Insights and Observations

Economic, Public Policy, and Fed Developments

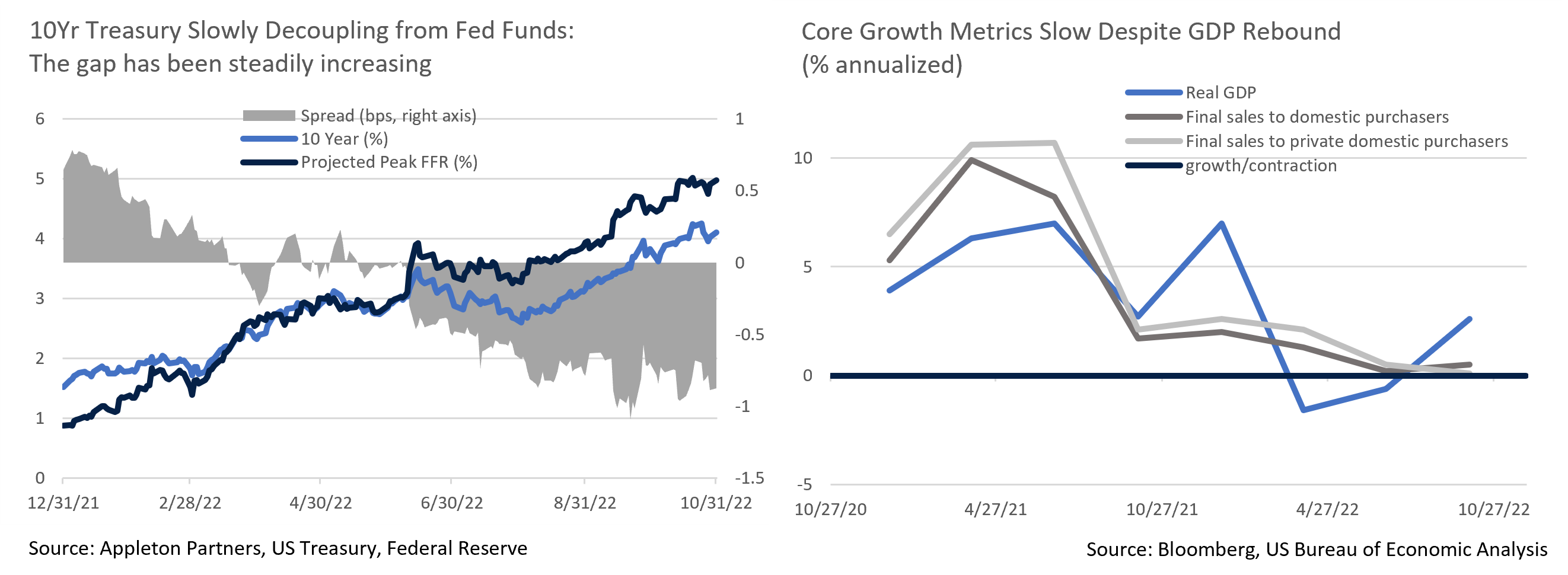

- On the surface, the Q3 GDP report was strong with growth two tenths above expectations at +2.6%. Details, however, were far less positive. Growth was boosted by a +2.8% contribution from highly volatile net exports. Final sales to domestic purchasers and final sales to private domestic purchasers, better indicators of the economy’s sustainable growth rate, both slowed and are now barely above contraction. These measures suggest stagnating economic activity.

- Consumer activity is sending conflicting messages despite weak personal consumption, which a Federal Reserve focused on lowering demand to align with supply constraints should welcome, although it strengthened to the highest levels since Fall 2021 later in the quarter. This is a poor omen for the Fed’s fight to right-size consumer demand to match supply. It is possible the August and September increases were temporary and driven by falling gas prices, but for now it appears the Fed has more work to do.

- Inflation failed to cool in September, with both Producer and Consumer core inflation surprising to the upside. PPI now shows an accelerating trend in the final demand services component, which rose 0.2% in July, 0.3% in August, and 0.4% in September. Core CPI’s +0.6% shows essentially no weakening since the start of the hiking cycle. Flat CPI core goods inflation and solid improvement in supply chain related ISM components imply we may have already seen most of the benefit from easing supply chains, and in turn a more aggressive Fed response will be needed.

- Wage growth decelerated in September, from +1.4% to +1.3% for all civilians, and +1.6% to +1.2% for private sector workers. This is welcome, though labor demand still appears hot. With core PPI inflation running at +8.4%, labor remains cheap on a relative basis compared to other production inputs. Indeed, the JOLTS survey surprised by increasing to 10.7M job openings, rather than falling to 9.8M as expected. If the Fed is looking for the unemployment rate to rise to 3.8% by year-end and 4.4% by 2023, they will likely first have to see a meaningful fall in inflation.

- More encouraging was the decline in rents, which are now following home prices downwards. While still up 7.5% YoY, this is down from 18% at the start of the year. This comes as the yearly change in the Case-Shiller Index posted the single biggest one-month deceleration in history, from +15.6% to +13%, in August. It will take some time before these changes flow through into inflation indices, but it is a welcome sign.

- As widely expected, the Federal Reserve raised short term rates 75bps in its meeting on 11/2. Markets initially took language in the press release that the Fed would take the “cumulative tightening of monetary policy” into account when evaluating future increases as a dovish pivot. Powell quickly clamped down on this in his press conference, indicating it was “very premature to think about pausing,” and that when hikes slow is “a much less important question” than how high they hike. We expect the pace of future hikes to slow, possibly as early as December, but anticipate Fed projections to show a higher terminal rate than the 5% the market is now pricing. The 10Yr UST has been slowly decoupling from Fed Funds as the year has gone on, so this should lead to further curve inversion.

- On a lighter note, British PM Liz Truss failed to outlast a head of lettuce in the Daily Star’s mock horserace, becoming the shortest-lived Prime Minister in British history after her government imploded in the fallout of a disastrous budget proposal. New Prime Minister Rishi Sunak vowed a return to financial stability, to favorable market response.

From the Trading Desk

Municipal Markets

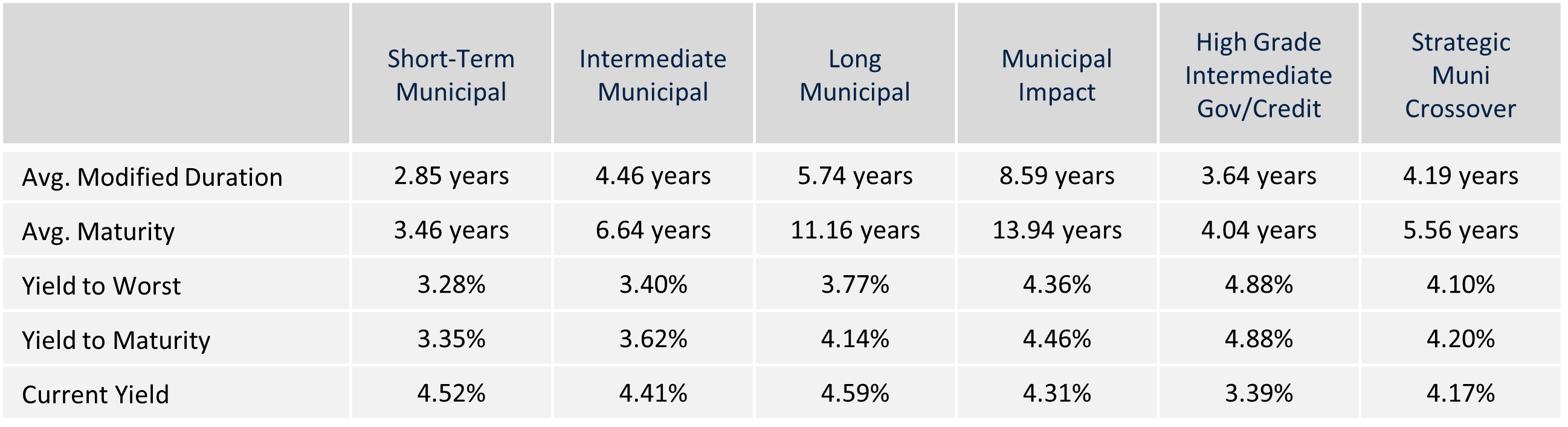

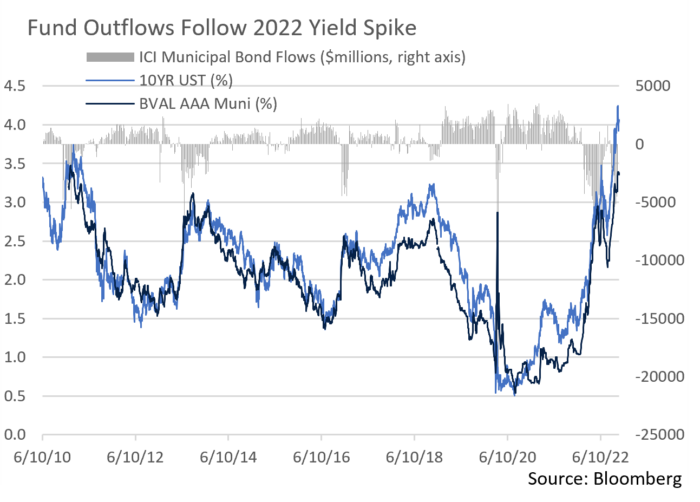

- 2022 has so far reversed previously prevailing municipal investor sentiment. October ended with the 12th consecutive week of net fund outflows and the negative aggregate YTD figure now exceeds $100 billion. Not surprisingly given this year’s volatile environment, long-term funds have incurred the highest net redemptions. Although fund flows are hardly the only technical barometer, retail sentiment has clearly receded, reducing support for the tax-exempt market. But with taxable-equivalent yields on high quality intermediate maturity issues in high tax states exceeding 6%, we anticipate a return to positive fund flows in the months ahead.

- October ended on a bear steepening trend as 30-year AAA yields rose to 4.14%. The front end of the curve remains quite flat though, with 2 to 5-year and 2 to 10-year spreads of only 6 bps and 23 bps, respectively. Relative steepness remains more attractive among 9 to 12-year maturities, an area of the curve we are targeting in many client portfolios.

- Lagging supply continues to characterize the municipal market, contributing to challenging conditions in which to transact. October issuance declined 49% vs. 2021 as rate volatility and Fed policy uncertainty weighed on issuers. Total issuance is off 17% YTD and Merrill Lynch now expects negative net issuance to exceed $60 billion in 2022.

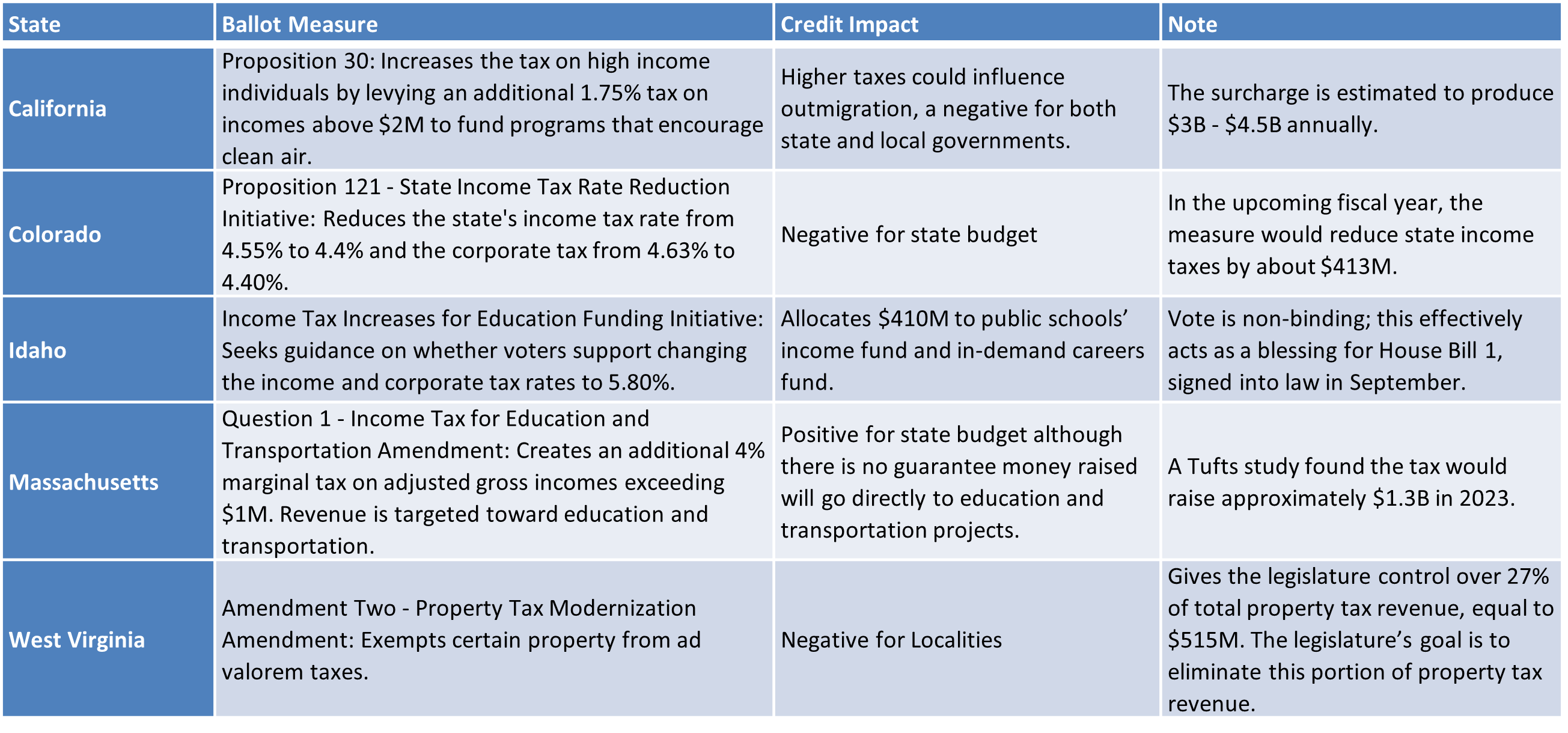

- As next week’s midterm elections approach, California and Massachusetts are getting attention due to ballot measures that propose raising taxes on their wealthiest residents.

- Massachusetts has a 5% flat income tax, and the ballot measure would add a 4% tax surcharge on adjusted gross income above $1 million. California already has the nation’s highest marginal income tax rate, and the ballot measure would levy an additional 1.75% tax on adjusted gross incomes above $2 million. If approved, these measures would further enhance the attractiveness of tax-exempt bonds. Colorado voters will also be asked to decide whether to cut the state income tax rate from 4.55% to 4.40% while limiting standard and itemized deductions for filers earning at least $300k.

Corporate Bond Markets

- A highly atypical year in the bond market now has investors acutely focused on UST liquidity and looking to the Treasury Department for insight. In its quarterly survey of primary dealers, the Treasury asked for opinions on its debt buyback program. This signaled that the Treasury Advisory Committee may recommend taking steps to support liquidity if they are deemed necessary. Concern has been focused on waning liquidity among off-the-run bonds in the secondary market, and a potential mitigating step might involve the Treasury buying as well as increasing their purchases of TIPS. A refunding announcement on 11/2 may offer color on a potential Treasury buyback program even if immediate action is not forthcoming. Nonetheless, the groundwork for a more formalized program could well come in the January announcement.

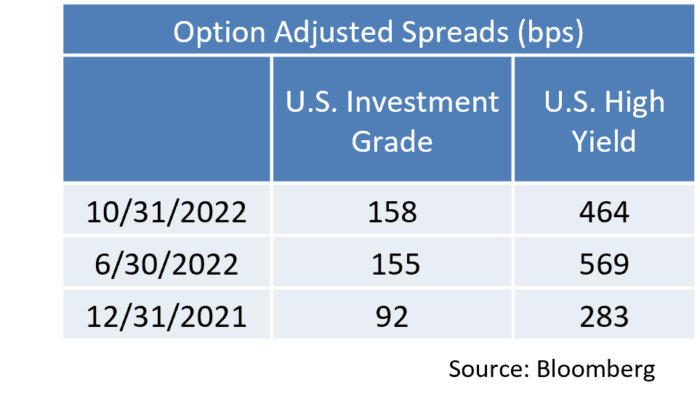

- The option adjusted spread on the Bloomberg US Corporate Bond Index ended October at 158bps, 7bps off a 10/12 YTD high of 165bps. Excess return on corporates relative to USTs was essentially flat to slightly higher as we began the month at 159bps. Over the last three months credit spreads have fluctuated within a 30bps range, narrowing slightly from larger ranges earlier in the year. In our view, spread volatility will remain evident but stay contained close to the current range.

- After a less than stellar month of issuance in September, the Investment Grade primary market came back to life in October with $83.2 billion coming to market. The metrics (concessions, interest, and performance) that we typically look at on new deals all improved as strong demand materialized. New issue concessions were down to 12.3bps from a YTD average of 13bps and deals were nearly 4 times oversubscribed. An uptick in issuance and the solid performance of the deals that came last month helped to keep credit spreads in a relatively tight range. While YTD issuance still trails 2021 by ~15%, we expect more issuers to be willing to meet investor demand over the next couple of months and would view this as a positive influence on spreads.

Public Sector Watch

Credit Comments

A Look at State Ballot Measures

On November 8th, voters in 37 states will decide 132 statewide ballot measures. Although most are not receiving top media billing, these measures can have an important impact on state and local credit, as voter support (or lack thereof) can alter tax collection trends and/or spending mandates. Below we reference a few important measures.

Bond Authorizations Reflect Solid Levels of New Borrowing

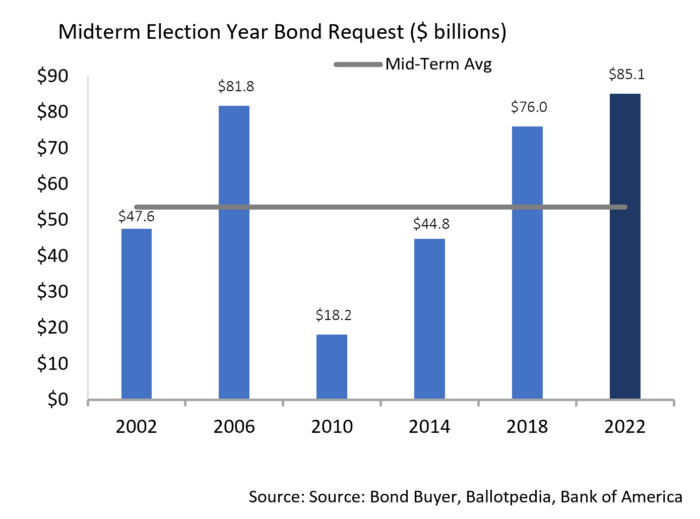

- Bond authorization approvals can be an indicator of future municipal issuance trends. State and local governments requested $85.1B of bond authorizations on the 2022 mid-term ballot according to Bond Buyer. This is well above the $53B average authorization sought over the last five midterm elections. TX and CA issuers account for the largest share of bond authorizations sought.

- Voters have approved 80.3% of bond authorizations in midterm election years since 2000, a trend that suggests a solid pipeline of new debt issuance may be forthcoming. However, authorization requests typically come to the market over several years, and issuers may postpone or forgo issuing authorized debt if they feel market conditions are inopportune or for other reasons. Analysts have indicated this may be the case in the coming year as many state and local governments are armed with strong balance sheets and most issuers still have ample federal aid that can be spent through 2026.

- With 26 governor seats up for re-election, states and local debt issuance is likely to be sluggish through early 2023 as new administrations come to power. Citi reported that “across states where the governor was newly elected, total general-obligation bond sales in the first three months of the governor’s term dipped 51% from the annual average for that period. When an incumbent was re-elected, issuance for that same time dipped 24%”. Paired with the January effect, which suggests lower issuance at the beginning of the year, new bond offering levels are expected to be weak to start 2023, followed by a solid rebound.

Strategy Overview

Composite Portfolio Positioning as of 10/31/2022

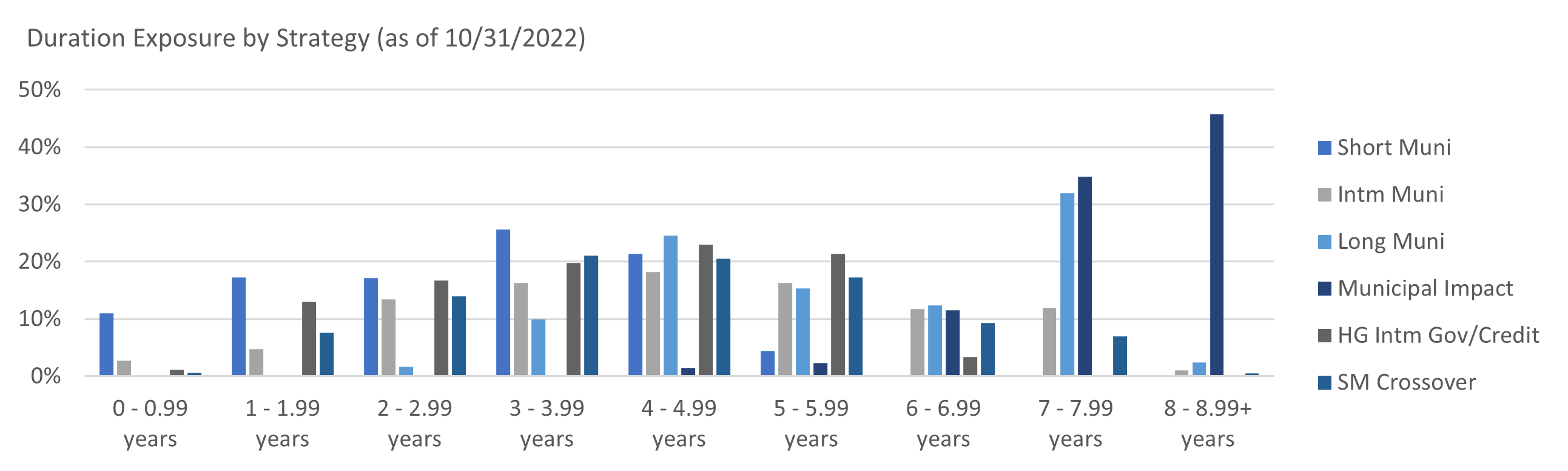

Duration Exposure as of 10/31/2022

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.