Insights and Observations

Economic, Public Policy, and Fed Developments

- The most surprising part of the failure of Silicon Valley Bank (SVB), the largest since 2008, was that it failed for very old-fashioned reasons. Banks make money by borrowing customer deposits and either loaning the proceeds out or investing in interest-bearing assets, capturing the margin between interest earned and paid. In SVB’s case, an affluent venture capital clientele largely did not need to borrow, so they invested an unusual amount of their balance sheet in long-term Treasuries. When rates rose and a VC funding slowdown prompted deposit withdrawals, they were forced to sell assets at large losses to raise capital, spooking depositors. This produced an old-fashioned bank run, more reminiscent of 1931 than 2008.

- This context is important in understanding the market reaction. While the saying goes the Fed always hikes until something breaks, this wasn’t a break in any conventional sense. SVB failed due to poor risk management and a loss of confidence, not a deterioration in loan credit quality due to a faltering economy.

- In fact, despite lingering concerns, the economic outlook remains remarkably robust – the February jobs report comfortably exceeded expectations, 311k vs 225k, making this the 11th consecutive month of above-consensus job growth. Real personal spending fell a modest -0.1%, although with prior month revisions from +1.1% to +1.5%, nominal spending was actually higher than forecast. Businesses are still hiring, and consumers are still spending; the Atlanta Fed’s GDPNow estimate now stands at +1.7%, a deceleration from Q4 but still solid. Of course, the downside of this strength is that 4.6% core PCE and an accelerating trend in core CPI still leaves inflation too hot for the Fed’s comfort.

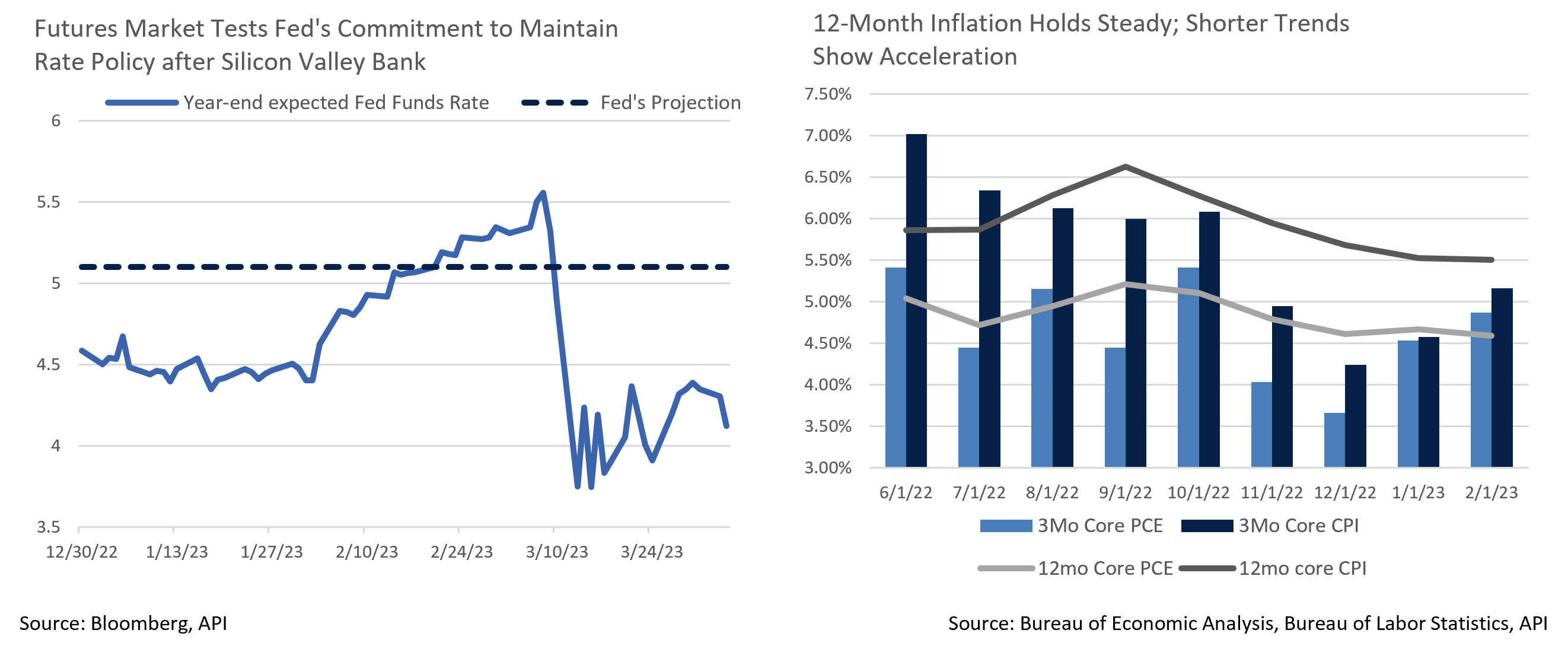

- By late February market expectations had risen to a peak Fed Funds Rate as high as 5.7%, but after the SVB collapse these fell sharply to just below 5%. At least for now, a decline in the expected peak rate makes sense. Bank turmoil will tighten credit conditions in much the same manner as additional hikes, by reducing banks’ ability to lend and customers’ desire to borrow. The Fed’s projection for a 5.1% year-end Fed Funds rate was unchanged in March; we do expect the Fed to achieve this target, though a rapid return to calmer financial markets could bring one or more additional hikes into play.

- More puzzling is the sudden drop in year-end rate expectations, with cuts now priced in as early as July. This directly contradicts the Fed’s commitment to hold rates at their terminal level for some time, and suggests futures traders are positioning for an imminent recession (in stark contrast with equities). We feel the Fed will push back against fresh expectations for a pivot and emphasize that every other disagreement between the Fed and the markets in the current hiking cycle has been resolved in the Fed’s favor.

- Another very real risk pushed to the backburner is the debt ceiling. With the Biden Administration demanding a clean bill and Speaker McCarthy seeking general spending concessions but not committing to specific policy proposals, negotiations will almost certainly go to the 11th hour. We believe both parties ultimately intend to raise the ceiling, although McCarthy’s razor thin control of the House, where any one member of his divided coalition can force a no-confidence vote, increases the odds that procedural delays trigger an unwanted crisis.

From the Trading Desk

Municipal Markets

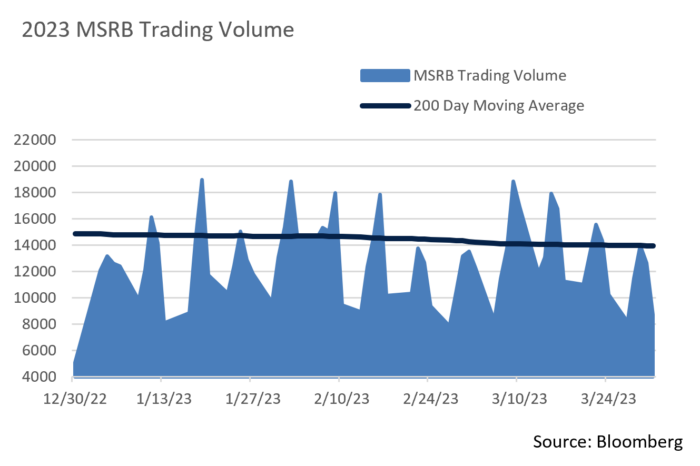

- We entered March with an expectation that it could be a challenging month given seasonal tax related selling and limited maturities; a performance boosting flight to quality was not anticipated. Nonetheless, the municipal market posted its strongest March returns since 2008, in large part due to banking turmoil and UST yields moving lower.

- Despite yields being well off October 2022’s peak, Q1 new issuance has been modest, trailing last year’s pace by 30% according to B of A and Refinitiv data. Limited supply creates challenges getting cash invested, but it has been a tailwind for returns. Localities have sold about $69 billion of long-term debt in 2023, down 23% from the same period a year ago. B of A is now projecting $400 billion of new supply for all of 2023, well off their prior $500 billion estimate.

- Muni/UST ratios remain relatively rich with the 10-year ratio ending Q1 at just over 65% and 2-year ratio at only 59%. We expect this dynamic to continue as long as the new offering calendar remains muted and demand is sustained. The most attractive part of the curve in our view now lies in a relatively tight 10 to 12-year maturity range.

- Many bid lists at the end of the month were comprised of bonds maturing between 2029 – 2033 with calls in 2026 – 2028, structures that we feel lack compelling relative value. Many such bid lists have not traded at all lately, and we instead are looking more actively at non-callable maturities in a 2029-2033 range.

- The spread between the yield dealers offer and traders bid, the bid/ask spread, has widened. Therefore, trading conditions have become challenging and price discovery is often coming from the new issue calendar rather than secondary markets. New issue deals are being bid aggressively, a sign of healthy demand.

Corporate Bond Markets

- March was one of the more volatile months in many years. The month opened with expectations that the Federal Reserve’s path of rate increases would persist and, accordingly, short term UST yields were poised to move higher. The 2Yr UST yield of 5.07% at the beginning of the month was the highest since June 2016. Those levels quickly disappeared on news that Silicon Valley Bank (SVB) was under severe duress. A flight to quality sent yields lower and they have not looked back. 2-year issues ended March at 4.02%, and investors who bet on higher yields rushed to cover, a “risk-off” environment eerily reminiscent of the 2008 financial crisis.

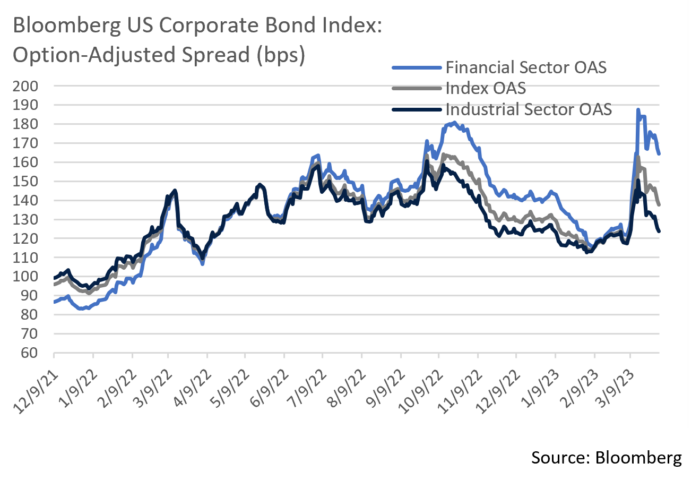

- Nonetheless, outside of directly impacted sectors such as regional banking, IG Credit has remained firm. After reaching post-pandemic highs (OAS of 169 bps) in October of 2022, the market has largely rallied. But it’s been a bumpy road; March opened with the Bloomberg Barclays US Credit Index at an OAS of 119 bps, a level that spiked to 154 bps in the days following SVB’s failure, before closing at 138 bps after the Federal government moved to defuse depositor and bank liquidity fears.

- Much of recent spread volatility was attributed to the Banking sector. The OAS within the sector began March at 127 bps and climbed as high as 187 bps before receding to 164 bps. We have long emphasized US Global Systemically Important Banks (GSIBs) instead of regional banks in bond selection, as our research team takes comfort from GSIB requirements that far exceed regional bank peers, including higher capital buffers, Total Loss-Absorbing Capacity (TLAC), resolvability, and more intensive supervisory/regulatory expectations. This longstanding credit stance has proven to be beneficial of late.

- Yields and spreads were not alone in feeling the reverberations of uncertainty. IG primary market issuers brought $100 billion of new debt in March, a figure that fell about 30% short of expectations. Immediately following news of SVB’s woes, a highly atypical zero issuance week ensued. Primary market conditions at other times were choppy, but those who were able to navigate uncertainty were rewarded as new issue concessions were low and deals were heavily oversubscribed. Secondary market performance was also generally solid. In short, we view IG Credit conditions favorably outside of the most heavily impacted pockets of the market and are looking for bond supply that meets our credit and relative value criteria.

Public Sector Watch

Credit Comments

Bank Stress & Municipal Credit

Despite weeks of turmoil in the Banking sector, municipal credit has largely remained unscathed. While banking stress appears to have stabilized, we detail in this section the myriad roles banks play within municipal credit and argue that the impact on municipalities is likely to be modest.

Variable Rate Demand Notes (VRDNs)

Within the Variable Rate Demand Note market, banks often provide liquidity support in the form of letters of credit or standby bond purchase agreements. According to Barclays, approximately $75 billion of VRDNs have liquidity support, the providers of which include Foreign Banks (36%), Global Systematically Important Banks (26%), Federal Agencies (20%), and Regional Banks (18%). We believe this part of the market faces little risk. Amongst Regional Banks, mostly larger institutions provide this liquidity and if they were to take a step back other institutions would fill the void. VRDNs in which Appleton invests are supported by large, North American financial institutions vetted by our Corporate Research Group.

Prepay Gas Bonds

Some banks also issue Prepaid Gas or Energy bonds through the municipal market, complex legal structures that are ultimately unsecured obligations of the financial institution. Most of these deals are backed by GSIBs or well-capitalized Foreign or Large Regional Banks, and we feel the likelihood of outstanding Prepay bonds coming under credit stress is minimal. Anecdotally, some large Prepay new issue deals have been put on hold, although recent market stabilization may allow them to get sold over the next few weeks. Appleton does not currently approve any corporate-backed municipalities, including Prepay Gas bonds, given greater pricing volatility these structures often encounter as compared to essential governmental issuers.

Direct Lending

A pocket of the market that may modestly impact municipal credit is direct lending from regional banks. According to Barclays, direct loans from banks to municipalities reached $186 billion in 2022 and small regional banks were responsible for about a third of that total. Should higher rates, balance sheet stress, and increased regulatory costs tighten lending standards, direct lending to municipalities would decline. Smaller municipalities would be more vulnerable as many rely on regional and community banking for capital rather than the public bond market. Larger, well-run municipalities also may have exposure to regional banks through operating cash, payroll, or short-term borrowings. However, given the breadth of these municipalities’ resources, we believe such exposure would likely be small relative to the scope of their operations, or can be easily passed on to other institutions.

The U.S. Public Finance Sustains Favorable Ratings Momentum

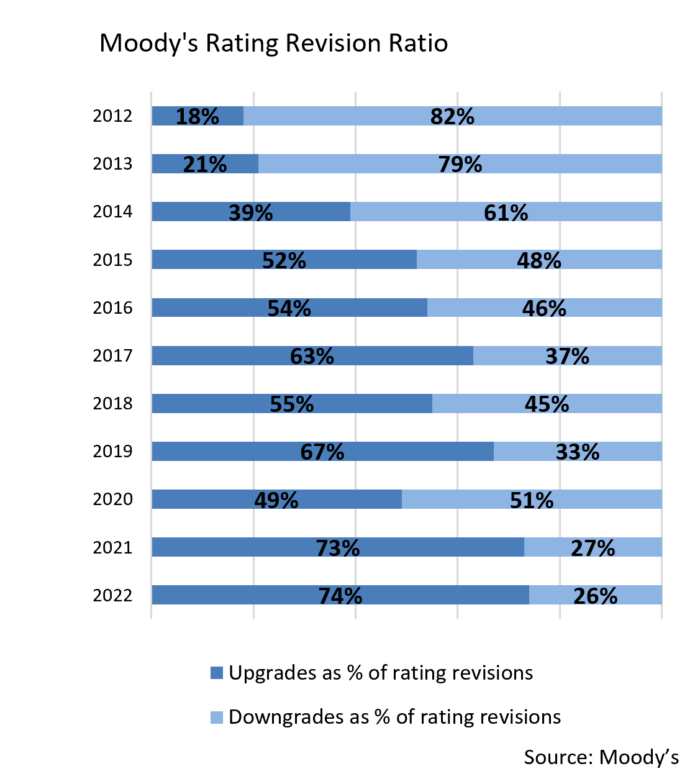

- Public finance obligors experienced favorable credit rating changes in 2022, with upgrades outpacing downgrades at both Moody’s and S&P for the second consecutive year.

- Moody’s upgrades accounted for 74% of total rating revisions in 2022, significantly higher than the ten-year average of 51%.

- Moody’s reported that $442.5 billion of debt was affected by rating changes, of which $387.1 billion was upgraded while $55.4 billion was downgraded. The State of New York’s upgrade represented the largest rating action based on total debt outstanding in 2022, impacting $76.8 billion of obligations. The state’s upgrade was driven by increases in resources and agile financial management and speaks to an overall trend of rating upgrades.

- S&P upgrades accounted for 76.5% of total rating revisions in 2022. Nearly all sectors experienced more upgrades than downgrades with Higher Education and Healthcare being notable exceptions. Transportation saw the largest percentage of ratings raised at 96% of the 82 rating revisions. The main driver of favorable rating performance in the transportation sector was ongoing improvements in airport revenue and operations.

- Highly positive rating revision ratios for Moody’s and S&P is an indication of municipal credit strength. Despite a modest softening in economic conditions in 2023, generous Federal aid, revenue outperformance, and prudent budgeting continue to support municipal issuer fundamentals.

Strategy Overview

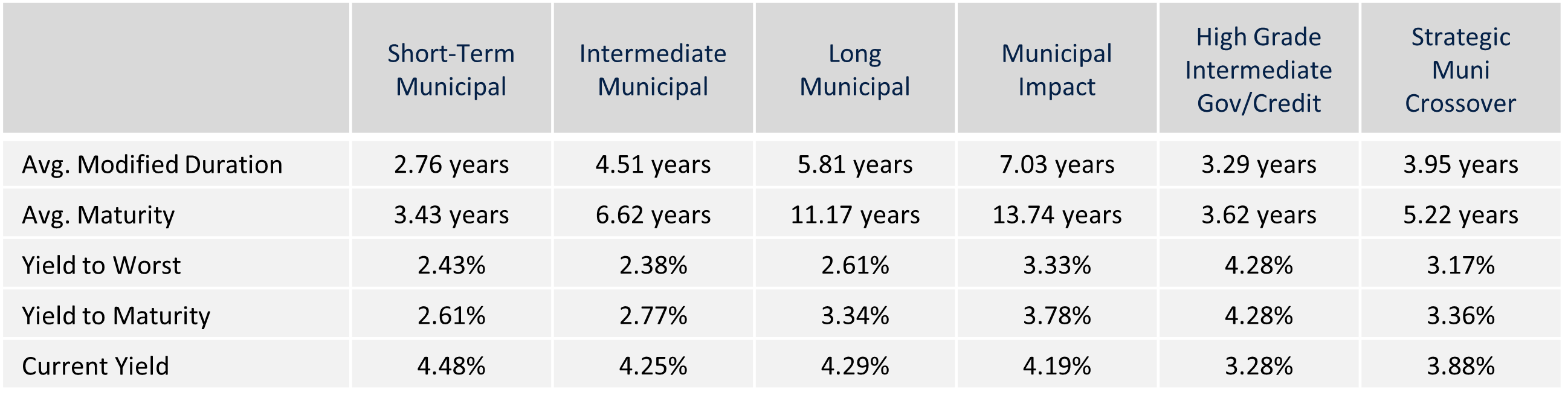

Composite Portfolio Positioning as of 3/31/2023

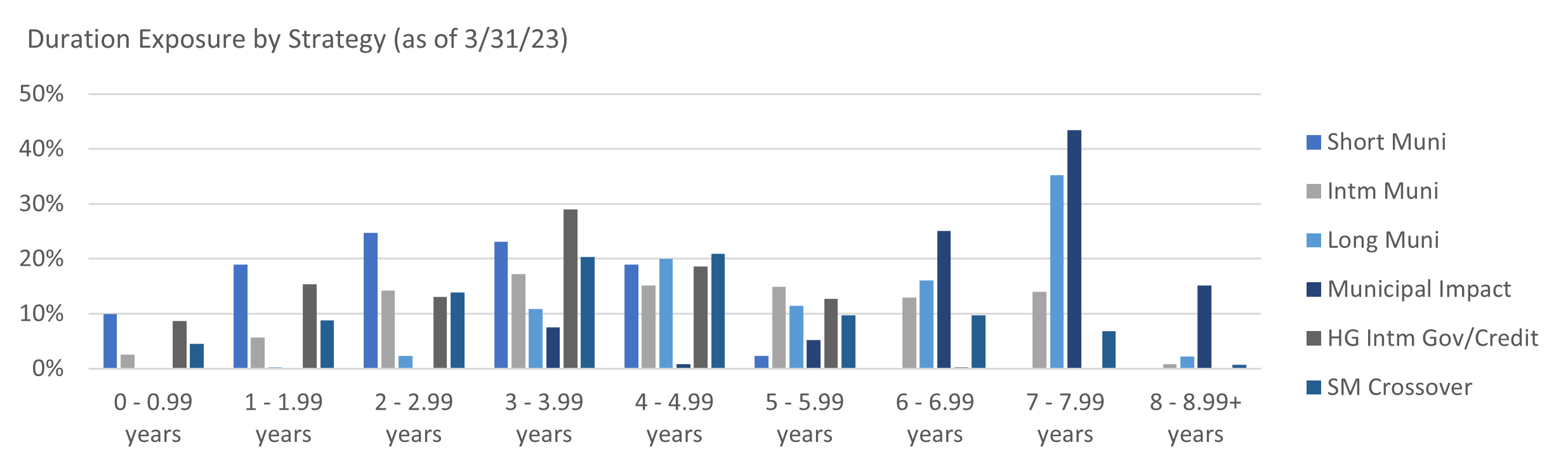

Duration Exposure as of 3/31/2023

The composites used to calculate strategy characteristics (“Characteristic Composites”) are subsets of the account groups used to calculate strategy performance (“Performance Composites”). Characteristic Composites excludes any account in the Performance Composite where cash exceeds 10% of the portfolio. Therefore, Characteristic Composites can be a smaller subset of accounts than Performance Composites. Inclusion of the additional accounts in the Characteristic Composites would likely alter the characteristics displayed above by the excess cash. Please contact us if you would like to see characteristics of Appleton’s Performance Composites.

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.