Insights & Observations

Economic, Public Policy, and Fed Developments

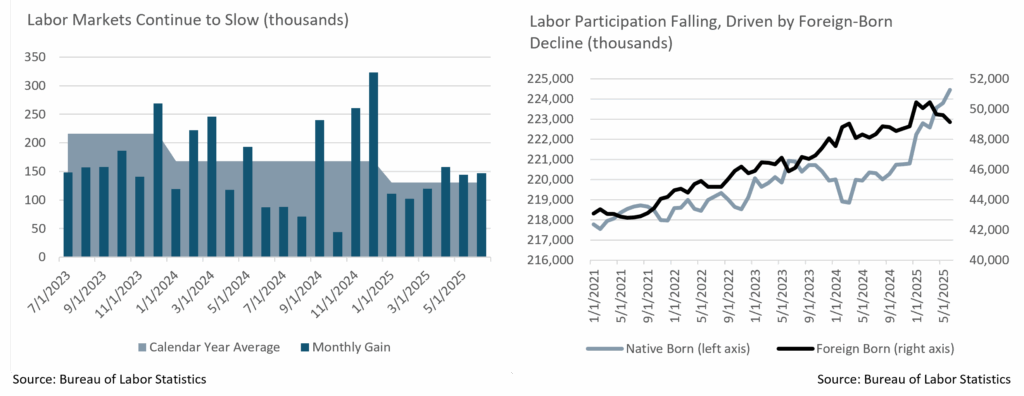

- June was bookended with two labor reports that received very similar, and we believe incorrect, market reactions. Both May’s 139k (revised to 144k) and June’s 147k job gains were objectively weak releases, below the long-term trendline. But the markets treated both as strong due to beating even worse expectations (126k and 106k, respectively). June’s unemployment rate dropped to 4.1%, not due to job creation, but rather falling labor force participation. This was particularly notable in foreign born participation, which had been the backbone of post-pandemic hiring. Meanwhile, private sector hiring was at a standstill in June, with public sector hiring in government and education contributing most of the growth. Markets may have cheered, but this was not a strong report.

- Oddly, this is probably good news for the Fed. The Trump Administration’s trade wars are still far from resolved and likely to reaccelerate as new tariffs are announced. According to the Fed’s Beige book surveys, tariff-related inflation is still to come; businesses have mostly not raised prices yet but expect to do so in the second half of the year. This creates a dilemma for the Fed.

- Their basic problem is this; tariffs can either fuel inflation or depress growth. If consumer spending remains strong, companies can pass along incremental costs, and tariffs lead to higher prices. If consumers won’t pay higher prices, however, then attempts to pass through costs will instead lead to substitution and spending declines. Prices would be largely stable, but consumption and growth would fall. As retail spending is currently weak, and contracted in May, the Fed has legitimate cause to worry about growth. The dilemma, though, is if the Fed starts cutting rates now to stimulate economy, they could fuel inflation by giving consumers the capacity to pay higher prices and turning a demand destruction effect into a price increase one. This in effect gives the Fed a choice between recession if they don’t cut, and stagflation if they do. With post-pandemic inflation fresh in their minds and consumer inflation forward expectations still high, they appear to be more comfortable risking the former.

- For now, the Fed is laser-focused on inflation, choosing to describe the labor market as “not an inflation concern.” This is doubly striking given labor is the other half of their dual mandate. While May and June’s labor reports were weak, they at least took some pressure off by allowing the Fed to continue to focus on beating inflation.

- Meanwhile, after a contentious legislative battle, the “One Big Beautiful Bill Act” narrowly passed Congress and was signed into law. The Administration views this as a growth priority but sweeping Medicaid and SNAP cuts will hit already struggling lower income Americans, and the extension of existing tax cuts is unlikely to be as stimulative as cutting them in the first place was. Longer term, while netted against estimated tariff revenue (if current policies remain) it’s at least no more accretive to national debt than current policy. We are already running a very high current account deficit and eventually this will begin to have implications for the longer part of the Treasury curve.

- Meanwhile, after the US strike on Iran, the Middle East seems to be holding an uneasy peace. After some breakdown to the traditional “flight to quality” trade after the Moody’s downgrade, this geopolitical shock brought a very normal “risk off” reaction, which is welcome. Another flare up remains a risk, however, both in the Middle East and with Treasury yields potentially not responding as they have in years past.

Sources: US Bureau of Labor, Federal Reserve, US Census Bureau

From the Trading Desk

Municipal Markets

- Municipals extended the bull steepener trade experienced during May with the front end of the curve moving lower as the rates market optimistically priced in Fed action. During June, the 1 to 3-year portion of the curve saw yields decline by 19-22bps and 5-year maturities experienced a yield drop of 17bps. Maturities of 7-years and longer saw the yield rally taper off by 7 to 10bps. 10-year maturities fell by 7bps, while maturities over 10-years saw no yield change, and the long-end of the curve moved slightly higher by 2bps. June saw the spread between 2s and 30s steepen by 21bps, with 12bps of steepening coming from the 2 to 10-year part of the curve. This move in the front-end drove positive price performance.

- Treasury yields exhibited sustained volatility before settling on a downward trend over the second half of the month as municipals closed June richer in the front-end of the curve and cheaper 10-years and out. Specifically, 2, 3 and 5-year AAA municipal/Treasury ratios declined between 1.10-1.96%, while 10 and 30-year ratios widened by 1.56% and 3.42%, respectively. Ratios closed the month at about 70% over 5 years, 77% for 10 years, and just shy of 95% for 30-year issues. The 10-year ratio is approaching the 5-year historical average of 81% while the 30-year ratio has exceeded the 91% 5-year average.

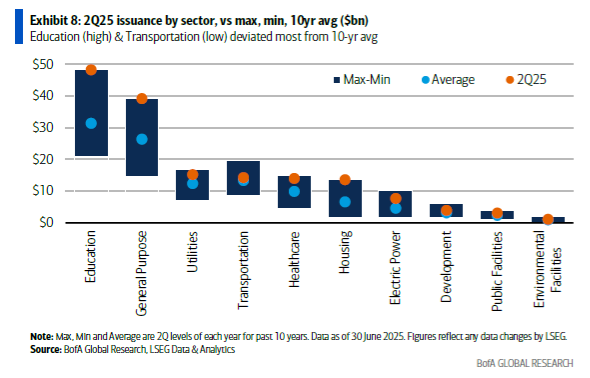

- June sustained this year’s robust issuance with JP Morgan reporting monthly gross new issuance of $57.2B, including taxable and corporate issues. The tax-exempt total of $54.2B marks the 2nd highest month of on record. This brings the YTD tax-exempt total to $256B, a 16% increase vs. 2024’s pace over the same period.

- Municipal fund flows were once again positive at $1.1B for the month according to Barclays, whose analysis noted that these inflows were concentrated primarily in national and long-term funds. On a YTD basis, net fund flows of $10.6B remain robust with ETFs accounting for the majority.

Corporate Markets

- US Investment Grade issuance topped syndicate estimates in June as a last day rush of $8.5B pushed the total to $109.5B. This was the second lowest month of 2025. As was the case in April, new supply was impacted by market volatility. In this case, a softening risk tone and a spike in geopolitical tensions created substantial uncertainty for issuers considering coming to market. Overall, the primary market stands on solid footing as the backdrop for issuers largely remains favorable. Sustained investor demand and falling rates continue to be supportive. July issuance should be strong as it is usually a bank heavy issuance month and may push net new supply well over $100B.

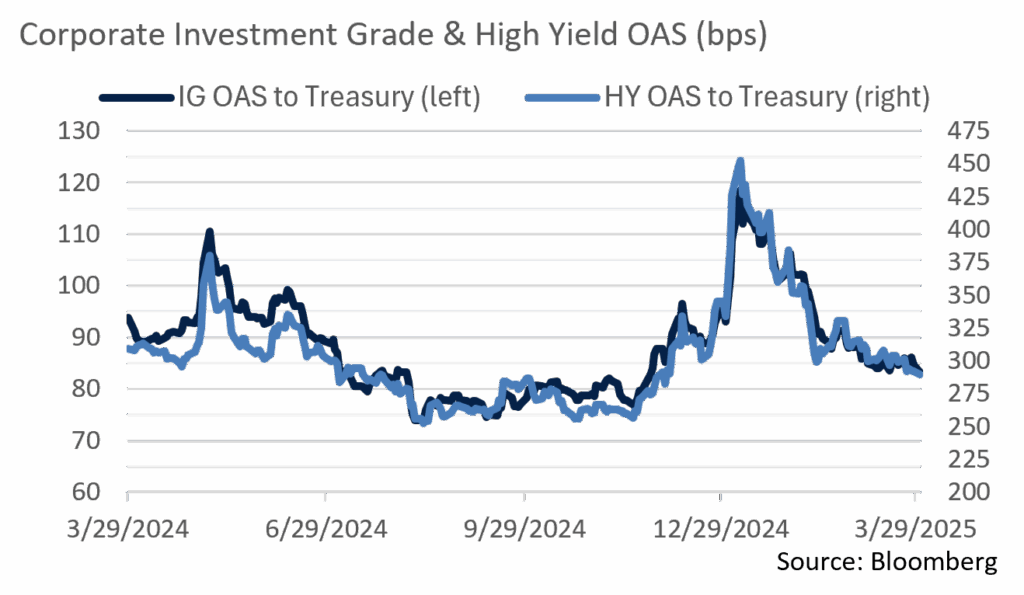

- OAS on the Bloomberg US investment Grade Bond Index has fully recovered from a YTD high of 116bps, rallying to close June at 83bps. This is just 6bps off February’s YTD low. Index performance was +1.87% for the month and is now +4.17% YTD. Intermediate duration has performed better than longer duration YTD, although a recent flattening of the UST curve bolstered longer duration returns in June. This was the first positive month of returns for the index since February, a period marked by a UST rate rally. Over the near term, economic woes and geopolitical tensions could put pressure on credit spreads, although we feel the trend is moving towards finding a bottom.

- High yield risk premiums have decreased significantly with spreads narrowing to the lowest they have been since March and yields moving to levels not seen since December. The 288 OAS on the Bloomberg US HY index is 164 bps below April’s peak. Attractive yields have been pushing investors to chase risk, as evidenced by massive recent inflows into high yield mutual funds. This positive credit backdrop has pushed issuers to the primary market, facilitating the largest IG issuance month of the year at $37.4B. There does not appear to be a near term likelihood that spreads or demand will move in a risk off direction and expect risk assets to perform well going forward.

Sources: MMD, Bloomberg, JP Morgan, Barclay’s, Lipper

Public Sector Watch

Policy Risks Impacting the Higher Education Sector

- Since the Trump Administration was inaugurated in January, the market has seen a flood of headlines regarding policy proposals and changes to funding programs which could have various impacts on the municipal market.

- The higher education sector has been facing particular Administrative pressures. The sector has been targeted through threats of implementing endowment taxes, cutting research funding, terminating the tax-exempt status of certain universities, and revoking student visas for international students. Below we highlight how each situation could impact bond issuers.

- Endowment taxes: The endowment tax passed in the recent tax bill will be implemented on a sliding scale capped at 8%, up from the current 1.4%. The tax would have the greatest impact on wealthy universities, such as those generally favored by our investment team. However, the 8% cap will have a somewhat muted financial impact, and we see this as favorable relative to previous proposals which aimed at increasing the cap to as much as 21%.

- Tax-exempt status: Revoking this designation was initially threatened at schools such as Columbia, Princeton, and Harvard, as the Administration claimed they had violated the law by admitting students based on race. Doing so would cause donations to become less attractive because they might no longer be deductible, and endowment investment income would be subject to federal taxes. While it appears that this threat has receded, if any university had their exemption revoked it would likely be followed by an appeal and a lengthy, multiple years long legal battle. It is unclear what would happen to outstanding debt, and who would bear the cost if outstanding debt became taxable.

- Research funding cuts: The Trump Administration recently informed Harvard that an investigation found it had violated federal civil rights law by allegedly failing to protect Jewish and Israeli students. The Administration stated that “failure to institute adequate changes will result in the loss of all federal financial resources.” This comes after the President had announced that negotiations were on a promising path and that the parties were close to a settlement, indicating just how volatile Federal policy has become. Although loss of Federal funding would be problematic, Harvard maintains ample liquidity and is could draw on sizeable fundraising efforts to help close a potential funding gap.

- Revocation of student visas: President Trump also stated that he would revoke international student visas across the country before paring the threat down to only select schools. While a reduction in international students would be a challenge for the higher education sector, the schools in which we invest have substantial financial resources, and their selectively affords admissions significant flexibility to backfill any gaps. Furthermore, a federal judge recently blocked the Trump Administration’s attempt to prohibit international students from enrolling at Harvard, setting a precedent should other universities be similarly challenged.

- These attacks have largely been aimed at Ivy League universities, with Harvard repeatedly being caught in the crosshairs. The outcome of these legal proceedings is not only important to investors in the bonds issued by these institutions, while also setting precedents for how legal proceedings could play out at other universities.

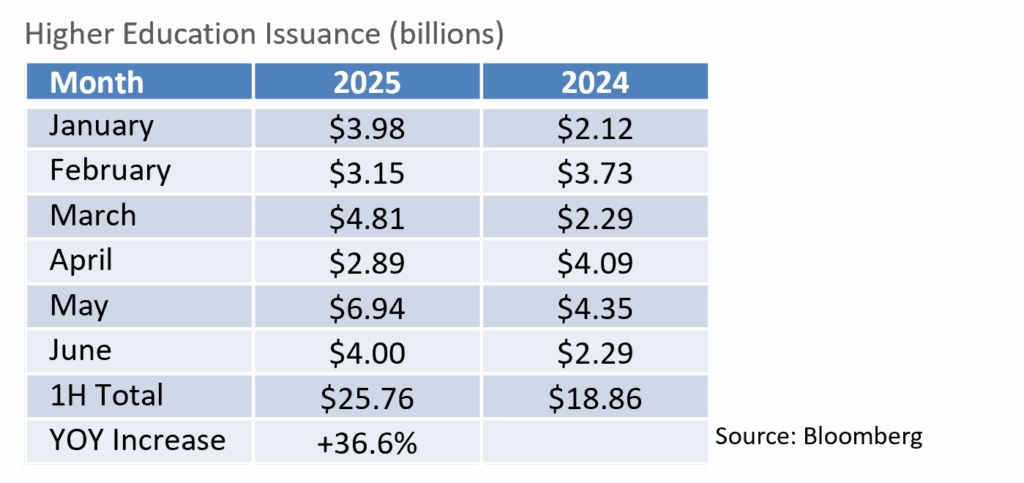

- Although many of these policy proposals are ongoing and final implications remain unknown, the level of uncertainty has produced a surge in 1H 2025 bond issuance as management teams work to get ahead of any potential changes. Through June, higher education issuance was up 36.6% from the year prior, creating opportunities for us to buy at attractive levels.

- Federal threats remain aimed at “liberal” Ivy League universities, a group of institutions characterized by substantial wealth, strong financial operations, and balance sheet strength. Higher Education credits in which we invest have significant financial resources, deep donor bases, and considerable admissions flexibility, all of which are supportive of sustained credit quality.

Source: Bloomberg, JP Morgan, Morgan Stanley

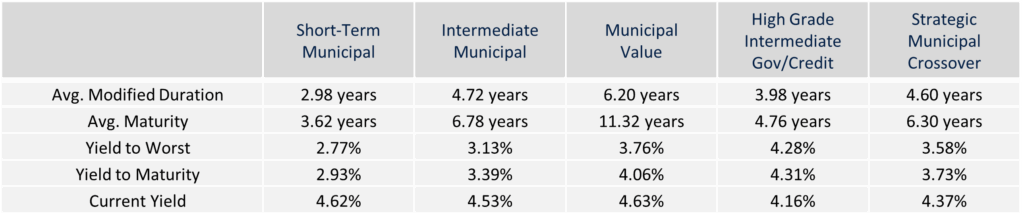

Composite Portfolio Positioning (As of 6/30/2025)

Strategy Overview

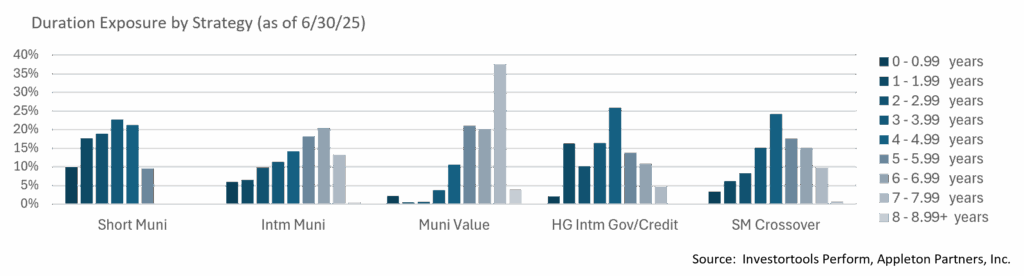

Duration Exposure (as of 6/30/2025)

The composites used to calculate strategy characteristics (“Characteristic Composites”) are subsets of the account groups used to calculate strategy performance (“Performance Composites”). Characteristic Composites excludes any account in the Performance Composite where cash exceeds 10% of the portfolio. Therefore, Characteristic Composites can be a smaller subset of accounts than Performance Composites. Inclusion of the additional accounts in the Characteristic Composites would likely alter the characteristics displayed above by the excess cash. Please contact us if you would like to see characteristics of Appleton’s Performance Composites.

Yield is a moment-in-time statistical metric for fixed income securities that helps investors determine the value of a security, portfolio or composite. YTW and YTM assume that the investor holds the bond to its call date or maturity. YTW and YTM are two of many factors that ultimately determine the rate of return of a bond or portfolio. Other factors include re-investment rate, whether the bond is held to maturity and whether the entity actually makes the coupon payments. Current Yield strictly measures a bond or portfolio’s cash flows and has no bearing on performance. For calculation purposes, Appleton uses an assumed cash yield which is updated on the last day of each quarter to match that of the Schwab Municipal Money Fund.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Not all products listed are available on every platform and certain strategies may not be available to all investors. Financial professionals should contact their home offices. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments and insurance products are not FDIC or any other government agency insured, are not bank guaranteed, and may lose value.