Insights and Observations

Economic, Public Policy, and Fed Developments

- October proved to be volatile in the Treasury markets, with the 10Yr spiking early in the month after steady, gradual increases in September. Yields peaked at an October 5th closing high of 3.23% before retracing to 3.08% at month end, only 3bps higher than September’s close. The market initially reacted to Fed Chairman Powell’s observation that short term rates were “nowhere close to normal.” However, the timing of the move also aligns closely with the expiration of a tax break for corporations buying bonds to fund pensions, implementation of $200B in additional Chinese tariffs, and the Fed’s increasing its monthly balance sheet runoff a further $10B to $50B. The move spooked equity markets; while they recovered somewhat in the final days of the month, October proved to be the S&P 500’s worst month since 2011, briefly dipping into correction territory.

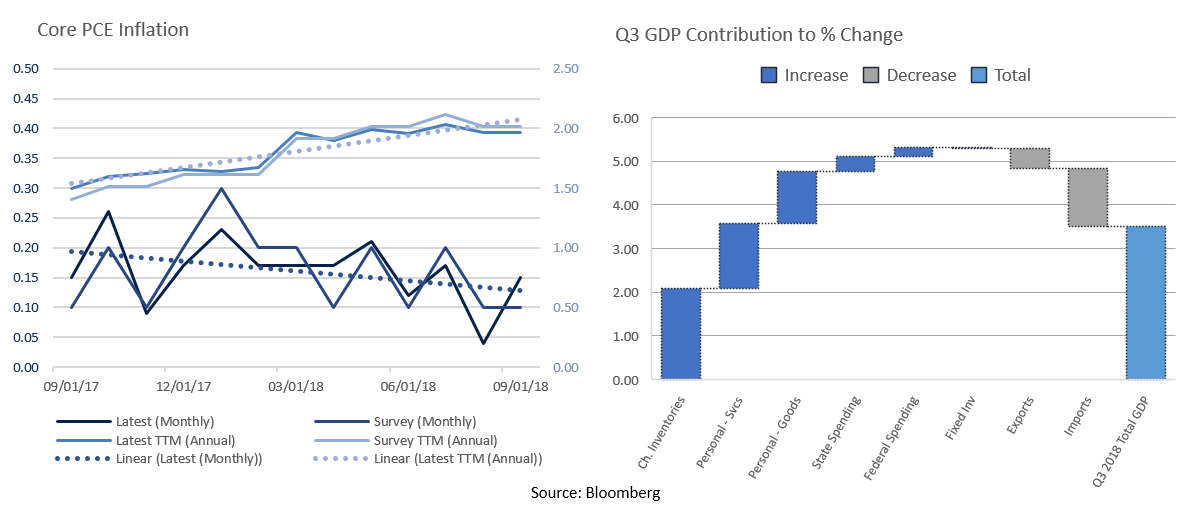

- While the annual inflation rate remains at or near Fed targets, monthly observations continue to weaken. CPI missed expectations in September, and while PPI returned to a monthly 0.2% pace after a flat reading in August, this wasn’t enough to stop the annual headline reading from dropping two tenths of a point. Meanwhile, Core PCE inflation, the Fed’s preferred measure, technically beat the consensus forecast of 0.1%, but taken out to an additional decimal place the reported 0.2% was only actually 0.15%. While the trailing 12-month inflation number gradually strengthened to the Fed’s 2% target in 2018, we note a recent decelerating trend in monthly readings. To remain at an annual rate of 2.0%, Core PCE will need to come in at 0.29% or higher in November, which would be the highest reading since January 2012. A miss in the annual rate could slow the pace of Fed rate hikes.

- As expected, GDP growth cooled in Q3, but at 3.5% it still slightly exceeded market expectations and came in at the very top of our anticipated range. Evidence of strong consumer spending and the need to replenish depleted inventories we had noted in previous commentaries was confirmed through a 4.0% acceleration in consumption and a 2.1% contribution to GDP from change in inventories. The previously discussed inflation slowdown was also evident, with the PCE deflator dropping to 1.6%, headline and core. Trade, meanwhile, was a strong detractor, taking nearly 1.8% from GDP, the largest negative impact in 33 years, as tariffs began to show their teeth.

- As America goes to the polls on Tuesday, November 6th, the Democrats are widely expected to regain control of the House, while the Republicans are expected to maintain or expand their hold on the Senate. Election forecaster FiveThirtyEight projects the Democrats have a roughly 7-in-8 chance of winning the House, while the Republicans have a 4-in-5 chance of winning the Senate, though they note an upset in either chamber is roughly as likely as any random day of the week being Tuesday and should not be ruled out. Over the long term, political gridlock will likely be detrimental, particularly with an annual budget deficit approaching $1 trillion, but in the short run a deadlocked Congress may be positive for the economy as it takes some political risk off the table.

Equity News & Notes

Risk Returns, Clouding a Positive Outlook

After enjoying a strong quarter with minimal volatility, October saw stocks suffer one of their worst months in years as the S&P 500 fell nearly 8%. Federal Reserve Chairman Jay Powell’s comments on October 3rd concerning the Fed’s comfort with letting interest rates rise above the neutral level sparked selling. The accompanying move up in interest rates, ongoing trade war concerns, and a host of other worries – US dollar strength, Italian debt, Middle Eastern geopolitics, the pending US midterms, and falling oil prices – cast a shadow over Q3 corporate earnings season.

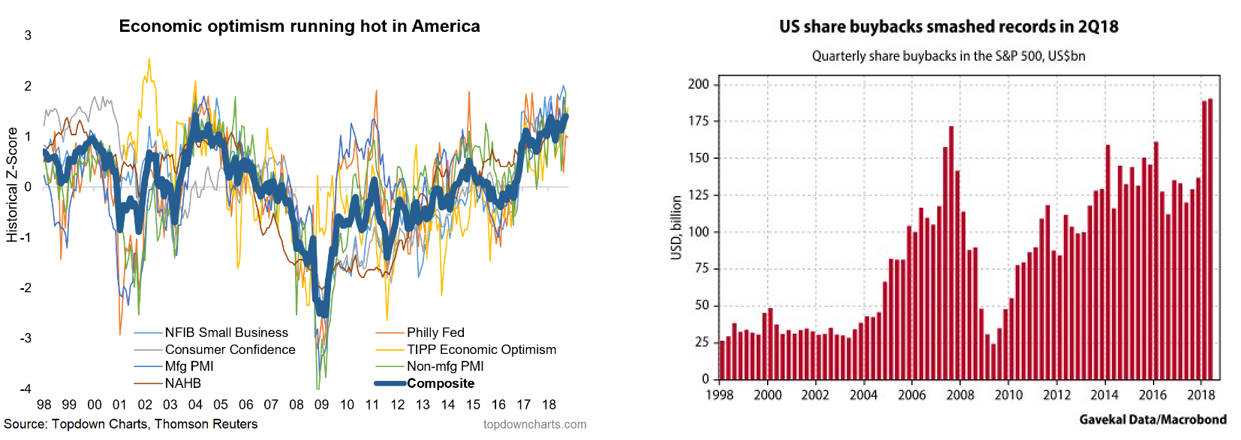

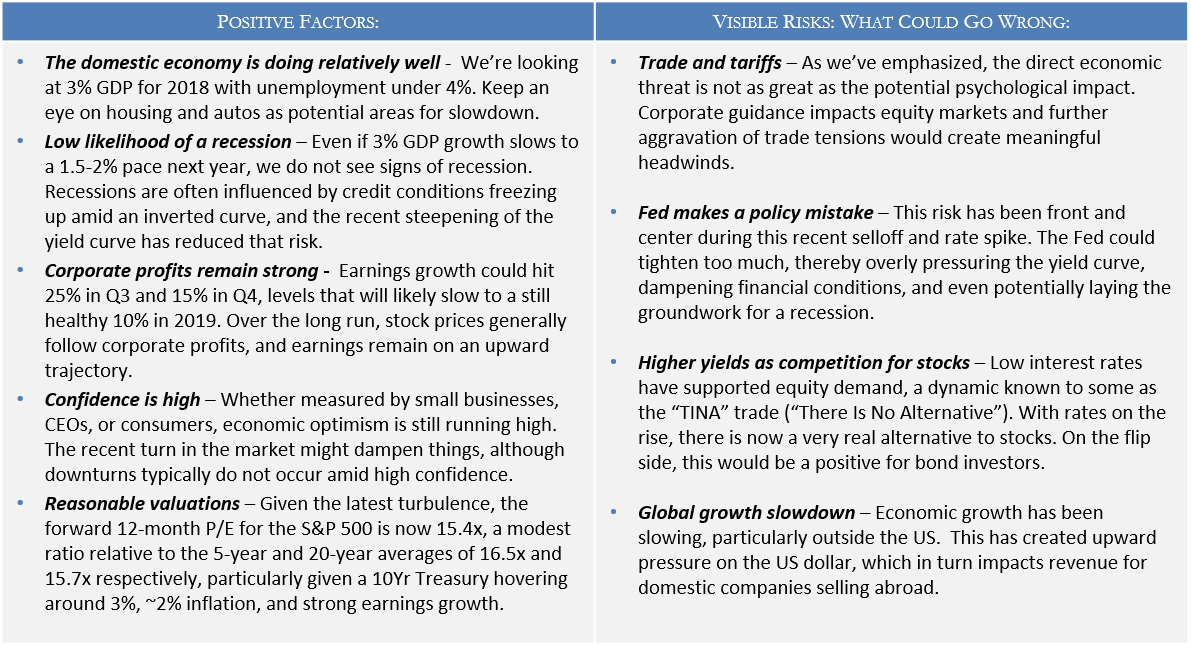

While unsettling, we believe this is a technical correction, not a breakdown of fundamentals. The US economy remains strong, with the first read on Q3 GDP showing 3.5% growth and unemployment still under 4%. While growth will likely slow in 2019, it is coming off a strong base, and we do not see signs of an imminent recession. The yield curve has not inverted, credit spreads are not stressed, leading economic indicators continue to trend higher, and confidence remains high. Housing and autos are slowing, and most of the developed world’s growth lags that of the US, but we’ve lived through these “growth scares” before, and feel the foundation remains solid.

As we’ve long emphasized, earnings ultimately drive markets, and robust bottom line growth has supported valuations for quite some time. More recently, rising interest rates, the impact of tariffs on input costs, and a stronger US dollar have investors fearing that we’ve seen “peak” earnings and potential margin erosion. Let’s not lose sight of the fact that Q3 surprised on the upside with blended earnings growth of +24.9% so far, well above the aggregate 19.3% estimate. Blended revenue growth is +8.5% and gross margin expansion is hovering just under last quarter’s record level of 12%. Will Q3 represent “peak earnings”? Likely so, although failing to exceed such elevated levels does not indicate economic weakness or give us reason for excessive concern. Earnings growth greater than 20% cannot continue in perpetuity. Valuation is much more supportive based on expectations for ~10% growth in 2019, and equity fundamentals remain favorable.

Investors have long been willing to step in and “buy the dip”, although this dynamic appeared to temporarily fade last month. An explanation for the recent lack of buyers is that corporations have been in buyback blackout periods which run from the end of their fiscal quarter until after earnings are reported. As the chart above reveals, companies have been a big source of equity demand, spending billions on their own stocks. The recent sell off in equities coincided with these blackout periods, thereby removing institutional demand. We expect companies to re-enter the market, especially given the recent pullback, a technical factor that could provide equity support.

So, where do we go from here? We agree with conventional wisdom that it’s a fool’s errand to attempt to predict market moves with any specificity. Instead, the Appleton team looks at fundamentally-driven data points and signals to help guide our decisions.

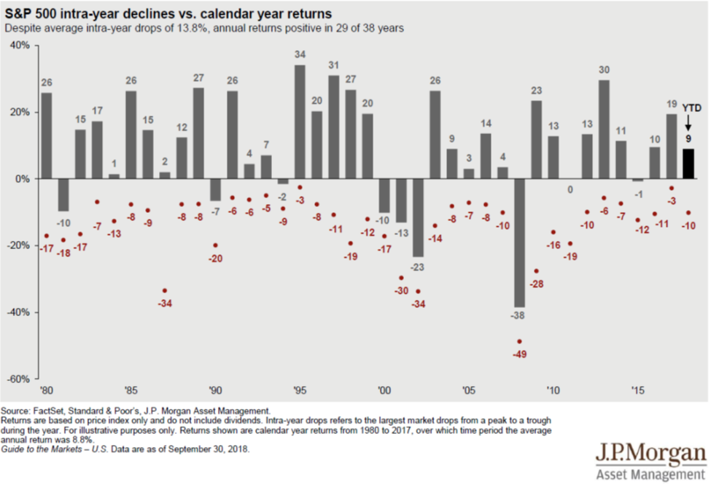

During stressful times, it is also very important to keep in mind that stock volatility is normal. We’ve added one of our favorite charts, courtesy of JP Morgan Asset Management, showing S&P 500 calendar year returns along with the largest drawdown in that given year.

From the Trading Desk

Municipal Markets

- Yields on the municipal curve moved higher during October, although slightly outperforming Treasuries, with the 10Yr ending at 2.70%. Upward pressure on longer maturities resulted in modest steepening, as the 2-10 Yr spread now stands at 65 bps, up from 61 bps at the end of Q3.

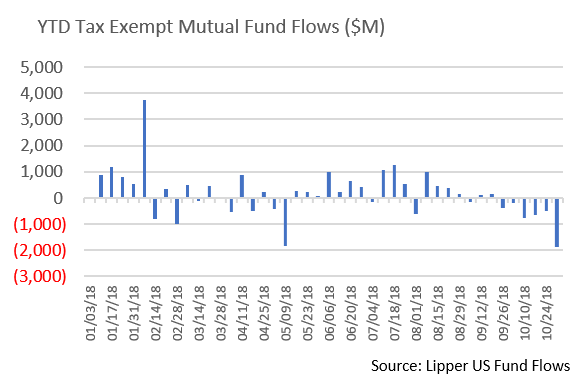

- Municipal mutual funds have experienced significant outflows over the past 6 weeks in the face of interest rate pressures and Fed speculation, bringing YTD net flows down to $6.9 billion from August’s high of $11.2 billion. However, this may not persist longer term as higher yields create more attractive income streams. We may also see increased foreign investment in munis, specifically originating from countries still experiencing very low sovereign debt yields. Foreign investors are attracted to the muni asset class for yield, diversification and low historical default rates. While these investors generally prefer taxable munis, tax-exempts are a viable alternative when the supply of taxable issues is limited.

- YTD issuance of $288.1 billion through the end of October is down 13.6% compared to the same period of 2017. And supply is expected to remain constrained, with 30-day visible sitting at just $5.6 billion as we approach shortened trading weeks due to the Midterm elections, Veterans Day and Thanksgiving. Tax loss harvesting accounts for a greater percentage of trading volume as year-end draws closer. While this environment creates trading challenges, we continue to look for opportunities to optimally position client portfolios.

Taxable Markets

- October began on solid footing, and Investment Grade credit spreads held tight as the market strengthened to levels that had not been touched since April of this year. On October 2nd, Comcast brought the second largest deal of the year and the fourth largest deal in IG history. Comcast’s $27 billion offering, which was slated to fund its Sky PLC acquisition, was well received and priced higher than initially thought. The relatively easy digestion of the deal was no surprise given strong demand and appetite for yield at the time. This too was the case for High Yield credit, as spreads in that market had not been as rich since July of 2007. A strong appetite for yield, a willingness to stretch for lower quality to obtain it, along with minimal new supply, contributed to solid high yield returns over the first 10 months of the year.

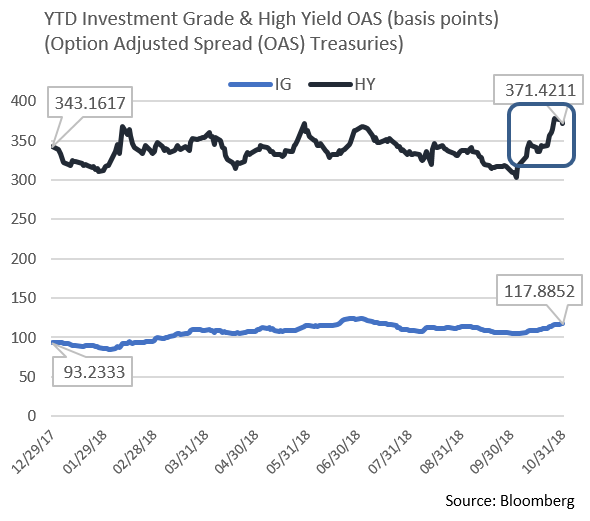

- This strong footing rapidly changed, becoming much more unstable as a “risk-off” sentiment began to materialize. Stock market volatility, heightened global macro risks, and a flight to safety characterized the last seven trading days, resulting in the worst performing October since the dismal days of 2008. As we have long emphasized, a flight to quality can happen very quickly, and the lower the credit quality the more rapidly this tends to occur. As the accompanying chart reveals, it took just 19 trading days to go from the low to high in High Yield spreads for the year, and the 22% change in spreads caught many investors off guard. However, the change in Investment Grade spreads was much more subdued. This recent shift highlights our preference for high quality investment grade credit, as we believe remaining “up in quality” is prudent, particularly as investors navigate global uncertainty, volatility, and rate shifts.

Financial Planning Perspectives

Year-End Tax Planning: Facts and Considerations

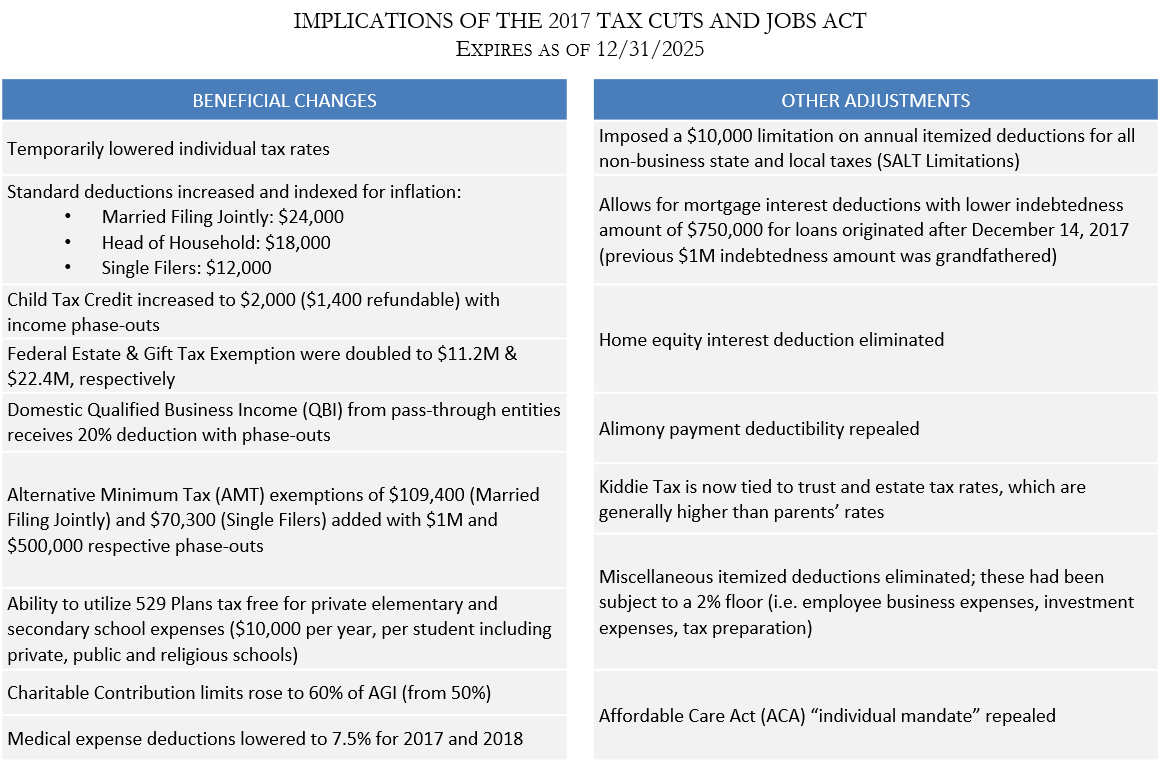

With the holidays and 2019 right around the corner, tax planning is kicking into high gear. Given the magnitude of last year’s tax law changes, we have fielded many client questions. Everyone’s tax situation is unique and there are no “cookie-cutter” answers. Nonetheless, we recommend considering several factors and encourage you to proactively consult with your tax advisor and Portfolio Manager.

Many elements of individual tax law did not change:

- Qualified dividends and capital gains tax rate (although 20% bracket was lowered)

- ACA taxes (3.8% net investment income tax and 0.9% Medicare Tax)

- Basis adjustment (step-up basis) upon death

- Marriage penalty for high earners

- Earned Income Tax Credit

- Credits for Adoption and Education

Common client inquiries include whether to add tax withholding and/or make higher estimated tax payments. This is a difficult question for us to answer without a detailed assessment of case specifics. However, the IRS has posted a withholding calculator to assist in estimating your 2018 tax liability. The website can be found at: https://apps.irs.gov/app/withholdingcalculator.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]