Thinking about risk a bit differently can be revealing. Individual interpretations vary which is why applying traditional investment techniques and individualized approaches are both essential parts of the equation. As 2022 unfolds, equity and bond markets enjoy lofty valuations by historic standards, although more speculative risk-taking is finally showing vulnerability. Encouraging clients to embrace constructive risks, a necessary ingredient in building long-term wealth, while avoiding questionable ones is simple in theory yet challenging in practice.

Trend Following Warrants Caution

The financial services industry is nothing if not creative as demonstrated by a recent wave of Special Purpose Acquisition Companies (SPACs). These securities are sold as common stock yet are shell companies set up with the intention of finding a private entity to take public via merger. At last report nearly 600 exist with 47 sporting market capitalizations > $500 mm1. Buyers are placing their faith in often opaque entities, perhaps based on confidence in management although that may be a generous interpretation. Regardless, SPACs are hardly alone as they jostle for investor attention with cryptocurrency2, “meme stocks,” and even esoteric instruments such as NFTs. “Fear of missing out” can be a dangerous motivation, as many learned two decades ago from a dot com bust that saw NASDAQ fall by 77%. The line between prudent, long-term investing and impulsive speculation can be blurry.

We seek to help clients optimize the right risks, not arbitrarily reduce them, yet how much and what type of risk is optimal? It ought not surprise anyone that our answer is “it depends.” The challenge of developing sustainable asset allocation plans requires first evaluating a client’s goals, time horizon, risk capacity, and risk tolerance.

Dampening the Downside Can Facilitate Opportunity

All risk-seeking markets introduce volatility, although tools such as portfolio diversification can have a mitigating influence. Stocks, bonds, real estate, commodities, and cash each offer distinct risk profiles and performance patterns. As conditions change, the positive performance of one asset class can offset the potentially negative returns of another, creating a more efficient portfolio. Individual holdings also introduce security specific risks and diversifying by number of holdings, market capitalization, style, and risk factors can reduce the impact of such idiosyncratic risks on overall portfolio volatility.

Widening the opportunity set also introduces new sources of capital appreciation and income. For example, the S&P 500 lacks exposure to small cap stocks, emerging markets, and other potential alpha drivers. Alternatives such as fund-of-funds, single manager hedge funds, or private equity offer an even wider range of exposures.

Too Much of a Good Thing?

As with many other beneficial endeavors, risk mitigation efforts can become counterproductive if not well calibrated. For one, excessive diversification can dilute alpha generation, or the ability of a manager to add excess returns above a benchmark. Owning too many stocks or funds minimizes the value of security selection, a product of poor execution rather than a flaw of diversification itself. Conviction matters, and we caution against paying active management fees to effectively own the market, which is why our equity strategies are typically limited to 40-45 names. Investors seeking to cost efficiently gain broad market exposures can do so through indexing, or hybrid strategies such as BetaCore.

Approaching Risk Management with an Institutional Mindset

Institutional managers often model each asset class’s contribution to total portfolio risk rather than measuring it solely in isolation, a process known as risk budgeting. Expected contribution to risk is allocated by asset class with the objective of maximizing a portfolio’s total return given a targeted overall risk level.

We feel risk budgeting has applicability to private clients, not just institutional investors. Shying away from asset classes such as a growth stocks may appear to dampen downside volatility, but at what cost to long-term performance? Not meeting future retirement, healthcare, or other needs is of equal concern. What makes more sense to us is identifying future liabilities and/or asset goals and then combining investments in a manner aimed at getting there over a defined time horizon as risk-efficiently as possible. For example, income-producing assets such as bonds, REITs, fixed annuities, or private pensions can help meet future income needs, and offers relatively low correlation to equities. Adding such exposures allows a greater allocation of one’s risk budget to be deployed in capital appreciation-focused equity strategies, thereby enhancing overall risk-return efficiency.

Back to Basics

Capitalism dictates that markets and individual security prices will fluctuate. Many factors exert short-term influence, yet quality has stood the test of time and helps separate value from hype. Buying stocks and bonds with compelling intrinsic value, and subsequently diversifying away a degree of security specific risk, is a key ingredient in building fundamentally sound portfolios.

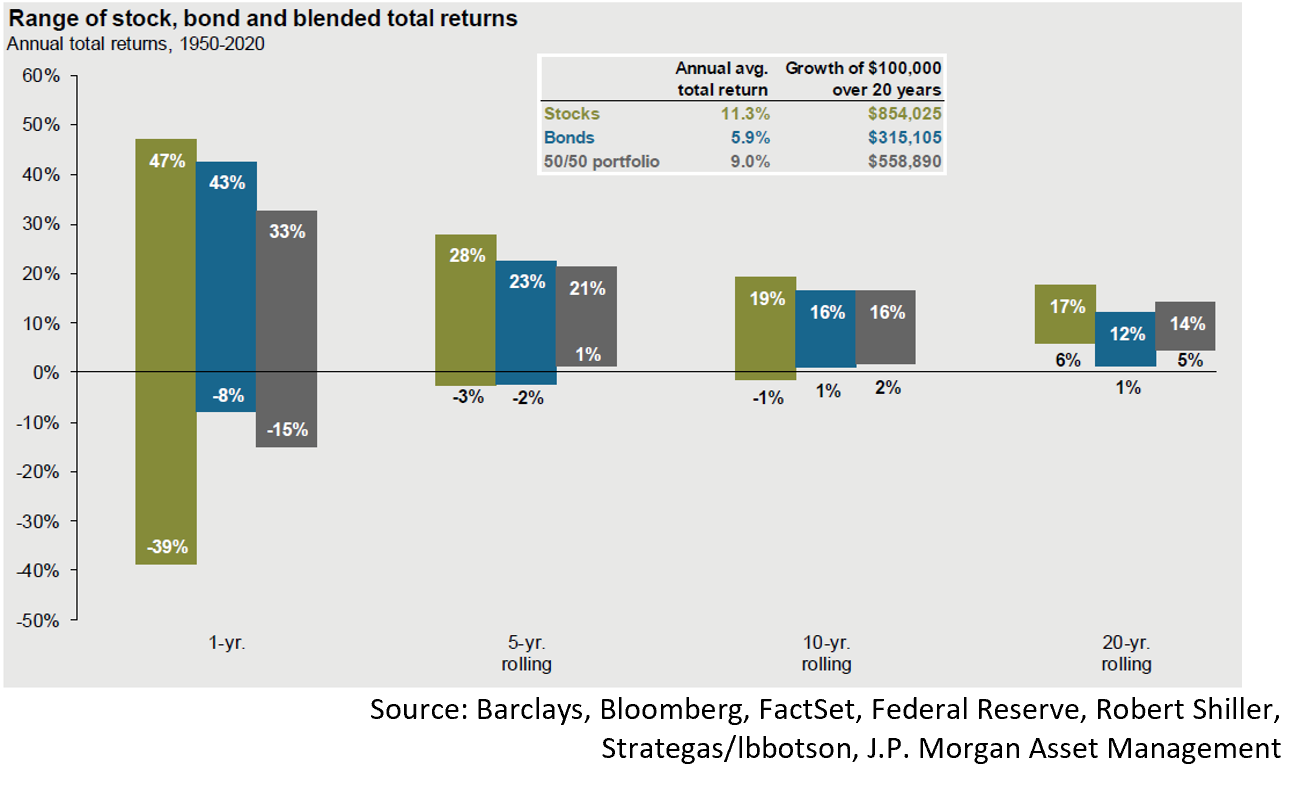

We also emphasize making time your ally. Staying invested long term in quality stocks and bonds has proven to be effective in smoothing out shorter-term volatility, as demonstrated below.

Every day we assume risk in many aspects of our lives. As wealth managers, we seek to develop a comfortable approach to managing it that also maximizes the likelihood of our clients’ achieving their financial objectives. Embracing prudent risks backed by fundamental analysis and the benefit of time is a good place to start.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.