Insights and Observations

Economic, Public Policy, and Fed Developments

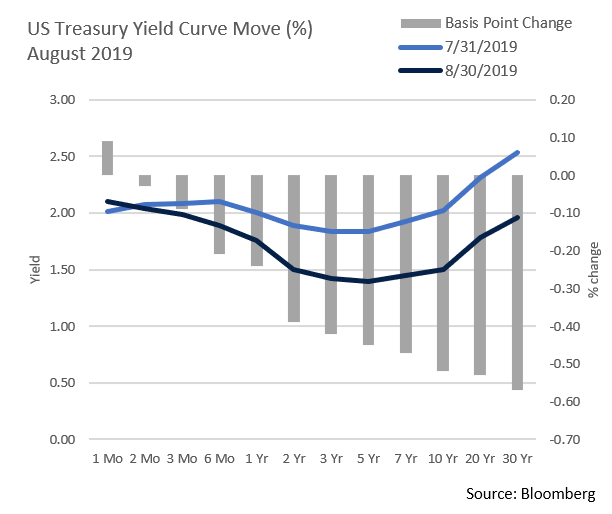

- Trade concerns dominated August, as the run-up to the G7 meeting saw the sharpest increase in tariffs and currency devaluation to date. At the summit, Trump tried to sooth markets with claims that China had resumed high-level contact, something insiders on both sides questioned. This rapid escalation rattled the equity markets, sent the 30Yr Treasury to all-time-lows, and inverted the 2-10Yr curve for the first time since the Great Recession. These latest tariffs should impact consumers more directly than past rounds; according to the AP, consumer goods under tariff jumped from 29% to 69% on 9/1. While there is now talk of an October summit in Washington, we see no obvious reason for either side to make needed concessions and believe the odds of resolution remain remote.

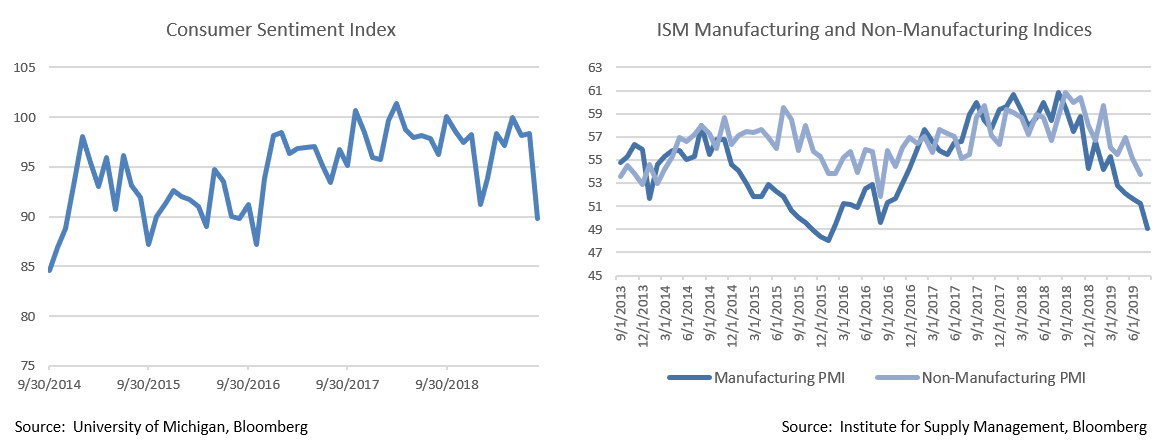

- There is growing evidence that this conflict is beginning to weigh on consumers. The University of Michigan Consumer Sentiment Index declined sharply in August, dropping from 98.4 to 89.9. A third of respondents made unprompted reference to tariffs, and those who did had markedly weaker outlooks than those who did not. Encouragingly, consumers have so far remained resilient, with retail sales (+0.7%) exceeding expectations once again in July. Increases were broad-based; 10 of 13 categories showed growth, led by a 2.8% increase in “non-store-sellers,” a group including online sales. This was a good report after a period of strong, if volatile, sales.

- President Trump seized the Fed’s Jackson Hole symposium as an opportunity to escalate attacks on the Fed, demanding a 100 basis point Fed Funds cut before the meetings began. Meanwhile, former Fed Chairman Bill Dudley penned an op-ed arguing that if further rate cuts make a continuation of the trade war more likely, the Fed’s mandate might be best served by not cutting, denying the President further cover from the economic side effects of his war. With pressure on its independence coming from both sides, the Fed is being forced to walk an increasingly fine line to remain above the political fray, thereby complicating policymaking.

- Brexit continues to evolve at a furious pace, as on 9/3 Prime Minister Johnson lost his parliamentary majority before the opposition passed a bill barring the UK from leaving on 10/31 without a deal. Johnson claims this move weakens the UK’s bargaining position and is now calling for fresh elections before the Brexit deadline. We expect Brexit to remain a source of considerable economic uncertainty in September and potentially October, as the market assesses the likelihood and cost of a no-deal Brexit.

- The non-partisan CBO revised their budgetary forecasts in August and now expects the annual US deficit to breach $1 trillion in 2020 and remain above that level thereafter. US debt held by the public is expected to reach 100% of GDP within a decade, a level traditionally associated with overly indebted economies. Furthermore, the latter phases of an economic expansion are typically periods in which debt/GDP contracts, not expands.

- While the US has remained a bright spot in a slowing global economy, the most recent ISM surveys now also show weakness. The ISM Service Index dropped 5.1 points to 53.7 in July, the weakest reading in two years, while the August ISM manufacturing survey unexpectedly fell to 49.1. Services represent more than two-thirds of the US economy and remain in expansion, but the rate of growth is slowing, and manufacturing has begun to contract, mirroring the slowdown the rest of the world has experienced for some time now.

Equity News & Notes

A Look at the Markets

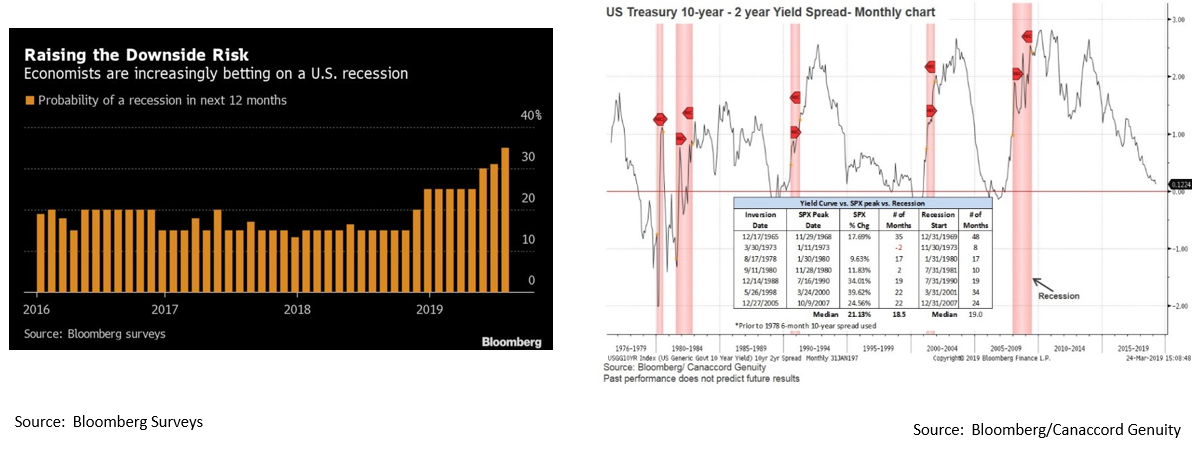

- Perhaps the biggest question facing investors is whether the US economy is facing an imminent recession. As seen in the accompanying chart, economists believe the probability of a recession within the next twelve months has increased considerably, in large part a fallout of the ongoing US – China trade dispute.

- Two economic tailwinds have kept the odds of a US recession from rising further; accommodative monetary policy, and a still resilient consumer. The Fed is almost certain to cut rates at their next meeting (9/18) with the only question being by how much. Given where the bond market has taken rates across the curve, we feel a 50 basis-point cut is on the table. St. Louis Fed President James Bullard, a voting member, believes that an “aggressive” step is warranted given the trade war and the fact that the entire Treasury curve is below the Fed Funds rate of 2-2.25%. Although the Fed is at risk of appearing to kowtow to the Administration, lack of meaningful inflation, a weakening economic outlook, and turbulent market conditions may give them the ammunition they need to remain accommodative.

- As we’ve long emphasized, the explicit costs of tariffs is far less impactful than the implicit toll they take on business confidence. The uncertainty surrounding trade has undoubtedly hampered business spending, whether it’s short-term inventory policy or longer-term capital allocation. We are seeing this indecision show up in survey data, most recently the August Manufacturing ISM. We are acutely focused on the jobs market (claims, layoffs, and hiring) looking for signs that trade uncertainty is spilling over into hiring decisions (so far, it hasn’t), as this would impact the consumer’s ability to continue carrying the economy.

- The inversion of the 2-10Yr portion of the Treasury curve garnered a great deal of attention in August as the financial press suggested the bond market was signaling recession. Yield curve inversions have preceded each of the past seven recessions, including the 2007 – 2009 downturn. While recessionary concerns are understandable, Appleton is of the mindset that the inversion is primarily a function of foreign Treasury demand given what is now nearly $17 trillion in negative yielding global debt.

- While the yield curve is one of many signals we monitor, it is important to not look at it in a vacuum. An inversion can spell doom should lending dry up and liquidity evaporate. But we have not seen this and credit spreads, both corporate and consumer, remain tight. With credit accessible, a healthy jobs market, an accommodative Fed, and a strong consumer, we feel the U.S. economy can weather the self-inflicted damage of the trade war with China . . . for now (assuming gasoline isn’t poured on an already simmering global trade fire).

- Volatility is likely to persist, yet we are cautiously optimistic that stocks, in general, can continue to perform. Defensive sectors (e.g. Real Estate, Utilities, Consumer Staples) performed well through August as investors sought lower volatility and higher yields. With the S&P 500 dividend yield (2.08%) above that of the 30Yr Treasury (1.96%), stocks look attractive from relative valuation and cash flow perspectives.

From the Trading Desk

Municipal Markets

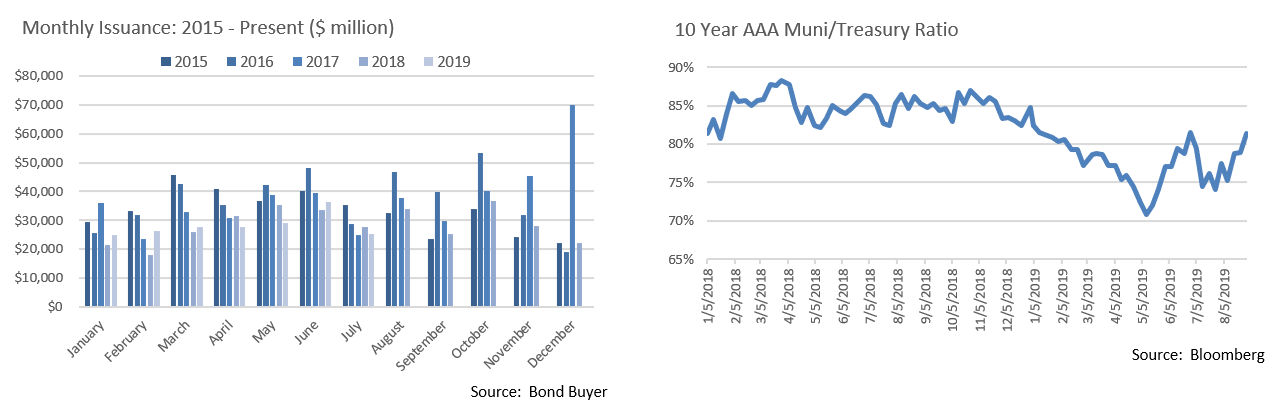

- Low interest rates contributed to a surge in August municipal issuance of $38.53 billion, the highest monthly level since December 2017, and an increase of 13% relative to the same period of last year. About a third of August’s issuance was in the form of refundings, as issuers took advantage of the rate environment. Technicals are still favorable, with issuance flat vs. 2018 prior to August’s spike, while demand remains extremely high. As expected, the market digested recently increased issuance well.

- While the municipal curve’s movements generally correlate with those of Treasuries, it is still very much subject to its own supply/demand dynamics. The easiest way to look at the relationship between the two is through the muni/Treasury yield ratio. Over the past 2 months, AAA 10-year municipals have become somewhat cheaper with respect to the same maturity Treasuries, as the muni/Treasury yield ratio has increased to 81.33% in the face of plummeting Treasury yields. As we’ve previously noted, the ratio had been as low as 70.85% in May.

- Retail continues to drive the municipal market and YTD net positive mutual flows have reached $62.7 billion. However, growth in foreign ownership over recent years has also been noteworthy. According to Federal Reserve data, non-US buyers hold more than $100 billion of municipal securities, much of it in taxable issues. This is double the level of a decade ago, a trend influenced by nearly $17 trillion in negative yielding sovereign debt and an accompanying desire among foreign investors for income and credit stability.

Taxable Markets

- The month of August was one for the investment grade record books as returns from the asset class were, yet again, strong. The Bloomberg Barclays U.S. Corporate Bond Index returned 3.14% and the longer version of the Index (Bloomberg Barclays U.S. Long Corporate) returned 5.86%. A sharp rally in Treasuries saw the 10Yr fall a whopping 51 basis points during the month to 1.50%. This drove overall IG sector returns as much of the broader non-Treasury asset class weakened modestly, with spreads widening by 12 basis points. Nonetheless, IG spreads in aggregate are 37 basis points tighter on the year.

- Amid recession fears, the long bond’s rally was even more pronounced with 30Yr Treasury yields falling 57 basis points to an all-time low of 1.96% at month’s end. Looking back at the beginning of a decades-long bull market, the 30Yr highwater yield was 15.19% on 9/30/81. With a large majority of positive global rates coming from of the US, demand for US IG corporates, Treasuries and municipals should remain strong. There are simply not many other places to go for positive income from high quality credits.

Financial Planning Perspectives

Continuing Care Retirement Communities: When “Aging-In-Place” Isn’t The Best Fit

What is a CCRC?

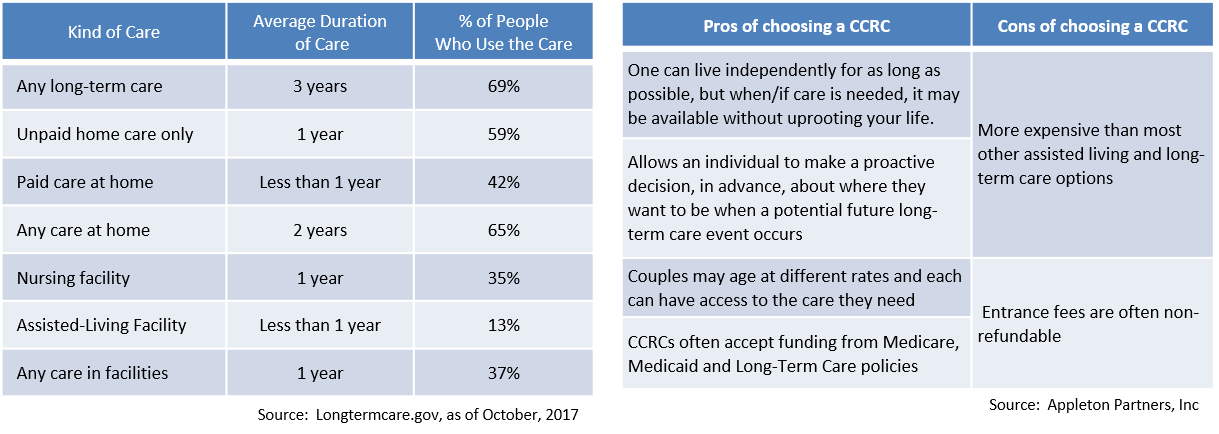

“Aging-in-Place” was addressed in our July 2019 edition as most Americans over age 50 would prefer to reside in their current residence as they age. While this is often considered the most desirable option, sometimes the home one currently lives in isn’t the most practical longer-term solution and a need for assisted living or long-term care may well arise. In fact, government data tells us that more than half of Americans will eventually need some type of care.

Continuing Care Retirement Communities (CCRCs) are a housing alternative that has become increasingly popular as they combine independent living, assisted living, and nursing home care. CCRCs have wide appeal as all-inclusive communities offering health services, social activities, meals, housekeeping, transportation, emergency help, and many other services. Proactively buying into a CCRC before your healthcare or other needs change offers an ability to age in a comfortable residence where advanced care availability is present should it be needed.

How does it work?

CCRCs generally have three main types of contracts, although other options are available and worth exploration with a healthcare advisor. In most cases, there is an upfront buy-in along with ongoing monthly fees.

- Option 1: The most expensive and comprehensive. A more significant upfront investment provides the user with unlimited assisted living and health services.

- Option 2: This model is similar, although monthly costs are reduced given more limited health services. If a resident’s needs exceed what is covered by monthly fees, they are charged market rates for incremental services.

- Option 3: Offers a lower initial buy-in, but residents pay market rates for health care services on an “as needed” basis.

https://www.seniorliving.org/continuing-care-retirement-communities/

What do Continuing Care Retirement Communities cost?

CCRCs vary significantly in cost and operation. Expense drivers include size, type of living space, location and the nature of care one is seeking. In some instances, the entry fee is partially refundable if you leave within a few years of moving in, while other options include partial refund terms for the resident or their heirs. It is important that individuals interested in this type of arrangement take all pertinent factors under consideration. Of course, please let us know if you would like to have a conversation specific to your situation.

http://money.com/money/4579934/continuing-care-retirement-communities-cost/

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]