Message Board Mania

If nearly a year of health crisis and economic turbulence was not enough, Q1 introduced us to Wallstreetbets, “meme stocks,” and seemingly irrational investor behavior. Besides creating headaches for Robinhood, regulators, and those buying at the wrong time or failing to sell quickly enough, is there any enduring meaning to the dizzying price gyrations of once abandoned stocks?

Rest assured that Appleton is not participating in this frenzy, although we are taking notice (while more closely following corporate earnings, inflation, and interest rates). Whether buyers believe in a dramatic digital reinvention of GameStop, are motivated by a “common man vs. hedge funds” narrative or are adherents to the “greater fool” theory, micro stock bubbles have emerged, crashed, and subsequently reinflated. At one point GameStop fell 90% off its peak in short order before partially recovering.1

We recognize that this is likely a sideshow to our clients but feel there is broader significance. Speculation is hardly new as the dot com frenzy of the late 1990s demonstrated, although certain stocks’ highly unusual trading patterns have raised questions about market stability and even integrity.

The Perils of a Trust Deficit

That which diminishes public confidence in the capital markets is a legitimate concern. Treasury Secretary Yellen apparently feels similarly, as she quickly convened February meetings with the SEC and other top regulators to ensure trading practices “are consistent with investor protection and fair and efficient markets.” This is imperative given that an erosion in public confidence would risk compromising the need for Americans to diligently invest for retirement. It remains to be seen whether market manipulation of any kind took place, yet social media promotion has arguably fed reckless retail speculation.

Interestingly, a recent CFA Institute study found that 81% of respondents using an adviser felt they had a fair opportunity to profit from the capital markets, whereas only 57% without an adviser expressed that view.2 The positive association between professional advice and perceived market integrity is reassuring. However, the same study also revealed a disturbing finding. Among all retail investors, only 46% reported trust in the financial services industry at large, perhaps a legacy of the Great Recession of 2007-2009, and the percentage was even lower among millennials and Gen X investors.2 Encouraging our clients’ younger family members to become confidently engaged in personal finance is a priority of ours given the nature of estate plans and the positive impact it can have on one’s financial future.

Equities Capture the Popular Imagination

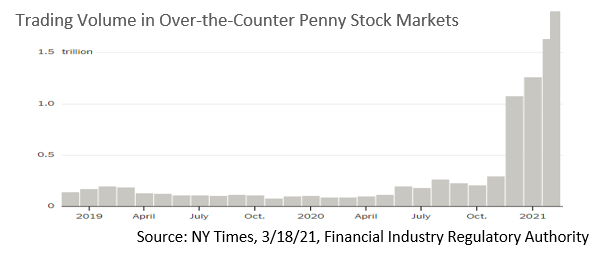

Despite lingering skepticism concerning the financial system, equity participation has surged. More than 10M new brokerage accounts were created in 2020 amid the pandemic.3 Average daily equity trading volume rose 56% in 2020 vs. 2019 and speculative penny stock trading has sharply increased.4

We see declining barriers to entry and market democratization as positive developments. Empowering new investors is necessary to build savings and retirement security. Yet in today’s world of zero commissions and lax leverage constraints, harm can be done to those operating with a casino mentality. Encouraging market participation is desirable, although investor education, discipline and an understanding of risk is also needed.

Foundations of Successful Wealth Management

Appleton Partners strives to build resilient, high trust relationships. Our ability to deliver compelling value depends on how well we understand individual goals, develop personalized recommendations, and actively collaborate. According to Oechsli, a wealth management research firm, clients with $250,000 to $10M of assets reported being more interested in clear and timely communication than investment performance. While both are essential, sustained commitment to a prudent investment strategy becomes more likely when working closely with a trusted advisor. That is why we prioritize portfolio manager accessibility and emphasize sharing commentary and planning insight. Our experience suggests that informed, involved clients are better positioned to reach their wealth management goals.

Take the Long View

Today’s headlines will invariably give way to new ones, yet certain fundamentals remain intact, including the importance of long-term asset allocation strategy. We have very limited ability to predict short-term market movements, let alone tomorrow’s story stock. The reality is market anomalies and inefficiencies regularly occur. A good defense lies in understanding and controlling risk, as well as letting time and compounding work for you.

Investment discipline is much more valuable than elusive market timing or trend following. We urge clients to temper the influences of daily prognostication. Despite the nature of our digital world, try and tune out the noise. Credible investment strategies are developed by thoughtful analysis of personal needs, not reacting to “horserace” stock coverage, let alone anonymous online recommendations. Ultimately, a well-structured asset allocation strategy coupled with time still represent a proven formula for success.

- GameStop reached a high of $483 on 1/28, a level that briefly made it the largest capitalization stock in the Russell 2000, after trading below $10 for most of 2020.

- CFA Institute study, 2020

- Certified Financial Planning Board, 3/20/21

- Barrons.com, February 18, 2021

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.