Insights and Observations

Economic, Public Policy, and Fed Developments

- December brought renewed talk of a Fed “pivot,” and growing expectations for Fed Funds rate cuts met only token resistance from Fed Chairman Jerome Powell. Just as with the last several “Fed pivots,” we’d push back on this characterization; the Fed stopped one hike short of their “dot plot” in June but one higher than they had signaled at the start of the year. If they begin cutting rates in March as the market now expects, they will have been on hold for nearly 9 months, or close to a full year if instead they wait until June. This is still the Fed’s intended “higher for longer” policy trajectory. This didn’t stop the markets from reacting ebulliently, with the 10Yr closing the year 90bps off its October highs at 3.88%, and the stock market soaring. These levels feel a little overbought, and we would have been happier starting the year with a 10Yr over 4%. Still, despite 2023 being relatively painful for fixed income investors for much of the year, calendar year returns for bonds ultimately finished looking rather good.

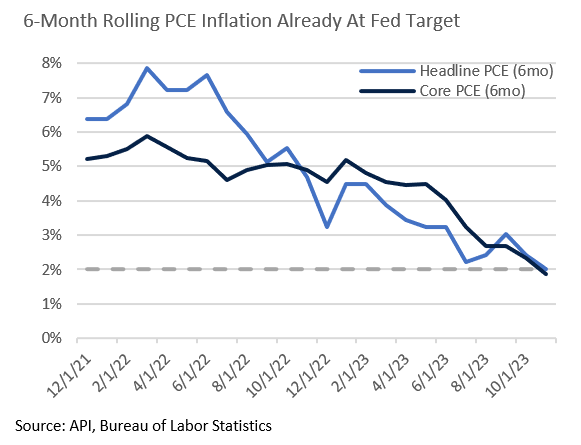

- The other good news for investors in 2024 is, absent any surprises, inflation should be a much smaller part of the economic narrative. Not only is the Fed well ahead of schedule bringing inflation down to its 2% mandate, but by shorter term measures it has likely already done so. Six-month annualized headline and core PCE is now at or below 2%, and base effects are the only thing keeping inflation over the Fed’s target. The Fed’s focus is no longer on lowering inflation so much as it is preventing it from reaccelerating.

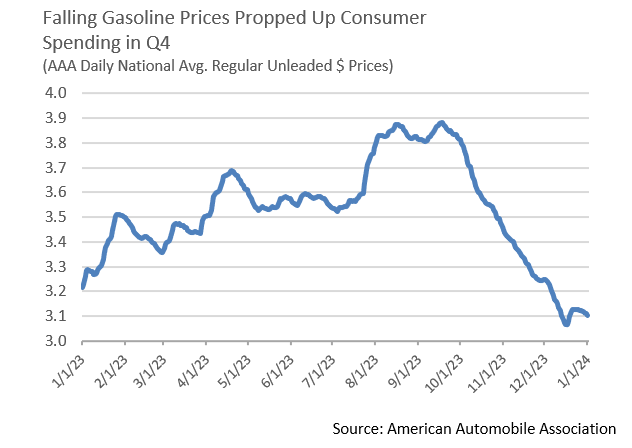

- We have long doubted the Fed’s ability to engineer a soft landing. But, with recent progress on inflation and with growth indicators coming in mostly better than expected, the likelihood of a soft landing has increased. We are not quite ready to declare victory, though. A factor we continue to watch is gas prices, which fell steadily throughout the fourth quarter. With consumers generally buying gas with credit, price changes usually impact spending with a one-month lag. Indeed, after evidence of an early slowdown, spending did pick up as the quarter went along. The extra money in consumers’ pockets has helped keep growth from slowing as much as we had expected in October. This trend may be reversing, however, with gas prices already below levels OPEC+ may find acceptable, and with worsening geopolitical tension in the Middle East. If gas prices rise from here, we expect consumer spending and growth to wane.

- Another risk that markets are overlooking is the expiration of the current continuing resolution funding the federal government in two phases, January 19th and February 2nd. House Speaker Mike Johnson passed the current “clean” resolution, with no changes in the level of spending, with the grudging support of his caucus, arguing he did not have enough time to negotiate a better bill. Subsequent negotiations have not been productive, however, and his narrow majority shrank to three with the expulsion of George Santos. Hardline Republicans have indicated they will not accept a clean resolution again; we expect either a partial shutdown to begin on the 19th, Johnson to lose a no confidence vote, or both.

- The outlook for 2024 will largely depend on whether the Fed is successful in executing a soft landing. If so, the curve will have to un-invert at some point, and with most market commentators expecting a year-end 10Yr yield of about 3.5%, yields will likely surprise somewhat to the upside. If not, then yields are likely to fall as growth softens and 3.5% will start to look optimistically high.

From the Trading Desk

Municipal Markets

- Total 2023 municipal issuance of $407.8 billion was up $4.2 billion vs. 2022, but still down from a high of $533.9 billion in 2020. California earned the top spot for state municipal issuance at $59.6 billion, followed by Texas and New York. Sluggish issuance continues to limit the availability of often oversubscribed primary market inventory, contributing to rich secondary market bids.

- Over the course of December 10-year AAA municipal yields declined by 33bps, according to MMD. The move is even more noteworthy if one looks back another month. From November 1 through year-end, 10-Year AAA municipal yields fell by 130bps. This significant yield compression could prompt more municipalities to come to market early in 2024 due to lower financing costs.

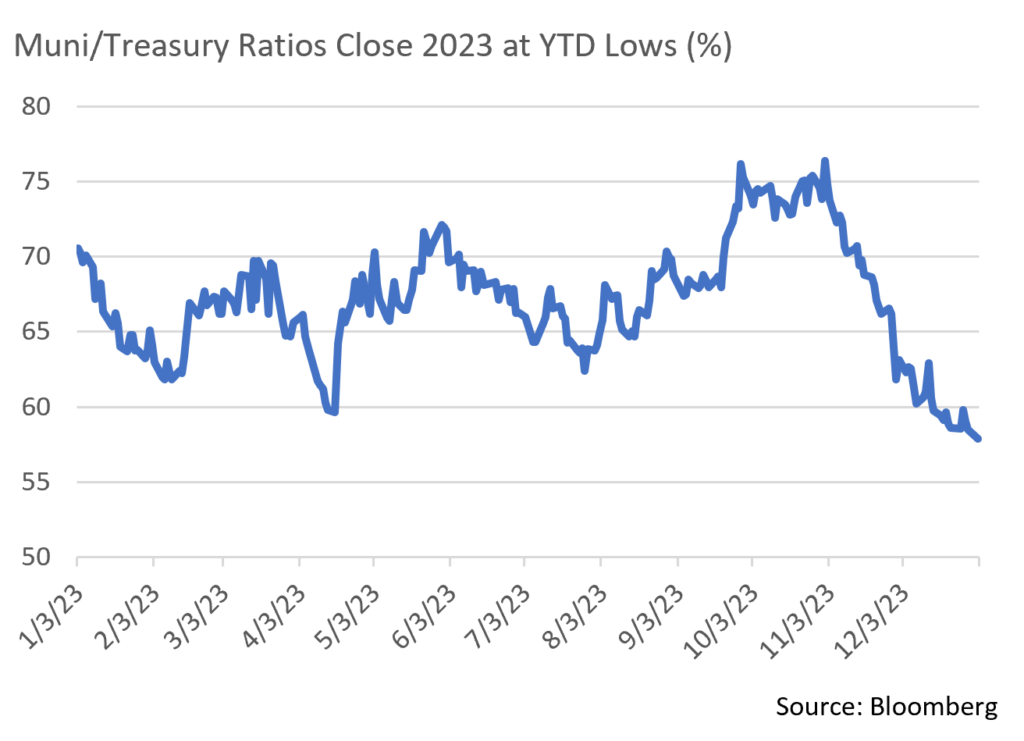

- Given the supply and demand dynamics that drove Q4 outperformance, ratios remain in the high 50% range for most maturities. The 10-Year AAA muni/ Treasury ratio ultimately ended the year at YTD lows of 58.8%. With technical factors expected to remain favorable during Q1, we anticipate that ratios will remain in this range for the immediately foreseeable future.

- Fed policy should continue to weigh heavily on the Treasury and municipal markets, particularly as many expect rate cuts to begin by Q2 2024. Curve normalization is likely to eventually come from receding front-end yields, although a slower than anticipated pace of Fed Funds reductions may delay the return of the traditional upward sloping yield curve.

Corporate Bond Markets

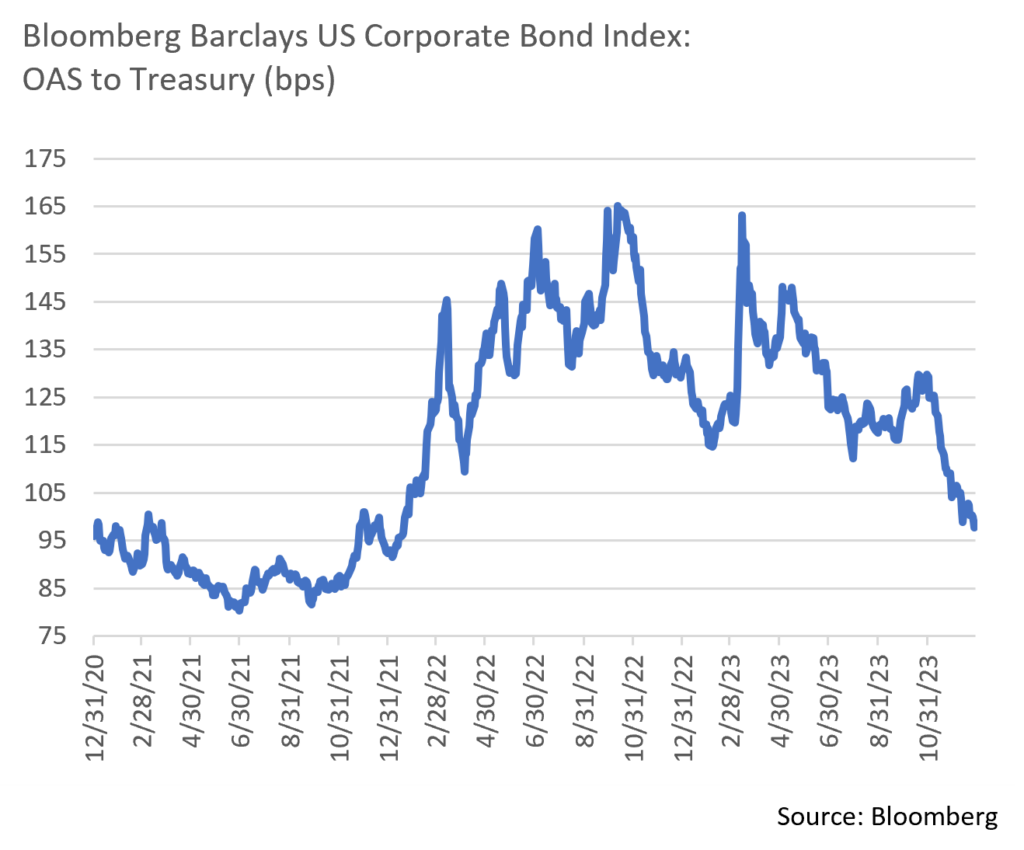

- Investment Grade credit spreads closed December with a flourish. The spread compression that began at the end of October gained momentum into November as the OAS on the Bloomberg Barclays US Corporate Bond Index dropped 5bps to 99bps. A low for the year of 98bps was reached on December 28th, marking the tightest OAS since the end of January 2022 and only 18bps above the 10-year low of 80bps set in June 2021.

- The rally in credit was sparked by declining UST yields in addition to a slowdown in new supply. January tends to be a strong month for Investment Grade credit, and we anticipate a range bound market until such time as the monetary policy and economic picture becomes clearer. At this stage, consensus points to a soft economic landing and an onset of Fed Funds rate reductions by mid-year.

- The US High Grade corporate primary market was quiet to end the year with only $23.6 billion of new offerings. Most of that came at the beginning of the month with buyers eagerly bidding on new supply as the overall bond market rallied. Nonetheless, over the course of the year the new issue market faced periods of sharp volatility and uncertainly that periodically sidelined issuers. It was looking as if total issuance was going to be a good bit lower than 2022 although a late year turnaround raised the total to $1.185 trillion, very close to 2022 and only slightly lower than average. Given a favorable current cost of funding, we expect a robust $160 billion to come to market in January.

- Historically speaking, the beginning of each year tends to be positive for credit spreads as the market begins to absorb sentiment. As inflation seemingly abates, growth and the possibility of a recession becomes a greater threat to both yields and spreads. Given the likelihood of a slowdown at some point and a possible cut in shorter term rates, we continue to proceed defensively while still taking opportunities as they arise.

Public Sector Watch

Credit Comments

Appleton Partners: 2024 Municipal Sector Outlook

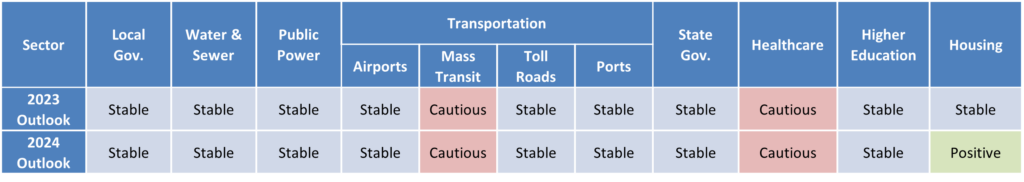

- After a tumultuous few years navigating the Covid-19 pandemic and its associated impact on today’s new normal, the dust has started to settle in the municipal market. From a credit perspective, our sector outlooks remain unchanged from 2023 with the exception of Housing. Going into 2024, eight of eleven outlooks are “stable”, two remain “cautious”, and only housing receives a “positive” outlook.

Of the nine sectors with a “stable” outlook, four exhibit similar trends due to their less cyclical nature. Their outlooks reflect resiliency during prior market downturns and prudent fiscal management.

- Water & Sewer – Given the essentiality of services provided and a self-regulated rate setting ability, revenues have largely remained stable and, in general, have incurred little to no operational disruptions.

- Public Power – This is a defensive sector with low volatility due to service essentiality. Financial metrics should continue to be strong and there has historically been minimal impact from recessionary periods.

- State Governments – State budget officers entered the current fiscal year with a cloudy economic vision, and most prudently incorporated that uncertainty into their spending plans. Should budget adjustments be insufficient, states maintain significant reserves that can offset disappointing revenue. Robust reserves, budget flexibility, and reduced fixed costs offer strong offsets to a potentially weaker economy.

- Local Governments – Property taxes are a leading revenue source and tend to be relatively stable over economic cycles. A risk factor on which we have been focusing – commercial real estate pressure – lingers and could create further strains in 2024 as asset owners and lenders are forced to grapple with the impact of sustained work from home. The effect will vary by city, and residential property typically accounts for a greater percentage of a city’s assessed value than commercial. Similar to states, local governments have significant budget flexibility, and given the 1 to 2-year lag between market value changes and property assessments, there is sufficient time to adjust budgets. Ample reserves and legacy stimulus funds also provide a revenue cushion.

Housing was the only sector to see a positive outlook change. Our view reflects strong demand for housing and improved attractiveness of Housing Finance Agency offerings, likely leading to greater loan origination and increased revenue. Underwriting prudency will be key, but access to federal enhancement programs as well as historically conservative lending practices lead us to expect positive loan portfolio performance. A caveat to our newly “positive” outlook is that investment opportunities will remain limited due to what are often unfavorable structural elements of Housing bonds, such as prepayment risk, small maturity sizes, and low coupons.

The Healthcare and Mass Transit sectors both have “cautious” outlooks having experienced significant difficulty since the beginning of the pandemic. Many consumer trends have permanently changed, altering their revenue generating ability.

Mass Transit faced a ridership cliff at the beginning of the pandemic that has been slow to rebound, as an ability to work remotely has remained prevalent. Many systems are expecting ridership will never fully recover and will need to add new revenue streams to replace fare drop-off. While mass transportation is an essential service, the political difficulties of raising new revenues will pose challenges in the coming years, leading to a “cautious” outlook.

Healthcare has had a “cautious” outlook for four years. The sector continues to be challenged by staffing shortages, rising supply costs, and wage growth. While expenses remain burdensome, inflation and wage growth are expected to grow at more manageable levels and most systems have made headway in increasing revenues, which we expect to contribute to marginal performance improvement. We feel most healthcare systems will be able to achieve long-term sustainable margins, however, margins are expected to remain compressed in 2024, driving our “cautious” outlook.

Strategy Overview

Composite Portfolio Positioning as of 12/31/2023

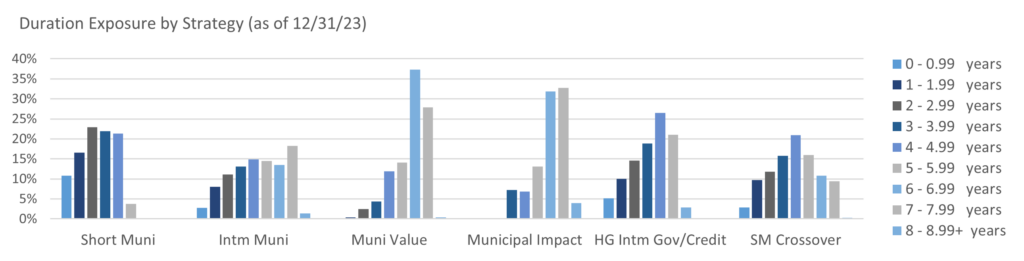

Duration Exposure as of 12/31/2023

The composites used to calculate strategy characteristics (“Characteristic Composites”) are subsets of the account groups used to calculate strategy performance (“Performance Composites”). Characteristic Composites excludes any account in the Performance Composite where cash exceeds 10% of the portfolio. Therefore, Characteristic Composites can be a smaller subset of accounts than Performance Composites. Inclusion of the additional accounts in the Characteristic Composites would likely alter the characteristics displayed above by the excess cash. Please contact us if you would like to see characteristics of Appleton’s Performance Composites.

Yield is a moment-in-time statistical metric for fixed income securities that helps investors determine the value of a security, portfolio or composite. YTW and YTM assume that the investor holds the bond to its call date or maturity. YTW and YTM are two of many factors that ultimately determine the rate of return of a bond or portfolio. Other factors include re-investment rate, whether the bond is held to maturity and whether the entity actually makes the coupon payments. Current Yield strictly measures a bond or portfolio’s cash flows and has no bearing on performance.

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.