Insights and Observations

Economic, Public Policy, and Fed Developments

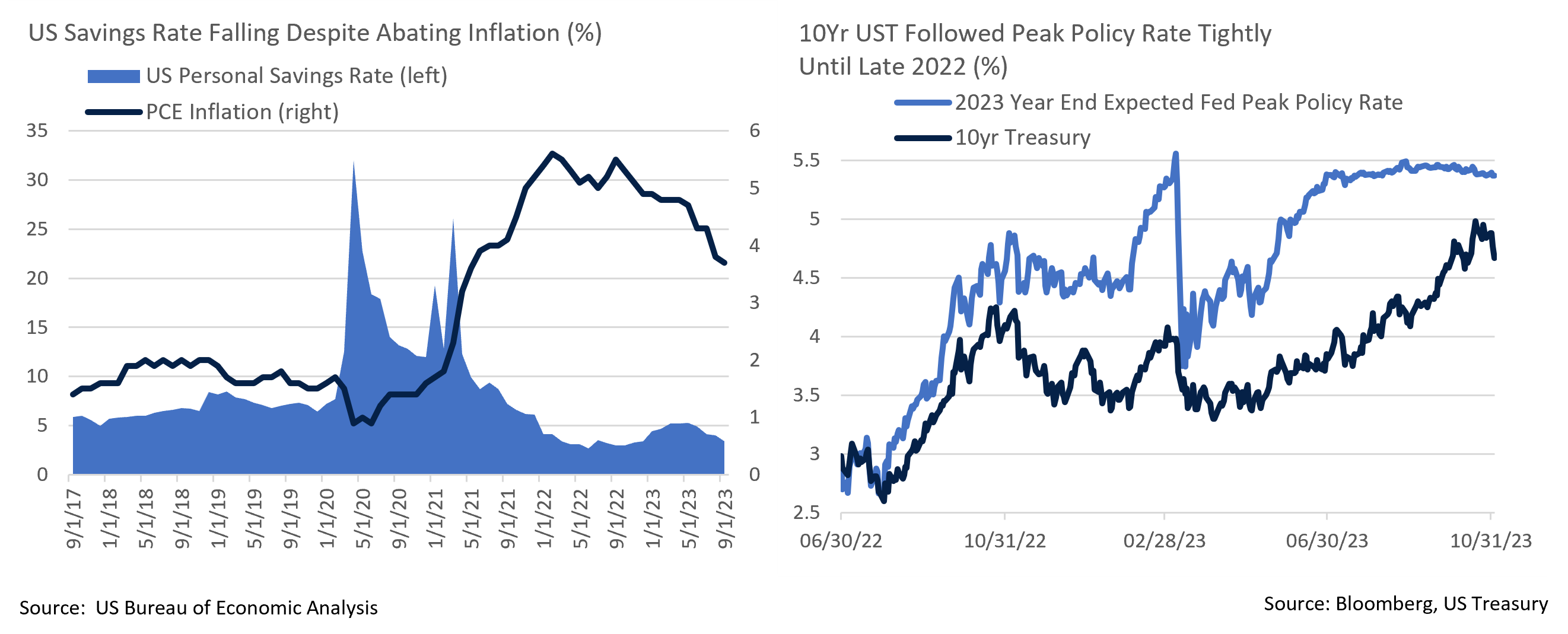

- As the end of the Federal Reserve’s hiking cycle approaches, the Fed Funds Rate has taken a backseat to other factors in explaining longer dated yields. This was evident through October’s rate volatility, as the 10Yr UST briefly breached 5% for the first time since 2007. We believe a combination of traditional supply and demand factors and investor sentiment are at play here.

- The supply side of the Treasury equation improved in October; first a quarterly refunding estimation of $776 billion came in well below expectations of $850 billion on higher deferred tax receipts, and then the next day’s announcement of lower-than-expected October issuance and only one more anticipated quarterly refunding increase was met with a market rally. There are still risks; we feel that the fourth times a charm election of Mike Johnson as Speaker of the House may be setting the stage for another shutdown in two weeks’ time, a story that should be getting more attention than it is. However, the US budget deficit being less bad than feared has provided support to bonds.

- The demand side is less encouraging. The Bank of Japan’s messaging around their yield curve control policies has been perhaps intentionally blurry. But, they are clearly easing, and with Japanese investors holding roughly $3 trillion in overseas bonds, any upwards movement in JPY yields will make domestic debt more attractive, potentially pressuring Treasuries. And while the default of Chinese mega real estate developer Country Garden brought surprisingly little market reaction, China’s real estate sector is clearly in trouble and the country has been selling Treasuries for some time to support their currency. Finally, in an impressively noncommittal press conference on November 1st, Jerome Powell indicated the Fed had no intentions of slowing their balance sheet reduction. With major price-insensitive Treasury buyers stepping back, it’s unsurprising that investor sentiment appears to increasingly be driving the Treasury market.

- If sentiment has become more important to rates, then the next few months should be interesting. Q3 showed impressive economic strength, with surging consumer spending driving GDP growth to an initial annualized estimate of +4.9%. However, we’ve also seen disagreement between backwards-looking hard data releases showing strength through quarter-end, and forward-looking investor surveys that suggest a sharp deterioration in October. Notably, the Fed Beige Book revealed economic activity coming to a standstill in most districts, and the ISM Manufacturing report slipped back towards its summer lows. Caterpillar, an industrial bellwether, also reported strong earnings in September but lowered guidance. It could very well be that sentiment has soured in spite of solid growth, but it’s possible that the surveys are picking up an inflection point that the activity-based indices will begin to show as October releases are reported. If so, this suggests rates may fall.

- Some evidence already supports this shift. The consumer savings rate continues to soften, and it is now well below its pre-pandemic average, even after recent upwards revisions suggested consumers were better off during the pandemic than data had initially shown. With consumer spending responsible for nearly 2.7 percentage points of Q3’s +4.9% growth, and inventory increases adding a further 1.3%, shrinking ability to spend could cause growth to stall. October’s somewhat tepid unemployment report also revealed moderating job growth in the establishment survey, but a sizable drop of nearly 350k in the household raised the unemployment rate to 3.9%. This is an early hard data point that supports recent survey weakness.

From the Trading Desk

Municipal Markets

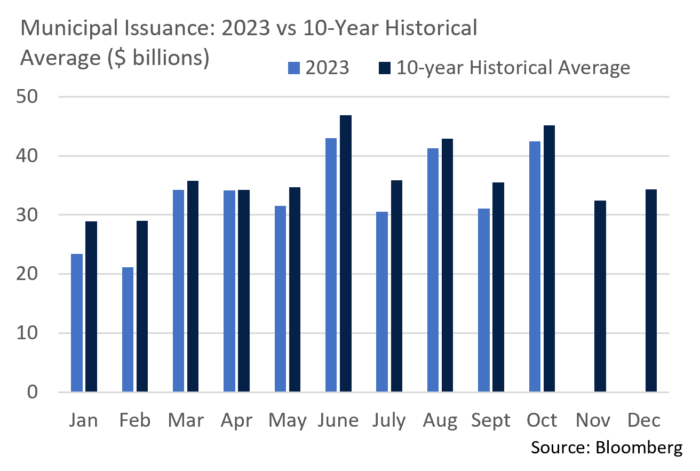

- As the calendar turns to November, the same themes that carried us through recent months remain evident – municipal yields are still at after–tax highs, and favorable technicals should be bolstered by about $14 billion of net negative supply in November and December. Treasuries are also beginning to rally. Given these factors, the outlook for municipal returns should improve after a negative period marked by positive economic surprises, Treasury yield pressure, and geopolitical tensions.

- Municipal supply gained some ground during October as YTD issuance now trails previous years by only about 7%, rather than early October’s 13%. However, November has historically been the 3rd weakest month, averaging about $32.4 billion over the past ten years. With a Federal Reserve meeting on the calendar, as well as Thanksgiving, we expect a seasonal primary market lull this year as well.

- Trading volume in the secondary market hit its highest level since December 2022 amid fund outflows and extensive tax related selling, much of which is being cycled back into new issues and well bid secondary market offerings. As we approach year end, tax motivated trading will drive the secondary market along with reaction to macroeconomic developments.

- Nominal yields on 10-year AAA munis of 3.60% exceed 6% on a tax-equivalent basis, the highest levels seen in over a decade. While the trajectory of Treasuries and other influences on the municipal market are inherently uncertain, we strongly believe current levels offer an attractive entry point for tax-exempt investors.

- The AAA curve is showing signs of normalization, as the inversion point has steadily shortened and now lies at 5 years. In intermediate accounts we are finding value in the 8 to 11-year maturity range, whereas more of a barbell structure had been emphasized earlier in the year.

Corporate Bond Markets

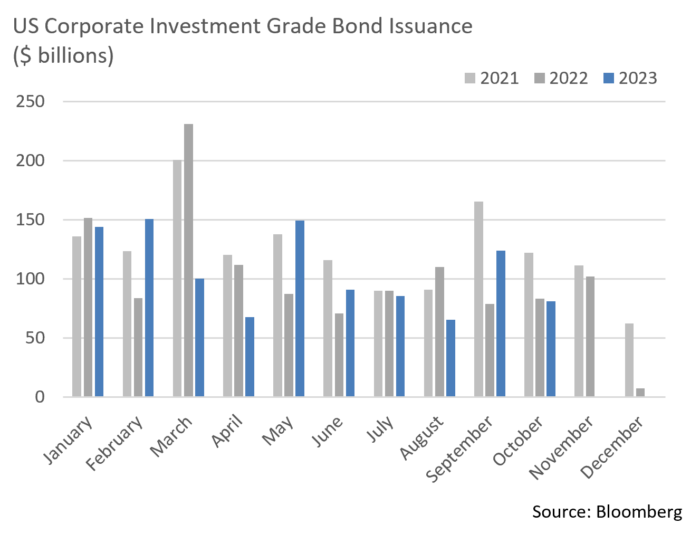

- In a surprise end to the month of October, the Investment Grade primary market engine kicked into high gear. Primary market issuance of $25.3 billion over the last week solidly beat expectations of $15-20 billion, raising the monthly total to a healthy $81 billion. Financials remain the most prolific sector coming to market, accounting for 65% of the monthly total and 45% of the YTD tally. Given curve structure, roughly 40% of all YTD IG issuance has come in maturities of 3 to 7-years. Despite considerable market volatility and upward pressure on rates, demand for credit has been sustained and we expect issuance to remain steady through the balance of 2023.

- Ford Motor Co. was not only in the news for being the first to cut a deal with the UAW, they were also granted a BBB- rating by S&P after being on positive outlook for two years. This not only propelled Ford back into the IG market for the third time, it added to the depth of the primary market. Demand for the $2.75 billion Ford brought to market was demonstrated by 10x oversubscription, another sign of healthy credit conditions, as was concessions of only 5 bps.

- The YTD average OAS on the Bloomberg US Corporate Credit Index was 129 at month’s end, exactly where it closed October. The 9 bps of widening experienced last month created some volatility as investors assessed economic conditions, but it was not unexpected. Spreads remain well within the ranges of the last 6 months and should stay steady as we close out the year.

- High Yield spreads have largely stayed stable, ending the month at 438 bps, roughly 18 bps above the YTD average. We do not invest in below investment grade names but follow the market carefully as an indication of credit appetite. Spread volatility occurs much more frequently in High Yield and, after a solid run, a risk off trajectory has begun to develop, a trend that warrants further scrutiny.

Public Sector Watch

Credit Comments

Municipal Credit Implications of a Federal Government Shutdown

The odds of a shutdown during Q4 2023 were believed to be relatively low as wars in Ukraine and Israel, coupled with air strikes in Syria, support the need for military funding, although news of a new House Speaker has increased the risk. A temporary extension of the spending bill by the November 17th deadline is anticipated, although this leaves the door open for a shutdown in early 2024.

There have been fourteen federal government shutdowns since 1981 with four lasting more than a business day. While federal employee furloughs and interruptions in federal aid distributions may create a need for short-term adjustments by municipal issuers, we believe that a federal government shutdown lasting beyond a few weeks would have minimal impact on the creditworthiness of high-quality municipal bond issuers.

Our comments below are strictly focused on credit quality, not the potential performance impact of rising Treasury yields or other non-credit related influences.

| Sector Implications |

Below we highlight sectors with an elevated reliance on federal payments:

|

| Regional Implications |

|

| Pre-refunded Bonds |

| While not specific to municipal credit, we thought it important to point out the implications a potential Moody’s downgrade of US Treasuries could have on Pre-refunded bonds. With S&P and Fitch already rating federal debt one notch below top tier, a rating cut by Moody’s would likely result in a corresponding downgrade of all re-rated Pre-refunded bonds backed by US Treasury or Agency collateral. While losing a “AAA” rating would be headline worthy, we believe the municipal market would continue to hold Pre-refunded bonds in high regard given the strength of the collateral. |

Strategy Overview

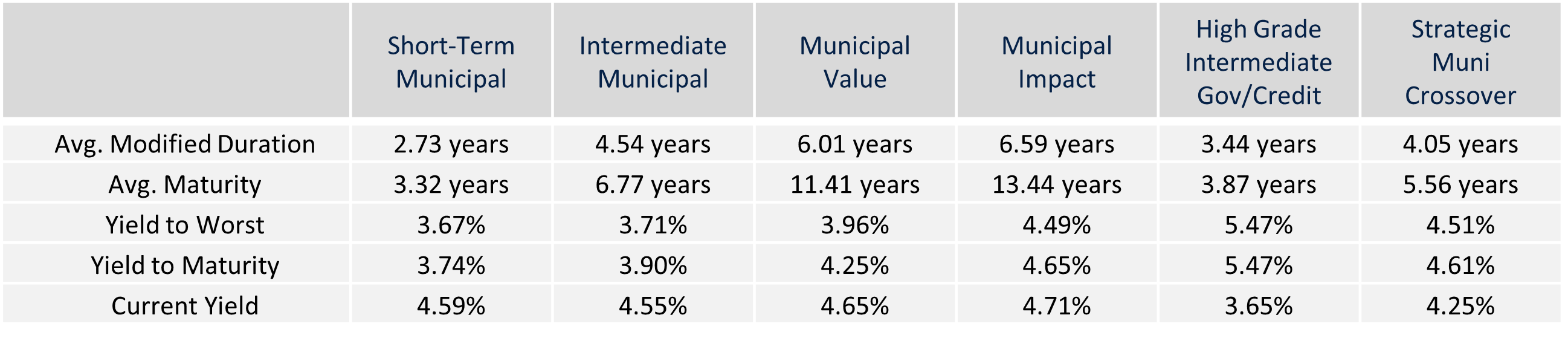

Composite Portfolio Positioning as of 10/31/2023

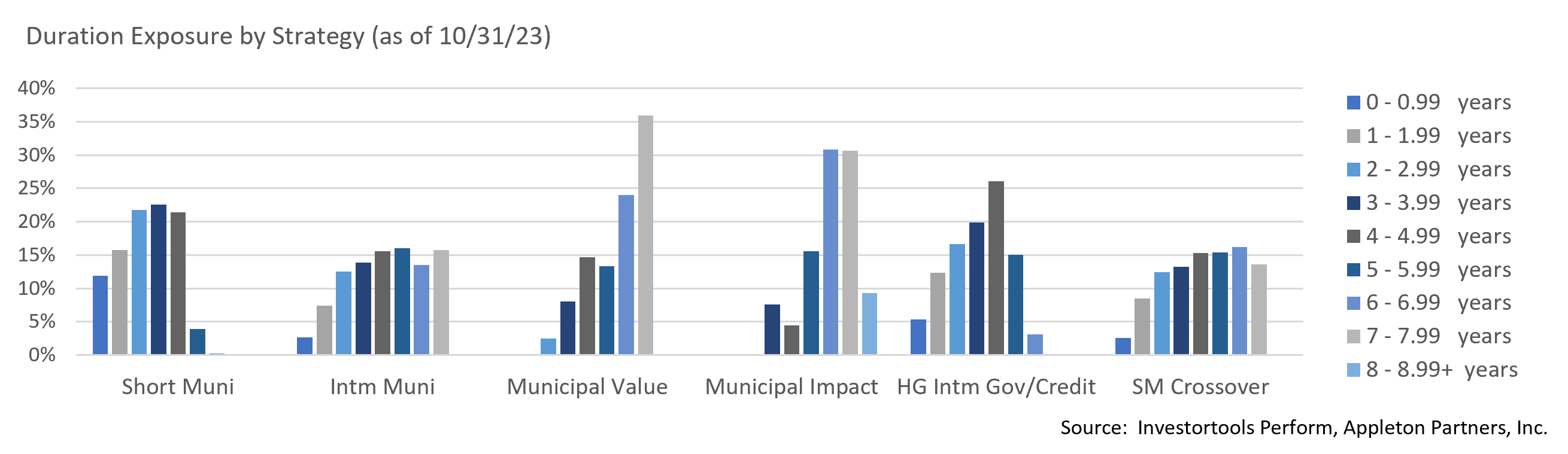

Duration Exposure as of 10/31/2023

The composites used to calculate strategy characteristics (“Characteristic Composites”) are subsets of the account groups used to calculate strategy performance (“Performance Composites”). Characteristic Composites excludes any account in the Performance Composite where cash exceeds 10% of the portfolio. Therefore, Characteristic Composites can be a smaller subset of accounts than Performance Composites. Inclusion of the additional accounts in the Characteristic Composites would likely alter the characteristics displayed above by the excess cash. Please contact us if you would like to see characteristics of Appleton’s Performance Composites.

Yield is a moment-in-time statistical metric for fixed income securities that helps investors determine the value of a security, portfolio or composite. YTW and YTM assume that the investor holds the bond to its call date or maturity. YTW and YTM are two of many factors that ultimately determine the rate of return of a bond or portfolio. Other factors include re-investment rate, whether the bond is held to maturity and whether the entity actually makes the coupon payments. Current Yield strictly measures a bond or portfolio’s cash flows and has no bearing on performance.

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.