Insights & Observations

Economic, Public Policy, and Fed Developments

- Most of the interesting market news from January might be best described as changes to the market backdrop, rather than foreground action. While a lot of it may not have been immediately market moving, we believe some of these events will play out in important ways as the year goes on.

- The largest was the surprise announcement of a Department of Justice investigation into Fed Chair Jerome Powell over ongoing Federal Reserve renovations. Trump has complained about cost overruns here in the past, but this represented a significant escalation, and one for the first time Powell suggested was intended to influence rate policy. Bipartisan outcry was immediate, and the head of the Senate Banking committee, Sen. Thom Tillis (R-NC), vowed to block hearings on any Fed appointees until this matter was resolved. In practice, this could leave Powell as Acting Chair beyond May.”

- Meanwhile, Trump announced federal housing agencies Fannie Mae and Freddie Mac would use $200B in cash on hand to purchase mortgages. This was intended to drive down mortgage rates as part of a broader “affordability” push before the midterms, in what is effectively “QE-like” market activity. While the immediate impact on borrowing costs was modest, we expect the Administration to continue to seek ways to inject monetary stimulus independent of the Federal Reserve.

- This is interesting, because at month-end Trump finally announced his pick to replace Chair Powell when his term ends in May. Kevin Warsh is considered a relative hawk and known as a vocal proponent of shrinking the Fed’s balance sheet, which would in effect be quantitative tightening. Market reaction to Warsh’s nomination suggested some relief for a relatively mainstream choice, with the dollar strengthening on the news. Senator Tillis was complimentary to Warsh but reiterated the Senate Banking Committee will not hold confirmation hearings while Powell is under investigation.

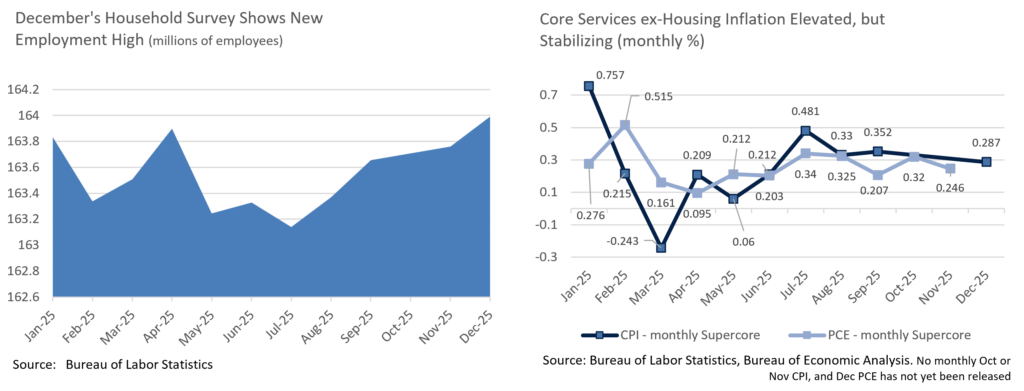

- There were several pieces of economic news last month that we found encouraging as well. First, the Fed’s Beige Book survey showed economic activity broadly strengthened, a clear improvement from the last several surveys. Second, while CPI continues to be impacted by the missed October shelter cost survey and the December shelter cost increase of 0.405% is a little concerning, the long-elevated “supercore” CPI (excludes shelter) is now trending downwards, and is converging with the high, but rangebound PCE “supercore” which has been running at a monthly rate consistent with annualized 3% inflation. We note that the January PPI inflation shows evidence of margin expansion, and while it’s too early to say if this is falling input or rising output prices, the latter would risk spilling into consumer price measures and should be watched. On balance, inflation data appears to be moving in the right direction, though for the last several years annual adjustments and rebalancing has led to January spikes, and we see risk of a continuation.

- Finally, we see some signs of stabilization in the labor markets. While nonfarm payrolls missed expectations, the unemployment rate unexpectedly dropped two tenths to 4.4% on the back of a much larger jobs gain, and a drop in unemployed workers, in the Household Survey. Giving us added confidence here is the Household survey’s total employed figure, which after a period of weakness in the summer and fall, has been in an uptrend and finally exceeded April’s 2025 high-water mark.

- All told, we believe Chair Powell was right to conclude that while there were still risks to both sides of the Fed’s dual mandate, they had diminished somewhat and were back in balance. We expect the Fed to remain on hold for the foreseeable future. Further reductions in the second half of the year are possible, but we believe the Fed will need data to paint a convincing case for cuts before they act.

Sources: Federal Reserve, Bureau of Labor Statistics, and Bureau of Economic Analysis

Equity News and Notes

A Look At The Markets

- Stocks were higher in January as each of the major USindices started 2026 with gains. The S&P 500 gained +1.4% for its best month since October and traded to a fresh all-time high as recently as Jan 27. The Nasdaq (+0.9%) snapped a 2-month losing streak and the DJIA outperformed, gaining +1.7% to give the index a 9-month winning streak. Small-cap stocks were the standout, with the Russell 2000 gaining +5.3% on the month, its best since August. Sector performance was mixed with a combination of cyclicals (Energy: +14.4%, Materials: +8.6%) and defensives (Staples +7.5%) outperforming while Financials (-2.6%) and Technology (-1.7%) were the main laggards.

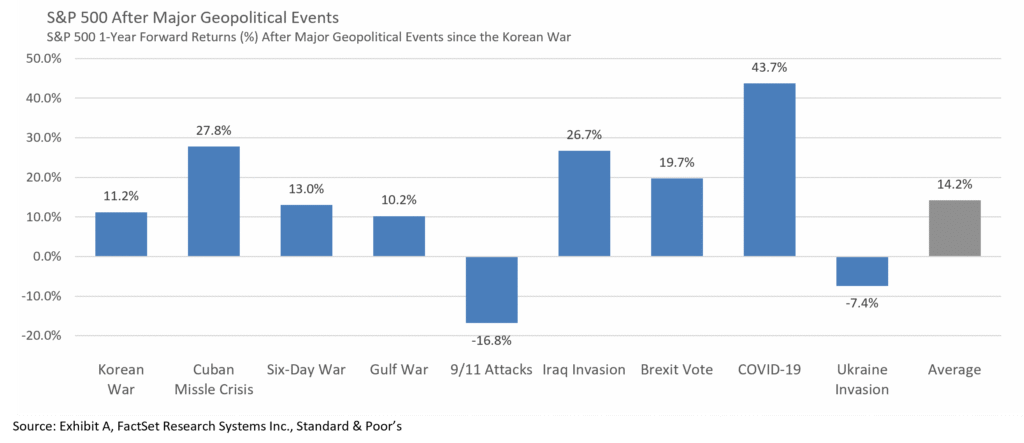

- January’s gains came despite a notable uptick in geopolitical flare-ups and headline risks. The month started with the US capture of President Nicolas Maduro, which ultimately lifted energy shares as US producers were seen as potential beneficiaries of the action in Venezuela. Later in the month, energy shares got a further boost as tensions with Iran increased on news that the US military was mobilizing in the region. Greenland was also in focus as the US administration pushed to assert its claim to the territory and threatened tariffs on any Eurozone country that opposed. On the news, the S&P 500 suffered its worst day since October (-2.1%) only to rebound sharply on an announced “framework” for a deal. Investors should not let geopolitical events dictate investment decisions. While they can certainly lead to short-term volatility, history shows that market recoveries often follow these flare-ups.

- January’s trade was highlighted by a breadth thrust with the occasional bouts of sharp rotations and volatility in commodities and metals. The Magnificent 7, market leaders for much of the past 3 years, underperformed (+0.5%) in January as investors rotated into cyclical and small-cap stocks. Both groups are seen as beneficiaries of the administration’s push to boost the economy ahead of mid-term elections. The Russell 2000 outperformed the S&P 500 for 14 straight days in January, the longest streak on record dating back to 1979, and the equal-weight S&P outperformed its cap-weighted counterpart by over 2% on the month. In precious metals, silver and gold both exploded higher to start the year due to geopolitical and fiscal risks. However, both reversed sharply as silver and gold fell -31% and -11%, respectively, on the final trading day of the month as crowded positioning and leveraged trades unwound. We would view the broadening trade as a healthy development should the smaller stocks continue to play catch-up and the volatility in the metals remain relatively contained.

- One of the main supports for stocks that keeps us constructive is corporate earnings. The Q4 reporting season is 33% complete and results have been strong with 75% of companies beating analyst estimates by an average margin of 9.1%. That’s been good enough to lift the blended earnings growth rate up to +11.9% as compared to the 12/31/25 consensus estimate of 8.3%. If it holds, this would mark the 5th straight quarter of double-digit growth. Margins remain strong as well with net profit margins currently sitting at 13.1%, the highest dating back to at least 2009. With the economy growing, corporate profits growing, the labor market stabilizing, the Fed expected to cut rates two times in 2026, fiscal policy support, and financial conditions relatively calm, we remain bullish on stocks in the longer term. That said, elevated valuations (22.2x fwd P/E) that leave little room for error and February historically being the 2nd toughest month for the S&P 500 might make the tape prone.

Sources: Bloomberg, FactSet

From the Trading Desk

Municipal Markets

- Municipals were off to the races in the New Year as January saw strong price performance, primarily out to 15 years. This occurred against a backdrop of supply that seemingly could not keep up with the demand from significant inflows and reinvestment. Rates rallied in a descending fashion (i.e. the short end outperformed) and the curve steepened. Specifically, the spread between 2s and 30s steepened by 26bps, while 2s to 10s and 10s to 15s steepened by 8bps and 11bps, respectively.

- The curve from 7-years and in saw absolute yields move significantly lower, specifically by 28bps for 1-year issues, 20bps for 3-years and 14 for 7-years. 10 to 15-year maturities moved lower, notably by 13bps in 10-years, while the 20-year spot increased 4bps. The long end (25 to 30-years) saw yields push higher by about 4 – 5bps, contributing to a steeper curve.

- Municipal ratios followed a similar pattern as ratios out to 10-years fell, with 20-years and longer staying relatively flat. Ratios out to 3 years tightened by about 5-7%, settling at 61%, while 5- and 7-year ratios dropped by 5% to close the month just shy of 60%. The 10-year maturity ended at 62%.

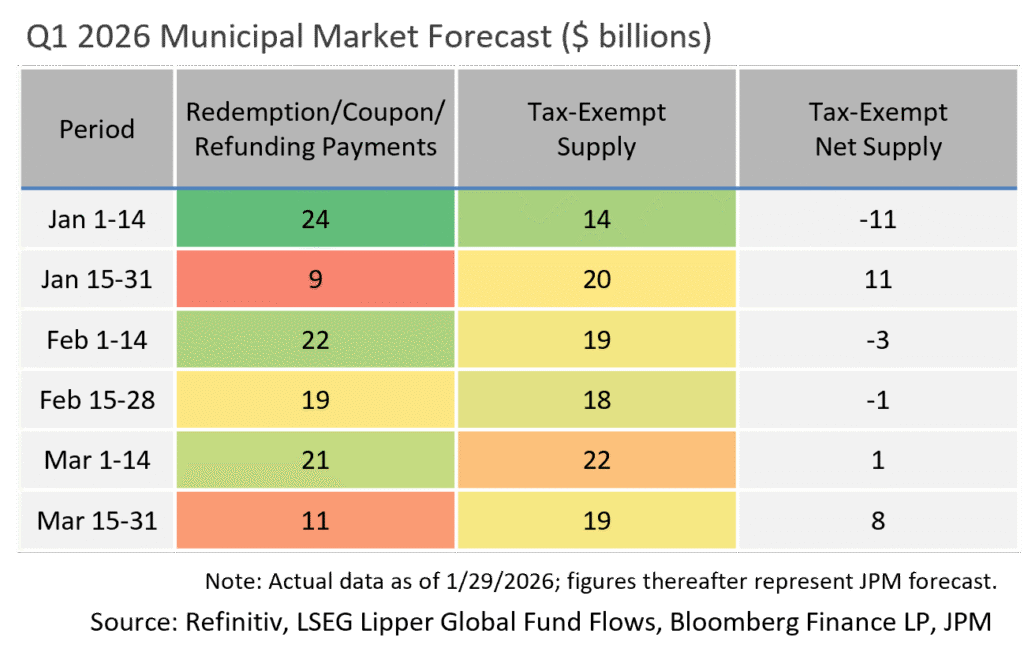

- According to JP Morgan, tax-exempt issuance in January totaled $34B, $1B lower than last year’s record. Over the month, gross issuance hit $35B, just below the $37B seen in the prior January.

- Municipal fund flows surged in January with net subscriptions totaling $6.4B based on data reported weekly to Lipper. JP Morgan estimates that municipal inflows could reach $13B once monthly reporting funds are factored in, which would be one of the highest months on record since Lipper started tracking in 1992.

- Market technicals are setting up for a constructive February,aided by $40B of reinvested principal and interest. Of note, this would be a record for February reinvestment, surpassing the prior peak of $37.5B recorded in 2017.

Corporate Markets

- UST yields moved modestly higher in January with a slight tilt toward curve flattening. The 10Yr bond rose 7bps to 4.24% after hitting a YTD high of 4.29% on January 20th, a level not reached since last August. We see a resistance level in the 4.25% range. Rates down the curve followed the same path with 2 and 3Yr issues higher by 5bps to 3.53% and 3.59%, respectively. The 1Yr remains the lowest yielding point on the curve at 3.48%. In our view, the 10Yr will remain range bond in the near term with a downward bias given uncertainty swirling around the markets.

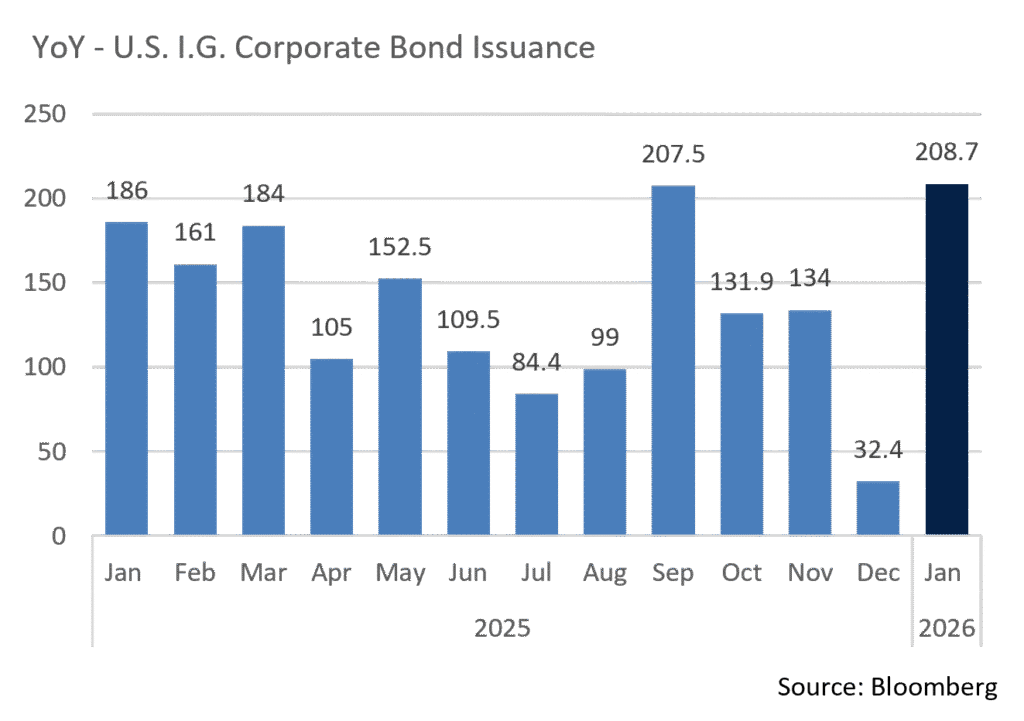

- January’s $208.7B of new debt brought by issuers was the largest monthly total since September’s $207.4B. It was also the 5th largest month on record and 12% higher than this same time last year. It is worth noting that the Financial sector accounted for 56% of last month’s issuance led by the US “Big Six” banks. The most notable deal was Goldman Sachs, who brought $16B of new debt mid-month, the largest investment grade Wall Street bank offering ever. As with others, management capitalized on attractive funding cost, strong investor demand, and a still solid economy. 2026 is expected to be a record setting year for issuance and, so far, things are moving in that direction. As long as the technical backdrop remains strong, the $190B expected to come in February should be realized.

- Investment Grade and High Yield spreads remain tight and feverish demand is keeping valuations strong. The Bloomberg US IG Credit Index OAS began the year at 78bps before moving higher by 5bps at month’s end. $15B of net fund flows (as per Lipper) bolstered demand, the lion’s share of which went into Short and Intermediate funds. We anticipate a continuation of tight, range-bound Investment Grade spreads over the next few months. However, a risk bifurcation became evident in January, as High Yield funds saw outflows of $869.7M.

Sources: Bloomberg, Bond Buyer, Barclays, JP Morgan, and Lipper Inc.

Financial Planning Perspectives

Trump Accounts and New Planning Opportunities

One of many provisions of the OBBBA signed into law on July 4, 2025, was the creation of so-called “Trump Accounts.” In an attempt to encourage greater retirement savings and provide a future financial leg-up for young Americans, these new accounts have garnered much attention over the past several weeks as the White House, Treasury Secretary Scott Bessent and others have touted their attributes. Investments must be made in low cost, no leverage exchange traded funds that replicate broad indices of U.S. stocks.

These new vehicles have features of minor custodial accounts and individual retirement accounts. Access to and funding of Trump Accounts will begin on July 5, 2026, and it is anticipated that they will be widely available at most financial institutions. To establish a new account, a one-time $1,000 contribution from the US Treasury will be made on behalf of eligible U.S. citizens born on or after January 1, 2025, and those born on or before December 31, 2028, who create an account.*

In addition to the initial $1,000 of Treasury funding, contributions can be made as follows:

•Parents and others (relatives and friends) may collectively contribute up to $5,000 annually (the initial contribution provided by the U.S. Treasury does not count toward the annual $5,000 cap). The $5,000 limit will be indexed for inflation beginning in 2028.

•Employers have also been given an opportunity to contribute up to $2,500 per employee (not $2,500 per child of the employee). Employer contributions are part of the $5,000 annual limit.

•501(c)(3) charities, state and local governments also have an ability to contribute to a Trump Account, and their contributions do not count against the $5,000 annual limit.

Trump Accounts do not require that a child have earned income in the year that contributions are made to their account. Furthermore, participants can still take advantage of 529 plans and other retirement accounts such as IRAs or Roth IRAs, provided they have earned income and meet eligibility requirements for IRA funding.

Withdrawal of assets held within Trump Accounts are not permitted before January 1st of the calendar year in which the child reaches the age of 18 and, at that point, the child becomes the sole owner of the account. Withdrawals are subject to tax at that time, as well as a 10% penalty prior to retirement. However, once a beneficiary attains the age of 18, Trump Accounts follow the same rules as IRA withdrawals, including various exceptions to the 10% early IRA withdrawal rules ($10,000 for a home purchase, attaining the age of 59½, $5,000 towards adoption, etc.).

These new accounts offer yet another tax advantaged avenue for retirement savings. At last week’s unveiling, Treasury Secretary Scott Bessent announced that approximately 600,000 American families had already elected to open a Trump Account for their children.

If you have any questions about Trump Accounts or other retirement savings options, please reach out to your Wealth Manager.

*For eligibility purposes, U.S. Citizens born between the dates noted above will be required to have a valid social security number, and their parent(s) or guardian(s) must complete Form 4547 as part of their 2025 Federal income tax filing or sign up at www.trumpaccounts.gov later this year.

Source: Appleton Partners, Inc., OBBBA, U.S. Department of the Treasury

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.