Insights and Observations

Economic, Public Policy, and Fed Developments

- Inflation talk dominated the financial news in March as President Biden’s $1.9 trillion stimulus plan was signed into law and the White House laid out the basis of a large infrastructure bill. There is a widespread belief that inflation will rise in coming months; YoY comparisons are about to begin being made against a very low base impacted by last March and April’s economic shutdowns. Even if the Core PCE, the Fed’s preferred inflation measure, were to remain flat this March and April, comparisons with the same months of 2020 would cause Core PCE to rise from February’s 1.41% to 1.95% by April. This base effect sheds no light on the more pressing question of whether inflation will persist. Evaluating upcoming monthly or quarterly changes should offer better perspective.

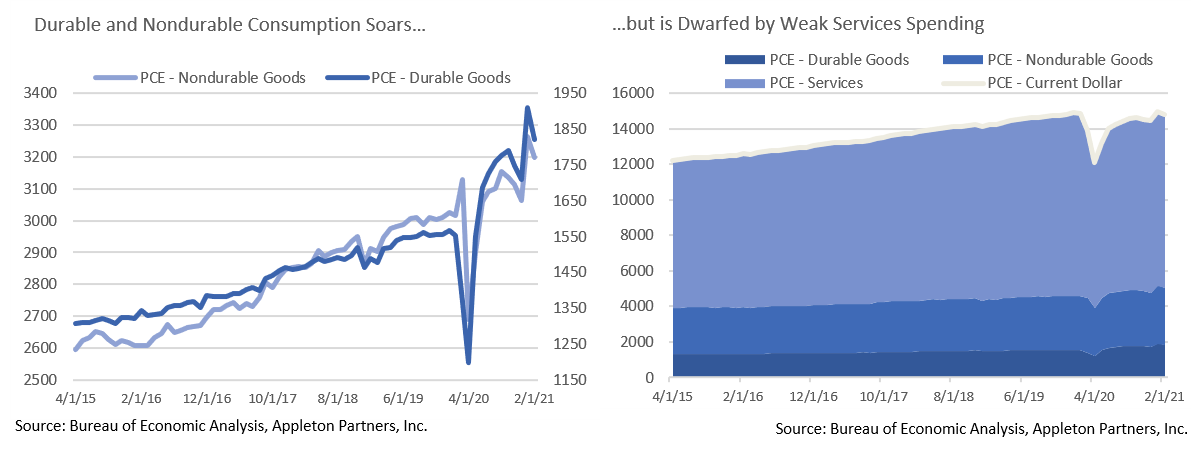

- There are several reasons to discount inflation fears; the simplest is that large stimulus efforts such as QEI through QEIII, and the American Recovery and Reinvestment Act failed to produce a meaningful surge. Additionally, while recoveries in Durable and Nondurable Goods consumption to above-trendline pre-pandemic levels have generated a great deal of attention, goods consumption is dwarfed by services and comprises only 30% of all consumer spending. With two-thirds of consumer spending still lagging, it is hard to see demand being sufficient to cause the economy to overheat.

- Despite strong momentum in the March employment report, a deeper look reveals that the pandemic is still weighing heavily. Although 11.4 million Americans reporting in The Household Survey that they either did not work at all or worked fewer hours because their employer had lost or closed their business was an improvement from the prior month’s 13.3 million, a sizeable employment gap persists. The economy bears scars that will take time to heal, and although labor demand is improving, it remains weak.

- Nonetheless, there are tangible signs that economic areas hit hardest are beginning to recover. March’s employment report produced a headline number of 916k new jobs, suggesting that labor demand is strengthening. Notably, most of the jobs were in leisure and hospitality, food service, and bars. Hiring in these sectors could point to an acceleration in services spending.

- While manufacturing is no longer the engine of the US economy, February’s ISM Manufacturing report was exceptional; the headline reading reaching levels not seen since 1983. This was followed by an equally strong ISM Services report. The index rose to 63.7, the highest reading since records began in 1997.

- Meanwhile, retail sales fell 3% in February and there was a surprise -1.1% drop in retail orders, although weather and supply bottlenecks were partly to blame. Notably, automobiles were down 8.7% as chip shortages constrained supply. A 200,000-ton container ship running aground and blocking the Suez Canal for several days captured popular imagination, while adding considerable strain to global supply chains and complicating efforts to assess the inflationary impact of backlogs.

- There was worrying news on the issue that has framed health and economic news over the past year: COVID-19. A drop in US cases since the start of the year has stalled and case counts are rising again. The “reopening trade” was fueled by a far-quicker-than-expected US vaccination push, and if too-rapid reopening contributes to a sustained new wave of infections, the recovery could be jeopardized.

Equity News and Notes

A Look at the Markets

- Stocks rallied on over the final month of Q1 as the S&P 500 gained 4.4% in March to bring YTD total return to +6.2%, a fourth straight positive quarter. A bullish narrative was bolstered by massive fiscal stimulus in the form of a new relief bill signed on March 11th equating to roughly 9% of GDP. An accommodative Fed, improving economy, accelerating vaccine rollout, and a rebound in corporate profits are also generating a substantial equity tailwind.

- The advance has been broad-based with all 11 S&P sectors higher for the month and comfortably above their respective 50-day moving averages. Another gauge of market breadth is revealed by more than 90% of S&P 500 companies trading above their 200-day moving average, confirming a long-term uptrend and robust performance participation.

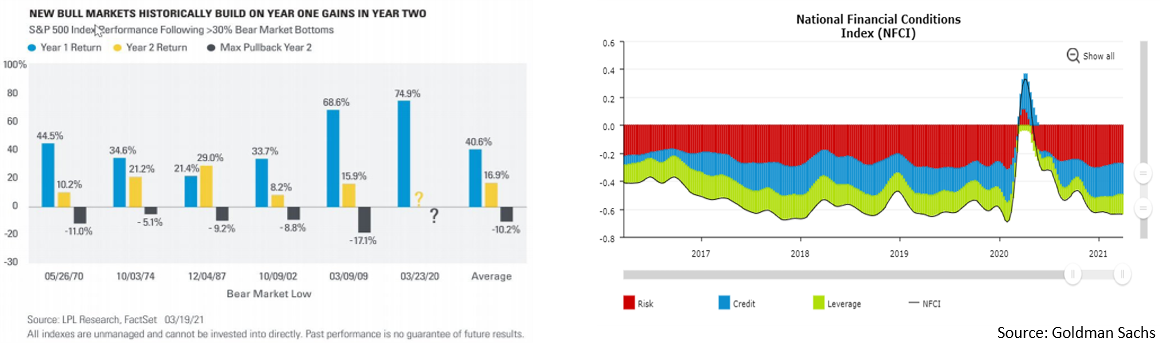

- Despite these positive indicators, one ought to be mindful that the market is more than a year off its lows. Year two market returns have historically tended to be muted, although positive, compared with the prior year, and significant drawdowns have occurred.

- Performance divergence is revealing, although every S&P sector has participated in the rally. Most economists are raising their 2021 GDP forecasts to a range of 6 to 9%. This would represent the strongest growth rate since the early 1980s. Interest rates, which are usually positively correlated with GDP growth, have moved higher, fueling a rotation into economically sensitive sectors. Cyclicals such as Energy, Financials, and Industrials have recently led equity performance, while more defensive, non-cyclical sectors have lagged. Many of the mega cap Technology names that soared during the pandemic have trailed of late as focus moves into areas more levered to economic reopening.

- Upward rate pressure has also hurt high growth, high valuation companies. These “longer duration” companies’ future cash flows are now being discounted at higher rates as UST yields increase, thereby reducing the present value of anticipated income streams. This helps explain why Large Value (+11.3%) has outperformed Large Growth (+0.9%) to start the year.

- We continue to emphasize a long-term, diversified approach to portfolio construction with exposure to both cyclical and secular growth. Our security selection is avoiding unprofitable, deep value names, as we feel these types of stocks have become highly speculative.

- Trend lines matter and Q1 earnings season kicks off in mid-April with Wall Street consensus calling for YoY S&P 500 growth of +23.8%. Even though year ago comparisons will be unnaturally positive given where we were in 2020, earnings estimates have also been on the rise. Q1 forecasts have increased from a year-end level of +15.8%, and a record number of companies have issued positive quarterly guidance. Corporate earnings must continue to rebound to allow markets to grow into today’s extended valuation multiples.

- Ample liquidity has helped financial conditions remain easy as evidenced by the NFCI, a barometer measuring more than 100 economic stress indicators. Below zero readings suggest an easier-than-average environment. We find it comforting that neither higher interest rates, nor rising inflation expectations have yet translated into tighter financial conditions. This may be one reason why Chairman Powell and the Federal Reserve currently seem to lack concern about interest rates and inflation. Should the HFCI Index reverse course, the Fed might not remain as ambivalent.

- While the economy is certain to see a boost from the President’s infrastructure plan, investors seem less preoccupied over the tax increases needed to help pay for it. Proposed changes will likely include an increase in the corporate tax rate to up to 28%, eliminating certain tax breaks on foreign income, and instituting a corporate minimum tax. Estimates are that the plan could shave anywhere from 5 to 9% off 2022 S&P 500 earnings. Much congressional negotiation awaits, and the terms and timing of potential changes remain unknown. It bears noting that tax increases are felt more quickly than infrastructure spending, so the economy and businesses could be impacted before benefiting from an acceleration in growth.

From the Trading Desk

Municipal Markets

- Favorable economic forecasts, forthcoming additional stimulus, and growing inflation concerns produced sustained upward pressure on Q1 fixed income yields. As noted below, USTs moved sharply higher and municipals followed, although they somewhat lagged. 10Yr AAA muni yields rose during Q1 from 0.71% to 1.12%. Curve steepening was pronounced with the spread between 2s and 10s rising from 57 to 98 basis points. We welcome a more normalized curve as it creates better opportunities to invest client assets and bolsters reinvestment income. As active managers, we are looking for opportunities to enhance yield and total return while seeking to protect capital as rates adjust.

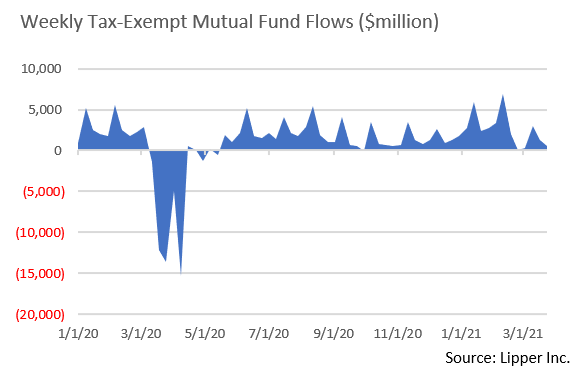

- The positive technical backdrop that has characterized the municipal market for some time remains intact. Demand is still strong with net municipal fund flows exceeding $31 billion YTD. Through the end of Q1, new tax-exempt issuance of $73 billion is only slightly ahead of relatively low 2020 comparisons. Furthermore, Citibank anticipates flat net new issuance in April, as maturities, calls, and coupon payments are likely to offset new offerings.

- Investment grade municipal demand is also unlikely to be tempered by near-term credit concerns. As the “Public Sector Watch” notes that follow on the next page indicate, most state and local budgets are comfortably exceeding conservative projections and substantial further Federal aid is forthcoming. And with income tax hikes possible, if not likely, demand for tax-exempt income is not likely to wane anytime soon.

Corporate Bond Markets

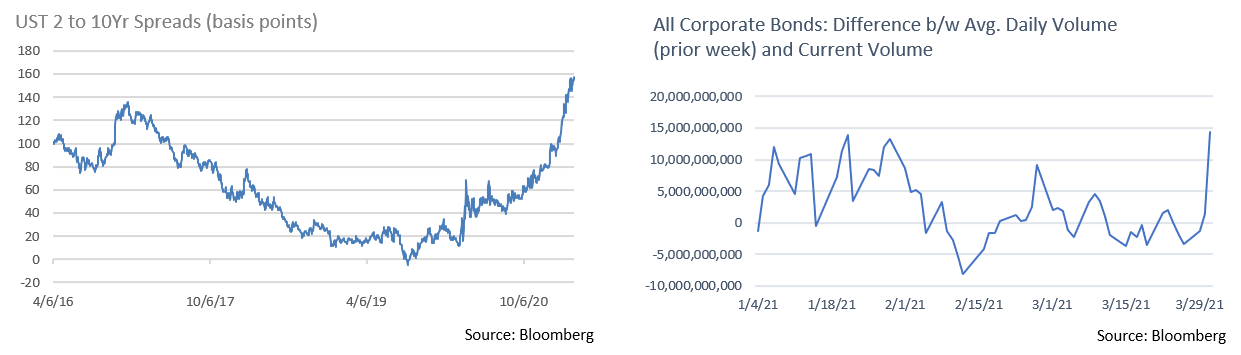

- Curve steepening has been the story of late, with the spread between 2s and 10s on the UST curve reaching 160 basis points at the end of March, a level not seen since the summer of 2015. With the front end of the curve remaining inside of 10 basis points due largely to an accommodative Federal Reserve, bear steepening of Q1 was driven by a spike in the 10Yr from 0.83% to 1.74%.

- Investment grade credit spreads have been in an elongated band throughout 2021. Option-adjusted spreads (OAS) reached cyclical lows at 88 basis points at month’s end. A solid fundamental credit outlook has fueled sustained demand for corporates despite modestly negative recent performance driven by upward rate pressure. We note that after several weeks of sluggish volumes, TRACE reported a $14.3 billion increase in trading activity on the last day of the month, an indication of vibrant market conditions given accompanying spread tightening.

- Investor appetite for corporate bond risk and the income it offers remains high despite the recent move up in the yield curve. The riskiest tier of the High Yield market (CCCs) was the top-performing US fixed-income asset class in Q1 with the Bloomberg Barclays US Corporate High Yield Index returning +3.58%. Below investment grade corporate issuers are capitalizing by issuing bonds at a historic pace. March high yield bond issuance reached a record $59.1 billion, contributing to a new high in quarterly corporate issuance of $148.7 billion.

Financial Planning Perspectives

Congress to Grapple with a Shifting Tax Environment

Estate Tax Exemptions Poised to Fall

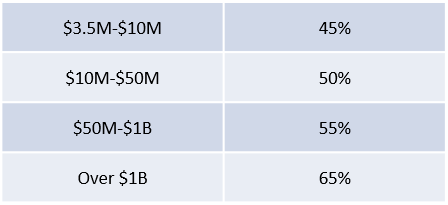

As a follow up to last month’s discussion of the “Ultra-Millionaire Tax Act,” and ahead of President Biden’s individual tax increase proposals expected later this month, two recently introduced bills could significantly alter the estate planning landscape. The first, “For the 99.5% Act,” was released on March 25 by Sen. Bernie Sanders (I-VT). The Act would reduce the federal estate tax exemption from $11.7M ($23.4M for couples) to $3.5M, or $7M for married couples, while also seeking to introduce the accompanying tiered estate tax rates.

As a follow up to last month’s discussion of the “Ultra-Millionaire Tax Act,” and ahead of President Biden’s individual tax increase proposals expected later this month, two recently introduced bills could significantly alter the estate planning landscape. The first, “For the 99.5% Act,” was released on March 25 by Sen. Bernie Sanders (I-VT). The Act would reduce the federal estate tax exemption from $11.7M ($23.4M for couples) to $3.5M, or $7M for married couples, while also seeking to introduce the accompanying tiered estate tax rates.

The proposal would also decouple the federal estate and gift taxes (the $11.7M federal estate tax exemption is currently a “unified credit” that may be used during life or at death) and restrict lifetime gifts to $1M (at which point the above estate tax rates apply). Furthermore, it would eliminate or limit common estate planning techniques such as annual gifts, GRATS, dynasty trusts and valuation discounts.

The second proposal, the Sensible Taxation and Equity Promotion (STEP) Act, seeks to end the cost basis step-up that individuals receive on appreciated assets upon their death. The STEP Act, introduced by Senators Van Hollen (D-MD), Booker (D-NJ), Sanders (I-VT), Whitehouse (D-RI) and Warren (D-MA), would limit the amount of unrealized capital gains eligible for a step-up in basis to $1M. If enacted, the legislation would be applied retroactively to January 1, 2021.

Upper Income Tax Rate Debate Pending

While the legislative fate of these estate tax proposals remains uncertain, the policy themes of the STEP ACT and the “For the 99.5% Act” are likely to be reflected in individual tax proposals the White House is expected to announce later this month. Upper income tax increases are being framed by proponents as policy adjustments aimed at offsetting some of the costs of economic stimulus and proposed infrastructure investment. Last August we summarized potential individual tax rate adjustments. Regardless of how this fiscal policy debate plays out, the tax environment has clearly changed, and we encourage clients to discuss potential impact on their financial plans.

Important Tax Planning Reminders:

The IRS, in Notice 2021-21, recently extended the following 2020 tax filing deadlines until May 17, 2021:

The IRS, in Notice 2021-21, recently extended the following 2020 tax filing deadlines until May 17, 2021:

- Individual tax returns

- Contributions to Traditional and Roth IRAs

- Contributions to Health Savings Accounts (HSAs) and Archer medical savings accounts (MSAs)

- Coverdell Education Savings Accounts (Coverdell ESAs)

- IRS has extended the window to claim refunds from tax year 2017 forward.

- Massachusetts and 34 other states have already aligned their tax filing deadlines with the IRS.

Please note that certain 2020 filings remain due on or before April 15, 2021:

- Q1 2021 estimated tax payments

- Trust and Estate tax returns

- Corporate tax returns

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]