Insights and Observations

Economic, Public Policy, and Fed Developments

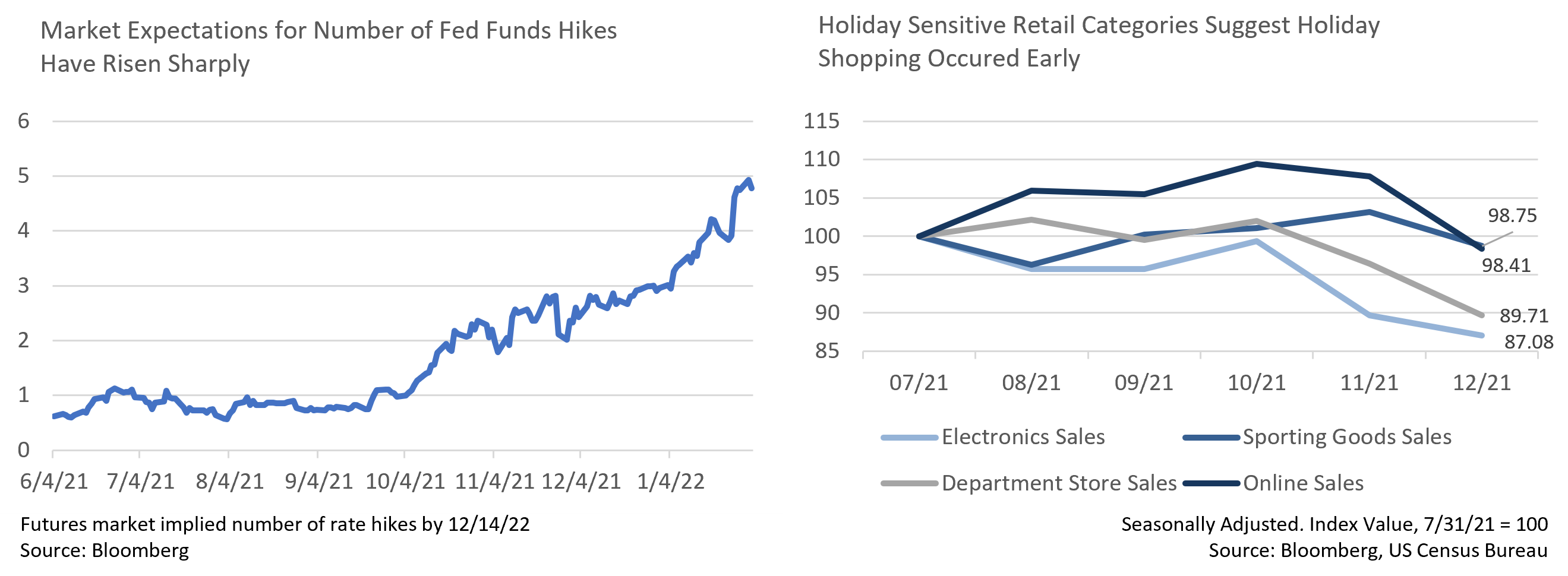

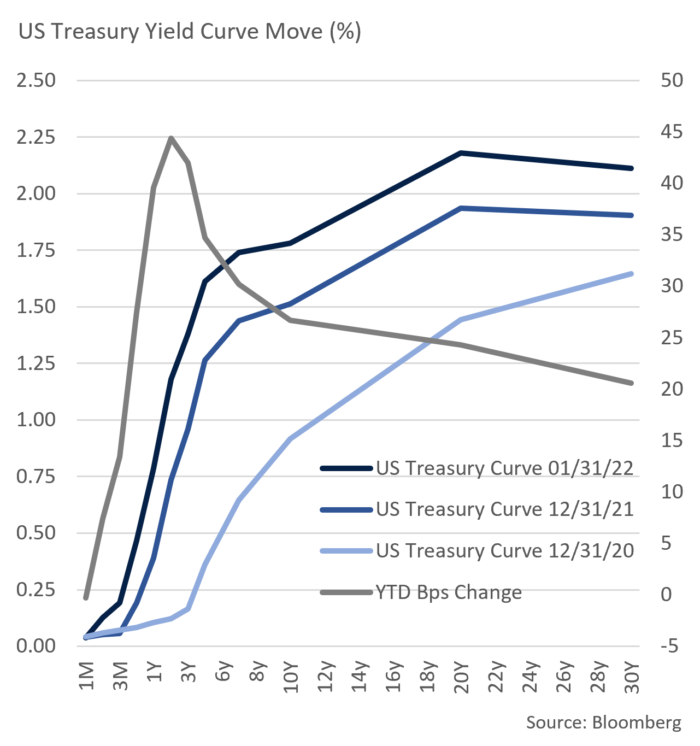

- Any hope for quiet markets at the start of 2022 was dashed in January. Equities traded off sharply as interest rates rose in an aggressive “bear flattener,” with 2Yr issues up 45 bps to 1.18% and 10Yr UST yields up 27 bps to 1.79%. These moves were largely driven by changing rate hike expectations. As recently as September the market had expected one Fed Funds rate increase, a consensus view that grew to three by year-end. Bloomberg’s interest rate probability monitor now shows nearly five hikes in 2022.

- We believe the Fed will lift rates off the lower bound with a 25bps hike in March. They have signaled as much, and the Fed has been very careful not to surprise the markets since at least the Taper Tantrum of 2013. However, the market has likely gotten ahead of itself by responding to current conditions rather than expectations and we feel that by the second half of the year the case for continuing beyond an initial few hikes will have weakened. The Fed’s reticence to commit to a rate hike schedule beyond March seems to be tacit recognition of that.

- First, inflation appears to be peaking. CPI hit a 40-year high in December but has shown signs of receding after the Delta-related surge that spurred the Fed into action, and while another Covid-related spike is hardly impossible, thus far manufacturing output seems to have held up relatively well. Year-over-year inflation readings will remain elevated for some time, but the monthly series should start moderating over the next several months regardless of Fed policy.

- A primary reason we expect inflation to slow is retail spending fell off a cliff in December. Surging spending earlier in Q4 had been widely interpreted as post-pandemic consumer demand, although we were more inclined to view these two months as front-loaded holiday shopping driven by supply chain concerns. December’s -1.8% nominal drop, with notable weakness in electronics, sporting goods, department stores, and online sales – all holiday-sensitive categories – provides a strong argument. With October and November’s surge appearing to borrow heavily from later months’ retail spending, early Q4 strength in consumer demand is unlikely to persist.

- Adding to this picture, Q4’s +6.4% GDP print was strong at the headline, but nearly two-thirds of the gain was due to an increase in inventories. Final Sales to Domestic Purchasers, a good proxy for underlying demand, grew at a more mundane +1.9%. This is important for two reasons. First, a buildup in inventories cannot continue indefinitely, and growth should revert over time towards the level of private sales. Second, after an extended Covid-influenced inventory drawdown, replenishment is the strongest sign yet that the bottlenecks that have fueled inflation are easing.

- Nonetheless, risks remain. China’s “zero Covid” policy could lead to protracted shutdowns if the Omicron variant takes hold, reversing some of the supply bottleneck improvements. And the 709k in upwards revisions we were looking for in November and December employment finally came in January, and due to upwards revisions to the participation rate the unemployment rate increased to 4.0%. The economy is doing a much better job bringing back labor after the pandemic than it once appeared. However, we remain 1.9mm workers short of pre-pandemic peaks, and average hourly earnings surging at an annual +5.7% rate in January suggests there may be some near-term pain until the workforce fully recovers. This is still below inflation and appears impacted by an Omicron-shortened workweek, but certainly bears watching.

Equity News and Notes

A Look at the Markets

- In a tumultuous start to 2022 the S&P 500 and Nasdaq both suffered their worst month since March 2020. Despite a late rally, the S&P 500 dropped -5.2% while the technology-heavy Nasdaq posted a -8.9% decline. Smaller companies fared no better with the Russell 2000 sinking -9.6% in January. Ten out of eleven sectors were down with the lone exception being Energy which enjoyed a +19.1% return.

- Equity weakness comes as investors grapple with higher inflation and interest rates, mixed economic releases, how the Fed will react to incoming data, and geopolitical concerns. The main risk is that the Fed gets too aggressive with rate hikes and/or balance sheet reduction (also known as quantitative tightening or “QT”) later this year. The market has been turbulent as investors try to discount the most likely outcomes, and rates have moved higher with ~5 quarter-point hikes in 2022 now priced in. Against a backdrop of higher rates and the threat of “QT”, the market has sold off, with growth names (higher sensitivity to interest rates) and higher valuation, speculative pockets most acutely impacted. As borrowing costs (bond yields) rise and asset prices (stocks) fall, financial conditions tighten which is what the Fed needs to fight inflation.

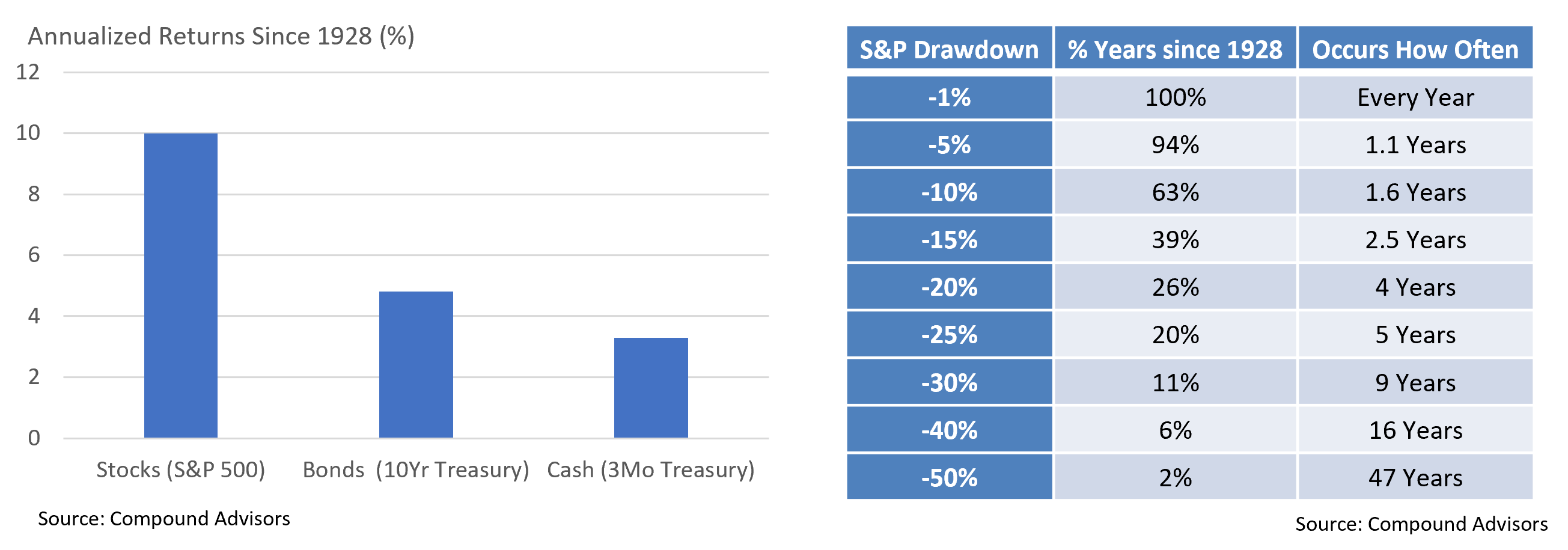

- Macro-driven volatility is a healthy reminder that the stock market imposes a price for producing historically greater returns than other major asset classes. That price is paid through higher risk, including periodic drawdowns which are a feature, not a bug, of markets. The last calendar year was an outlier as the average year experiences a drawdown of nearly -13%. Time horizon permitting, history has shown that corrections can be buying opportunities even if further volatility lies ahead.

- Q4 earnings season is less than halfway complete, but results (Facebook’s parent company aside) have so far been good, especially those of heavyweights such as Apple, Microsoft, and Google. The blended S&P 500 earnings growth rate has improved to +24.3% from a 12/31/21 estimate of +21.4% and 77% of companies have beaten estimates, albeit by a declining average margin of 4%. Expectations are critical and there is risk of analysts raising the bar too high and companies struggling to beat elevated expectations.

- Corporate credit spreads give us comfort that recent equity weakness may be a correction rather than something more sinister. So far, spreads have not shown the type of stress often associated with periods of worsening price action.

- Investors should brace for further volatility as the market digests each new data point and Fed policy interpretation. Investor sentiment has shifted to a more cautious tone, yet the S&P 500 was able to bounce off recent lows. We follow several indicators (put/call ratio, RSI, % stocks below 10-day, VIX, investor sentiment surveys, etc.) that point to oversold levels, although we are mindful that bottoming is rarely a one-and-done event and retests are common.

- We are constructive on equities looking further out. The economy remains in an uptrend led by a resilient consumer. We do not expect to see sustained +6.9% GDP and anticipate a longer-term trend of low-to-mid single digits. However, a slowdown in abnormally high growth rates does not mean contraction or recession, and bear stock markets are rare outside of recession. Corporate earnings are expected to rise 8-9% in 2022 and 10% in 2023 and fortified corporate balance should lead to elevated levels of cap-ex and increased dividends, share buybacks, and M&A activity.

- We also feel that despite tightening financial conditions the Fed is not likely to move as aggressively as many anticipate given a likely easing of inflation and economic growth. The Fed will move off emergency monetary policy levels yet remain historically accommodative. Valuation multiples have already fallen, with a forward P/E declining from 21.3x to 19.2x in January. Despite likely rough patches, equities should regain their footing as 2022 plays out and produce modestly positive returns.

From the Trading Desk

Municipal Markets

- While the month of January is generally slow in the municipal market, this year was an exception with rates increasing about 50-60 bps across the curve. The municipal curve was slower to react to a highly likely Fed rate hike in March than the UST market, but it has now caught up. We see this development offering a better entry point for buyers deterred by persistently low yields.

- It is worth noting that while recent price action has impacted absolute yields, we have not seen material credit spread widening. Given the strength in credit fundamentals, we do not see a reason for that to change significantly anytime soon.

- In terms of relative value, the 10-Year AAA Muni/Treasury ratio spent all of 2021 in a 60-70% range yet ended the month significantly cheaper on a relative basis at 87.6%. This was primarily due to the move in municipals as USTs were largely flat.

- Curve structure has flattened considerably as front-end yields drove the upward move. The differential between 2s and 10s declined to 66 bps, the lowest level since February of 2021, yet it is still elevated from the 57 bps recorded at the beginning of 2021.

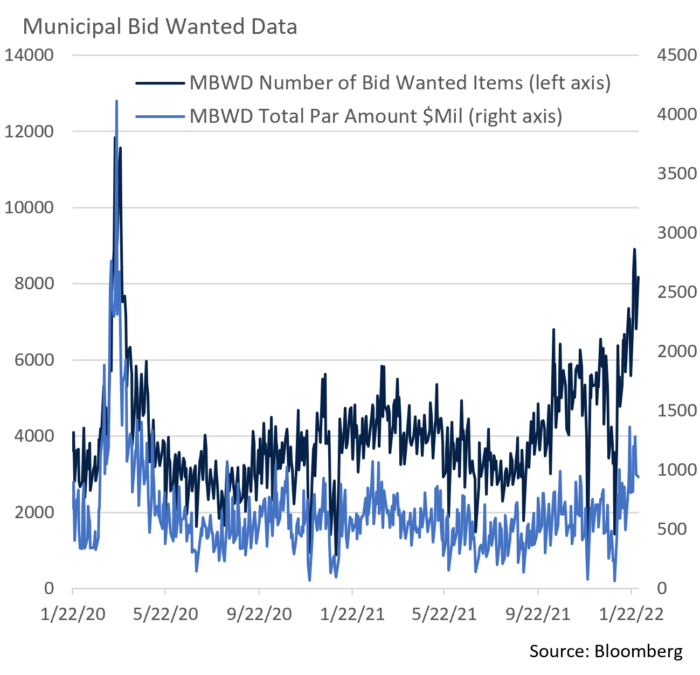

- The change in market dynamics has at least temporarily slowed fund flows. The last three weeks of January all saw net outflows for IG municipals and notably, secondary market supply has risen from $7B to $11.1B YTD. Municipal bond bid wanteds hit highs not seen since the pandemic spike of March 2020. In general, we see volatility of this nature as an opportunity given our flexible, active investment approach.

Corporate Bond Markets

- Price and spread volatility increased considerably in January across the investment grade credit markets as investors digested a more hawkish Fed and signs of “risk-off” sentiment returned after a long period of favorable markets. In this environment IG corporate issuance slowed considerably after a robust start. The $142B of new debt issued in January was near the average and secondary market trading waned. Not surprisingly, retail investors have pulled back a bit in response, with Lipper Inc. reporting net YTD taxable fixed income fund outflows of $8.8B.

- As is often the case, riskier corporate markets fared worse than higher grade credits with US high yield corporate spreads spiking to 345 bps over USTs vs. 87 for A rated credits. Corporate balance sheets and overall credit quality largely remain strong though, and the January move wider in our view reflects a general repricing of risk in the face of tighter monetary policy much more than corporate credit concerns.

- The UST curve flattened over the month with 2-10 spreads falling from 79 bps on January 3rd to a month-end level of 63 bps, due largely to a disproportionate increase in yields on the front end of the curve. We feel at least 50 bps of March Fed Funds increases have already been priced in with month-end 10Yr UST yields rising to 1.78% and the 1yr to 0.85%.

Financial Planning Perspectives

Revisiting the Benefits of Appleton Access

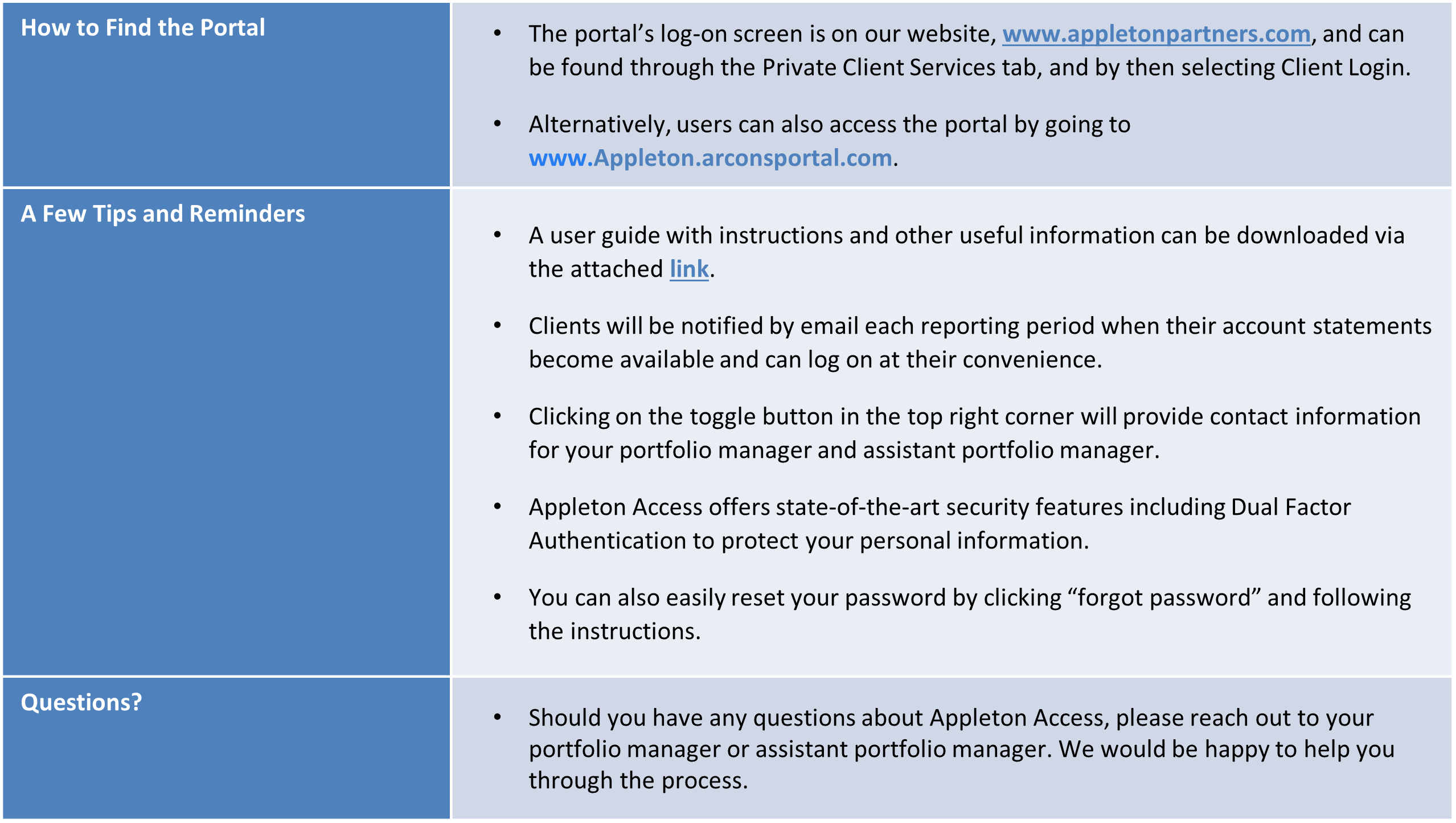

As a follow up to our Fall 2020 communication, we wanted to highlight some of the valuable attributes of Appleton Access, our private client portal. After registering and logging on to this secure client portal, users can quickly access:

As a follow up to our Fall 2020 communication, we wanted to highlight some of the valuable attributes of Appleton Access, our private client portal. After registering and logging on to this secure client portal, users can quickly access:

- Their most current account appraisal statement

- Past quarterly account statements

- Our Quarterly Perspectives market commentary

- Legal and regulatory documents including disclosure statements, our privacy policy, and Appleton’s Form ADV, GIPS report, and Form CRS

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]