Insights and Observations

Economic, Public Policy, and Fed Developments

- In a dramatic 11th hour twist, a deal to keep the Federal government open came together after Speaker McCarthy made the unexpected move to abandon his hard right colleagues and instead seek a bipartisan deal. The continuing resolution passed with the support of almost all Democrats and slightly more than half of Republicans. The move was unexpected given the fragility of McCarthy’s coalition and rules making it easy to seek a vote to remove a Speaker, and sure enough McCarthy failed a no-confidence vote on Tuesday evening. It remains to be seen who will replace McCarthy and the process has the potential to significantly delay the 2024 budget and increases the chances of a November shutdown.

- Assuming the House successfully selects a Speaker, the remaining budgetary differences are fairly small. The House bill extends 2023 spending levels for 45 days; the Senate proposal set 2024 spending at levels agreed to in the debt ceiling bill. The media is making much of this difference; in practice it amounts to about 1%, a far cry from the 27% discretionary spending cuts Republican hardliners had initially sought. We expect a final result very close to the levels set in the debt ceiling bill, though the uncertainty around the Speakership is a wildcard.

- Inflation continues to improve, albeit with some noise in the most recent releases. Both CPI and PCE headline inflation came in relatively hot on energy price increases (gasoline rose 10.7% in PCE), but Core was split, with a higher-than-expected Core CPI at +0.3% but a lower-than-expected Core PCE of +0.1%. Encouragingly, the so-called PCE “supercore” (which BLS began reporting this month) fell to +0.14% monthly and +4.4% YoY. Despite the blip in Core CPI, inflation is clearly falling, though the run-up in oil prices is still concerning and could start flowing through to Core if unchecked.

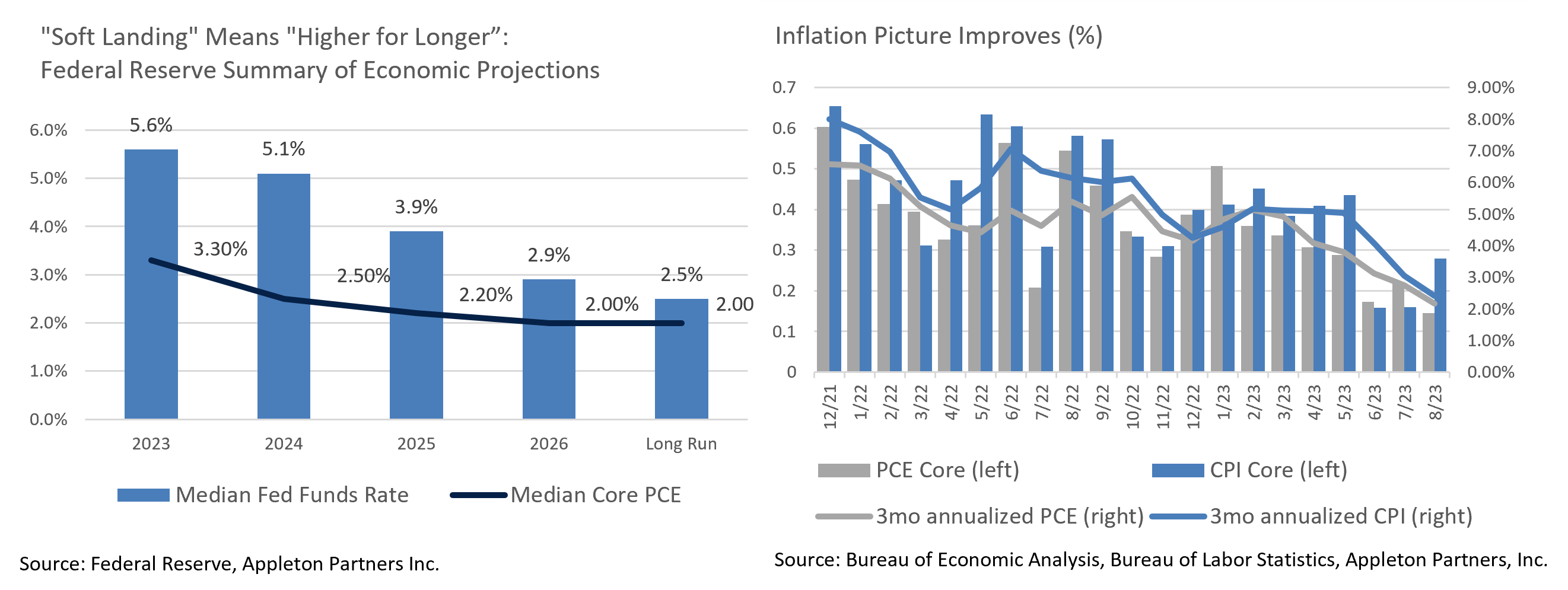

- As expected, the Federal Reserve left their benchmark rate unchanged at 5.5% in September. The “dot plot” still indicates the Fed expects to hike one more time before year-end, and while there is a huge amount of dispersion, the Fed expects a median 5.1% rate at the end of 2024. We feel one additional hike is reasonably likely, but it may not occur until January.

- More importantly, the Fed’s outlook indicates they expect a “soft landing,” with inflation slowly falling to their 2.0% target only in 2026, growth slowing but not faltering, and rates remaining elevated through at least 2025. The equity markets have priced a soft landing for some time now; the Fed’s outlook was little changed from June, but the market has belatedly realized a “soft landing” means “higher for longer” and the yield curve steepened significantly in response. The curve remains deeply inverted and the 10Yr UST is currently the lowest yielding part of the curve, but Tuesday’s 4.80% is the highest this maturity has yielded since late 2007. Rate moves of this size often have unintended consequences and we remain vigilant for cracks forming in the economy.

- Complicating the Fed’s job, the United Auto Workers (UAW) went on strike on September 15th, walking out on several Big Three auto plants. At present, only 25,000 of UAW’s nearly 150,000 workers are on strike, though that number is slowly rising. This comes at a dangerous time for the Fed, as their focus shifts from the current level of inflation to whether growth and labor demand is too strong and might cause inflation to reaccelerate. A strike of this size could skew employment statistics and cause growth to slow, but these effects are likely to be only temporary unless the strike becomes protracted. Large temporary effects like this will cloud the Fed’s picture of current labor conditions.

From the Trading Desk

Municipal Markets

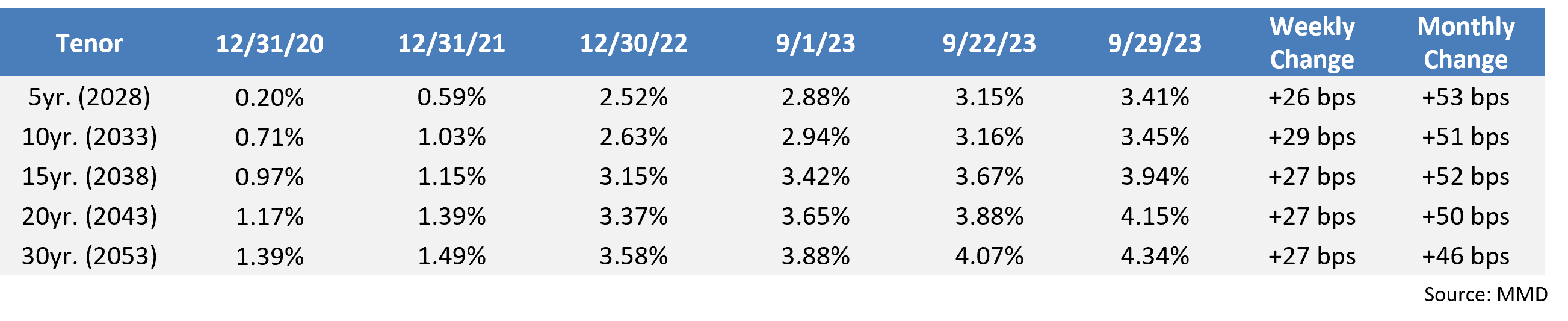

- Municipal yields rose 55 bps, 53 bps and 51 bps in September over 2, 5, and 10-year maturities respectively, following USTs up as “higher for longer” rate expectations sank in with investors. Much of that move in 10-year issues, ~29 bps, occurred over the final week of the month and 10-year AAA yields of that maturity have now reached highs not seen since January of 2009 when yields hit 3.53% and the Fed Funds rate stood at 1.50%. On a tax-equivalent basis, yields on 10-year AAA munis for those in a combined 42% tax bracket hit 5.94% at the end of Q3. We see significant value among high quality issuers with nominal yields at current levels, and adding some duration at this point in the cycle is a worthy consideration.

- A challenging month for the municipal market pushed 2, 5 and 10-year AAA muni/UST ratios to 72.5%, 74% and 75.5% respectively after ratios spent most of the summer at relatively rich levels in the 60s. The bellwether 10-year ratio is now at a YTD high, suggesting there is greater relative tax-exempt value than earlier in the year.

- We expect issuance to remain below average this month as yields are elevated, further propping up demand for new issues. Trading in the secondary market will remain dependent on economic factors and is becoming increasingly influenced by tax-loss swaps on the longer end as we enter Q4. October has an estimated $32 billion coming back to investors, down from a high of $48 billion in August, and is historically one of the lightest months for redemptions. This technical factor, coupled with supply outpacing demand, lessens the squeeze on liquidity and should offset any potential additional negative price action.

- We continue to find value in the 7 to 10–year maturity range, as yields shifted up roughly 50 bps across the curve over the course of September.

Corporate Bond Markets

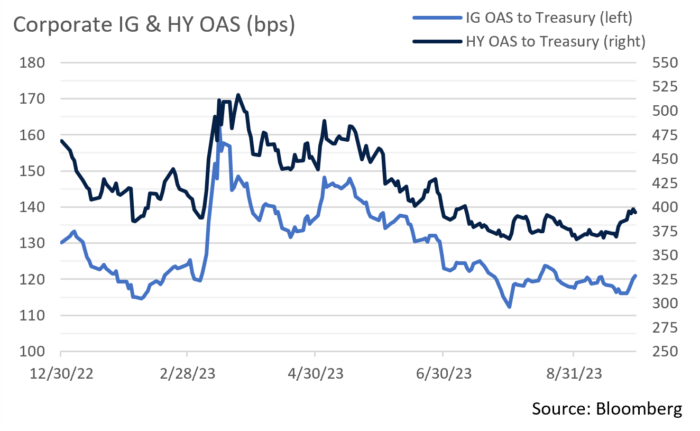

- Investment Grade credit spreads have been range bound. OAS on the Bloomberg US Aggregate Corporate Bond Index ended September at 121 bps after a MTD low of 116 bps was realized on the 20th, just 4 bps wider than the July 31st YTD low of 112 bps. Despite considerable volatility, spreads remain slightly tighter than the 5-year average of 123 bps as investor demand for high grade credit has been sustained and credit fears have stayed muted.

- High-grade corporate performance has been driven by moves in USTs, a factor that accounted for -0.62% of the overall -0.73% total return on the month. Excess return relative to USTs has been +2.22% on a YTD basis, a nominal but positive risk premium. We continue to believe that IG Credit spreads will remain close to near term averages.

- Primary market supply of IG credit beat expectations in September with ~$124 billion hitting the market vs. a projected $120 billion. The path to getting there was inconsistent, and issuers were selective about coming to market. Average new issue concessions of 9 bps are still tracking lower than 2022’s average of 13 bps, although order oversubscriptions of 2.5x fell well below the YTD average of 3.5x. The Financial sector accounted for 55% of monthly new issuance volume, followed by Utilities at 9%. YTD volume of $981 billion is tracking very close to last year’s pace and we are assuming that new issuance for the full year should land close to the $1.2 trillion market expectation.

- High Yield has been a recent bright spot in the fixed income markets. The lower quality Bloomberg US Corporate High Yield index returned -1.18% on the month vs. a -2.67% loss for its high-grade counterpart. For most of the month, High Yield credit spreads remained very close to YTD tights, reaching an OAS of 367 bps before closing at 398 bps. High Yield new issuance was a robust $24 billion on the month, the largest new supply since January 2022 and a sign of persistent demand for credit.

Public Sector Watch

Credit Comments

Labor Strife and the Municipal Market

Union strikes have been in the news of late and analysts are scrambling to assess economic impact. Labor related work stoppages have touched nearly all corners of the economy, including the Auto, Film, Hospitality, and Healthcare industries. Some strikes will more directly impact the municipal market than others, distinctions driven largely by the extent to which labor conflict has broader economic implications.

United Auto Workers (UAW)

- On September 15th, UAW workers initiated a strike against three major Detroit auto manufacturers: GM, Ford and Stellantis.

- The union is requesting a 40% cumulative increase in hourly wages over the length of a four-year contract, while the three manufacturers have offered half that amount. While there could be broader economic impact on GDP, in terms of municipal credit implications, our focus lies with the most directly affected state and local governments.

- The union is holding a stand-up strike and about 25,000 employees across 20 states are currently picketing. Michigan has a large share of unionized UAW workers. The strike is a negative for the state, although the expected impact is limited and a decline in overall tax revenues should be muted. The state has added to financial reserves in recent years, an asset base that can be readily drawn upon to offset near-term revenue loss. Michigan and its localities stand to ultimately benefit if the strike results in higher wages and bonus payments.

- While the strike could expand to additional states, Michigan represents a proxy for state and local governments, many of which have also added to reserves by deploying stimulus funds and by virtue of strong tax revenue performance. We see minimal current impact of the UAW strike on Michigan and local municipal credits we approve.

Kaiser Permanente

- Tens of thousands of workers at Kaiser Permanente went out on strike on October 4th after negotiators failed to reach an agreement with the Coalition of Kaiser Permanente Unions consisting of over 75,000 healthcare workers. Kaiser Permanente is the largest nonprofit private healthcare organization in the U.S., serving nearly 13 million patients. The strike is the largest in the history of the healthcare industry.

- The Coalition of Kaiser Permanente Unions is working to negotiate new staffing level requirements along with better pay and benefits. The strike will target hundreds of Kaiser Permanente facilities across California, Colorado, Oregon, Washington, Virginia, and Washington D.C.

- The coalition has not carried out a strike in over 25 years, labor peace that can be attributed to a unique national labor management partnership formed in 1997 that brought the workforce into company decision-making processes from the ground up. The working relationship has typically facilitated smooth bargaining, and in the past, contracts had often been negotiated “significantly before [their] expiration” dates, according to Hal Ruddick, executive director for the Alliance of Healthcare Unions.

- The breakdown in labor talks at Kaiser Permanente serves as an example of the difficulty of recent healthcare labor negotiations. The Healthcare sector has faced acute difficulties as employees are feeling overworked due to labor shortages at the same time the profitability of health systems has been pressured by inflation.

- Depending on the length of the work stoppage, the Kaiser strike will likely pressure the healthcare system’s near-term profitability. California, as well as local governments with a high concentration of employees, could also see tax revenue impact. As with the UAW strike, we do not anticipate significant credit deterioration in any bond issuers we hold in client portfolios.

While these are examples of very prominent labor battles, unions across the nation have been assertively negotiating contracts over the past year. The pandemic prompted many to reassess career paths, job demands, and work-life balance, causing a tight labor market and stronger negotiation power. According to a database of labor relations at Cornell University’s School of Industrial and Labor Relations, the number of strikes with 100+ strikers that have lasted a week or more soared to 56 over the first nine months of 2023, a 65% increase from the same period of 2022.

It is important to note that there have been high profile contract negotiations that did not produce work stoppages. The Teamsters and UPS achieved most of their bargaining goals without a strike, attaining a key contract demand calling for greater investment in safety essentials. Members of the International Longshore and Warehouse Union also came to agreement terms after several months of negotiations, resulting in a 32% salary increase over six years.

In a still tight labor market, more unions are expected to seek increased pay and benefits, a trend that can be beneficial to municipal bond issuers over the long run. Income increases have a direct impact on taxes and encourage consumer spending as nominal wage growth outpaces inflation.

Strategy Overview

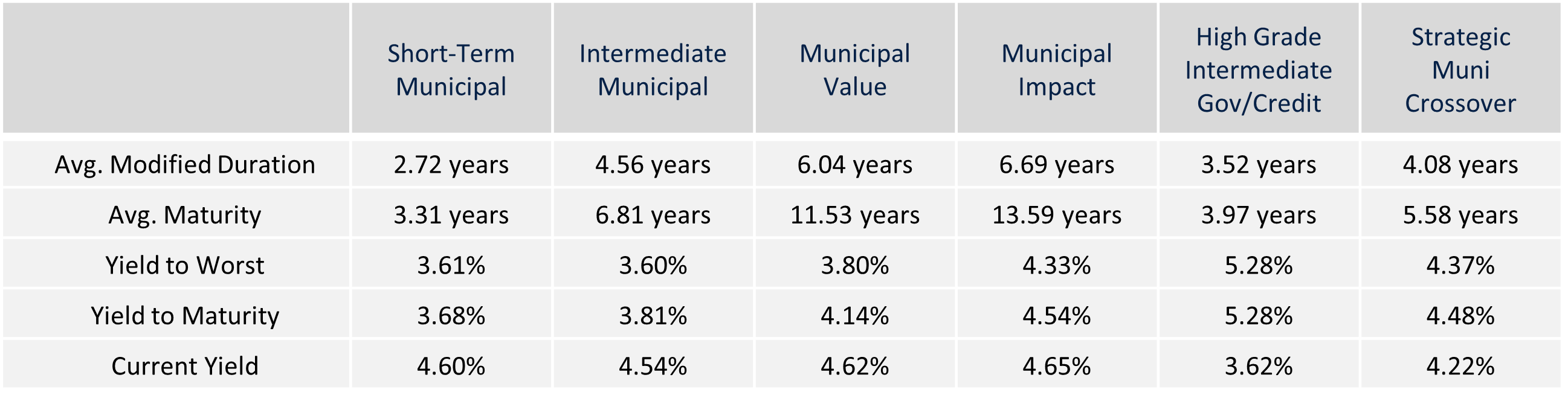

Composite Portfolio Positioning as of 9/30/2023

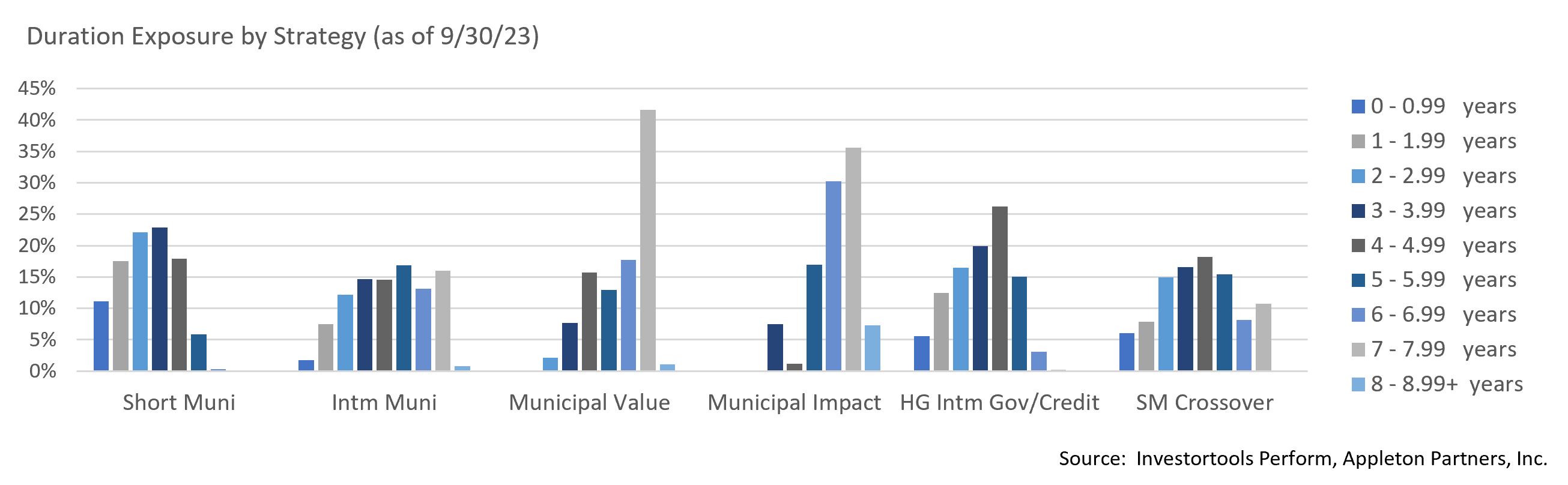

Duration Exposure as of 9/30/2023

The composites used to calculate strategy characteristics (“Characteristic Composites”) are subsets of the account groups used to calculate strategy performance (“Performance Composites”). Characteristic Composites excludes any account in the Performance Composite where cash exceeds 10% of the portfolio. Therefore, Characteristic Composites can be a smaller subset of accounts than Performance Composites. Inclusion of the additional accounts in the Characteristic Composites would likely alter the characteristics displayed above by the excess cash. Please contact us if you would like to see characteristics of Appleton’s Performance Composites.

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.

This is a paragrah

This is a bigger subhead

This is content next to an image