Insights and Observations

Economic, Public Policy, and Fed Developments

- As we write, Congressional negotiations on a second stimulus deal continue, after the House passed a $3T package in May and the Senate unveiled a $1T counterproposal at the end of July. Large issues remain to be bridged – the Republican plan contained no aid for cities and states and reduced weekly Federal unemployment benefits from $600 to $200, for example – however, we are optimistic that a new stimulus deal will be forthcoming. In an election year both parties recognize that more fiscal stimulus is required, and President Trump is eager to sign something. Time is of the essence, as badly needed weekly Federal unemployment benefits have now lapsed. Negotiations may favor the Democratic approach, which includes considerable municipal aid, as the Senate has not yet voted on the Republican plan and it is unclear if it has the votes to pass without Democratic support.

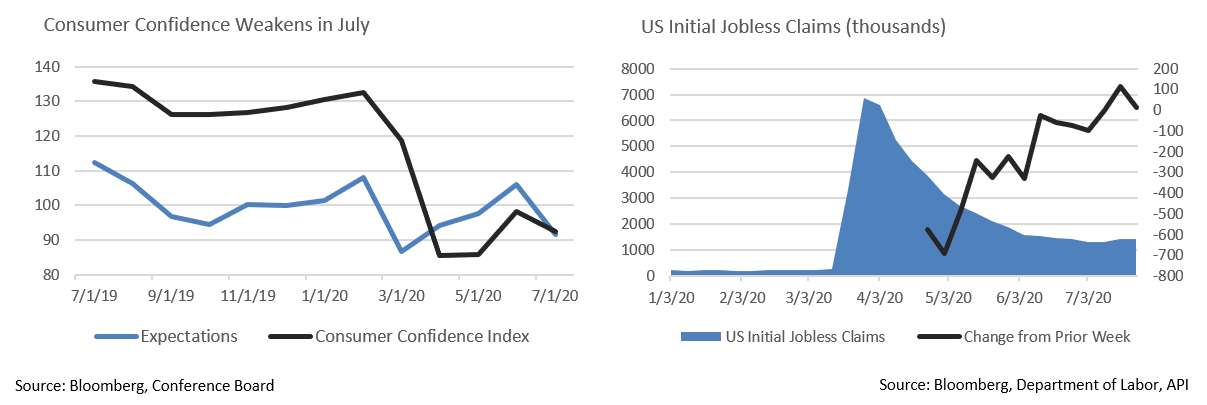

- After several weeks of strengthening, the labor market is showing cracks; the 7/23 weekly jobs report missed expectations, with new unemployment claims of 1.42M exceeding a flat consensus expectation of 1.3M. This was the first increase in new claims since the lockdown-related massive spike in March, as a worsening pandemic in large sections of the country caused several states to begin rolling back re-openings.

- This deterioration was echoed in July’s consumer confidence readings; the headline reading slid to 92.6 vs. expectations of 95.0. Conditions at the time the survey ended on 7/17 were still relatively strong and much of the disconcerting weakness began to be revealed later in the month. Forward expectations dropped from 106.1 to 91.5 Much of the decline was concentrated in states such as California and Florida where Coronavirus cases were surging, whereas New York showed improvement amid far more successful control of the virus. We expect consumer confidence to weaken further in August should the pandemic worsen and feel economic growth will remain tied to our ability to contain the Coronavirus pandemic.

- After a five-month delay, the nominations of Judy Shelton and Christopher Waller to the Fed Board of Governors cleared the Senate Banking Committee on 7/22 on a party line vote. Waller’s nomination wasn’t controversial, but Shelton, a former gold bug whose policy stances changed dramatically upon joining the Trump campaign as an advisor, is an extremely controversial and politically divisive pick. Her nomination is expected to meet with some resistance, although she is likely to be confirmed. Should this be the case, the market’s response bears monitoring, as her confirmation would further jeopardize the Federal Reserve’s perceived independence at a time when their role in the economy is arguably greater than ever before.

- Fed Chairman Jerome Powell used part of his testimony in July’s FOMC meeting to stress that, despite unprecedented federal stimulus and deficit spending, he remains far more concerned about deflation than inflation. The recession was driven by a demand shock rather than a supply shock, as daily life was abruptly shut down to halt the spread of Coronavirus. Stimulus efforts have been focused on keeping companies out of bankruptcy and individuals employed, or put another way, preserving supply capacity despite a collapse in demand. Supply is likely to continue to exceed demand for the foreseeable future, particularly in sectors dependent on large-scale public consumption, a dynamic that should keep a lid on inflation for some time. While the US government is engaged in unprecedented levels of stimulus spending, we support Chairman Powell’s approach.

- The second quarter GDP report was historically bad; the best that can be said is that the 32.9% annualized decline was closely in line with expectations. On a quarterly basis, the 9.5% fall puts the US somewhat ahead of the Eurozone, where GDP contracted an even more severe 12.1%. Regardless, a decline in US economic activity of nearly 10% in 3 months is sobering and reflects the sudden shock incurred as a result of Q2 lockdowns.

Equity News and Notes

A Look at the Markets

- The S&P 500 rallied on in July, gaining over 5.5% despite a backdrop of rising COVID-19 cases and signs that the Q2 economic recovery may be losing momentum. We see several factors driving investor optimism. Despite what is likely to be an uneven recovery, the worst is hopefully behind us and a second wave is unlikely to lead to the same level of economic shutdowns as March and April. Hopes for a medical breakthrough were bolstered by an August 3rd report in the NY Times highlighting work being done across the globe on more than 165 potential vaccines, 27 of which are being tested on humans, a handful in later stages.

- Amid high levels of viral and economic uncertainty, an equity tailwind for stocks remains paramount – the historic extent of fiscal and monetary policy response. The Federal government has passed trillions in rescue legislation, and the Federal Reserve has added nearly $3T to its balance sheet since March. With inflation muted, policy should stay accommodative and liquidity levels high.

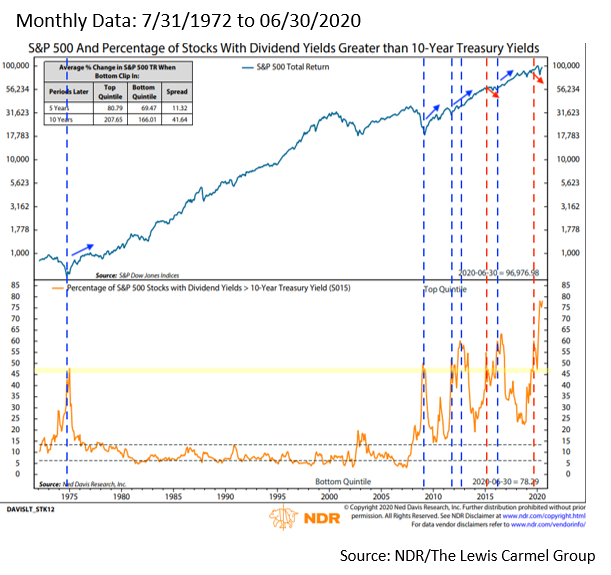

- The appeal of equities can also be seen through a total return and income lens. The 10Yr UST was yielding 0.53% at month’s end, as compared to the S&P 500’s 1.80%. Given economic concerns, the Fed vowing to indefinitely keep short term rates low, and investor demand for fixed income remaining strong, Treasury yields are likely to remain highly constrained. The TINA (There Is No Alternative) dynamic is apparent in the accompanying graphic which reveals the highest percentage of stocks outyielding the 10-Year UST in 50 years.

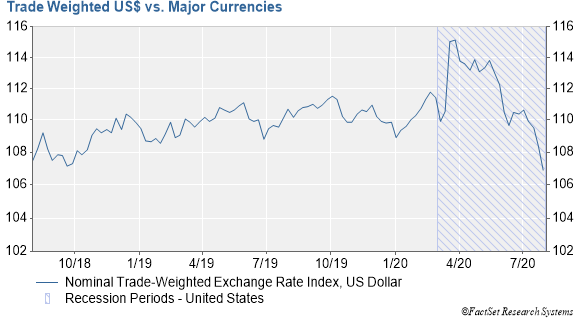

- A recent trend of note concerns the weakening US dollar, a development that benefits companies that sell overseas given increased foreign purchasing power. Larger companies tend to have greater international sales, which may help explain small cap stocks’ relative weakness. We expect a weaker dollar to be beneficial for our investment strategy, as we tend to focus on large multinationals and are overweight Technology, a sector that collectively derives more than 50% of revenue from overseas.

- Q2 earnings season is more than halfway completed and the results have exceeded deeply depressed expectations. Analyst consensus as reporting began projected a drop of 44% in S&P 500 earnings per share. So far, 84% of reporting companies have beaten analyst estimates, a record high going back to 2008. The margin of those beats is also impressive, as actual earnings have surpassed expectations by a record 22%. Furthermore, we are encouraged that ~70% have beaten revenue expectations, a less easily manipulated metric. Nonetheless, the revised -35% quarterly earnings fall would still be the largest year-over-year decline since Q4 2008 (-69%).

- One thing that has not changed is the dominance of mega cap Technology names. Apple, Microsoft, and Amazon all reported strong quarters despite the pandemic and have seen their stock prices rise accordingly. Investors should be mindful of concentration risk that comes with these giants’ increasing share of the S&P 500 Index, although there are significant distinctions between today’s conditions and the often-cited Tech bubble period. These companies represent a much larger share of Index earnings than the top companies did in 2001, earnings growth rates are far stronger, and valuations are not nearly as high. Digitization represents a secular trend that has only been amplified by the pandemic. A clear line between winners and losers is becoming evident, a development we embrace given our focus on individual stock selection.

From the Trading Desk

Municipal Markets

- The municipal curve reflects historically low yields, a condition that will likely persist. Technical conditions remain very strong and there is significant support for the asset class. Mutual fund flows have been positive for the past 11 consecutive weeks, raising YTD net inflows to $3.1B despite $47B of pandemic induced net outflows in the Spring. Intermediate maturity strategies have led the way with $1.5B in net inflows.

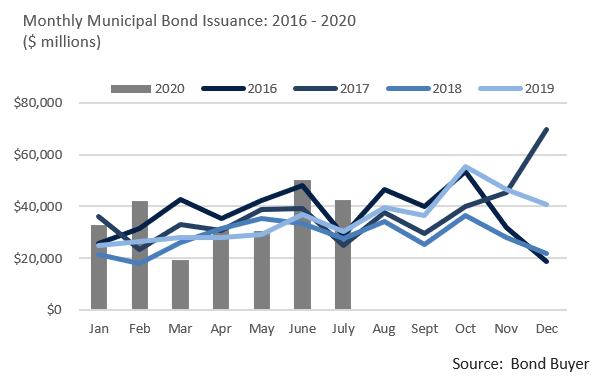

- Sustained demand for municipals is anticipated in August as $36B of upcoming coupons and maturities are likely to far exceed expected new supply, leaving investors with considerable cash to reinvest in the tax-exempt markets.

- Yield is at a premium across the global fixed income marketplace. On a relative basis, municipals still appear attractive with the 10Yr AAA municipal/UST ratio ending July at 118%. However, with the 10Yr UST at 0.55% small changes in yield levels can significantly alter ratios, thereby increasing the volatility of the often-referenced AAA municipal/UST ratio.

- Although July municipal supply of $42.6B came in 40% higher than the same month of last year, 35% of that issuance was taxable. As a result, tax-exempt investors still face relatively tight primary market bond availability, a factor that has helped tightly constrain yields. Bond Buyer 30-day visible supply is about $14.5B, slightly higher than the average for the year.

Corporate Bond Markets

- Investment grade corporate bond issuance slowed considerably this past month as only $63.45B of new debt hit the market. It was the slowest month since February’s $89.3B and well below the 2020 monthly average of $175B. Companies have reduced their pace of borrowing as cash raised thus far has fortified balance sheets and appears to sufficiently address perceived liquidity needs. Demand for high grade corporates has easily absorbed earlier levels of high issuance, and with net supply waning of late, technical factors should remain favorable.

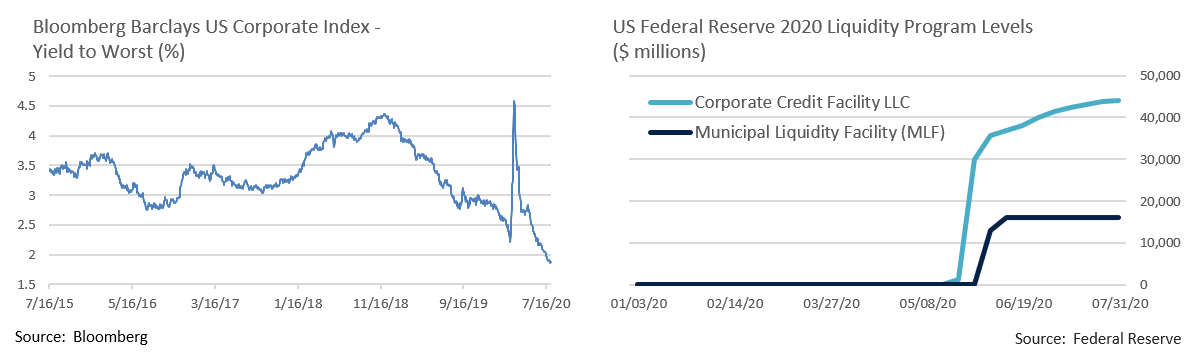

- After spiking to 4.58% on 3/20, the Bloomberg Barclays US Credit Index YTW dropped below 2% on 7/17 for the first time ever. A combination of ultra-low UST rates and tightening credit spreads have driven yields to record lows.

- Corporate bonds are not the only asset class posting record low rates. The UST 5Yr note touched 0.26% on 7/28 before grinding lower to close the month at 0.20%. By comparison, the benchmark note began the year at 1.71%. The Fed continues to grapple with a suppressed yield environment and a highly uncertain economic outlook. At this stage we do not anticipate negative yields, although some have broached the possibility.

Financial Planning Perspectives

November’s Elections: Potential Tax Implications

With the 2020 Presidential Election less than 90 days away polling data is currently favorable for the Democratic Party. Should the Democrats win back the Presidency, assume the Senate majority, and maintain control of the House of Representatives, we could see changes to the nation’s tax code. November’s outcome remains uncertain though and future tax negotiations will be highly dependent on political conditions at the time. Nonetheless, thinking about your income tax and estate planning in advance can be beneficial.

A Democratic sweep in November would likely result in changes to provisions of President Trump’s signature 2017 Tax Cuts and Jobs Act (TCJA) with Joe Biden’s alternative approach eventually taking center stage. According to campaign policy statements, Biden tax proposals would likely result in more progressive tax policies and could include certain of the following changes:

- Lower taxable estate exemption amounts to $3.5M (vs. $11.58M in 2020 and $5M in 2026)

- Restoration of the pre-TCJA top tax rate to 39.6%

- Taxation of ordinary dividends and capital gains at 39.6% for those earning over $1M (currently 20%)

- Taxation of carried interest income as ordinary income (currently taxed at 20% if held for 3 years)

- Expansion of the Social Security payroll tax through an additional payroll tax increase of 12.4% on wages in excess of $400,000

- Limiting the value of itemized deductions at 28%

- Repeal of the inherited assets basis step-up (effectively taxing all unrealized appreciation of capital assets)

- Expansion of Earned Income Tax Credit for workers without children 65 years of age or greater

- Addition of a renewable energy related tax credit

- Phase-out of qualified business income deduction for those with taxable income >$400,000

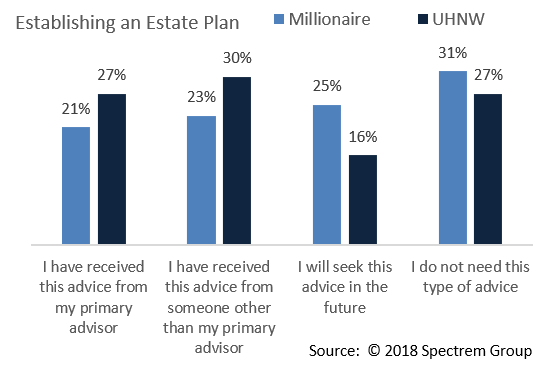

While it is highly unlikely all these proposals become law, now is the time to consider taking advantage of opportunities provided by the TCJA by reviewing and implementing plans that can reduce the size of your taxable estate. Regardless of November’s results, planning ought to be undertaken as the 2017 TCJA’s individual mandates expire on December 31, 2025.

A recent Appleton Financial Planning brief addressed the value of proactive estate planning . The provisions of the TCJA were outlined in November 2018’s Review and Outlook. We recommend reviewing these materials and then contacting your portfolio manager to discuss potential implications for you and your family.

Appleton’s Financial Planning Webinar Series Will Continue in September:

“Massachusetts Estate Taxes: Proactive Planning Matters” (Sept. 15, 2020)

“Financial Consequences of Adulthood” (Sept. 22, 2020)

Registration is open on our web site

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]