Insights and Observations

Economic, Public Policy, and Fed Developments

- While we were never convinced, the FOMC meeting at the end of July led to market speculation of a coming Fed “pivot” to a more accommodative policy. Markets flirted with the idea for much of August as well until Powell put to bed the idea of a “dovish Fed pivot” in his Jackson Hole testimony. “The historical record cautions strongly against prematurely loosening policy,” Powell noted, and “Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance.”

- While the stock market seemed a little blindsided, the bond market appeared to have priced in no change fairly well. There was little impact to Bloomberg’s WIRP futures-derived Fed Fund rate expectations, although with several Fed speakers publicly stating they expect Fed Funds to exceed 4%, the implied 3.9% March 2023 Fed Fund rates may have room to rise by about another half hike.

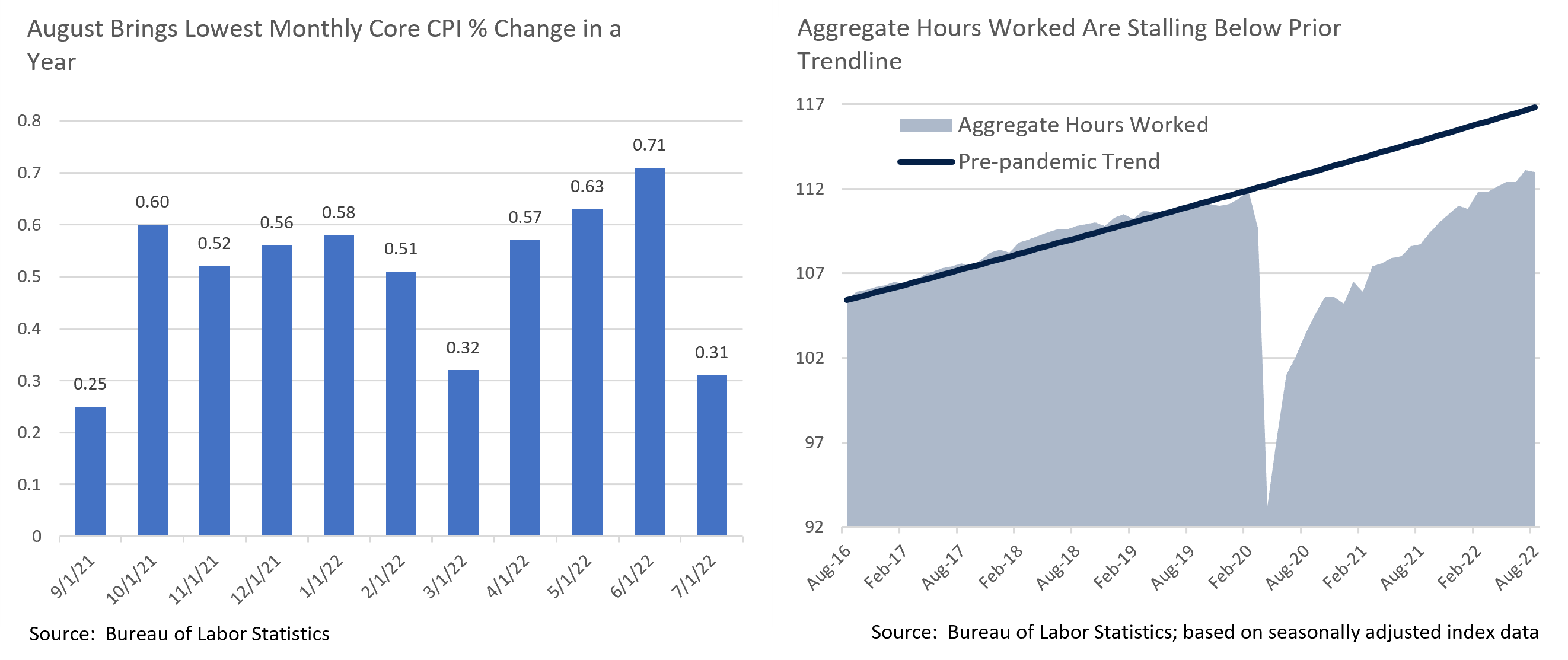

- There was plenty of good news in the July inflation report – falling oil prices helped pull the headline down to flat vs. +0.2%, and core to +0.3% vs. +0.5%, although the report brought less evidence of food price softening than we had hoped. This is the smallest monthly core CPI increase in a year. The PCE inflation report released near the end of the month was even better, falling -0.1% vs. flat expectations, and core only rose 0.1%, half the expected increase. Notably, the declines were broad based, with slowing inflation in all categories other than food and housing.

- Oil prices should pull headline August inflation down again upon the September 13th release, and while poor harvest data might offset this a little, food prices have been in steady decline for some time now. We expect the Fed to remain focused on core, not headline inflation (where the food and energy impacts will be clearest) but declines in these two categories would be a welcome relief. At the margin, it would increase the likelihood of a soft landing.

- While inflation is clearly slowing, the employment picture remains complex. The August jobs report was closely in line with expectations (growth moderating to 315k vs. expectations for 300k), although it did bring with it 110k of prior downward revisions. One notable surprise was a large increase in workforce participation that pulled the unemployment rate up 0.2% to +3.7%. Also, while it garnered less attention, a decline in the average workweek nudged aggregate hours worked down 0.1% despite workforce growth and may have explained a slight reduction in average hourly wage growth.

- This begs the question, with most economic indicators pointing to recession, of how we could be in one with solid job growth? Two things are worth keeping in mind. First, labor is often a lagging indicator, and especially after a sustained period of labor shortages employers may be reluctant to reduce headcount. Second, while the unemployment rate has hit pre-pandemic lows, aggregate hours worked have only just reached pre-pandemic levels, and remain well below prior trendline. Since the labor supply was previously too small to support aggregate demand (leading to inflation), aggregate demand could fall quite a bit before the labor supply would need to be reduced, and employment may continue to look healthy even in an economic contraction. This may be the outcome the Fed is counting on.

From the Trading Desk

Municipal Markets

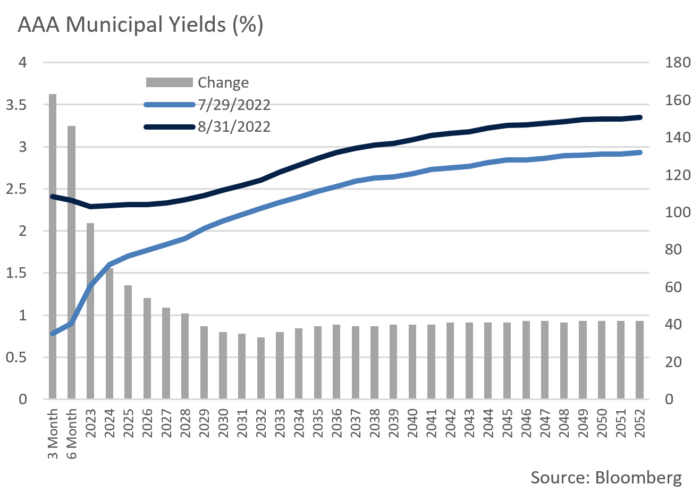

- August brought a steep sell-off in the front end of the AAA municipal curve given a rapid acceleration of monetary policy tightening. Over the course of the month, 3-month yields rose by 163bps, 6 months by 146bps, 1-year bonds by 94bps, and 2-years by 70bps.

- The slope of the tax-exempt curve flattened as short yields rose causing a decline in the spread between 2 and 10-year yields to 29bps by the end of August. As a point of reference, during the last period of significant municipal market strain in 2020, the slope flattened to just 11bps. Further flattening could occur with most market participants fully expecting a Fed Funds rate hike of as much as 75bps after the September meeting.

- Curve flattening will inevitably lead to valuation challenges. A key driver of repricing lies in an ability to pick up what were longer maturity yields at a shorter position on the curve. This leads many to a front-end bias that allows investors to reduce duration risk.

- AAA muni/UST ratios across various maturities all now rest above their five-year averages, suggesting there is value in tax-exempt issues. Within the tax-exempt curve, the ratio of 2Yr yields to 30Yr yields has increased dramatically over the past year given the spike in short rates off extremely low levels. August’s month end ratio of 69% compares to only 4.7% one year earlier. Perhaps more notably, today’s 2 to 30-year AAA municipal ratio of 69% lies well above the 5-year average of 58.1%.

- With the curve being relatively flat, we are seeking value in pockets of intermediate steepness and selectively with credit spreads. In a reversal from last month, long duration and lower credit went from performance contributors to laggards.

- We caution that the front end of the municipal curve may remain quite volatile due to summer technical factors compressing ratios. As discussed, limited supply on top of the seasonal cash roll added to a positive tone for municipals. With the Fed expected to hike rates again, the front end could experience some volatility.

- The September new issue calendar is likely to be modestly lower relative to recent historical averages. The month began on a holiday shortened week and issuers have tended to stay on the sidelines during the week of FOMC meetings, the next due to take place at the end of September. Limited new issue supply will likely bolster near term market pricing dynamics.

Corporate Bond Markets

- The Investment Grade credit market incurred more than its share of volatility during August. Remnants of July’s credit rally lingered and by mid-month the Bloomberg Barclays US Corporate Index touched an OAS of 131, 29bps off the YTD high 160 set in early July. Despite that spread volatility, August ended just 3bps tighter than where we began the month. In general, liquidity strains have been exacerbated among lower quality issues. The risk-off tone present since the Jackson Hole meeting should abate as additional market participants return after the end of summer. In our view, although further credit spread widening may occur, it is unlikely to break out in a meaningful way. Spreads should remain range bound over the near term.

- The IG primary market surprised investors with a record-setting pace of issuance during a typically quiet month. In total, $110.25 billion of new debt was brought to market in August with the vast majority hitting in the first two weeks as sentiment generally turned positive. This new supply reflected a sizeable volume that had been waiting on the sidelines for advantageous opportunities to come to market. New issue concessions are still quite high, yet we take comfort that upside breaks in spreads or rates have been prompting issuers to jump in. September tends to see heavy supply and the weeks following Labor Day should be very active. This upcoming period is likely to set the tone for the primary market and we expect demand to pick up, as spread levels suggest value is present in many IG bond issues.

- High grade corporates are clearly affected by UST yields, and a sizeable move inside of 10Yrs drove recent credit underperformance despite modest spread tightening. On the month, the largest move was along the 3Yr UST curve with a 71bps increase driving yields to 3.52%. Aside from the 20Yr bond at 3.57%, 3Yr issues are the highest yielding. The curve remains inverted out to intermediate maturities, with 10Yr yields rising by 54bps in August to 3.20%, a level not seen since mid-June.

- Another interesting note is that the spread differential between the 2 and 10 years began the month at -50bps but narrowed to -25bps to close it out. Both are points not seen in over 20 years. The Fed’s reiteration of its steadfast commitment to fighting inflation in the coming months have driven up short-term rates. The markets will be watching the next round of rate hikes announced at the end of September closely, and the language used by the Fed will likely set the tone for the balance of 2022.

Public Sector Watch

Credit Comments

State Pension Funding Is Healthy Despite Recently Lagging Investment Returns

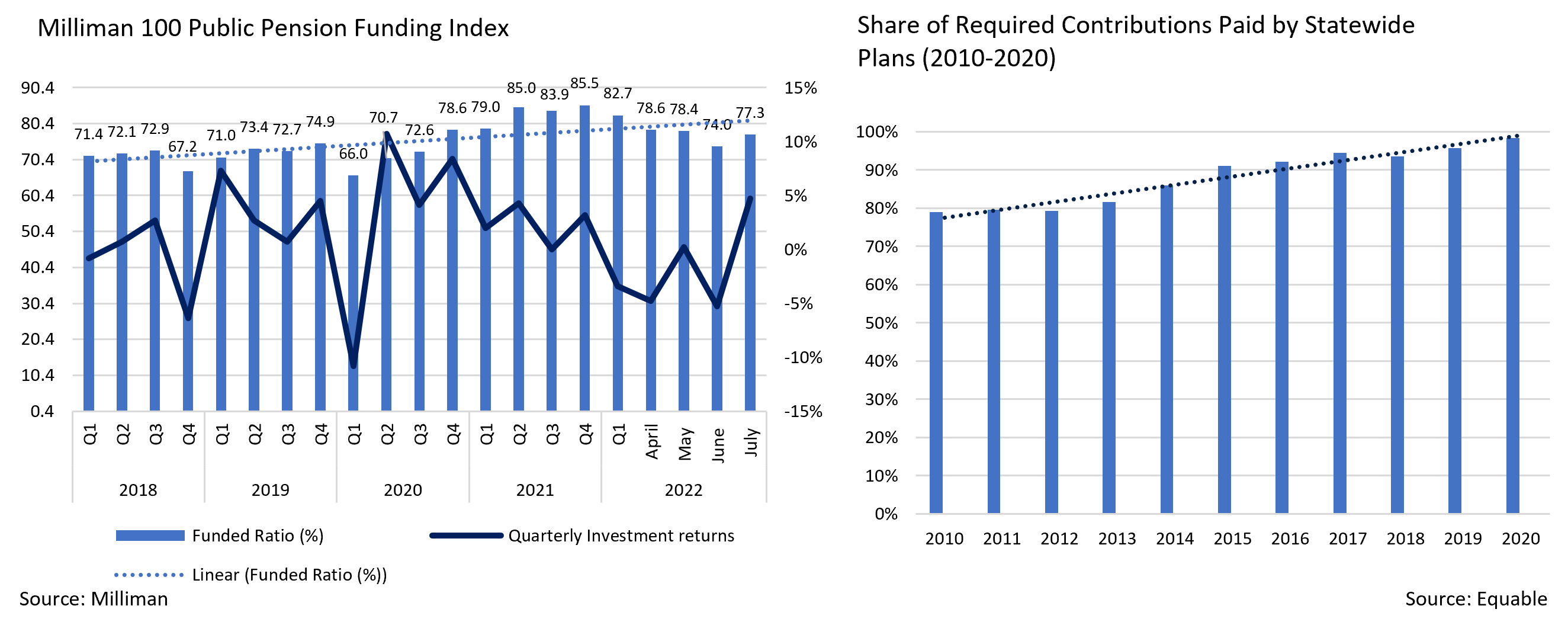

- The Milliman Public Pension Funding Index (PPFI), which covers the 100 largest US public pension funds, recently published updated funded ratios in their July report. Negative first half 2022 investment returns caused funded ratios to tumble to 74.0% in June before recovering to 77.3% in July, a level that remains off a December 2021 high of 85.5%. Wilshire Advisors reported a similar story for state pension plans, as average year-over-year funded levels decreased by 11.3% to 70.1% as of June 30th.

- Wilshire Trust Universe Comparison Service reported that although their index of public pension funds posted a median -7.9% aggregate investment return through June 30th, the three- and five-year average annualized performance remained strong at +6.46% and +6.82%, respectively due to a massive +21% return in FY21.

- While first half 2022 declines in pension funding ratios have generated negative headlines, current levels are largely still above historical averages and measured over longer periods remain on an upward trajectory.

- Although investment returns significantly impact funded ratios, investment assumptions and contribution levels are also key factors and most states have significantly improved both over the past decade.

- Data from the National Association of State Retirement Administrators reveals an average assumed rate of return of +6.99% in March, marking the first time that the rate has dropped below +7% since data collection began. Overly optimistic investment performance assumptions can be a future funding risk, and we are pleased to see these estimates gradually declining. In fact, the average estimated rate of return has fallen from 8% In 2001.

- States have also steadily increased their contributions and those of public sector employees over this period. Equable, a bipartisan nonprofit, reported that public sector workers contributed 36.5% more of their income in 2022 than in 2001.

- States have also made significant one-time contributions of their own over the past year aided by an influx of Federal pandemic stimulus and unexpected budget surpluses. Although American Rescue Plan funds were restricted from going into public pension funds, states were able to find various ways to work around the limitation.

- Increased pension contributions and funding levels have had a significantly positive impact on state credit profiles. Recently, New Jersey and Vermont’s rating outlooks were both improved due in large part to positive pension changes. Both have historically struggled with pension costs and large unfunded liabilities.

- New Jersey’s outlook was revised to positive by S&P as the state’s budget included a fully actuarially determined contribution to its retirement systems for the 2nd consecutive year after 20 years of failing to do so.

- Vermont’s outlook was revised to stable from negative by S&P, a decision influenced by recently enacted reforms that significantly reduced long-term unfunded liabilities. The reform package builds assets through one-time general fund appropriations, phased-in employee contribution increases, and state contributions above actuarially determined levels. Vermont’s plan is a good example of the tools available to improve funded ratios beyond relying on investment returns.

Strategy Overview

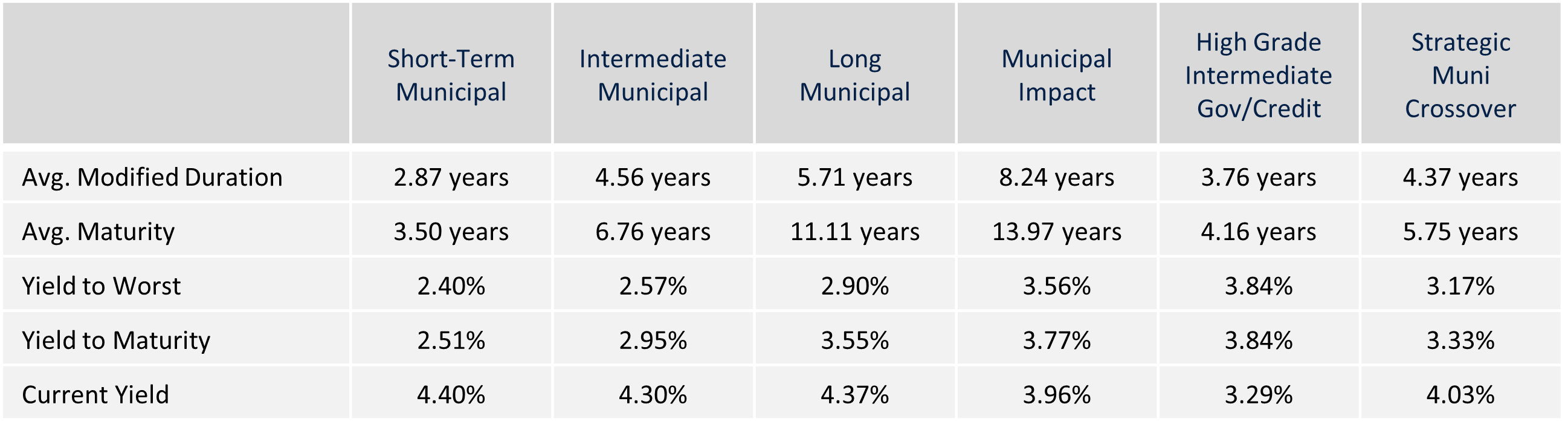

Composite Portfolio Positioning as of 8/31/2022

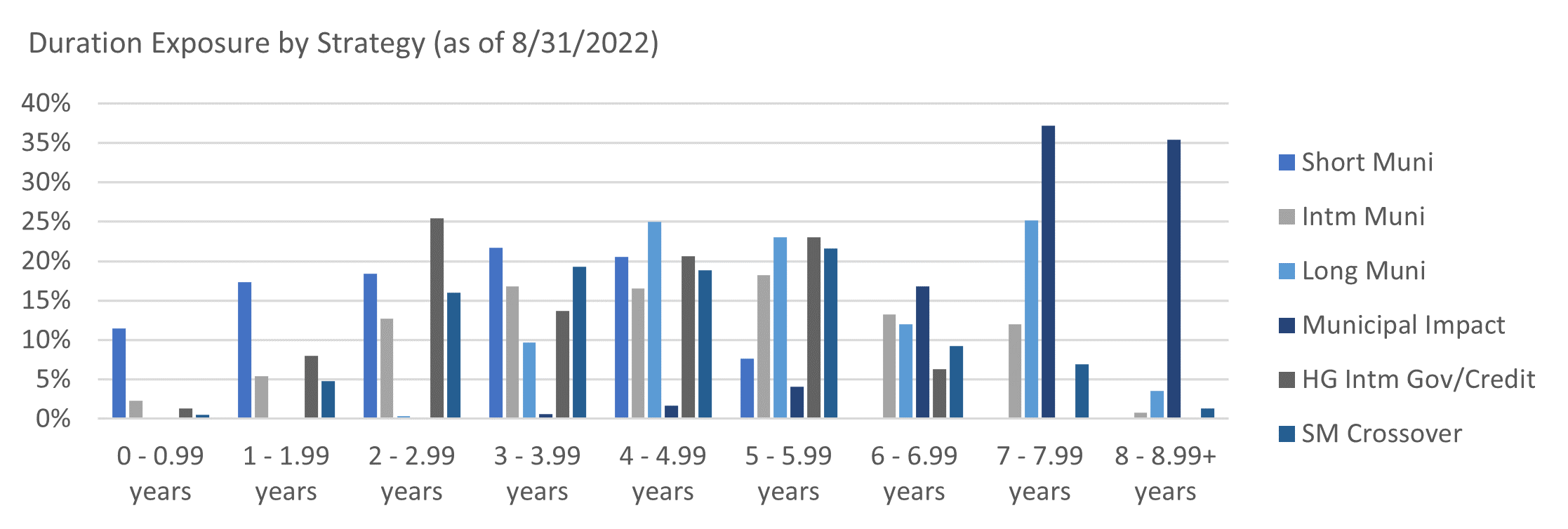

Duration Exposure as of 8/31/2022

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.