drop in defense spending (which, in the wake of a significant increase in the 2020 defense budget, will not persist) and a decline in civilian aircraft spending related to the grounding of the Boeing 737-MAX. Boeing’s decision to halt production of the airliner may detract 0.5-0.8% from Q1 GDP per Bloomberg News. Workers are not expected to be furloughed, minimizing spillover effects, and as long as the halt is short, impact to full-year GDP should be modest.

- While geopolitical risks remain acute, two longstanding concerns were greatly reduced in December. First, the Trump Administration announced a “Phase One” trade deal had been reached, and expects to sign an agreement on January 15th that essentially rolls back the tariff clock to May 2019. Second, Boris Johnson won a resounding victory in the UK Parliamentary elections on December 12th, gaining majority support for his Brexit plan. Conversely, it remains to be seen how a sharp escalation of US-Iranian tensions ultimately plays out.

- Looking into 2020, our base case is that recession risk continues to abate, although growth should slow from the 2018-2019 pace as the effect of tax cuts dissipates and higher trade costs are incurred. We expect short-term rates to remain on hold, anchoring the front end of the curve. We believe longer maturities may drift up slightly but the 10Yr UST will continue to remain range-bound absent external shocks.

From the Trading Desk

Municipal Markets

- Tremendous retail demand remained the story in the municipal asset class as the year closed, with mutual funds taking in a record $93.6 billion in net new assets in 2019. Furthermore, all 52 weeks produced positive net cash flow.

- Although 2019’s level of net negative municipal issuance of $50 billion is unlikely to be repeated, net new supply is still likely to be constrained. JP Morgan projects $20 billion of net negative issuance in 2020, although some strategists forecast slightly positive numbers. Furthermore, taxable offerings are supporting muni supply as tax-exempt issuance remains under pressure. We remain favorable on market technicals entering 2020 and see sustained support for the muni market given strong demand and a lack of tax-exempt paper.

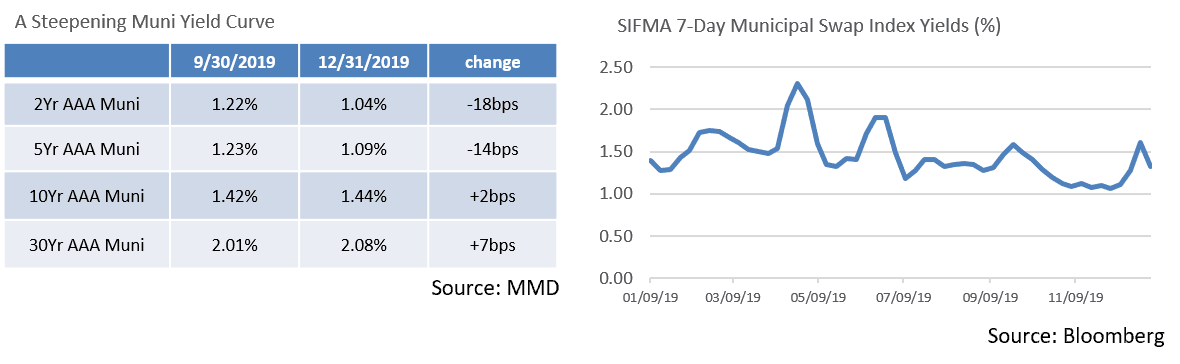

- Despite a steepening in the AAA municipal curve over Q4, the front end remained quite flat at year-end, with only 1 basis point of yield pick up over the first 4 years. This has maintained the potential appeal of Variable Rate Demand Notes (VRDN) for front-end exposure. SIFMA, the proxy for VRDN yields, finished December at 1.32%, equivalent to 8-year AAA municipal yields.

- With the Fed signaling short rates are likely to remain on hold and recession fears abating, the differential between 2 and 10-year AAA municipals increased meaningfully as Q4 closed, moving from 20 to 40 basis points over the quarter. We continue to see value in the 6 to 12-year maturity range.

Taxable Markets

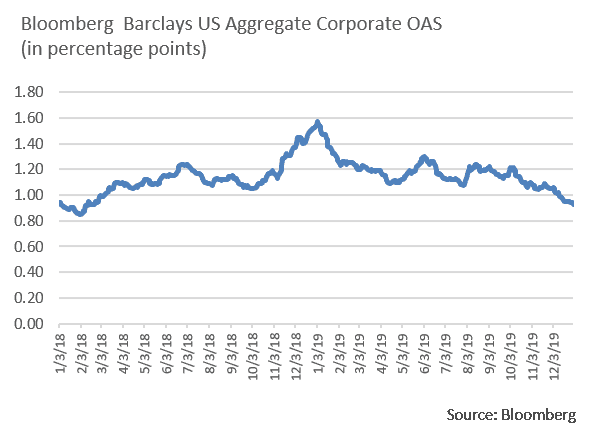

- Investment grade credit spreads closed December by hitting lows not seen since late February 2018. A steep 11 basis points monthly decline (105 vs. 94) in the Bloomberg Barclays US Aggregate Corporate Index OAS vs. 10Yr UST was spurred by lack of supply and a rush to put cash to work before year end.

- Coupled with low US Treasury yields, the cost of issuing high grade corporate debt is now far lower than it has ever been. In 2017 investment grade spreads of 93 basis points combined with a 2.41% 10Yr UST yield created a 3.34% yield. At year-end, the cost to issue investment grade debt has fallen to only 2.85%, with spreads of 94 basis points and a 1.92% 10Yr UST. Although we expect January to be a busy month of issuance, it could be short-lived. Dealers are calling for issuance to be down 5-8% YOY in 2020. Reduced new supply coupled with still strong credit conditions should help spreads stay range bound.

- The Federal Reserve’s balance sheet hit a 7 year low of just over $3.7 trillion in September after several months of not buying longer dated Treasury debt and mortgages. However, structural problems in the repo markets forced the Fed to begin buying again while also offering daily cash facilities to banks to meet overnight funding needs. This intervention has rapidly expanded the balance sheet to $4.1 trillion, helping to maintain liquidity, keep a lid on interest rates, and sustain risk appetite. Signs of repo market stability should allow the Fed to taper its balance sheet growth although no public stance has yet been communicated.

Public Sector Watch

Credit Comments

Municipal Revenue Trends Remain Strong

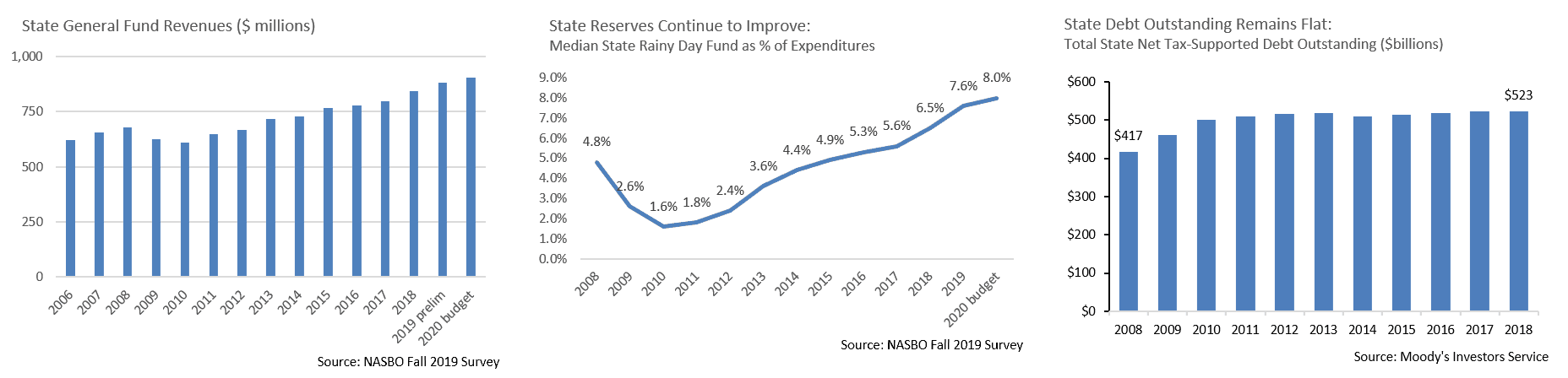

- Fiscal 2019 general fund revenues grew at a healthy 4.2% pace, although this decelerated from 2018’s 6.9% year-over-year growth. Revenue gains have been supported by strong consumer spending, investment market performance, and tax reform-driven stimulus. We anticipate growth will further moderate from recent levels, driven by a slower economy and softening in the housing market.

Financial Reserves Have Also Strengthened

- Many states have prioritized rebuilding reserves in the years after the Financial Crisis and robust revenues have allowed for healthy deposits. According to the National Association of State Budget Officers, total rainy-day fund balances reached $72.3 billion in fiscal 2019, up $45 billion since the lows of 2010. The median rainy-day fund balance was 7.6% in fiscal 2019, well above 2010’s 1.6% level and the pre-recession high of 4.8%. Most states are now well positioned for the next downturn. (Source: NASBO Fall 2019 Fiscal Survey of States)

Debt Levels Are Largely Stable

- Ongoing austerity and cash-funding of most infrastructure projects has resulted in relatively flat state debt levels, improving leverage metrics. Total state debt outstanding increased by only 0.8% in fiscal 2018 to $682 billion. Factoring in a sizeable drop in 2014, the five-year average growth rate is -0.2%. Median debt outstanding relative to state GDP has steadily dropped from a near-term high of 2.47% in 2012 to 2.06% in 2018. We will be closely monitoring individual issuers though, as we anticipate future leverage increases. Lack of federal support for increased infrastructure funding is forcing state and local governments to take on a larger burden to finance necessary capital investments.

Despite Favorable Credit Trends, Individual Issuer Risks Remain

- The market was recently reminded that although municipal bonds have recently been a rewarding asset class, individual issuers can experience credit specific problems.

- Provident Oklahoma Education Resources, the non-profit that financed a $250 million student housing project near the University of Oklahoma, sued the University, claiming the school’s choice to back out of an annual lease has all but doomed the dormitory’s future. The non-profit’s bonds maturing in 2057 traded as high as $94.05 in May before recently changing hands at only $56.50.

- CalPlant I LLC, a company that is building the world’s first facility to convert debris from rice cultivation into fiberboard, announced it expects to dip into reserves to make its January bond interest payment. Rising construction costs and an unproven technology have led to recurring delays in the expected commercial start date. Tax-exempt bonds issued in 2017 and maturing in 2039 traded at a price of $101 on 12/17 compared to $109 two weeks earlier.

Strategy Overview

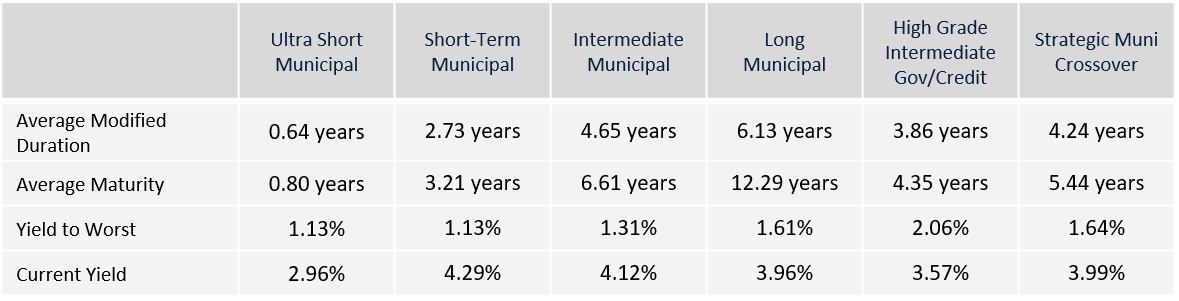

Portfolio Positioning as of 12/31/19

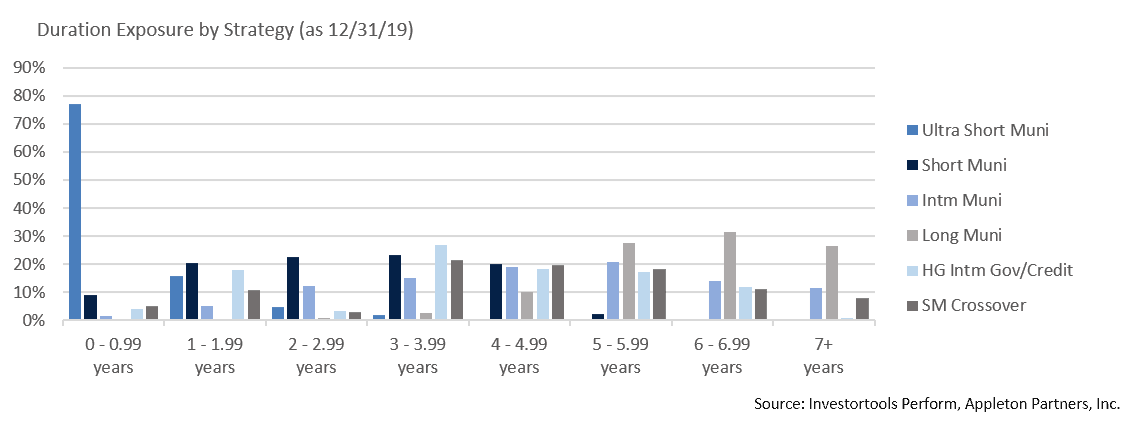

Duration Exposure by Strategy as of 12/31/19

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.