“Recency bias is the tendency to overweight recent events or trends, projecting them into the future.” Advisor Perspectives, 4/21/23

The recent passing of legendary investor Charlie Munger has prompted many prominent investors to publicly reflect upon his wisdom. The human element was often central to Munger’s insights concerning investment decision-making, and he was a pioneer in the field of behavioral finance. Looking back on 2023, adhering to a diversified asset allocation strategy was ultimately rewarded in the aftermath of a very difficult prior year, although staying the course required perspective and foresight.

Balanced Strategies Reassert Their Value

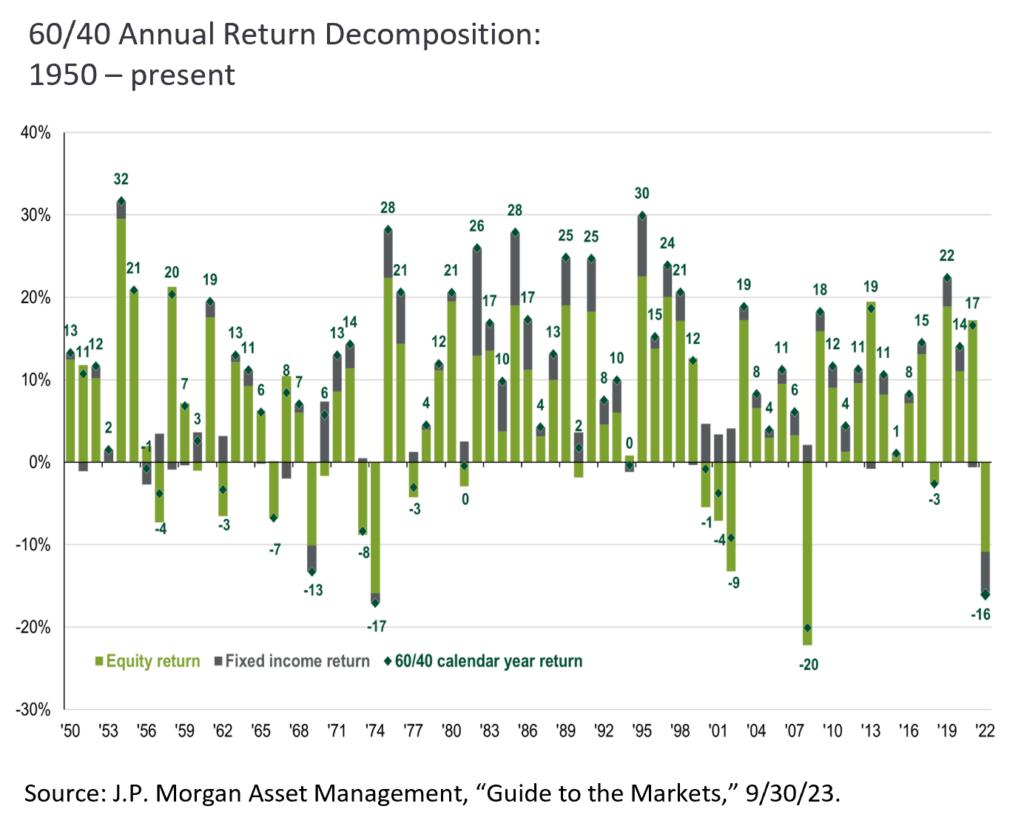

Seven Fed Funds rate hikes totaling 425 basis points coupled with recessionary fears roiled the capital markets in 2022, leading to an unusual confluence of highly negative equity and bond market returns. Balanced strategies have long been designed to generate income while moderating risk, in part due to a relatively low historical correlation between stocks and high-quality bonds. Bear markets in 2022 in both asset classes (the S&P 500 fell -18.1% and the Bloomberg US Aggregate Bond Index produced a -13.0% return) led to assertions that the “60/40” portfolio construct was flawed, if not dead.

Why with the long-term record displayed in the accompanying graph was the viability of traditional balanced strategies questioned? An explanation lies in the extent to which cognitive distortions affect investment decisions. Throughout 2022 and into 2023, surging yields drove down bond prices at the same time equity returns were weak, an anomalous relationship rather than the norm. Many assumed this would persist indefinitely, an understandable reaction to current conditions, but one disconnected from objective probabilities.

Such behavioral responses are similar to how we feel about our favorite sports teams at a given moment, or a “hot hand” at casino games involving independent dice rolls. Human beings often overweight the most recent information they receive rather than the bigger picture, a contributor to the investment industry’s “fear and greed” dynamic. Abandoning the diversification, income, and risk mitigation benefits of balanced portfolios may not have been a good idea in retrospect, as the S&P 500 and Bloomberg US Aggregate Bond Index posted +26.3% and +5.5% returns this past year.

Momentum Can Be a Double-Edged Sword

The unfortunate tendency of retail investors to buy high and sell low is well chronicled, yet avoiding this scenario is easier said than done. An explanatory factor is that investors often project recent momentum to future expectations. Doing so can add considerable risk should hot performance turn or lose out on subsequent gains when bear markets rebound, while also potentially impacting asset allocation. The best remedy may lie in sticking to a long-term investment strategy designed with risk tolerance and return objectives in mind.

The tremendous recent performance of the so called “Magnificent Seven”1 offers another vivid example. Over the course of 2023, the average return of these seven stocks was +107%. These are enormously successful businesses, and our conclusion is not that high-flying stocks should necessarily be shunned, but rather arbitrarily buying what is hot without assessing intrinsic value is a flawed approach. The converse may also be true – quality, out of favor companies at times present attractive investment opportunities.

Stay Grounded in Fundamentals

Circling back to Charlie Munger, he once cited patience, discipline, and long-term thinking as characteristics strongly associated with successful investing. We agree and often remind ourselves and clients to try and act accordingly. Today’s storylines will inevitably be prominent in our minds; the challenge lies in not allowing them to distort our decision-making. Focusing on fundamentals such as earnings growth, balance sheet strength, and management acumen offers a better approach.

1. Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.