Insights and Observations

Economic, Public Policy, and Fed Developments

- Geopolitical turmoil took center stage in February when Russia invaded Ukraine on the 24th. From Ukrainian president Volodymyr Zelenskyy’s now-famous “I need ammunition, not a ride,” to millennials posting tutorials to TikTok on how to operate abandoned Russian tanks, the courage and resolve of Ukrainians has captured global imagination and we share hopes for peace, preservation of Ukraine’s national sovereignty, and protection of her citizens.

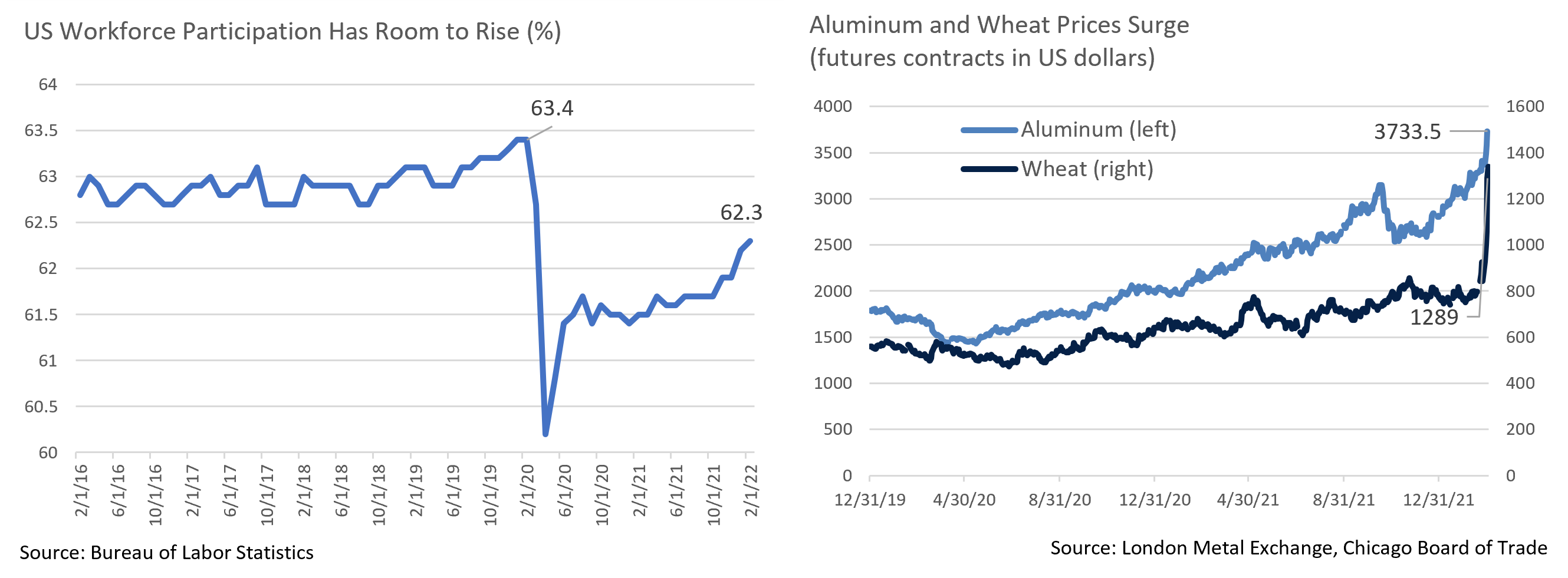

- The ensuing risk-off trade reversed recent Treasury weakness and pulled yields back below 2%. Prices have been rising for some time in commodities where Russia or Ukraine are major players as oil crested above $130/barrel, aluminum reached all-time highs, and corn and wheat – Russia and Ukraine together produce 20% of global supply – rose on supply disruptions. The near-term impact of war is likely to be inflationary, even though longer term its effects are less certain.

- Ironically, despite this initial inflationary bias, market expectations for Fed Funds rate hikes began to reverse and fall after war broke out. We believe this was driven by a diversion in the market’s attention rather than any fundamental reassessment of inflation risk, as the rate hike trade had gotten increasingly crowded in recent weeks. Chairman Powell’s remarks on March 2nd committing to a hike at the March meeting stabilized the markets somewhat but the initial reaction is one more reason to think Fed Funds rate expectations are currently too aggressive.

- The CPI print at the start of February surprised to the upside, +0.6% vs. +0.4% on a monthly basis and +7.5% vs. +7.2% annually. The details were not as bad as the headline suggests; a downtrend in monthly prints is still – barely – in place, and most of the upside surprise was driven by pandemic-sensitive categories. Less related categories such as owner’s equivalent rent remain stable though elevated relative to historical norms, something that demands close attention in coming months.

- While retail sales began the month by surprising to the upside at +3.8% vs +2.0%, this report is heavily biased towards goods spending, and came on the back of downward December revisions from -1.9% to -2.5% and in November from +0.7% to +0.2%. January’s nominal level of retail sales was not much higher than expected despite a large monthly increase. Weak restaurant and bar sales suggested January’s strength may have been driven by Omicron diverting spending from services to goods.

- Consumer spending and personal income reports at month-end provided further evidence of this substitution; while goods consumption was strong at +4.3% (+21.3% in auto spending as supply chains improved), services growth was nearly negligible at +0.1%. Flat income growth due to child tax credit expirations offsetting wage increases influenced a savings rate decline from 8.2% to 6.4%, the lowest level since 2013. With a falling savings rate, current levels of spending are not sustainable without workforce growth.

- The BLS jobs report released on March 4th came in unexpectedly strong, 678k new jobs vs. expectations of 423k. Typically, upside surprises like this are considered evidence of a too-hot economy, however with the labor force still nearly 1.2 million below February 2020’s peak, last month’s combination of strong jobs momentum, labor participation growth, and flat wage data is likely to take some pressure off the Fed. Although we do not believe it will reduce the likelihood of a March rate hike, higher labor participation should ultimately help moderate inflation.

Equity News and Notes

A Look at the Markets

- Stocks were mostly in the red in February in the face of geopolitical turmoil as the S&P 500 suffered its first back-to-back monthly declines since Fall of 2020. The Index fell 3.0% bringing YTD total return to -8.0%. Nasdaq was an underperformer declining -3.4%, with Energy the sole positive S&P 500 sector at +7.1%.

- The Russian invasion of Ukraine on February 24th was preceded by an earlier S&P 500 anticipatory sell-off, and the market initially rose 4% off its low once hostilities began before turning downward. Ongoing daily swings reveal just how fluid the situation is and how vulnerable markets are to headlines. We cannot predict how this tragic conflict ends or its ultimate economic impact, although direct US economic exposure outside of energy is minimal. Ripple effects that cause us angst lie in the inflationary impact of oil (now >$130/barrel) and commodity prices. The European Union’s greater economic vulnerability is also of concern. While not yet evident, energy related demand destruction, credit market instability, and a significant run-up of the US dollar would be red flags.

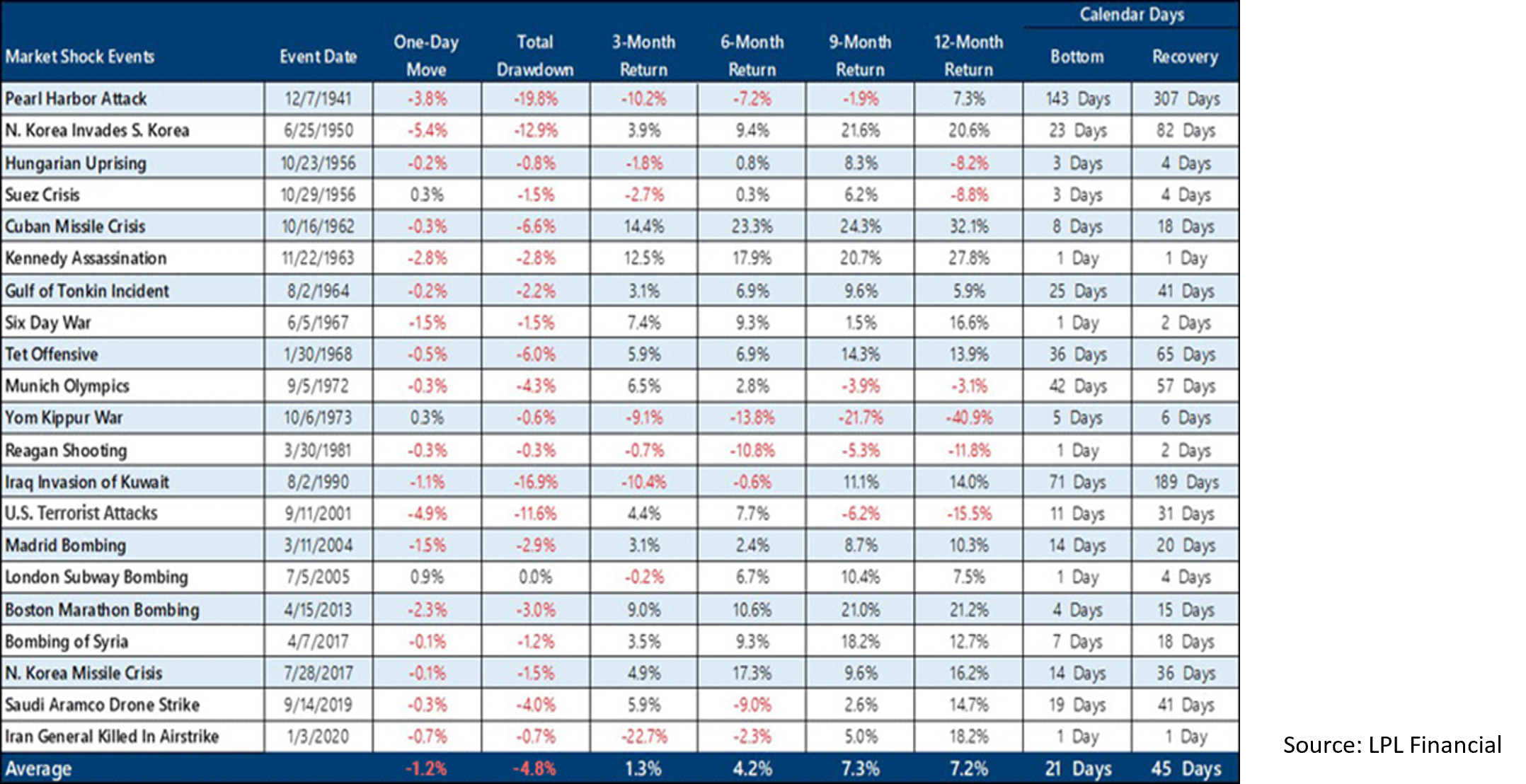

- Geopolitical crises impose an immeasurable humanitarian toll, yet market impact is typically much more muted. Historically, stocks have suffered short, steep drops only to recover in the following weeks and months. We advise clients not to make investment decisions based on geopolitical events, and to instead focus on risk tolerance and asset allocation strategy.

- Leading up to the Ukraine conflict, the market had been aggressively pricing in Fed rate hikes, with the odds of 50bps in March hitting 100% and 6-7 hikes expected by December. The expected pace has since moderated due largely to fallout from the Russian invasion. Chairman Powell recently testified that he only backs a 25bps hike in March and feels a “soft landing” is achievable, comments that soothed the equity markets. Policy normalization is easier said than done, although the Fed is acutely aware of the risk of policy error.

- Despite tightening financial conditions, the Fed is not likely to move as aggressively as many anticipate given a likely easing of inflation and economic growth. We expect the Fed to move off of emergency monetary policies yet remain accommodative. Valuation multiples have already fallen, with the S&P 500’s forward P/E declining from 21.3x to about 18.5x. Despite rough patches, equities should regain their footing as 2022 plays out and produce modestly positive returns.

- Stocks were not the only asset class to suffer YTD losses. Fixed income vehicles, whose prices are negatively correlated with interest rates, also dropped as the 10Yr UST yield rose from 1.51% at year-end 2021 to 1.82% at the end of February. This contributed to 60/40 balanced portfolios losing about 5% YTD on average, just the 4th time over the last decade a two-month drawdown of this magnitude has occurred. Amid a long falling interest rate cycle, investors have become accustomed to stock and bond prices moving in opposite directions. Over the long term, negative correlation is the norm, although much shorter period correlations can be positive in either direction. We expect volatility to persist but remain confident in the value of well-structured asset allocation strategies.

- As the year moves on, the US economy should be bolstered by a healthy consumer, low unemployment and rising wages, a strong housing market, and ample liquidity. COVID-19 trends have improved considerably, and restrictions are rapidly receding. Corporate balance sheets remain formidable which should lead to buybacks, M&A, and dividend increases. Earnings are also expected to grow, albeit at a more moderate pace.

From the Trading Desk

Municipal Markets

- Over the course of the month, AAA municipal yields rose, and the curve flattened. The short end of the curve increased 16bps despite lagging USTs, while the 10Yr AAA increased a much more modest 3bps. The spread between 2s and 10s began February at 64 bps but narrowed to 52 bps by month’s end. The yield curve reaction we saw is to be expected given a high likelihood of forthcoming Fed Funds rate hikes.

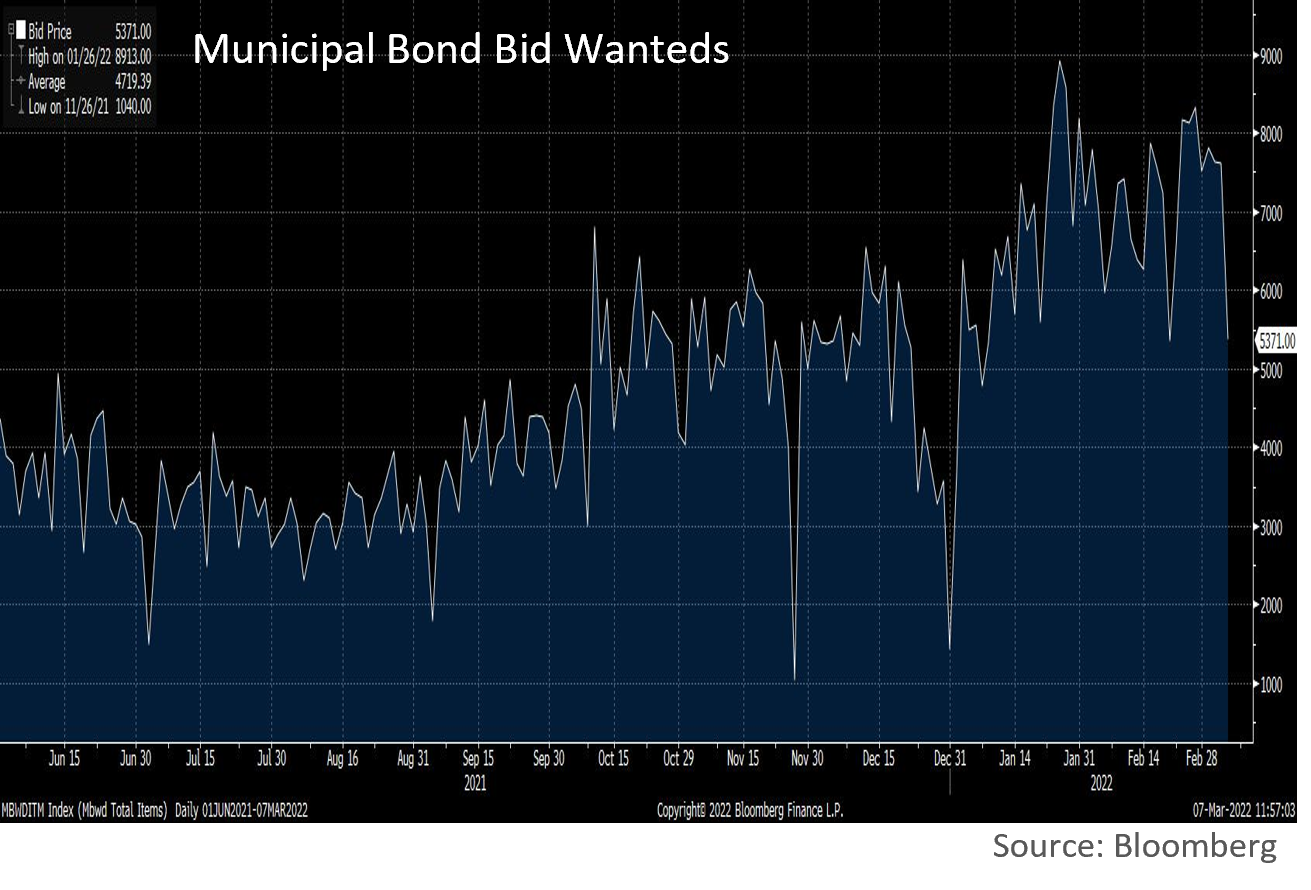

- Bloomberg reports a significant increase in the number of bid wanted items this year, with a daily average of 6,723 up sharply from the prior year’s average of 4,126. An increased volume of bonds out for bid is often a reflection of market volatility, and we see opportunities for tax-exempt investors.

- Retail investor sentiment has been impacted by inflation and rate concerns, as evidenced by an 8th consecutive week of mutual fund outflows. We started 2022 with a week of inflows, although since that time net outflows have totaled almost $12.6 billion. April tax payments typically contribute to relatively weak flows during March and April, a dynamic that is likely to extend the recent demand downturn. Although this may add to upward yield pressure, more attractive values are becoming available in quality bond issues we like from a credit standpoint.

- The 10Yr AAA municipals/UST ratio is a common relative value indicator and can influence investors attempting to hedge their exposures. Municipal yields are significantly impacted by supply and demand dynamics along with the direction of USTs and are thus generally slower and less reactive than USTs. In times of increased volatility, as UST yields are moving, the 10Yr AAA ratio also tends to be volatile. We have seen this recently given flight to quality trading in USTs. Recently elevated ratios should dampen the impact of rising UST yields on municipals.

Corporate Bond Markets

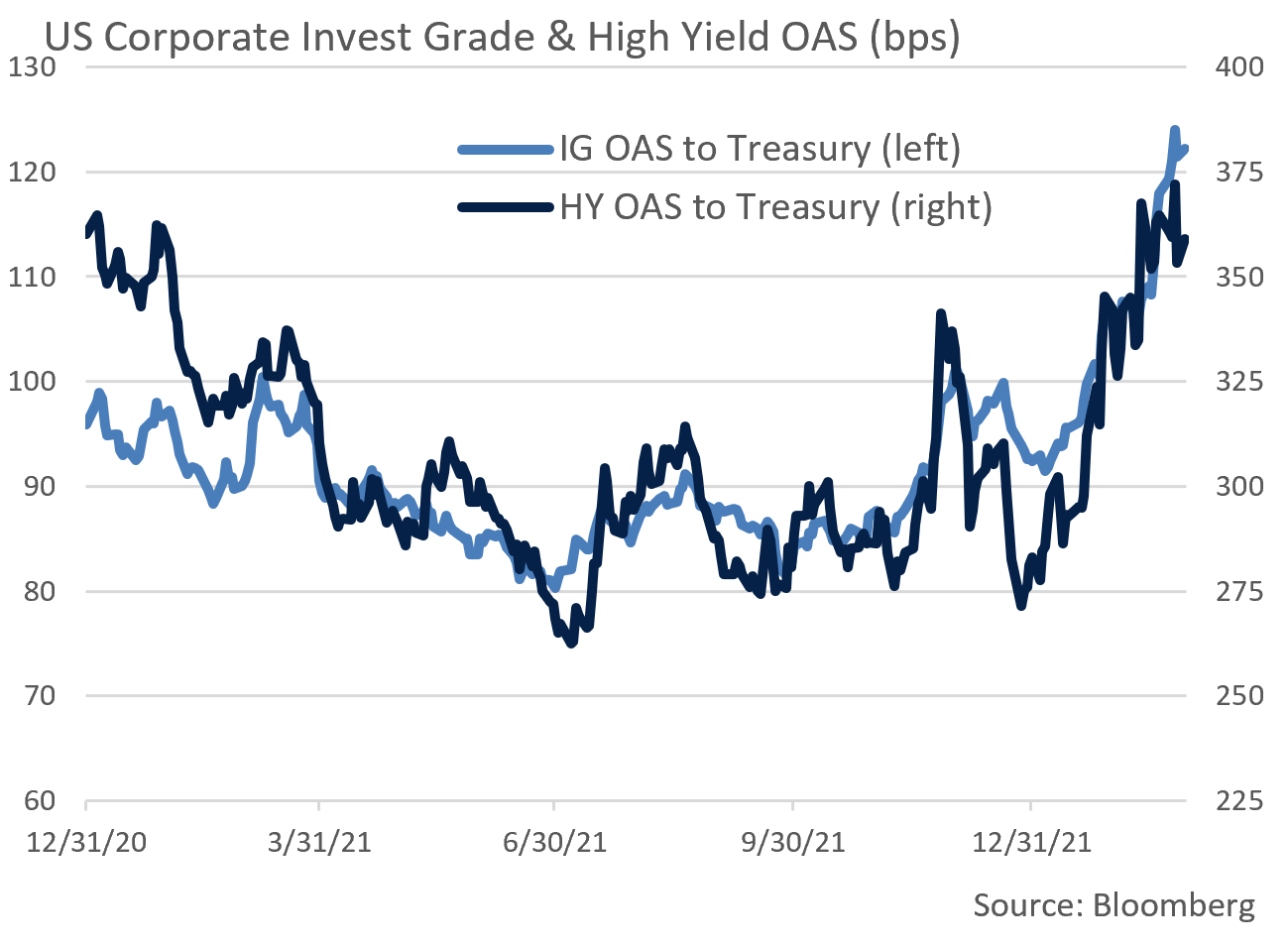

- Given an almost unimaginable geopolitical crisis in the Ukraine, a risk-off tone was not surprisingly a catalyst for Investment Grade and High Yield corporate credit spread widening. A muted move in IG spreads at the beginning of the month accelerated by the second week as events in Eastern Europe unfolded. OAS widened by 19 bps on the month, ending at 124 bps, the widest levels since November of 2020. As is often the case, lower quality bonds experienced the greatest spread movement and, with just over 50% of the Bloomberg Barclays US Corporate Bond Index comprised of lower quality names, benchmark performance was impacted. We anticipate spreads stabilizing over coming weeks given a still solid economic and corporate credit outlook, although we share concern about the implications of war in Ukraine.

- In this environment, the primary market has recently experienced ebbs and flows of supply and demand. Current uncertainty and volatility has pressured corporate issuers to find opportune times to come to market. Last month’s $84 billion of new IG supply fell well short of expectations, and the price concessions required to sell bond offerings were noticeably higher. Credit spread stability likely requires the primary market to regain its footing.

- Street consensus for March supply of roughly $150 billion may not be reached if market tone remains risk averse. Historically, major geopolitical events are highly unsettling but tend to be relatively brief. If that once again proves to be the case, we anticipate an above average Q2 issuance calendar with spreads and market demand regaining traction.

- Within our High-Grade Intermediate Government/Credit strategy, the extent to which duration changes as interest rates move, also known as convexity, tends to be modest. This has historically helped mitigate risk, largely due to our emphasis on higher coupon bonds and intermediate curve positioning. In times like these, we are diligently focused on high quality credits and maintain a long-term investment horizon.

Financial Planning Perspectives

Qualified Charitable Distributions

As mentioned in January’s Financial Planning Perspectives, there are many ways to pursue charitable giving objectives. Your team at Appleton can help you evaluate how best to accomplish your goals in an efficient, tax advantaged manner. A common method that many of our clients have used involves Qualified Charitable Distributions, or QCDs. Here are some of the principal benefits, as well as common mistakes, associated with QCDs.

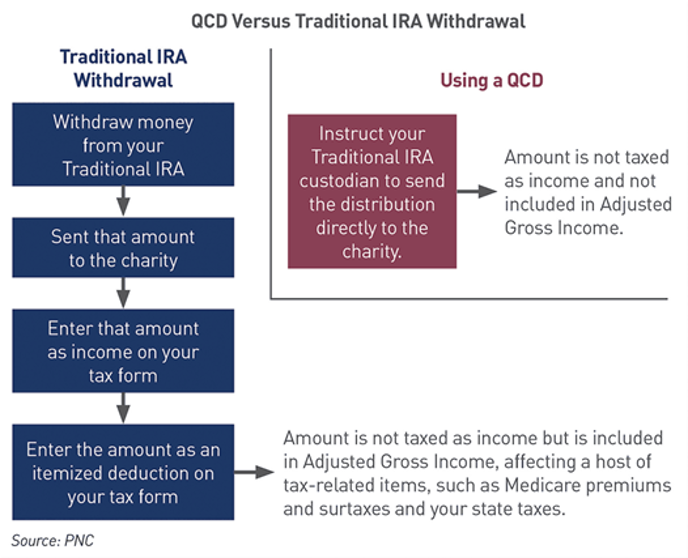

Distributions made from a Traditional IRA or Traditional Inherited IRA are typically taxed as ordinary income. This can become burdensome for those with large Required Minimum Distributions (RMDs). Qualified Charitable Distributions offer an ability to transfer RMDs directly to a qualified charity on a nontaxable basis, provided the following conditions are met.

- You must be age 70½ or older.

- A maximum of $100,000 per year is allowable.

- The donation must come directly from your IRA. You cannot withdraw funds from the IRA, deposit them into a checking account, and then make the donation.

- Private grant-making foundations, donor-advised funds, and charitable gift annuities do not count as qualified charities.

- You cannot receive anything in return for making the donation, not even a tee shirt or tote bag.

- A donation classified as a QCD cannot also be classified as a charitable deduction.

Several common mistakes concerning Qualified Charitable Distributions ought to be noted.

- First dollars out rule

- You cannot take your full RMD and then decide to make a QCD after the fact. If the goal is to offset the income from an RMD, the RMD must be done in conjunction with the QCD

- Timing of donations made by check

- To qualify for nontaxable status, QCDs must be cashed within the applicable tax year. It does not matter if a check was written during the tax year, it must also be cashed during that tax year.

- Deductible Contribution

- IRA owners may be allowed to make deductible contributions to an IRA at any age under the provisions of the SECURE Act (provided they do not exceed income limitations), so long as the owner has earned income. If you make a deductible contribution, your QCD will be taxable, dollar for dollar.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]