Insights and Observations

Economic, Public Policy, and Fed Developments

- The Democrats’ sweep of both Georgia Senate seats on January 6th has increased both the likelihood and size of a third COVID-19 stimulus bill. Stimulus negotiations are ongoing, with Biden seeking $1.9 trillion, including aid for state and local governments, continuing unemployment benefits into the Fall, a $15 minimum wage, and an additional $1,400 stimulus check. The GOP has countered with a pared down $618 billion bill omitting most of those features, and with more targeted $1,000 stimulus checks. Despite a “productive” meeting with Republican negotiators, the Democrats are seeking to pass Biden’s proposal via budget reconciliation. With Biden wanting to demonstrate bipartisanship, while also protecting economic growth and appeasing progressive concern he will be too quick to compromise, we see a compromise stimulus bill closer to Biden’s plan than the GOP’s as the likely outcome.

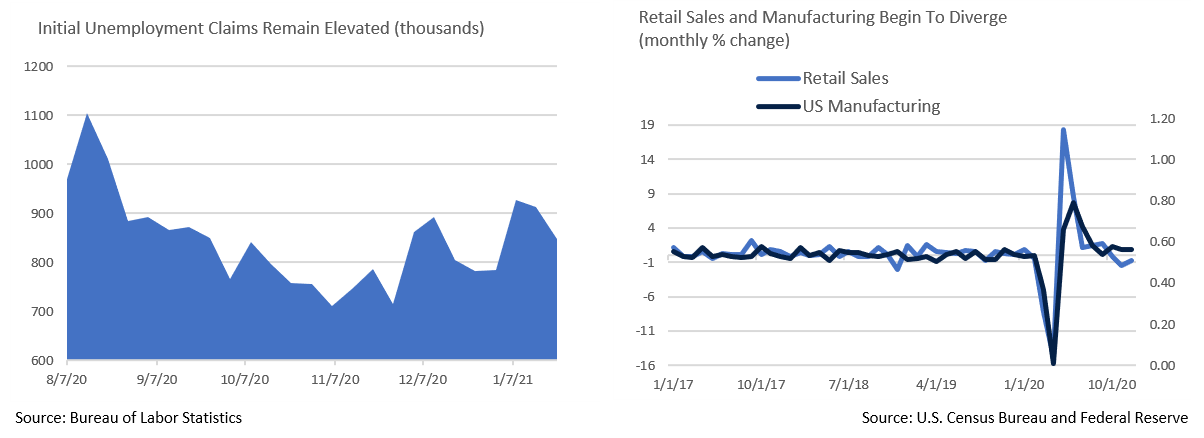

- Unemployment data remains disconcerting; new claims have modestly trended downward over the course of the month from a very high base, falling from 926k the first week of January to 847k the week of the 23rd. Encouragingly, a good number of states reported fewer layoffs in manufacturing, food services, and hospitality. However, the four-week moving average of 868k remains the highest since 1967, as far back as records exist, and is deeply concerning.

- Retail sales disappointed in December, coming in at -0.7% vs. flat expectations, while November was revised downward to -1.4%. Retail sales closed 2020 up 0.6%, the weakest reading in 11 years. Meanwhile, US manufacturing rose more than expected in December at +0.9%, with total industrial production rising the most in five months. Retail weakness and manufacturing strength is not a sustainable combination and leaves us skeptical of a near-term surge in inflation after unprecedented monetary and fiscal stimulus. Demand appears in no danger of exceeding supply anytime soon. Indeed, ISM Manufacturing unexpectedly declined in January, and while evidence of production bottlenecks was at part to blame, large declines in new orders and production are worrying.

- Janet Yellen returns to Washington after being confirmed 84-15 as our first female Secretary of the Treasury. We welcome her confirmation and view it as supportive of the financial markets. Yellen’s tenure at the Federal Reserve revealed her to be generally dovish and highly capable.

- After several Federal Reserve officials spoke openly about scenarios that could lead to a tapering of asset purchases in the first half of January, Chairman Powell aggressively clamped down on speculation, saying it was “not the time to be talking about an exit”. Any discussion of such a move, much less the move itself, would be telegraphed well ahead of time. The Fed is clearly signaling that short term rates will remain on hold until the US economy returns to “full employment” (likely under 4% unemployment), and inflation exceeds the Fed’s 2% mandate on a sustained basis (likely measured by a 12-month trailing average of 2-3%).

- There were few surprises in Q4’s GDP report – the initial release came in at 4.0%, slightly below 4.2% consensus. Highlights include Core Personal Consumption Expenditure (PCE) inflation slowing more than expected, from 3.4% to 1.4%, business equipment investment and private residential investment strength, and solid Final Sales to Private Domestic Purchasers growth of +5.6%. Goods consumption declined modestly but was offset by strength in services consumption. Private inventory growth contributed +1.04% to the top-line GDP growth rate, as retail spending and consumption slowed during a period of manufacturing strength. Our base case is further modest GDP deceleration.

Equity News and Notes

A Look at the Markets

- Stocks had been off to a good start to 2021, enjoying a post-election rally until the final days of January. The S&P 500 then dropped -3.3% over the last week of the month leaving the index with a -1% YTD return. The tech-heavy Nasdaq, small cap Russell 2000, and emerging market indices all fared better, gaining 1.4%, 5.0%, and 3.1% respectively.

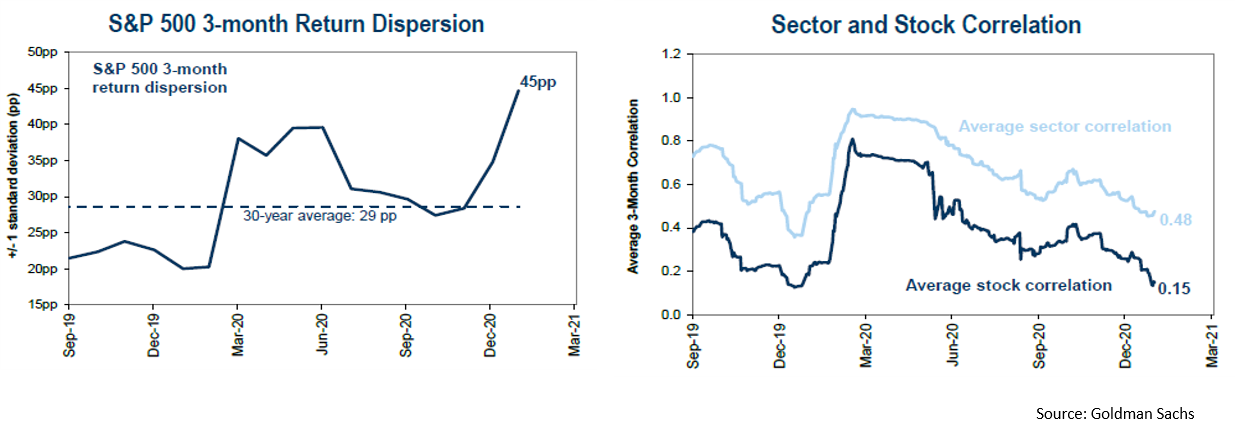

- Underlying sector performance has varied considerably. Through the first 14 trading days of the year, Energy (+11.0%) was the top performing sector, nearly 15% better than Consumer Staples (-3.8%). Wide performance divergence isn’t confined to sectors. Individual stock correlations have hit multiyear lows, as S&P 500 stock dispersion reached its highest level since 2009. A stock picking environment is welcome as it provides an attractive backdrop for active managers.

- Although less than half of S&P companies have reported Q4 earnings, the results so far have been very encouraging. Nearly 84% have beaten consensus analyst estimates, which would be the second highest quarterly reading since 2008. Not only are most companies beating estimates, they are doing so at an above average rate of 13.6%. This has driven Q1’s consensus blended earnings growth rate to -2.8%, well above the -9.3% estimate in place at year-end. We have long emphasized that valuations need to be justified by earnings, and strong bottom- line momentum is unequivocally positive. However, investor expectations are also running high and certain stocks have traded down after beating expectations, a development that bears further scrutiny.

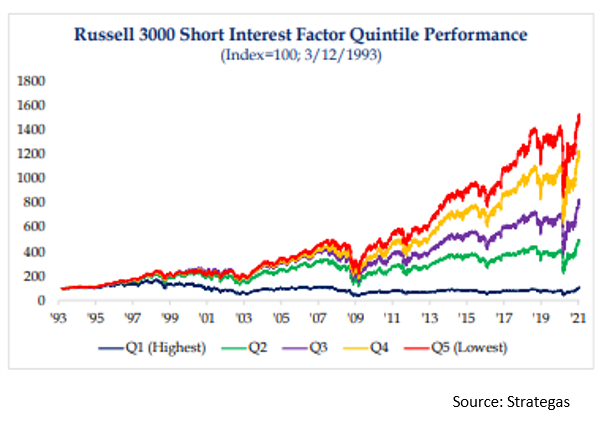

- A bizarre but notable recent story has been the incredible surge in select struggling and heavily shorted stocks, including GameStop, AMC Entertainment and Blackberry. This was a short squeeze for the ages with social media mobilized traders targeting certain stocks held by hedge funds. The strange price momentum of these names has no real basis in business performance, but it did garner considerable attention. Speculation is hardly new to markets, although the magnitude of recent gains (which began rapidly melting away as we wrote on Feb. 2nd), and this episode’s populist roots are a relatively new phenomenon. However, we do not see systemic risk even though some hedge funds have had to sell long positions to cover short losses.

- Recent turbulence was not fundamentally based and has not dented the equity market rally’s foundation: economic recovery, fiscal stimulus, vaccine optimism, an accommodative Fed, the TINA trade, stable credit conditions, and improving corporate earnings. Lastly, while short squeezes can prop up stocks with heavy short interest, the strategy typically hasn’t panned out over the long run. The chart below demonstrates that stocks with the highest short interest have lagged those with less interest by a wide margin over nearly 30 years.

From the Trading Desk

Municipal Markets

- The story remains largely the same in the municipal market. Demand is unabated with $13.8 billion of January net mutual fund flows. Supply limitations persist, thereby maintaining technical conditions highly supportive of the market.

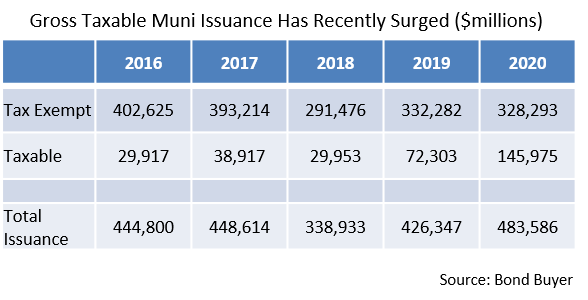

- $24 billion of new debt was issued this past month, a 27% decline vs. $32.7 billion in 2020. Forward issuance expectations have not yet increased, with Bond Buyer 30-day visible supply sitting at a modest $10 billion. However, many market analysts are predicting a surge later in 2021 as municipalities take advantage of low interest rates to finance deferred projects and fortify budgets. Street analysts are generally looking for an increase in new tax-exempt supply relative to 2020. This would be welcomed as we look to deploy client capital.

- As President Biden’s agenda moves ahead there may be a push to bring back tax-exempt advanced refundings. They were eliminated as part of the 2017 Tax Cuts and Jobs Act and heavily influenced last year’s surge in taxable municipal issuance, some of which came at the expense of tax-exempt supply. We favor a reversal of the refunding restriction and feel it is a distinct possibility given very modest budget implications that would need to be factored into a Congressional negotiation process.

- The front-end of the municipal curve has been stable and we do not expect much structural change given the Fed’s commitment to maintaining accommodative monetary policy. A degree of steepening of the longer end of the curve is more likely over the course of 2021.

- The 2Yr AAA muni/UST ratio began February at 100%, whereas a rise in UST yields has contributed to a decline in the 10Yr AAA muni/UST ratio to a tight 65%. We concur with market analysts who recently expressed expectations that ratios will drift up over coming months but likely remain below 100%.

Corporate Bond Markets

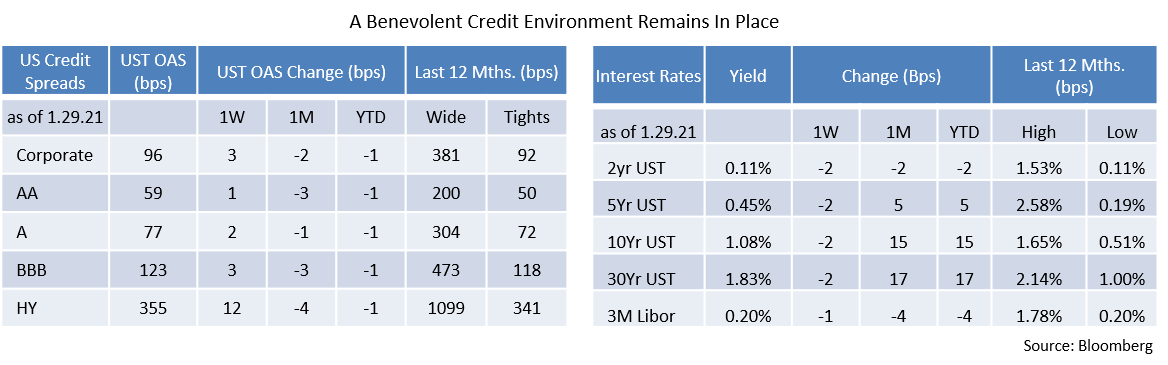

- Investment Grade credit market conditions remain buoyant, with investor risk appetite and demand for income intact. Economic confidence is backed by optimism concerning vaccine distribution and a Federal Reserve firmly committed to recovery and highly supportive of the capital markets.

- Along with consistent foreign buying, retail demand for corporate credit has not changed, with January posting $26.6 billion of net cash flow into mutual funds. Investment grade spreads remain tight, closing the month just 1 bp wider than where we ended 2020.

- The search for income is perhaps most evident in the High Yield market with lower quality names outperforming on the month. High Yield issuers have taken note and brought $52 billion of new debt to market in January, the 3rd largest month of issuance on record. Low UST yields and a largely “risk on” environment have enabled high yield spreads to reach historic lows. Yields on the lower quality CCC bucket tightened by 21bps points in January and the overall High Yield index touched a record low of 4.10% before closing the month at 4.31%.

- While we are encouraged by the sustained strength of the corporate credit markets and do not see demand significantly diminishing anytime soon, the risk premium is rather low. Staying up in credit quality is advisable.

Financial Planning Perspectives

Dissecting Recent Tax Law Changes – What Might Impact You

Although 2020 was a year of turmoil most of us would gladly forget, it did introduce significant federal legislation offering considerable taxpayer relief. As we approach tax season, let’s review changes made effective for 2020 and beyond.

On January 1, 2020, prior to the onset of COVID-19 crisis, the Setting Every Community Up for Retirement Enhancement (SECURE) Act was implemented. As we wrote about later that month in Review and Outlook, major provisions of the SECURE Act included:

- an increase to the required minimum distribution (RMD) age to 72 for those individuals who did not attain the age of 70 ½ prior to December 31, 2019;

- a repeal of age limitations on Traditional IRAs, enabling continued contributions after age 70 ½ for those with earned income;

- elimination of the popular “Stretch IRA” by requiring funds to be withdrawn from IRAs ten years following the death of the IRA owner (with exceptions for “eligible beneficiaries”) beginning in 2020; and

- allowing up to $10,000 in a 529 Educational Savings Plan to be used for payment of student loan debt.

Just as taxpayers were digesting the new SECURE Act provisions, COVID-19 turned the world upside down. The Coronavirus Aid, Relief and Economic Security (CARES) Act was subsequently enacted in March. The CARES Act, in addition to monetary and financial relief to individuals and businesses:

- provided penalty free and favorable tax treatment of Coronavirus Related Distributions (CRDs) from retirement accounts for taxpayers directly impacted by COVID-19;

- suspended 2020 RMDs for 401(k) plans and IRAs with a limited ability to return 2020 RMDs (eventually all distributions were made eligible to be rolled back into the account if done so prior to August 31, 2020); and

- increased 401(k) loan limits to $100,000 from $50,000 subject to account balances and prior loans outstanding.

As outlined last month, the Consolidated Appropriations Act, 2021 was signed into law on December 27, 2020, another in a series of federal responses to the pandemic. Along with extended unemployment insurance and financial assistance to qualified taxpayers, the Act:

- offered a $300 income tax deduction ($600 if married filing jointly) for 2021 charitable contributions made by non-itemizing taxpayers;

- extended through 2021 modified charitable contribution limits for itemized deductions (100% deductibility of cash donations to public charities); and

- permanently established a 7.5% of adjusted gross income (AGI) threshold for deducting medical payments, down from a previously scheduled 2021 increase to 10%.

It is also important to note that for 2021:

- RMDs are not waived for 2021, but will now begin at age 72;

- Qualified Charitable Distributions (QCDs) from IRAs are allowable up to $100,000 for those ages 70 ½;

- IRA contributions may continue to be made beyond age 70 ½ subject to earned income;

- Coronavirus Related Distributions (CRDs) are no longer allowable; and

- The Kiddie Tax Version of the Tax Cuts and Jobs Act has expired.

As we look ahead, it is expected that SECURE Act 2.0 will be enacted in some form. President Biden’s initial $1.9 trillion proposal faces considerable GOP resistance, although negotiations are taking place. Regardless of how this plays out, we anticipate there will be financial planning impact and will inform our clients accordingly.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]