Insights and Observations

Economic, Public Policy, and Fed Developments

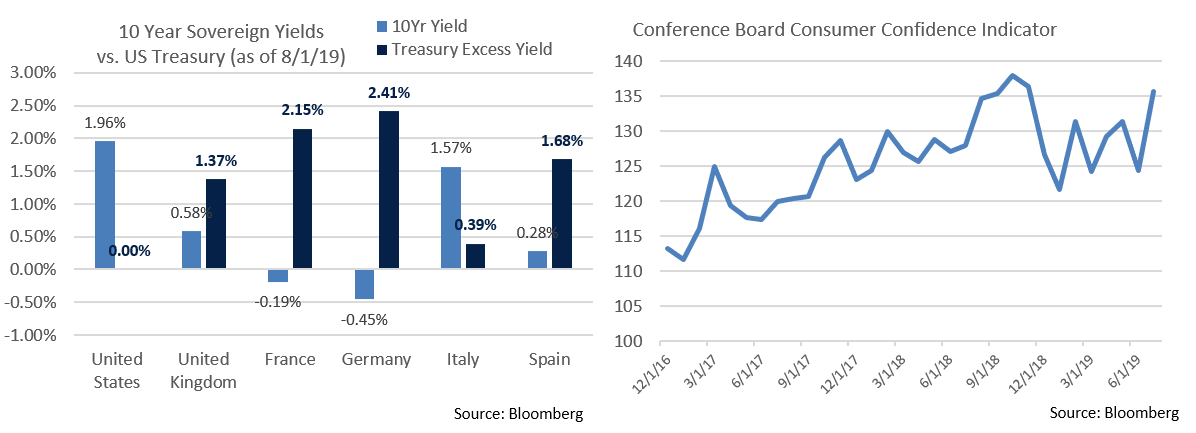

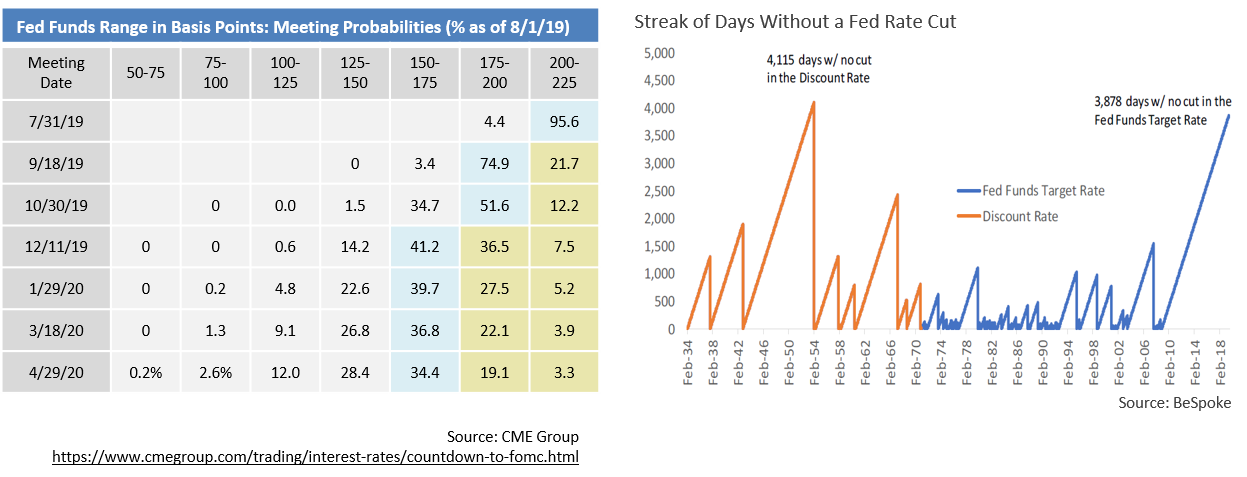

- Considering the lack of any real uncertainty that it would happen, the first Fed Funds rate cut in 11 years dominated July’s news. While there was some speculation about the prospect of a 50 basis point cut (largely fueled by a speech by NY Fed President John Williams), Chairman Jerome Powell ultimately delivered a 25 basis point cut on the 31st. In his Q&A he described the move as an “insurance cut” and a “mid-cycle adjustment” rather than the first of a “long series of rate cuts.” Both the equity markets, which had hoped for a series of rate reductions, and President Trump, who wanted a more dramatic cut, expressed disappointment. Equities quickly dropped more than 1% on the news, the first such decline in two months. While there is evidence that the US and world economies have slowed, they have yet to stall and modest growth should continue to support asset prices without significant fiscal easing, provided global trade conflict does not spiral out of control.

- The Q2 GDP report was similarly unsurprising as growth slowed from Q1, but to a better-than-expected 2.1%. The drivers of growth were also broadly in line with expectations; net exports weighed on growth as did a decline in inventory levels, although evidence of retail strength in recent months, including a knockout May report released last month and surging consumer confidence indicators, led to a solid contribution from consumer demand. Indeed, the second quarter was an inverse of the first, with private sales to domestic consumers coming in well above GDP at 3.5%; in Q1, the strong headline number was belied by weak final sales. The impact of the trade war continues to make itself felt; in addition to weak net exports, business investment essentially stalled as firms try to make sense of a rapidly changing and highly volatile global trade environment.

- On that note, President Trump surprised the markets on August 1st by announcing a 10% tariff on all remaining Chinese imports effective September 1st. Equity markets sold off and yields dropped sharply on the news. While it remains possible that this is another “negotiation technique”, the Chinese quickly announced a currency devaluation before taking a step towards stabilization, and the Trump Administration designated China a “currency manipulator”. These developments aggravated already tense negotiations, dampened hopes for resolution, and are likely to further slow global growth.

- Overseas, Mario Draghi left rates unchanged on July 25th, but citing an outlook getting “worse and worse” he set the stage for future cuts. Markets expect a 10 basis points cut to -50 basis points, likely in September. German bunds hit all-time lows on the news, with the 10Yr falling to a then-record -0.42%. Meanwhile, the Tories elected Boris Johnson as party leader, in turn making him the new UK Prime Minister. While initial market reaction was muted, the pound began sliding as traders grappled with Johnson’s commitment to pursuing even a no-deal Brexit. Lower European sovereign yields and political instability from either a no-deal Brexit or the collapse of the Tory government over an inability to deliver Brexit (we see them as equally likely) should keep a ceiling on US Treasury yields in coming months.

- At home, a tentative bipartisan debt ceiling deal cleared the House and Senate and now awaits Trump’s signature. The deal would waive the debt ceiling through July 2021, permanently end sequestration, and caps discretionary spending at $1.37 trillion for 2020 and $1.375 trillion for 2021, an increase from FY19’s $1.32 trillion. In the short run this deal removes a major political risk from recently turbulent markets; longer term, we expect larger deficits and greater Treasury issuance.

Equity News & Notes

A Look at the Markets

A decided lack of volatility may be ending

- The S&P 500 dropped -1.1% on July 31, its first 1% move in either direction since June 6th and began the first week of August even more sharply lower on renewed trade conflict. Prior to this onset of turbulence the equity markets had seen 36 trading days of relative tranquility, with the VIX down 36% YTD. Not quite as subdued as 2017, but much quieter than 2018. We’ve had 19 1% days, 4 2% days, and only 1 3% day. Since 1928, the average year has seen 60 1% moves, 17 2%, and 7 3%. The punch line is that 2019’s calm waters are far more atypical than years characterized by sharp swings.

Q2 earnings season: pretty good so far

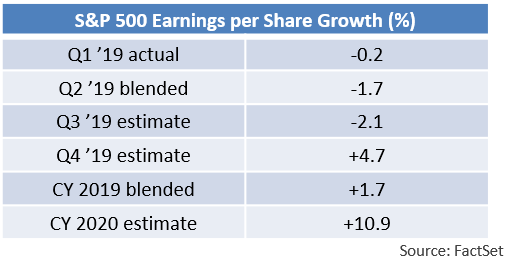

- Corporate results have so far been better than feared. With ~60% of S&P 500 companies reporting, the blended earnings growth rate has improved to -1.7% from a -2.7% estimate as of June 30th and Q2’s earnings decline is largely a function of Boeing’s 737 Max-related earnings miss. Aggregate beat rates have been strong, with 76% of S&P 500 companies beating earnings estimates and 61% exceeding revenue expectations. More importantly, company earnings have been 5.4% above expectations, well ahead of the 5-year average of +4.8%.

Some context given a murky forward outlook

- Wall St. analysts continue to lower their forecasts for the remainder of the year and the Chinese currency devaluation announced on August 5th will certainly not help. Q3 estimates of -2.1% have declined from +1.1% as of March 31st and Q4 estimates now call for 4.7% growth vs. a prior +7.5% projection. If this plays out, full year 2019 earnings growth would be a modest +1.7%. We feel the “earnings recession” demands greater context and see a healthier outlook than current headlines suggest provided the US – China trade saga once again calms. Earnings growth is measured quarterly on a year-over-year basis. S&P earnings grew 23% in 2018 largely due to corporate tax reform, thereby setting up very difficult 2019 comparisons. Forward-looking markets tell the same story: 2017 was strong in anticipation of tax reform, 2018 modestly lower discounting the one-time nature of the cuts, and 2019 has been good so far (despite flat earnings growth) as investors look to reaccelerating 2020 profits.

The Fed takes insurance…but don’t bank on overly dovish policy

- The Federal Reserve announced a 0.25% Federal Funds rate cut at their July 31st meeting. It is the first rate cut in more than 10 years, second only to a streak ended in 1954. With stocks not far off all-time highs and unemployment near record lows, many questioned why a rate cut was needed. We believe the Fed was proactively seeking to avoid importing economic weakness from abroad rather than trying to fight a potential recession after it begins. This “insurance cut” can also be viewed as an attempt to “right the wrong” of last December’s hike. Either way, with inflation stubbornly low and the impact of the trade war still very uncertain, we won’t argue with this telegraphed cut. We are more concerned with how the Fed signals its forward outlook and feel investors, who are pricing in 2 more cuts this year, could be disappointed.

From the Trading Desk

Municipal Markets

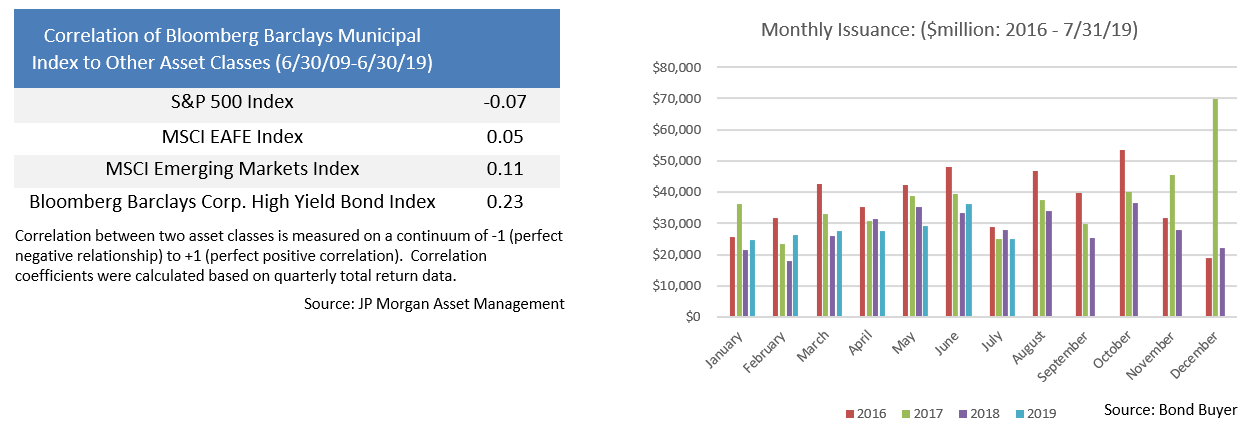

- On the municipal front, we see a continuation of intense buying pressure. August began with equity markets shaken by another flare up in the US – China trade dispute. In the face of uncertainty and volatility risk appetites can be compromised, and high-quality municipals are often seen as a safe-haven asset class that has historically demonstrated a low correlation to equities and other riskier assets. Furthermore, investors will be looking to reinvest a large volume of principal redemptions and income payments. As a proxy for investor demand in a retail-driven market, one need only look at mutual fund flows. Municipal funds have now posted 30 consecutive weeks of inflows and gathered year-to-date net assets of $52.9B, already the highest annual net inflow on record.

- Municipal issuance was consistent with historical trends and dipped during the month of July to $25.1B, although we expect an accelerated pace coming to market as the year moves on. Looking forward, 30-day visible supply has jumped to $16B, which is the highest it has been for the year and significantly above the YTD average of $7.8B. The average August issuance since 2015 is $37.6B, so we are likely to see a pick-up in new supply to end the summer, particularly given the likelihood of low municipal yields incentivizing issuers. Additional supply would be welcome as new municipal offerings have typically been oversubscribed, at times highly so.

Taxable Markets

- The Investment Grade bond market continued to roar in July as investor appetite for income showed no signs of letting up, although a trade induced equity sell-off on August 5th at least temporarily tempered risk appetite even among higher quality issues. Nonetheless, July’s markets were characterized by a dovish Fed, strong mutual fund inflows, and limited new issuance, which collectively has sustained a robust environment for higher grade taxable securities. The Bloomberg Barclays US Corporate Index OAS ended the month at 108 basis points above Treasuries, 22 basis points higher than the June sell-off high, and 50 tighter than where 2019 began.

- Against this backdrop, many investors have been inclined to move down in quality to meet yield expectations. As a result, lower quality IG (BBB) spreads have tightened dramatically and recently outperformed other ratings categories. Although corporate credit quality remains on solid footing, we feel investors are not being adequately compensated for taking on lower grade credit risk given the extent to which quality premiums have diminished. In our view, caution is in order.

Financial Planning Perspectives

Social Security Benefit Decision-Making: It’s More Complicated Than You May Think

When Should I Take Benefits?

Making a Social Security Retirement Benefit election is a decision nearly all Americans will make during their lifetimes, and one that may significantly influence one’s retirement income. Unfortunately, it’s also plagued by confusion and prone to compromised decision-making. Deciding when you or loved ones should take social security benefits requires making future assumptions. Although individuals receive an 8% benefit increase each year they forgo benefits beyond their Full Retirement Age (FRA), postponing also requires living long enough to make up for the deferred income.

A Few Personal Considerations

Although there are others, here are some important factors to assess:

- Your anticipated Retirement Age

- Your personal health and family longevity history

- Marital status and your spouse’s social security situation

Other considerations are specific to personal situations such as: retirement benefits impacted by the Windfall Elimination Provision (WEP); Government Pension Offset (GPO); divorce; significant age difference between spouses; and current/expected survivor benefits.

Notable Age Milestones

- 62 is the earliest age at which an individual can elect to begin receiving benefits

- 65-67 represents FRA for Social Security retirement benefits

- 70 is the latest age to which one might wish to defer benefits, as there is no value in waiting longer. The Social Security Administration will not pay you retroactively for missed time.

Our Recommendations

- Visit www.ssa.gov to set up an online account. Take the time to confirm your earnings history is accurate.

- Think about your situation. At Appleton, we’re happy to help you assess various options before you make an election.

- Do not claim benefits before you attain your FRA unless you are certain this is the right choice for you. You could unknowingly disqualify yourself from higher future benefits.

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]