Insights and Observations

Economic, Public Policy, and Fed Developments

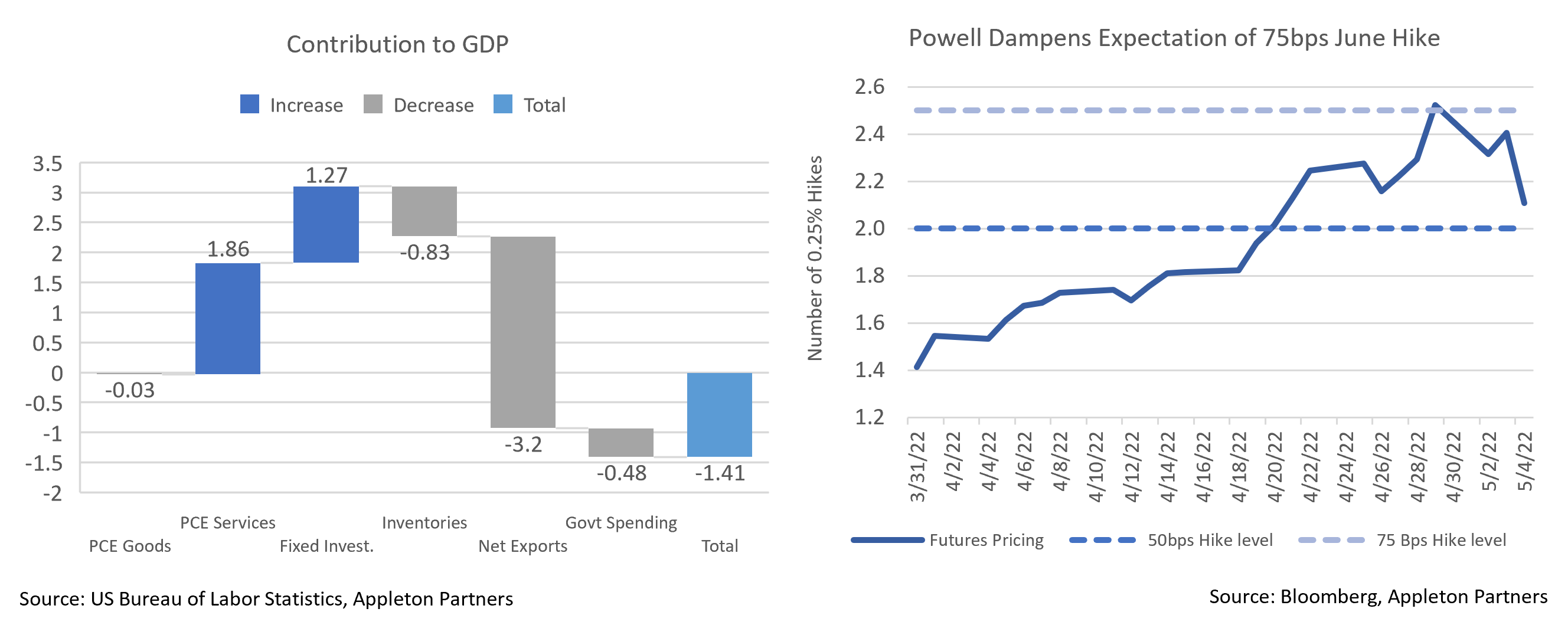

- The Q1 GDP report released at the end of April shocked markets expecting a slowdown to +1.0% by contracting 1.4%. While the headline figure sparked talk of recession, the details of the GDP report were somewhat stronger. With the US recovery outpacing the rest of the world and domestic demand stronger than foreign, a record trade deficit detracted 3.2% from growth, while a buildup in Q4 inventories essentially moved 0.84% of growth from Q1 into the prior quarter. Final sales to domestic purchasers, a good proxy for underlying demand, strengthened from +1.0% to +2.6%, suggesting the economy continues ticking along, and we do not expect this to be the first quarter of a recession.

- That said, inflation is clearly weighing on consumers. Inflation-adjusted income dropped 2% in the GDP report, the fourth consecutive quarterly decrease, and consumer spending came in at the lower range of projections at +2.7%. The personal savings rate also dropped from 7.7% to 6.6%, and consumer use of revolving credit facilities rose at an annualized +20.7% rate, as consumers deferred saving and turned to credit cards to support current consumption. Accordingly, March’s retail sales report missed, +0.5% vs. expectations of +0.6%. We do not expect Q2 to show a further GDP contraction, but we are concerned about growth prospects in the second half of the year and into 2023 and think the Fed may struggle with its planned pace of hikes.

- While cooling demand would normally take pressure off inflation, the supply picture is worsening as well. China’s “Zero Covid” policy has produced sweeping lockdowns crippling mainland Chinese cities representing more than 40% of the country’s economic output. Chinese manufacturing and nonmanufacturing PMIs fell to the lowest levels in two years, at 47.4 and 41.9 respectively (values below 50 represent contraction). It may take some time for these lockdowns to begin impacting US prices, but some of the recent improvement in chip supply is likely to reverse by the summer.

- Given this backdrop, the Fed’s 50bps short term rate hike announced after Wednesday’s meeting was a foregone conclusion. Instead, the market reaction was primarily driven by changes in outlook. The pace of quantitative tightening outlined by the Fed was slower than expected, starting at a runoff cap of $30 billion a month, and rising to $60 billion after three months. Participants had instead expected increases every month. Taken with the Treasury’s earlier announcement of cuts in its quarterly debt sale, the third consecutive quarterly decrease, the market will have a smaller supply of Treasuries to absorb later in the year than had been expected.

- Chairman Powell used his press conference to downplay the possibility of a 75bps hike at the next meeting in June, one market participants had increasingly begun to contemplate in recent weeks, noting inflation was being driven by supply shocks and the Fed’s policy tools were demand-oriented. After several consecutive FOMC meetings where the Fed surprised to the hawkish side, this may be the beginning of a more dovish tilt as the Fed becomes concerned with growth. Treasury yields fell after the meeting, particularly at the front of the curve.

- The May 6th jobs report also bears watching. Weekly new unemployment claims data bounced off recent lows but are continuing to trend downwards, implying a tight labor force. A strong BLS employment report, particularly with an uptick in the participation rate, would be an encouraging sign, suggesting workers are returning to the workforce.

Equity News and Notes

A Look at the Markets

- April brought more than showers as the S&P 500 fell 8.7%, its worst April performance since 1970. The Index is now down 12.9% YTD, the weakest start to a year in the post-WW2 era. Nasdaq fared even worse, posting a -13.2% return for the month and -21% YTD. Selling was broad based with only the defensive Consumer Staples sector finishing with a positive return.

- The path of least resistance has clearly been to the downside for well documented reasons: a Fed-led global monetary policy shift, surging inflation, recession fears, and a relentless Russian war against Ukraine. China’s “Zero Covid” policy has also aggravated already strained global supply chains and threatens to curtail growth in the world’s 2nd largest economy. A contrarian would note that China’s stance could have deflationary impact on industrial commodities while inducing the Chinese central bank to ease monetary policy. Such a development might offer a tailwind for risk assets.

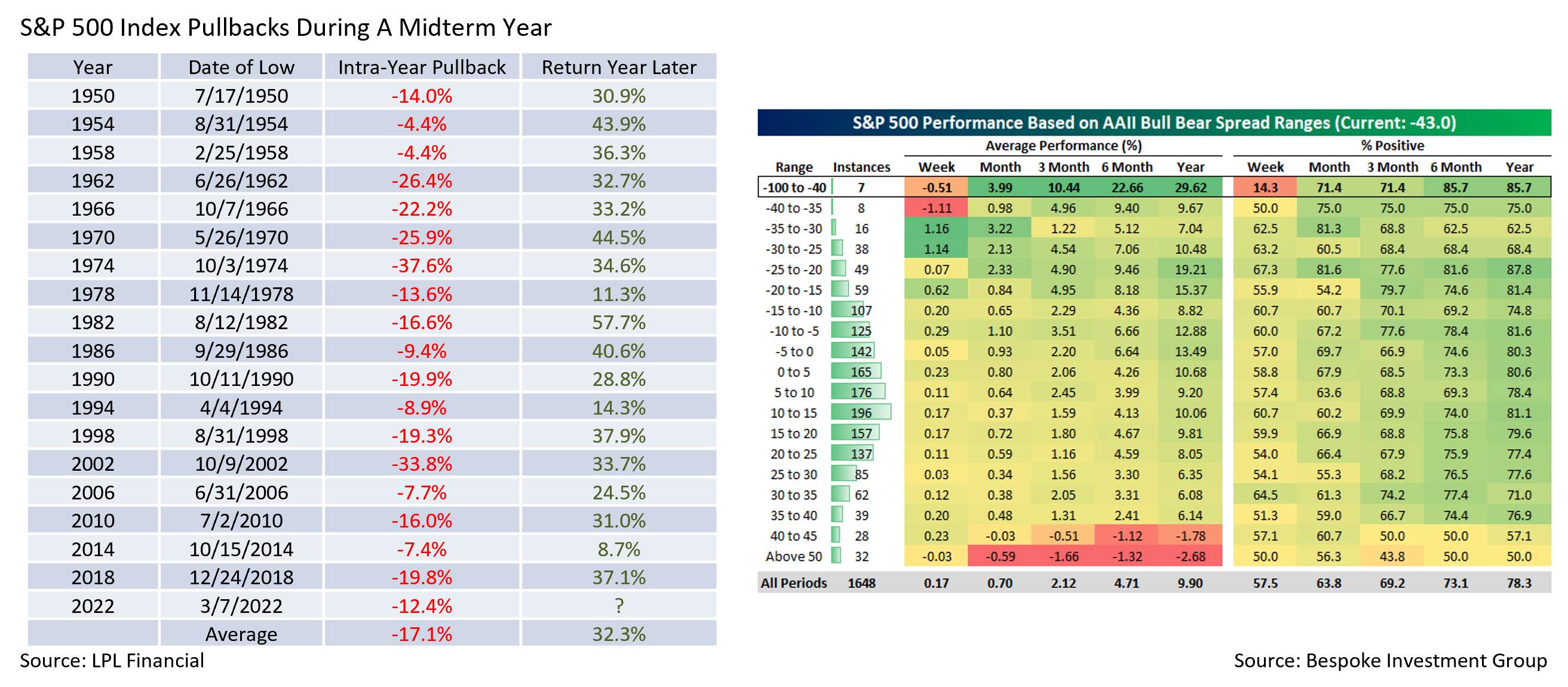

- Recent downside volatility has left us at the lower end of the year’s equity market trading range. Several indicators suggest a tradable low may be near, although bottoms are almost always visible only in hindsight and V-shaped recoveries are rarely the norm. The S&P 500’s YTD return of -12.9% is in the ballpark of the average intra-year maximum drawdown, but history tells us that midterm years tend to see greater volatility (-17.1% average intra-year maximum drawdown), so perhaps the lows are not yet in place. But we are encouraged by how the market has historically fared following midterm election year lows. Rallies and downward retests are likely until greater clarity is gained relative to Fed policy, the economy, and Ukraine.

- Corporate earnings offer a cause for optimism. Through the end of April, 55% of Q1 earnings are in and the results have largely been favorable. The blended earnings growth rate has improved to +7.1% (3/31 estimate of +4.7%) with 80% of companies beating analyst earnings estimates by an average margin of 3.4%. Revenue growth has been stronger with a blended growth rate of +12.2%. Despite upward cost pressures, net profit margins have held in at +12.2%, modestly below last quarter’s +12.4% and well above the 5-year average of +11.2%.

- Despite generally solid earnings, companies have not been rewarded of late, with macro worries displacing micro fundamentals. Volatility has been a byproduct, with an extraordinary 86% of YTD trading days producing a high to low intraday move of greater than +/- 1%. We expect volatility to remain elevated until today’s uncertainties settle down. For now, odds of a recession in 2022 remain low but are rising for 2023. Indicators to watch include inflation, consumer spending and sentiment, credit conditions and the yield curve, and the labor market.

- A key to the market regaining stability and momentum lies in when and why the Fed eventually pauses monetary policy tightening. Either inflation comes down or economic growth suffers enough to force them to pause. Either way, we feel the market has priced in peak hawkish Fed at this point and a strong positive day as we publish on 5/4 offers support for this notion.

- We close on an optimistic note. Recent AAII Investor Sentiment Survey revealed the lowest percentage of bulls (15.8%) since 1992. Interestingly, 59.4% of investors expect lower prices six months out, the highest reading since March 2009, a time that coincided with the lows of the Great Financial Crisis. Today’s bull/bear spread sits at -43, a condition that has historically been followed by very attractive forward returns, as negative sentiment is often a positive contrarian indicator.

From the Trading Desk

Municipal Markets

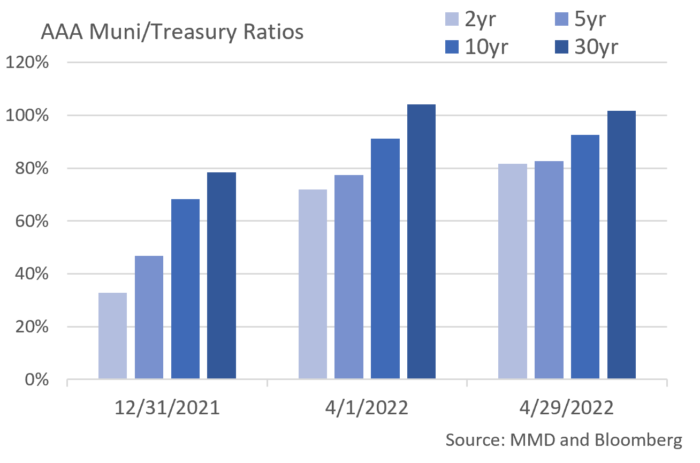

- A sharp rise in municipal yields continued in April with the 10Yr AAA curve ending the month at 2.72% and the 2Yr reaching 2.22%. The market clearly has its focus set on inflation and the magnitude of forthcoming Fed Fund rate hikes, an environment that has impacted YTD performance across most asset classes.

- The upside of this yield movement lies not only in higher income streams available on reinvested or newly deployed cash, but also in gaining the curve steepness that increases the value of incremental duration. To that point, the spread between AAA 2s and 10s is now a healthier 50bps.

- Rising interest rates and a substantial increase in equity market volatility have influenced municipal credit spreads which had been very tight for almost two years. AAA-A spreads ended April at 43 bps after spending most of 2021 in a 20-30bps range. Widening spreads means investors are now being paid more for the same risk profile, assuming all else remains equal.

- Assets have been flowing out of municipal mutual funds over the course of 2022, a major reversal from 2021 but one that is not terribly surprising given recent downside volatility. Over the last 16 weeks municipal funds have incurred net outflows of over $41 billion, selling pressure that is helping to push rates higher.

- As we discussed in recent commentary, we now see significant value in high quality municipals on an absolute basis and relative to Treasuries. The 10-year AAA to UST ratio began May at 92% as compared to a 52-week average just shy of 73%. Security selection is always paramount, although recent repricing has created considerable values across the municipal curve.

Corporate Bond Markets

- It is hardly news that yields across the fixed income landscape have moved sharply higher as the Fed scrambles to contain inflation. April’s trading saw the 2Yr UST yield rise from 2.33% to 2.71% while the 30Yr increased from 2.44% to 2.96%. In the face of this move, the VIX Volatility Index spiked to the low 30s, the highest recordings since early 2021.

- Investment Grade credit spreads had been on a sustained tightening trajectory at the beginning of April although that quickly shifted into a 4-week widening trend. OAS on the Bloomberg Barclays US Corporate Bond Index rose 20bps to 135 OAS over the course of the month. On a YTD basis, IG spreads are off by roughly 43bps. Early May OAS spreads of 145 appear to us to be fair value after accounting for economic conditions, corporate fundamentals, and valuations. IG credit spreads should remain range bound as we push through Q2.

- Although very lumpy, the primary market has tracked last year’s issuance pace. In the face of considerable volatility, the $580 billion brought to market YTD is just slightly lower than the same period in 2021. How we got there appears quite different though as turbulent markets have sidelined some issuers. The cost of issuing bonds and required concessions has steadily climbed over the course of the year, particularly for lower tier investment grade names. We expect this dynamic to persist over coming months as issuers will be nimble in their approach to the primary markets, thereby reducing new issue supply among names we like.

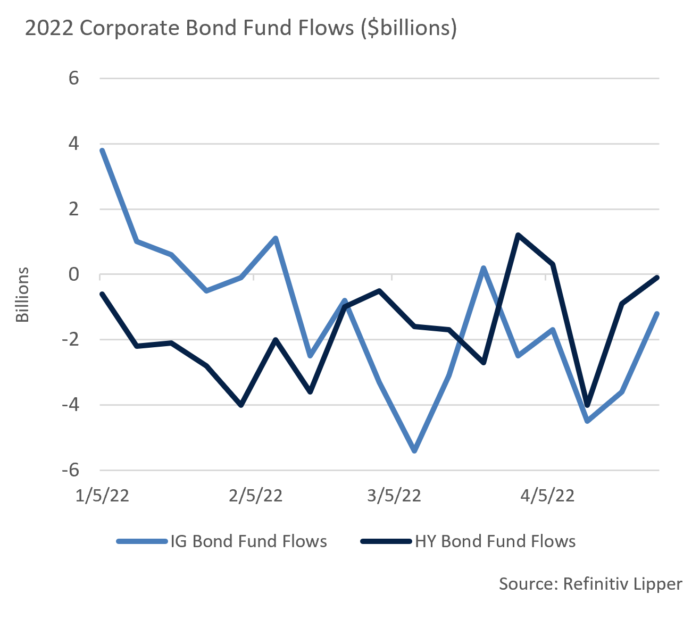

- Another indicator of shaky retail sentiment lies with corporate bond mutual fund flows. So far in 2022, IG bond funds have incurred $22.4 billion of net outflows, a sharp change from $83.5 billion in net inflows over the same period of 2021. While not a leading indicator of market sentiment, we are paying close attention as flows can impact secondary and primary market conditions.

Financial Planning Perspectives

Cybersecurity – Protecting Data in a Digital World

In our digital world cybersecurity threats are ever present and require taking prudent steps to protect ourselves online. In this piece we offer recommendations concerning steps that can be taken to increase security against fraud, theft, and property damage, and what we at Appleton do to secure client data.

In our digital world cybersecurity threats are ever present and require taking prudent steps to protect ourselves online. In this piece we offer recommendations concerning steps that can be taken to increase security against fraud, theft, and property damage, and what we at Appleton do to secure client data.

Two Common Types of Cybersecurity Threats:

Malware: Malware is software intentionally designed to damage or disable a computer, server or system, and/or steal data or gain unauthorized access to networks.

Phishing: Phishing occurs when cybercriminals pretend to be a trustworthy source to try and acquire sensitive personal information such as usernames, passwords, social security numbers, and credit card details.

How Can I Defend Against Online Threats?

Proactive steps can be taken by individuals to help protect against cyber threats. Below are some “best practices” that can help reduce online risk.

- Install the latest operating system and subsequent updates when prompted by your software provider. Installing anti-virus and anti-spyware software on all devices that connect to the Internet also adds a layer of defense. Norton and MacAfee are two highly regarded anti-virus software providers.

- Be diligent about reviewing emails before clicking on any links, opening any attachments, or providing personal information.

- Enhance password security by creating passwords that are sufficiently long and reasonably complicated. We recommend 8-12 characters with the use of upper- and lower-case letters, numbers, and symbols. Never share your username or password with anyone either verbally or by email.

- When available, set up Multi-Factor Authentication, a security protocol that only grants a computer user access after successfully presenting two or more types of validation credentials.

For more detailed information on cybersecurity and related subject matter, please refer to these Financial Planning Briefs available on our website.

- The importance of designating trusted contacts

- Cybersecurity: Protecting you and your loved ones online

- Multi-factor authentication implementation instructions

- Data Security Protocols

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]