Insights & Observations

Economic, Public Policy, and Fed Developments

- For the second straight year, the biggest economic news of August came in Jerome Powell’s Jackson Hole testimony. In a speech taken as dovish (likely more so than he intended), Powell brought the Fed’s dual mandate back into balance after an extended period in which the price stability mandate dominated. And, while the Fed remains concerned over inflation in the pipeline, Powell painted labor market weakness as a more immediate risk. In response, futures markets fully priced in a September cut.

- They will most likely not be disappointed. But the Fed will be data dependent, and given where they see risk, we expect employment data will outweigh inflation in solidifying a September cut. The Nonfarm Payrolls release on 9/5 will be critical, but the BLS Preliminary Benchmark Revision to the Establishment Survey on the 9th is the biggest wildcard for policy rates. There’s a very loose consensus that this will be a large negative revision, similar to last year’s. The last revision was driven by the business “birth/death” model overstating business formation and a sizable influx in immigrant workers. We expect little change in the former, but with the latter having reversed sharply in 2025, there is high uncertainty around this revision. Most likely, as expected data would lock in a cut in September, but upside surprises could allow the Fed to hold.

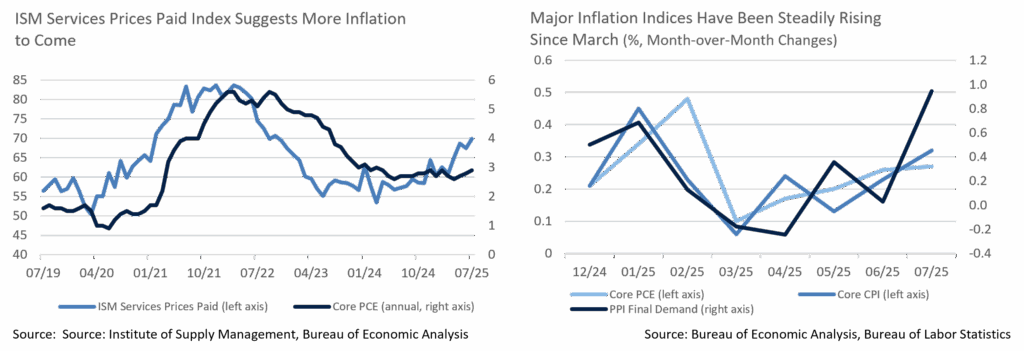

- We do not think an upside surprise to inflation on its own is likely to stop the Fed from cutting. That’s too bad, because there’s growing evidence that tariffs have begun flowing into inflation data. After bottoming in March, CPI, PPI, and PCE have been accelerating, and after a few months of goods price pressures, all three experienced an unexpected pop in services prices in July. PPI was the hottest print in three years, driven by substantial trade services contributions. There’s a plausible case to be made this represents companies protecting margins via preemptive price increases. The ISM Services PMI Prices Paid sub-index is worrisome as well; this is a reliable leading indicator for core inflation and hit its highest level since Covid in July. We think the bar for August CPI inflation stopping a Fed cut is extremely high, but a hot print may slow the pace of future reductions more than the market now expects.

- Tariffs continue to be murky. Courts ruled at month’s end that Trump’s use of the International Emergency Economic Powers Act was unconstitutional, though the case was sent back to the Court of International Trade to determine if tariffs should be rolled back broadly or only for the case plaintiffs. Most likely, this significantly extends uncertainty around tariff levels; Trump has appealed to the Supreme Court for an expedited ruling. Meanwhile, in mid-August, Trump doubled tariffs on India, a country with an early negotiated deal, over allegations they have been buying and reselling Russian oil. Steel and aluminum tariffs were also unexpectedly broadened to include goods containing the materials, notably with no in-transit exemption, shocking importers.

- We have recently seen more encouraging economic data. July retail sales technically missed, but on the back of large prior period upwards revisions, so the nominal level of spending was better than expected. And, in the first Q2 GDP release, we had pointed to the decline in Final Sales to Private Domestic Purchasers to +1.2% as being of concern. In the second release this was revised up to +1.9%, unchanged from Q1. Demand is still a little weak, but it appears to be holding stable, which is encouraging.

- President Trump shifted gears in his campaign to induce the Federal Reserve to cut rates, attempting to fire Lisa Cook for alleged improprieties in mortgage applications. Cook has vowed to stay on and fight; the President can fire her for cause, but this will likely require a conviction. Unless she steps down voluntarily, which appears unlikely, we expect a long fight and lingering concerns over Fed independence.

Sources: Bloomberg, Chicago Board of Trade, Bureau of Labor Statistics, Bureau of Economic Analysis, Bureau of Labor Statistics, Institute of Supply Management, &US Census Bureau

From the Trading Desk

Municipal Markets

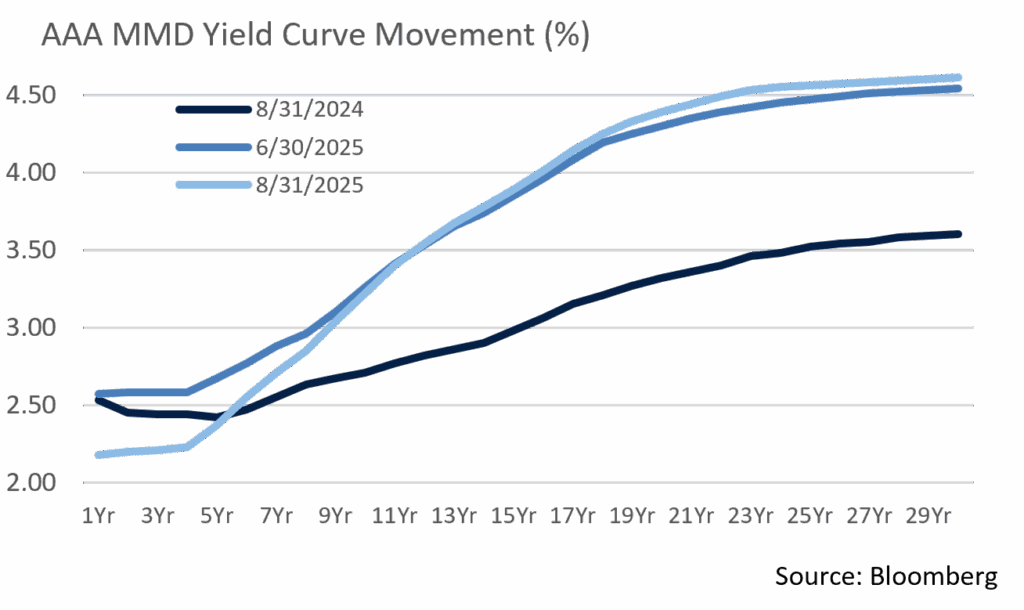

- Municipal yields sustained the downward trajectory that we have witnessed since the end of May over the course of August. The drop in yields was consistent across the curve, though more pronounced for maturities inside of 10 years. Specifically, the 1 to 3-year part of the curve saw yields decline by 19 to 21bps, while 5- to 7-year yields fell by 14 to 16bps. Maturities of 10 years and longer, recent laggards amid a summer bond rally, rallied as well, with strong demand causing yields to fall by 10 bps on the AAA 10-year and 6 to 9bps for longer maturities.

- The curve continued steepening, albeit at a slower pace relative to recent months. At the end of August, the spread between 2s and 30s stood at 241 bps, up another 13bps after steepening by 32bps in July. As was the case in July, the bulk of the steepening move has been felt with maturities of up to 10 years as 2 to 10-year issues account for 9bps of the 13bps steepening incurred in August.

- According to JP Morgan, August gross issuance totaled $48B, exceeding the 5-year average by 16%, while tax-exempt supply came in at $45B, exceeding the 5-year average by 34%. This brings the YTD gross supply to $378B, while the tax-exempt issuance total is $348B. According to JP Morgan, September supply is expected to total approximately $46B, but with less reinvestment support from anticipated redemptions; therefore, technicals could prove to be challenging in the coming months, especially when overlayed with market-driving economic data that could inject additional volatility into the markets at large.

- While the summer months are traditionally constructive for municipals due to outsized amounts of principal and coupon payments coming back into the market, this summer’s strong issuance more than kept pace with the typical reinvestment trend. The steepness of the curve and the relative attractiveness of municipal yields, particularly north of 10 years, coupled with macro factors such as a slowing labor market, led to revised expectations of upcoming Fed rate cuts and provided strong momentum for municipals during August.

Corporate Markets

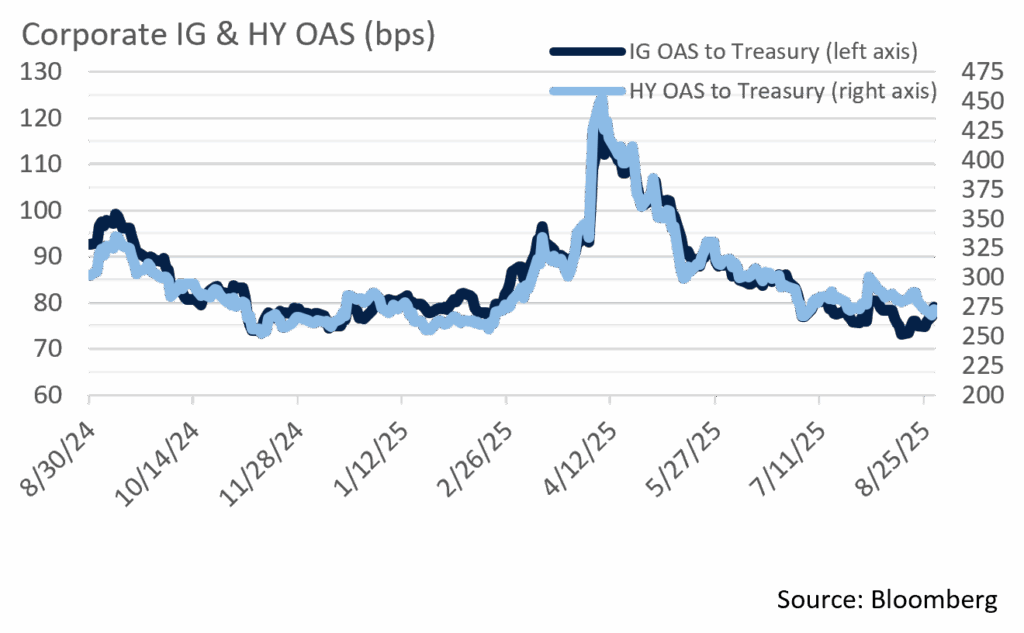

- Unlike last month’s rangebound spread environment, the trajectory of US Investment Grade Credit spreads spiraled down to YTD lows in August. In fact, the 73 OAS printed on the 15th for the Bloomberg US Corporate Bond Index was the lowest level since March 1998. Similarly, high yield spreads moved lower by 6bps point to an OAS of 272 to end the month. Due to corresponding movement in US Treasuries, the YTW on the Bloomberg US High Yield Index fell to 6.75%, a low that has not been seen since April 2022.

- Spread direction suggests that investors are reaching for yield as reductions in the Fed Funds rate are close to being initiated. As a result, the market is feeling pressure on both ends of the yield curve. We do not see a great deal of impact forthcoming in terms of credit spreads, although given the amount of issuance expected, there could be near term widening before the end of Q3.

- The pace of Investment Grade issuance was slower than the previous couple of months, although the backdrop for issuers remains strong. The $99B of new debt brought to market in August was in line with the $90-$100B estimated by syndicate and also right on the 5-year average of $100B. Year-to-date issuance reached $1.079 trillion, a sizeable level relative to historic norms. This is 1% lower YoY yet remains on track to easily hit the market’s $1.5 trillion expectation for 2025.

- The cost of bringing new debt to market is quite low for issuers as concession spreads are minimal, spreads are hovering around 20+ year lows, and demand for high quality credit is robust. Of YTD issuance, 46% has been in the financial sector, which collectively accounts for 44% of the single A ratings category. From a maturity perspective, 27% of YTD issuance comes from the 5 to 7-yr part of the curve, while 31% was issued in 10 to 30-year maturities. As anticipated, September issuance began with an increase in companies coming to market and we feel that the favorable backdrop enjoyed of late by issuers will remain strong.

Sources: Bloomberg, JP Morgan, Barclays, Lipper

Public Sector Watch

Rating Agency Rating Revisions

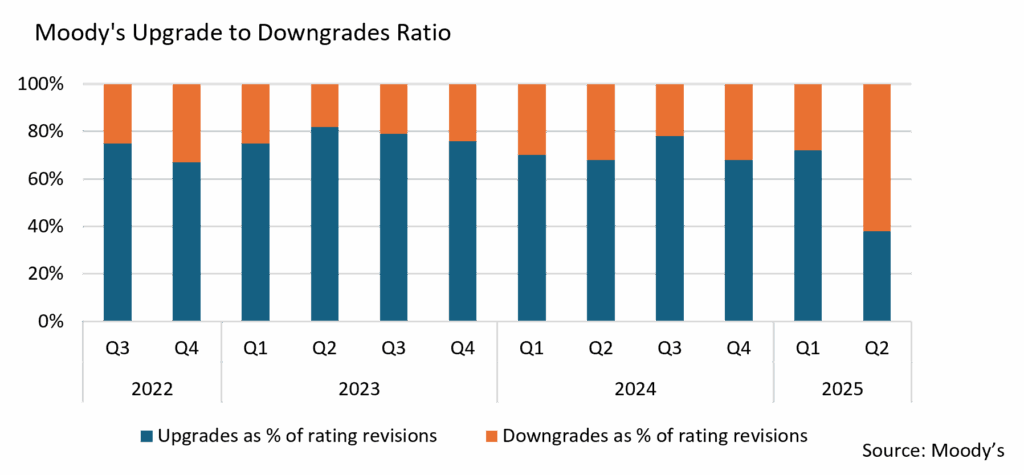

- Moody’s reported that for the first time since 2020 public finance downgrades outpaced upgrades through Q2 2025, with 126 downgrades against only 75 upgrades.

- Fifty of the downgrades were linked to the negative US sovereign credit rating change from AAA to Aa1. Most of these credits involved housing finance agencies with strong credit links to federal insurance enhancements offered in support of mortgage-backed securities secured by federal agencies.

- When excluding credits related to the US sovereign rating revision, downgrades still marginally outpaced upgrades, a dynamic that is largely reflective of federal policy uncertainty, namely concerns relative to Medicaid and federal grant funding.

- In addition to housing, the higher education and state sectors have been most impacted, with higher education facing seven downgrades compared to no upgrades, and the state sector grappling with seven first half 2025 downgrades vs. four upgrades.

- Higher education has been most directly pressured by federal policy uncertainty. Actual and prospective changes relate to endowment taxes, tax-exempt status, student visa restrictions, and federal funding, among others. Collectively, these risks have driven credit downgrades although many have not come to fruition or have so far had much less impact than some had expected. Nonetheless, uncertainty has produced credit strain and downgrades in certain cases.

- The State of Maryland and the District of Columbia (DC) have suffered the most direct impact of federal workforce downsizing and overall instability, the result of which has been layoffs and declining real estate values.

- While the rating revisions ratio points to a more negative overall outlook, management teams overseeing the municipal debt we hold have evidenced proactive, conservative budgeting practices. As a result, should an economic slowdown accelerate, or in the face of other modest challenges, we feel these credits are well prepared to manage financial strain.

US Public Pensions

- Strong investment returns over the first half of the year have boosted US pension funding ratios, which are collectively expected to increase over the balance of 2025.

- Milliman reported that the most recent public pension funding index (PPFI) shows the funded ratio grew 0.1% month-over-month to 83% in July, the fourth consecutive month of increases. The PPFI is a monthly analysis published by Milliman that tracks the funded status of the 100 largest US public defined pension plans.

- Milliman estimates that if pension returns remain on track with current estimates, the median funded ratio will rise to 84.6% by next July, the close of the fiscal year. If results skew more positively, ratios could exceed 90%, while a more bearish scenario would lead to ratios just below 80% based on their current projections. Among the 100 plans tracked, 60 had funded ratios at or above 80% at the end of July with 14 fully funded or better.

- One year does not necessarily fundamentally change pension profiles, but strong returns can certainly improve funding ratios while maintaining or lowering the annual contribution needed from municipalities to keep unfunded liabilities in check.

Sources: Moody’s, S&P, Milliman, and B of A

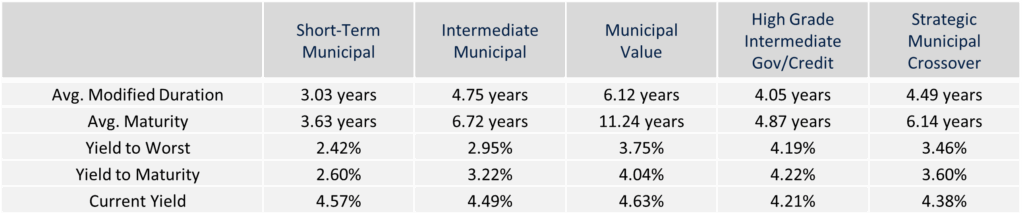

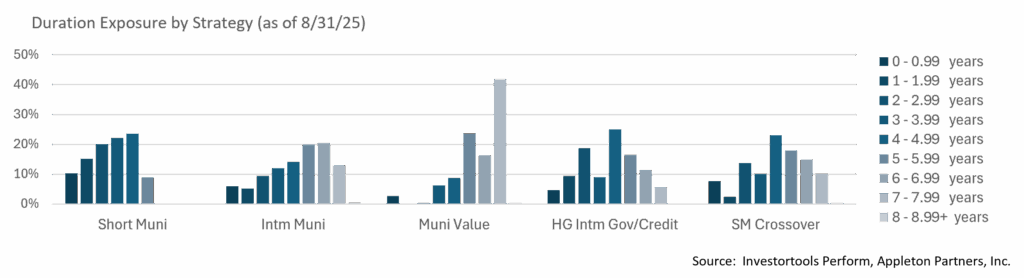

Composite Portfolio Positioning (As of 8/31/25)

Strategy Overview

Duration Exposure (as of 8/31/25)

The composites used to calculate strategy characteristics (“Characteristic Composites”) are subsets of the account groups used to calculate strategy performance (“Performance Composites”). Characteristic Composites excludes any account in the Performance Composite where cash exceeds 10% of the portfolio. Therefore, Characteristic Composites can be a smaller subset of accounts than Performance Composites. Inclusion of the additional accounts in the Characteristic Composites would likely alter the characteristics displayed above by the excess cash. Please contact us if you would like to see characteristics of Appleton’s Performance Composites.

Yield is a moment-in-time statistical metric for fixed income securities that helps investors determine the value of a security, portfolio or composite. YTW and YTM assume that the investor holds the bond to its call date or maturity. YTW and YTM are two of many factors that ultimately determine the rate of return of a bond or portfolio. Other factors include re-investment rate, whether the bond is held to maturity and whether the entity actually makes the coupon payments. Current Yield strictly measures a bond or portfolio’s cash flows and has no bearing on performance. For calculation purposes, Appleton uses an assumed cash yield which is updated on the last day of each quarter to match that of the Schwab Municipal Money Fund.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Not all products listed are available on every platform and certain strategies may not be available to all investors. Financial professionals should contact their home offices. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill, acumen, or experience. Investments and insurance products are not FDIC or any other government agency insured, are not bank guaranteed, and may lose value.