Traffic is an inevitable part of urban American life as those of us who frequent highways in Greater Boston or most other metropolitan areas know all too well. Apologies for raising an irritating topic, but we feel there are useful parallels to be drawn between driving and investment decision-making.

Perception in both realms is often distinct from reality as emotion can distort our interpretation of information. How often on traffic choked highways have you observed the adjoining lane appear to be less congested and changed lanes only to quickly come to a stop as those previously behind you move ahead? Social scientists have studied the phenomenon and offer a compelling rationale.

When assessing the lane to our left or right while stopped or travelling very slowly, people tend to focus their attention forward and overly emphasize a very temporary or even insignificant perception that others are advancing more rapidly. The inference is that drivers are responding to somewhat of an illusion; namely, that the next lane on a congested road is preferable even when traffic flow over a more meaningful period averages the same speed.

The punch line is that impulsive, reactionary moves are often counterproductive. As wealth advisors, we stress this to clients but fully recognize that emotion makes us human, and it isn’t always easy to stay put when experiencing market related stress. Let’s look at a couple of psychological explanations for why some are prone to abruptly switch lanes and/or asset allocation strategies.

Recency bias is a cognitive tendency to place much more emphasis on recent events than past ones regardless of their relative significance. When driving, you are likely to overweight the most recent thing you see, specifically cars passing you to the right or left, and believe that is likely to continue. When investing, people often overvalue short-term performance trends, which is why asset flows typically gravitate towards “hot” mutual funds, stocks, or sectors. Chasing cars or performance is not advisable as it may be illusory and risks backfiring. The reason is that more cars moving towards one lane itself generates traffic slowing congestion, just as performance chasing can introduce greater risk by inflating valuations to the point where a subsequent sell-off becomes more likely.

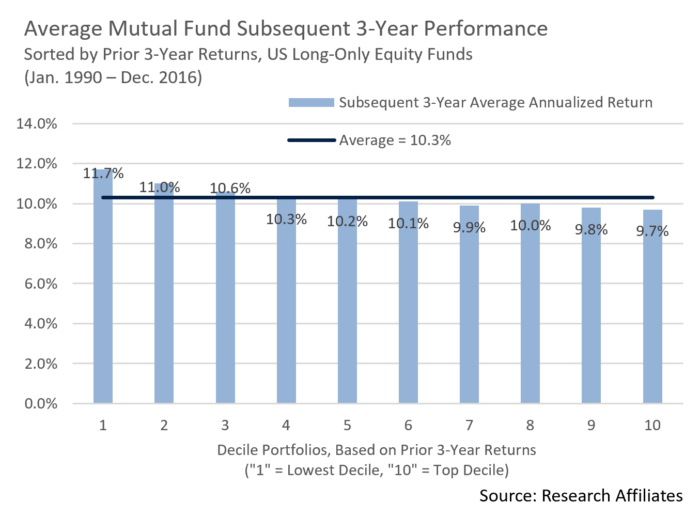

Whether recognized or not, many of our daily decisions factor in expectations of risk relative to anticipated benefit or return. That’s why we develop asset allocation and portfolio strategies with a clear sense of both a client’s goals and their willingness and ability to accept risk. Overreacting to short term developments without fundamentally based rationale, whether by joining the herd or by impulsively selling during unsettled times, can create opportunity cost (foregone market gains) or portfolio risk (loss of capital). A prominent academic study offers confirming evidence of that point, finding that over a 26-year period average 3-year forward mutual fund returns were inversely related to the same funds’ prior 3-year performance decile. In other words, there is a meaningful cost to chasing what appears to be the hot performer.1

Unfortunately, risk analogies also apply to our highways as data suggests that jumping off course can result in much more severe potential consequences than traffic. Even if one is to assume that lane changers get to their destination a little sooner, is it worth the risk? Perhaps not. According to Insurance Information Institute, reckless lane changes create 9% of all US accidents and directly factor into the deaths of 6,000 drivers annually.2

By no means are we suggesting that asset allocation ought to be on autopilot. Active management drives our investment process, and we will make portfolio adjustments as market conditions change and opportunities present themselves. We believe that wealth management ought to be highly personalized and recognize that individual needs and objectives evolve over time. The distinction we make, though, is between impulsive and well-grounded, fundamentally sound decisions.

Think about it in terms of the difference between relying on roadside traffic intelligence provided by Waze and reacting in frustration to what you momentarily see on the highway to one side or another. When risk tolerance, income needs, tax situations, or liability planning changes, portfolio strategy may need to adjust in response. But we rely on factors of that nature to make decisions as opposed to being overly influenced by daily market prognostication. The dynamics of fear and greed that often characterize investor behavior are somewhat analogous to the frustration and envy that drivers experience when battling their way to their destination.

Traffic patterns and markets can be unpredictable, yet in both contexts a steady path is typically more effective in getting from Point A to Point B. As Portfolio Managers, we have the responsibility of developing investment strategies that give each client the best opportunity to achieve their personal financial objectives, and to do so in a risk conscious manner. Course corrections are sometimes needed, but they ought to be based on more than momentary emotion.